Constellation Energy's Options Frenzy: What You Need to Know

Constellation Energy's Options Frenzy: What You Need to Know

Investors with a lot of money to spend have taken a bearish stance on Constellation Energy (NASDAQ:CEG).

對有大量資金的投資者來說,他們對宏星能源(納斯達克:CEG)採取了看淡的態度。

And retail traders should know.

零售交易者應該了解這一點。

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

我們今天注意到這一點,當交易出現在我們在Benzinga跟蹤的公共可用期權歷史記錄中時。

Whether this is an institution or just a wealthy individual, we don't know. But when something this big happens with CEG, it often means somebody knows something is about to happen.

我們不清楚這是機構還是富有的個人。但當CEG發生這麼大的事情時,往往意味着有人知道即將發生某事。

Today, Benzinga's options scanner spotted 11 options trades for Constellation Energy.

今天,Benzinga的期權掃描器發現了11筆宏星能源的期權交易。

This isn't normal.

這並不正常。

The overall sentiment of these big-money traders is split between 9% bullish and 90%, bearish.

這些大資金交易者的總體情緒在9%的看好和90%的看淡之間分裂。

Out of all of the options we uncovered, 10 are puts, for a total amount of $877,860, and there was 1 call, for a total amount of $29,400.

在我們發現的所有期權中,有10個是看跌期權,總金額爲$877,860,還有1個是看漲期權,總金額爲$29,400。

Predicted Price Range

預測價格區間

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $185.0 to $250.0 for Constellation Energy over the recent three months.

根據交易活動看來,重要投資者在最近三個月內,目標是將康斯特ellation Energy的價格區間定在185.0美元到250.0美元之間。

Volume & Open Interest Trends

成交量和未平倉量趨勢

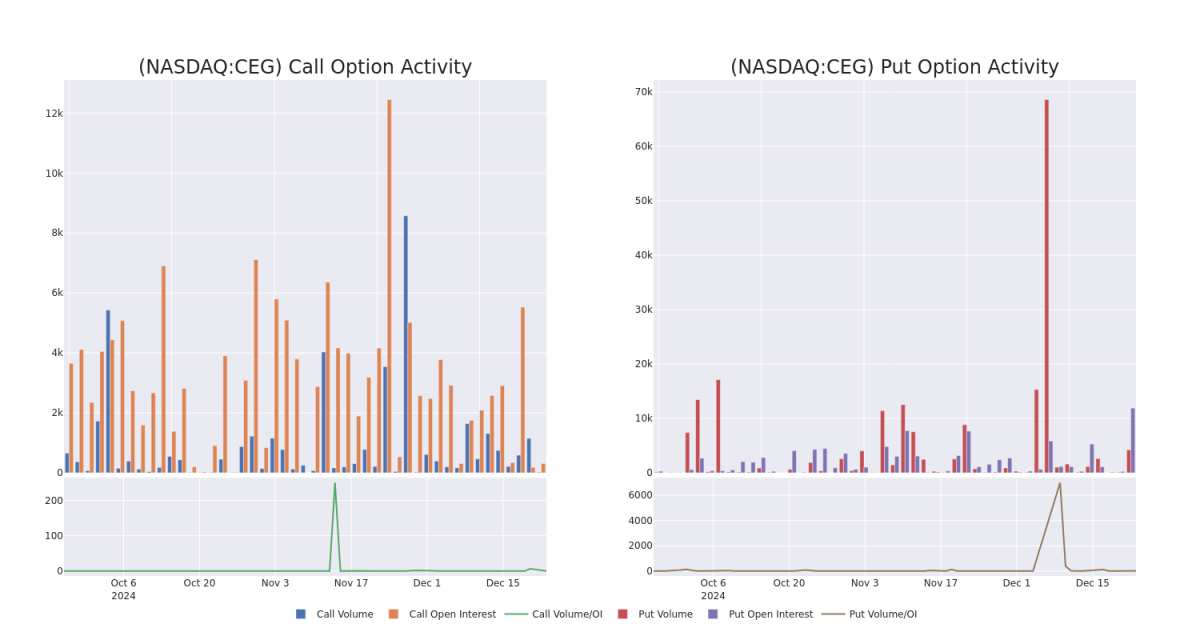

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Constellation Energy's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Constellation Energy's significant trades, within a strike price range of $185.0 to $250.0, over the past month.

