Sam Altman-Backed Nuclear Power Startup Oklo Receives Outperform Rating From Wedbush Amid 'AI Revolution' Buzz

Sam Altman-Backed Nuclear Power Startup Oklo Receives Outperform Rating From Wedbush Amid 'AI Revolution' Buzz

OpenAI CEO Sam Altman-backed nuclear power startup Oklo Inc. (NASDAQ:OKLO) received an outperform rating from Wedbush Securities, marking another milestone in its push to power the artificial intelligence revolution through advanced nuclear technology.

OpenAI CEO薩姆·阿爾特曼支持的核能初創公司Oklo Inc.(NASDAQ:OKLO)收到了Wedbush證券的優於大盤評級,標誌着其推動通過先進核科技實現人工智能革命的又一里程碑。

What Happened: Wedbush analyst Dan Ives set a $26 price target for Oklo, citing the company's strategic position to capitalize on surging energy demands from data centers. "With the AI revolution underway, the industry will need roughly a tenfold increase in computing power by 2030," Ives wrote in his Thursday note, according to Investor's Business Daily.

發生了什麼:Wedbush分析師丹·艾夫斯爲Oklo設定了26美元的目標價格,指出該公司在應對數據中心日益增長的能源需求方面的戰略位置。"隨着人工智能革命的展開,行業將在2030年前需要大約十倍的計算能力增加,"艾夫斯在投資者商業日報的週四報告中寫道。

The rating follows Oklo's Wednesday announcement of an agreement to supply up to 12 gigawatts of nuclear power to Switch, an AI provider and data center operator, through 2044. The company plans to develop, construct, and operate powerhouses across the United States, with its first Aurora reactor expected to be operational by 2027.

該評級是在Oklo週三宣佈與交換機達成協議,計劃到2044年爲其提供多達12千兆瓦的核電之後發佈的,該公司是一家人工智能提供商和數據中心運營商。該公司計劃在美國各地開發、建設和運營電廠,其首個Aurora反應堆預計將在2027年投入運營。

Why It Matters: Oklo's shares have surged approximately 100% in 2024, despite a 9% December decline. The stock's momentum aligns with broader nuclear energy sector gains, sparked by Constellation Energy Corp.'s (NASDAQ:CEG) September deal to power Microsoft Corp.'s (NASDAQ:MSFT) data centers.

爲什麼這很重要:Oklo的股票在2024年大約上漲了100%,儘管12月有所下降9%。該股的勢頭與更廣泛的核能行業板塊增長一致,這一增長是由Constellation Energy CORP.(NASDAQ:CEG)在9月達成的爲微軟公司(NASDAQ:MSFT)的數據中心提供電力的交易所推動。

According to McKinsey & Co., data center energy demand is projected to grow from 4% to 11-12% of total U.S. energy consumption by 2030. This surge has attracted major tech companies, with Amazon.com Inc. (NASDAQ:AMZN), Alphabet Inc. (NASDAQ:GOOGL) (NASDAQ:GOOG), and Oracle Corp. (NYSE:ORCL) all investing in small modular reactor technology.

根據麥肯錫公司的數據,數據中心的能源需求預計將在2030年前從美國總能源消費的4%增長至11-12%。這種激增吸引了主要科技公司,包括亞馬遜公司(NASDAQ:AMZN)、Alphabet Inc.(NASDAQ:GOOGL)(NASDAQ:GOOG)和甲骨文公司(紐交所:ORCL)都在投資小型模塊化反應堆技術。

While Oklo forecasts a full-year operating loss of $40-50 million, its customer pipeline has grown significantly, reaching approximately 2,100 megawatts by the third quarter of 2024.

儘管Oklo預測全年運營虧損爲4000-5000萬,但其客戶管道顯著增長,到2024年第三季度達到了約2100兆瓦。

Price Action: Oklo stock closed at $22.02 on Monday, up 2.32% for the day. In after-hours trading, the stock dipped to $22.00. Year to date, Oklo shares have surged by 107.74%, according to data from Benzinga Pro.

價格走勢:Oklo股票週一收於22.02美元,全天上漲2.32%。在盤後交易中,股票跌至22.00美元。截至目前,Oklo的股價已上漲107.74%,根據Benzinga Pro的數據。

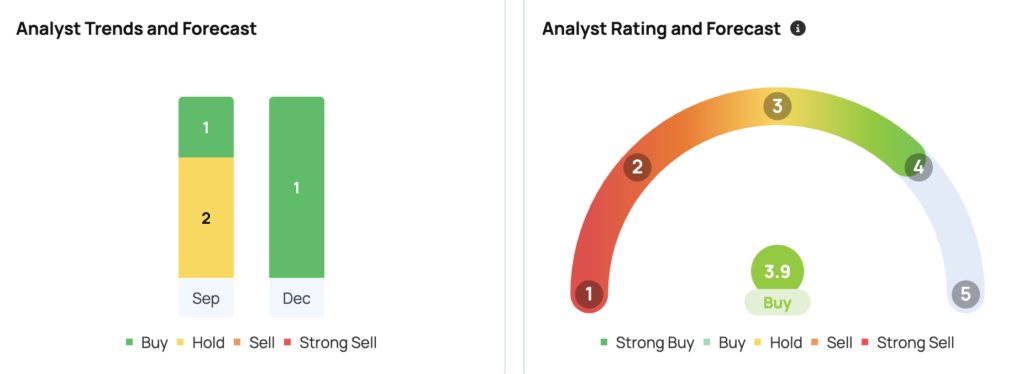

Oklo has a consensus price target of $15.33 from 4 analysts, with a high of $26 and a low of $10. The most recent ratings from Wedbush, Citigroup, and B. Riley Securities imply a downside of 30.30% from the average target.

Oklo的共識目標價格爲來自4位分析師的15.33美元,最高爲26美元,最低爲10美元。Wedbush、花旗集團和b. Riley證券的最新評級暗示平均目標下調30.30%。

- Tesla Shorts, Gordon Johnson, And James Chanos Express Skepticism On Robotaxi Potential Amid Usage Data Debate: The 'Promise' Worth Much More Than Reality

- 特斯拉做空者戈登·約翰遜和詹姆斯·查諾斯對機器人出租車的潛力表示懷疑,原因是使用數據的爭議:這些"承諾"遠遠超過了現實。

Image Via Shutterstock

圖片來自Shutterstock。

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

免責聲明:本內容部分使用人工智能工具生成,並經Benzinga編輯審核發佈。