Cleanspark Options Trading: A Deep Dive Into Market Sentiment

Cleanspark Options Trading: A Deep Dive Into Market Sentiment

Whales with a lot of money to spend have taken a noticeably bullish stance on Cleanspark.

擁有大量資金的鯨魚對CleanSpark採取了明顯的看好態度。

Looking at options history for Cleanspark (NASDAQ:CLSK) we detected 50 trades.

查看CleanSpark(納斯達克:CLSK)的期權歷史,我們檢測到了50筆交易。

If we consider the specifics of each trade, it is accurate to state that 56% of the investors opened trades with bullish expectations and 36% with bearish.

考慮到每筆交易的具體情況,可以準確地說,56%的投資者以看漲的預期開盤交易,36%則是看淡。

From the overall spotted trades, 15 are puts, for a total amount of $5,835,570 and 35, calls, for a total amount of $2,223,001.

從整體發現的交易中,15筆是看跌期權,總金額爲5,835,570美元,35筆是看漲期權,總金額爲2,223,001美元。

Predicted Price Range

預測價格區間

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $5.0 and $37.0 for Cleanspark, spanning the last three months.

在評估交易量和未平倉合約後,很明顯主要市場交易者專注於CleanSpark的價格區間在5.0美元到37.0美元之間,跨度爲過去三個月。

Analyzing Volume & Open Interest

分析成交量和未平倉合約

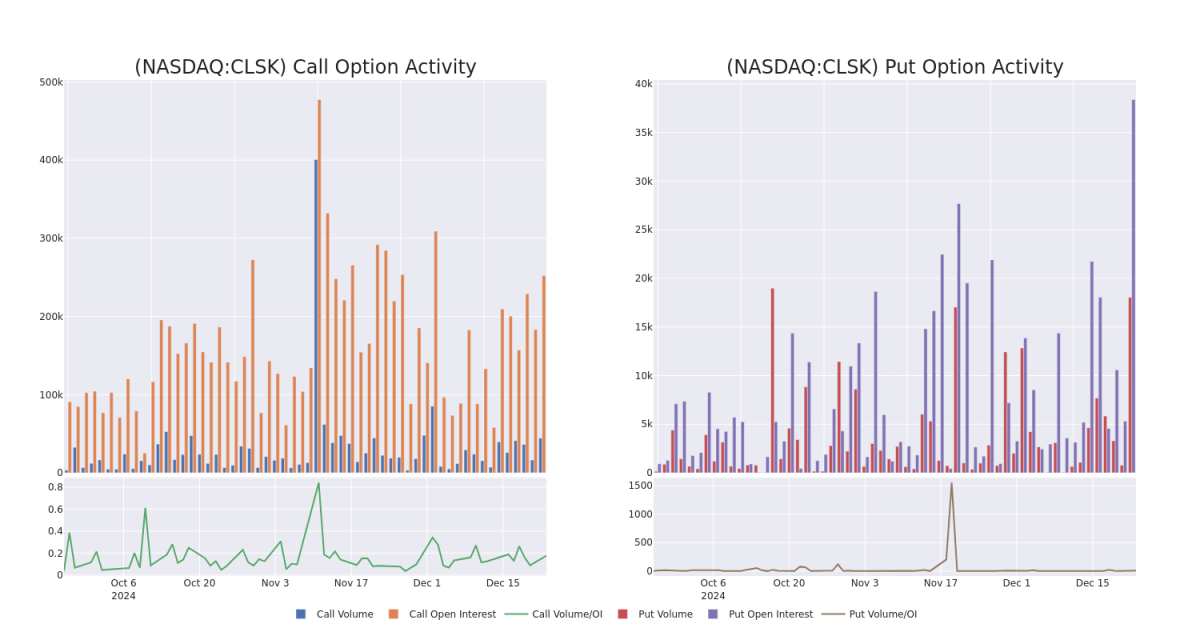

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Cleanspark's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Cleanspark's significant trades, within a strike price range of $5.0 to $37.0, over the past month.

