Embracing Change and Opportunity in 2025: Here's Your Investment Guide

Embracing Change and Opportunity in 2025: Here's Your Investment Guide

In 2025, the global economy is expected to experience a slowdown, with emerging markets confronting significant challenges while the U.S. economy retains its leadership position. Although the fundamental economic outlook for the U.S. continues to indicate a potential soft landing, the pace and direction of policies from the Trump administration will be critical factors influencing economic performance. Tariff measures are particularly noteworthy, as they may create dual pressures of rising inflation and decelerating growth.

預計到2025年,全球經濟將面臨放緩,新興市場將面臨重大挑戰,而美國經濟將保持領先地位。儘管美國的基本經濟前景繼續顯示出潛在的 軟着陸,特朗普政府的政策步伐和方向將是影響經濟表現的關鍵因素。關稅措施尤其值得注意,因爲它們可能造成通貨膨脹上升和增長減速的雙重壓力。

The year 2025 is anticipated to be marked by macroeconomic variability, with the U.S.-China policy landscape still lacking a clear trajectory. For investors, 2025 presents a landscape of both transformation and opportunity. Our meticulously crafted investor strategy guide aims to equip you with valuable insights and inspiration for your investment decisions.

預計2025年將標誌着宏觀經濟的波動,美國與中國的政策格局仍缺乏明確的軌跡。對於投資者而言,2025年呈現出轉型與機遇並存的局面。我們精心設計的投資者策略指南旨在爲您的投資決策提供有價值的見解和靈感。

1) Driving Forces Behind a Stronger U.S. Dollar and Its Allure for Investors

1)強勢美元背後的驅動因素及其對投資者的吸引力

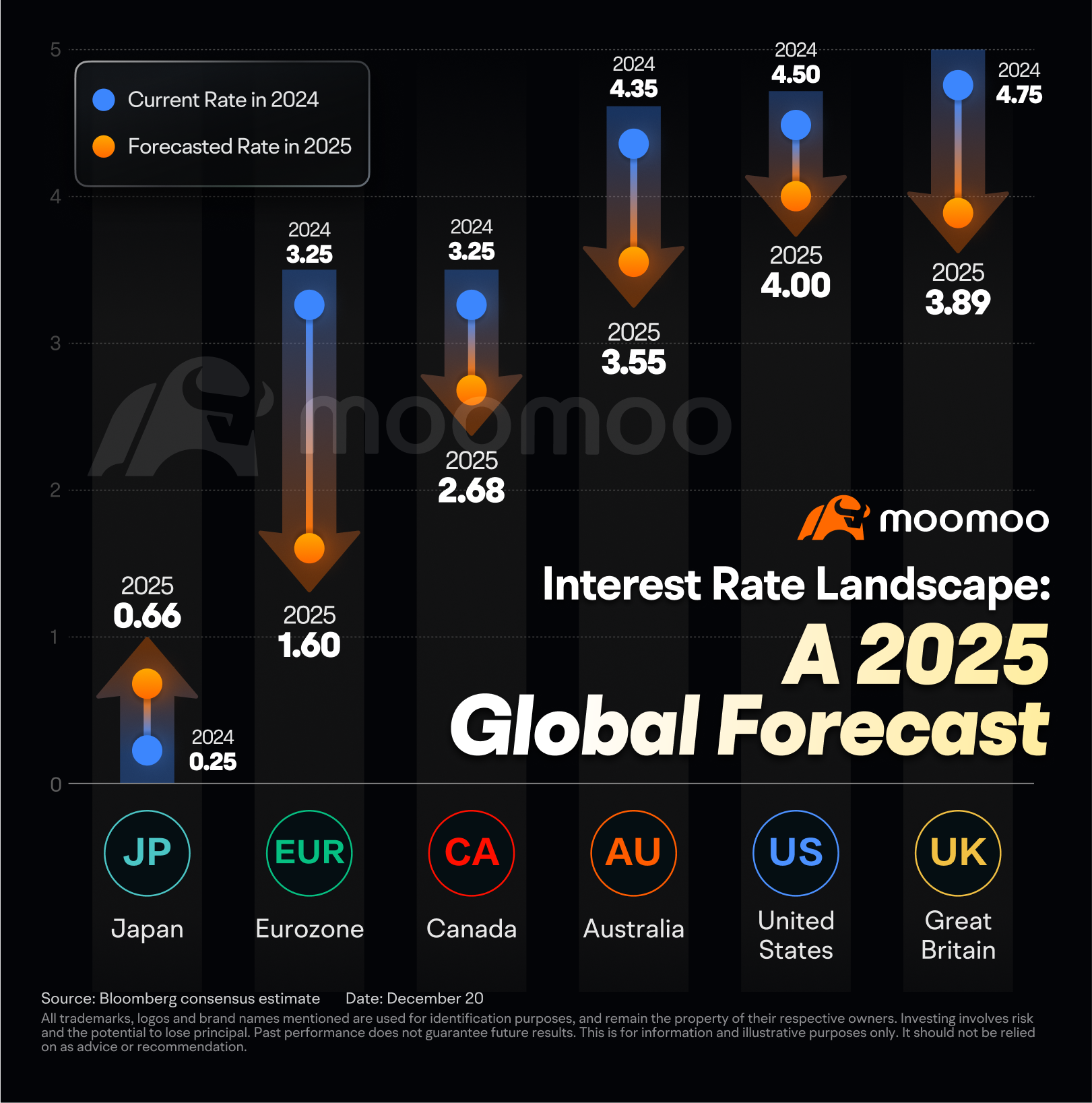

⭐ Anticipated Rate Cuts: Projections suggest that the magnitude of interest rate cuts in the U.S. in 2025 may be less aggressive compared to those of other central banks. Given the substantial U.S. fiscal deficit, a more restrictive interest rate environment will be essential to maintain fiscal balance. In contrast, both the Bank of Canada and the European Central Bank may have greater flexibility for significant rate reductions, as the EU and Canada face more pronounced economic downside risks.