檢查成交量和未平倉合約可以爲股票研究提供關鍵見解。這些信息對於評估在特定行權價格下康斯特ellation Energy的期權流動性和興趣水平至關重要。以下是我們展示的康斯特ellation Energy在過去一個月內看漲和看跌期權的重要交易的成交量和未平倉合約趨勢快照,行權價格區間爲185.0美元到250.0美元。

Constellation Energy 30-Day Option Volume & Interest Snapshot

康斯特拉能源30天期權交易 成交量&未平倉合約快照

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CEG | PUT | TRADE | BEARISH | 01/15/27 | $34.8 | $33.5 | $34.3 | $200.00 | $205.8K | 67 | 60 |

| CEG | PUT | SWEEP | BEARISH | 03/21/25 | $5.7 | $5.6 | $5.6 | $185.00 | $136.0K | 251 | 450 |

| CEG | PUT | SWEEP | BEARISH | 03/21/25 | $5.6 | $5.5 | $5.6 | $185.00 | $115.8K | 251 | 207 |

| CEG | PUT | SWEEP | BEARISH | 03/21/25 | $5.7 | $5.3 | $5.7 | $185.00 | $114.0K | 251 | 808 |

| CEG | PUT | SWEEP | BEARISH | 03/21/25 | $5.7 | $5.3 | $5.7 | $185.00 | $88.3K | 251 | 607 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 行權價 | 總交易價格 | 未平倉合約 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CEG | 看跌 | 交易 | 看淡 | 01/15/27 | $34.8 | $33.5 | $34.3 | $200.00 | 205.8千美元 | 67 | 60 |

| CEG | 看跌 | 掃單 | 看淡 | 03/21/25 | $5.7 | $5.6 | $5.6 | $185.00 | 136,000美元 | 251 | 450 |

| CEG | 看跌 | 掃單 | 看淡 | 03/21/25 | $5.6 | $5.5 | $5.6 | $185.00 | $115.8K | 251 | 207 |

| CEG | 看跌 | 掃單 | 看淡 | 03/21/25 | $5.7 | $5.3 | $5.7 | $185.00 | $114.0K | 251 | 808 |

| CEG | 看跌 | 掃單 | 看淡 | 03/21/25 | $5.7 | $5.3 | $5.7 | $185.00 | $88.3K | 251 | 607 |

About Constellation Energy

Constellation Energy

Constellation Energy Corp offers energy solutions. It provides clean energy and sustainable solutions to homes, businesses, the public sector, community aggregations, and a range of wholesale customers (such as municipalities, cooperatives, and other strategics). The company offers comprehensive energy solutions and a variety of pricing options for electric, natural gas, and renewable energy products for companies of any size.

星座能源CORP提供能源解決方案。它爲住宅、企業、公共部門、社區聚合體以及一系列批發客戶(如市政府、合作社和其他戰略客戶)提供清潔能源和可持續解決方案。該公司爲任何規模的公司提供全面的能源解決方案和多種電力、天然氣和可再生能源產品的定價選項。

Having examined the options trading patterns of Constellation Energy, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在審查了Constellation Energy的期權交易模式之後,我們的注意力現在直接轉向該公司。這一轉變使我們能夠深入了解其當前市場地位和表現。

Where Is Constellation Energy Standing Right Now?

康斯添利能源目前處於什麼位置?

- Trading volume stands at 691,268, with CEG's price up by 0.5%, positioned at $228.16.

- RSI indicators show the stock to be may be oversold.

- Earnings announcement expected in 64 days.

- 交易量爲691,268,CEG的價格上漲了0.5%,當前報228.16美元。

- RSI因數顯示該股票可能被超賣。

- 預計在64天后發佈業績。

Expert Opinions on Constellation Energy

Constellation Energy的專家意見。

In the last month, 1 experts released ratings on this stock with an average target price of $269.0.

在過去一個月中,1位分析師對該股票發佈了評級,平均目標價爲269.0美元。

Unusual Options Activity Detected: Smart Money on the Move

檢測到期權異動:聰明資金正在行動

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* Showing optimism, an analyst from B of A Securities upgrades its rating to Buy with a revised price target of $269.

Benzinga Edge的期權異動板塊在市場變動之前發現潛在的市場動向。查看大資金在你最喜歡的股票上採取了什麼倉位。點擊此處獲取訪問權限。* 頂級分析師來自美銀證券將評級上調至買入,目標價調整爲269美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Constellation Energy with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供了更高利潤的潛力。精明的交易者通過持續教育、戰略性交易調整、利用各種因數並保持對市場動態的關注來減輕這些風險。通過Benzinga Pro實時提醒,跟上最新的Constellation Energy期權交易動態。

Whether this is an institution or just a wealthy individual, we don't know. But when something this big happens with CEG, it often means somebody knows something is about to happen.

Whether this is an institution or just a wealthy individual, we don't know. But when something this big happens with CEG, it often means somebody knows something is about to happen.