分析成交量和未平倉合約提供了對股票研究的關鍵見解。這些信息對於評估CleanSpark在特定執行價格下的流動性和興趣水平至關重要。以下是過去一個月CleanSpark重大交易中看漲期權和看跌期權成交量和未平倉合約趨勢的快照,執行價格範圍爲5.0美元到37.0美元。

Cleanspark 30-Day Option Volume & Interest Snapshot

CleanSpark 30天期權成交量與興趣快照

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CLSK | PUT | SWEEP | BULLISH | 01/16/26 | $25.6 | $25.4 | $25.4 | $35.00 | $1.4M | 2.2K | 1.0K |

| CLSK | PUT | SWEEP | BULLISH | 01/16/26 | $25.3 | $25.1 | $25.3 | $35.00 | $1.1M | 2.2K | 447 |

| CLSK | PUT | SWEEP | BULLISH | 01/16/26 | $28.1 | $27.35 | $27.35 | $37.00 | $913.5K | 4.4K | 1.0K |

| CLSK | PUT | SWEEP | BULLISH | 01/16/26 | $25.55 | $25.35 | $25.4 | $35.00 | $871.2K | 2.2K | 1.4K |

| CLSK | PUT | SWEEP | BULLISH | 01/16/26 | $28.2 | $27.3 | $27.3 | $37.00 | $663.4K | 4.4K | 579 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 行權價 | 總交易價格 | 未平倉合約 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CleanSpark | 看跌 | 掃單 | 看好 | 01/16/26 | $25.6 | $25.4 | $25.4 | $35.00 | $1.4M | 2.2K | 1.0K |

| CleanSpark | 看跌 | 掃單 | 看好 | 01/16/26 | $25.3 | $25.1 | $25.3 | $35.00 | $1.1M | 2.2K | 447 |

| CleanSpark | 看跌 | 掃單 | 看好 | 01/16/26 | $28.1 | $27.35 | $27.35 | $37.00 | $913.5K | 4.4K | 1.0K |

| CleanSpark | 看跌 | 掃單 | 看好 | 01/16/26 | $25.55 | $25.35 | $25.4 | $35.00 | ¥871.2K | 2.2K | 1.4K |

| CleanSpark | 看跌 | 掃單 | 看好 | 01/16/26 | $28.2 | $27.3 | $27.3 | $37.00 | 663.4K美元 | 4.4K | 579 |

About Cleanspark

關於CleanSpark

Cleanspark Inc is a bitcoin mining company. Through CleanSpark, Inc., and the Company's wholly owned subsidiaries, the company mines bitcoin. The company entered the bitcoin mining industry through its acquisition of ATL. Bitcoin mining is the sole reportable segment of the company.

CleanSpark Inc是一家比特幣挖礦公司。通過CleanSpark, Inc.及其全資子公司,公司進行比特幣挖礦。公司通過收購ATL進入比特幣挖礦行業。比特幣挖礦是公司的唯一可報告細分市場。

Having examined the options trading patterns of Cleanspark, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在分析了CleanSpark的期權交易模式後,我們現在的注意力直接轉向公司本身。這一轉變使我們能夠深入了解其當前的市場地位和表現

Present Market Standing of Cleanspark

CleanSpark的當前市場地位

- With a volume of 19,975,235, the price of CLSK is down -8.48% at $10.2.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 45 days.

- 在成交量爲19,975,235的情況下,CLSk的價格下跌了8.48%,目前爲10.2美元。

- RSI因數暗示基礎股票可能接近超賣。

- 下一個業績預計在45天內發佈。

Unusual Options Activity Detected: Smart Money on the Move

檢測到期權異動:聰明資金正在行動

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Benzinga Edge的期權異動板塊在市場發生變化之前發現潛在的市場動向。看看大資金在你喜歡的股票上採取了什麼倉位。點擊這裏獲取訪問權限。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Cleanspark options trades with real-time alerts from Benzinga Pro.

期權交易具有更高的風險和潛在的回報。聰明的交易者通過不斷學習、調整策略、監控多個因數並密切關注市場動態來管理這些風險。通過Benzinga Pro的實時警報,保持對最新CleanSpark期權交易的了解。

From the overall spotted trades, 15 are puts, for a total amount of $5,835,570 and 35, calls, for a total amount of $2,223,001.

From the overall spotted trades, 15 are puts, for a total amount of $5,835,570 and 35, calls, for a total amount of $2,223,001.