AMD and Micron Are Top Analyst Picks for AI and Next-Gen Tech Growth

AMD and Micron Are Top Analyst Picks for AI and Next-Gen Tech Growth

Rosenblatt polled its analysts, including Steve Frankel, gathering their top picks for the first half of 2025. The stocks reflect key themes across its research universe, including the Age of Artificial Intelligence and the build-out of next-generation broadband.

羅斯蘭特對其分析師進行了調查,包括Steve Frankel,收集他們對2025年上半年的最佳股票推薦。這些股票反映了其研究領域的關鍵主題,包括人工智能時代和下一代寬帶的建設。

Steve Frankel maintained a Buy rating on Advanced Micro Devices, Inc (NASDAQ:AMD) with a price target of $250.

Steve Frankel對美國超微公司(納斯達克:AMD)維持買入評級,目標價格爲250美元。

AMD is one of Rosenblatt's top picks for the first half of 2025 on momentum in CPU and GPU share gains into 2025 and a broader non-AI recovery exiting 2025.

AMD是羅斯蘭特在2025年上半年的最佳股票之一,基於其在CPU和GPU市場份額增長的動能以及2025年退出時更廣泛的非人工智能復甦。

The difference entering 2025 is that the Street acknowledges this dynamic, which has legs for double-digit market share in GPU compute and AI inference at the edge, being a secular opportunity on Xilinx incumbency and chiplet prowess.

進入2025年的不同之處在於,市場認識到這一動態,這能在GPU計算和邊緣人工智能推理中實現雙位數市場份額,成爲與Xilinx現有產品和芯片組技術的長期機會。

AMD's EPYC processors will likely continue increasing the company's revenue share in server and Data Center CPUs as the business proposition is significant, the analyst said.

分析師表示,AMD的EPYC處理器可能會繼續提高公司在服務器和IDC概念CPU中的營業收入份額,因爲這一業務主張是相當重要的。

AMD's MI350 in 2025 and MI400 in 2026 GPUs will drive additional revenues and increased market share on hyperscale adoption, chiplet scale, and AI moving to the edge, he added.

他補充道,AMD在2025年的MI350和2026年的MI400 GPU將推動額外的營業收入,並在超大規模應用、芯片組規模以及人工智能轉向邊緣方面增加市場份額。

The price target reflects a 25-times P/E multiple to Frankel's $10.00 fiscal 2026 adjusted EPS. This multiple is in line with the analyst's AI compute group average of 25 times.

該目標價格反映了對Frankel的10.00美元2026財年調整後每股收益的25倍市盈率。這一倍數與分析師的人工智能計算組的平均值25倍相符。

Frankel reiterated a Buy rating on Micron Technology, Inc (NASDAQ:MU) with a price target of $250.

Frankel重申對美光科技(納斯達克:MU)的買入評級,目標價格爲250美元。

Micron is one of Rosenblatt's top picks for the first half of 2025, as he liked the big opportunity for DRAM content deployment in AI platforms going forward.

美光是Rosenblatt在2025年上半年的首選之一,因爲他看好人工智能平台中DRAm內容部署的巨大機會。

In particular, the analyst liked Micron's HBM opportunity, where the trade ratios are 3-to-1 to DDR5 and moving to 4-to-1 with the move to HBM4, a structural shift Frankel did not witness in any other memory cycle.

特別是,分析師看好美光的HBM機會,交易比率爲3比1(DDR5),隨着HBM4的推出,交易比率將提升至4比1,這是Frankel在其他任何存儲週期中沒有見到的結構性變化。

Industry HBM supply continues to be an issue to watch as supply does not catch up to demand well into calendar 2025.

行業的HBM供應仍然是一個需要關注的問題,因爲供應在2025年日歷年內未能跟上需求。

For Micron, Frankel's viewpoint on HBM is more related to the overall implications of DRAM bit supply, with HBM3E garnering a 3-to-1 trade ratio and HBM4 a 4-to-1 trade ratio, creating a favorable supply and demand dynamic.

對於美光而言,Frankel對HBM的看法更多是與DRAm位供給的整體影響相關,其中HBM3E的交易比率爲3比1,而HBM4的交易比率爲4比1,形成了良好的供需動態。

Frankel noted Micron as an HBM share gainer in HBM3E and HBM4 varietals and as the segment moves from 8-Hi to 12-Hi and 16-Hi configurations, where power efficiency (a Micron structural advantage) becomes increasingly important.

Frankel指出美光在HBM3E和HBM4品種中佔據HBM份額,同時隨着該細分市場從8-Hi配置轉向12-Hi和16-Hi配置,能效(美光的結構性優勢)變得愈發重要。

Frankel found using P/E to value Micron reasonable, given its proven consistent profitability through cross-memory cycles, aggressive share buybacks, and a cycle driven by AI workload dynamics correlating to DRAM content. The price target reflects a mid-teens P/E multiple on the analyst's $18 fiscal 2026 adjusted EPS.

Frankel認爲使用市盈率對美光進行估值是合理的,因爲其在跨存儲週期中展現出持續的盈利能力、積極的回購股票,以及受人工智能工作負載動態驅動的週期與DRAm內容相關。目標價格反映出基於分析師所預期的2026財年調整後的每股收益18美元的中等十幾倍市盈率。

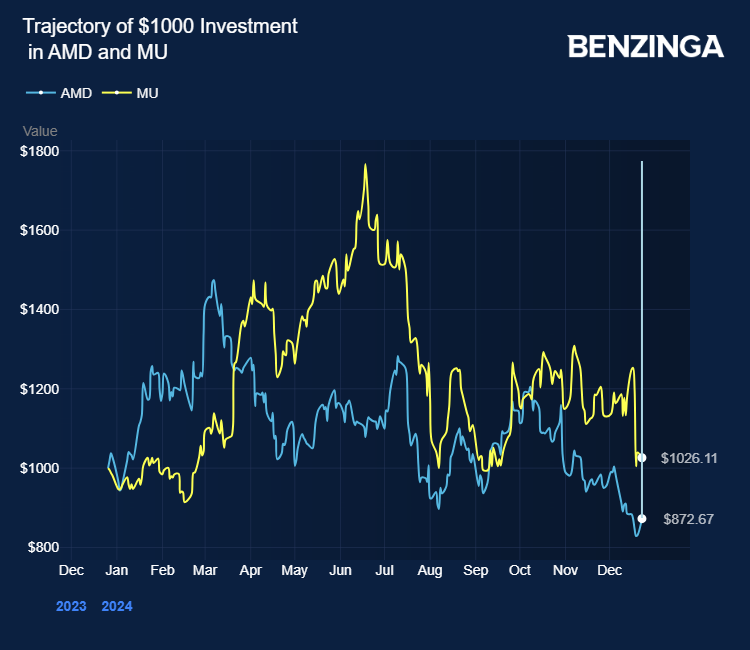

Price Actions: At last check on Monday, AMD stock was up 4.70% at $124.82. MU is down 0.78%.

價格走勢:在週一的最後檢查時, 美國超微公司股票上漲了4.70%,達到124.82美元。美光下跌了0.78%。

Photo via Shutterstock

圖片來自Shutterstock

The difference entering 2025 is that the Street acknowledges this dynamic, which has legs for double-digit market share in GPU compute and AI inference at the edge, being a secular opportunity on Xilinx incumbency and chiplet prowess.

The difference entering 2025 is that the Street acknowledges this dynamic, which has legs for double-digit market share in GPU compute and AI inference at the edge, being a secular opportunity on Xilinx incumbency and chiplet prowess.