⭐ 預期減息:預計2025年美國的利率減幅可能會比其他中央銀行的減幅遜色。考慮到美國巨大的財政赤字,更嚴格的利率環境對於維持財政平衡至關重要。相較之下,加拿大銀行和歐洲中央銀行可能在大幅減息上具備更大靈活性,因爲歐盟和加拿大面臨更明顯的經濟下行風險。

⭐ "America First" Policy: The "America First" policy is likely to strengthen domestic economic circulation. While Trump's policies could escalate trade conflicts with multiple countries, the robustness of the U.S. internal consumption cycle will support the economy, thereby bolstering the Dollar Index. This dynamic may exert downward pressure on currencies in non-U.S. economies.

⭐ "美國優先"政策:"美國優先"政策可能會加強國內經濟循環。儘管特朗普的政策可能加劇與多個國家的貿易衝突,但美國內部消費週期的強勁將支撐經濟,從而提升美元指數。這種動態可能對非美國經濟體的貨幣施加下行壓力。

⭐ Continued Capital Inflows: In 2025, the U.S. financial account is expected to continue experiencing capital inflows, driven by the relative strength of the U.S. economy and a favorable risk appetite among investors. Ongoing technological innovation and a stable equity market will further attract global investors to U.S. assets.

⭐ 資本流入持續:預計到2025年,美國金融賬戶將繼續經歷資本流入,受益於美國經濟的相對強勁和投資者的良好風險偏好。持續的技術創新和穩定的股票市場將進一步吸引全球投資者前往美國資產。

2) Downward Trend in U.S. Treasury Yields Relatively Certain, but Caution Advised

2) 美國國債收益率的下行趨勢相對確定,但建議謹慎行事

Although the Fed introduced a new qualifier on the 'extent and timing' of future rate cuts, it is expected to continue gradually easing to normalize policy in 2025, albeit at a slower pace. Historically, bond assets tend to perform well during easing cycles, with short-duration bonds being particularly sensitive to changes in the federal funds rate. This suggests a relatively clear downward trajectory for interest rates.

儘管聯儲局對未來減息的'幅度和時機'引入了新限定,但預計將繼續逐步放寬,以便在2025年前實現政策正常化,儘管速度較慢。歷史上,債券資產在放寬週期中表現良好,短期債券對聯邦基金利率變化尤其敏感。這表明利率具有相對明確的下行軌跡。

While long-duration bond yields are also trending downward, the potential for further declines appears limited due to the current resilience of the U.S. economy. Historically, during periods of Republican control, the 10-year yield has exhibited significant volatility, offering more trading opportunities than consistent trends. The new policies under the Trump administration are likely to continue influencing fluctuations in long-duration bond yields, particularly concerning fiscal policy and subsequent inflation trends within the U.S. economy.

雖然長期債券收益率也在下行,但由於美國經濟目前的韌性,進一步下降的潛力似乎有限。歷史上,在共和黨控制時期,10年期收益率表現出顯著的波動性,提供了比穩定趨勢更多的交易機會。特朗普政府的新政策可能會繼續影響長期債券收益率的波動,特別是與財政政策和隨後的美國經濟通脹趨勢有關。

Additionally, the second half of 2025 will represent a critical juncture for the Federal Reserve's monetary policy, and a pause in rate cuts cannot be ruled out. This will largely depend on the effects of Trump's new policies on the economy. Both tariff and immigration policies present dual risks for the U.S. economy, potentially driving inflation while also suppressing economic vitality.

此外,2025年下半年將是聯儲局貨幣政策的一個關鍵節點,暫停減息的可能性不能排除。這將在很大程度上取決於特朗普新政策對經濟的影響。關稅和移民政策對美國經濟構成雙重風險,可能在推動通脹的同時抑制經濟活力。

Should the U.S. labor market cool more than anticipated next year, an increase in the unemployment rate could prompt the Federal Reserve to accelerate the pace of rate cuts. In such a scenario, long-duration bonds may experience favorable price appreciation.

如果明年美國勞動力市場降溫超出預期,失業率的上升可能促使聯儲局加快減息步伐。在這種情況下,長期債券可能會經歷有利的價格上漲。

3) Market Focus Gradually Shifts to Small and Mid-Cap Stocks

3) 市場焦點逐漸轉向小型和中型股票

Analysts maintain a broadly optimistic outlook for potential gains in the U.S. stock market; however, much of this optimism has already been priced into current market valuations. Consequently, expected returns for U.S. equities in the coming year are likely to be lower than those observed in 2024. Additionally, the potential for expansion in U.S. stock valuations appears limited, with future price increases anticipated to be driven more by earnings growth than by valuation enhancements.

分析師對美國股市潛在收益維持廣泛樂觀的展望;然而,這種樂觀情緒已經在當前市場估值中反映出來。因此,預計未來一年美國股票的回報可能低於2024年觀察到的回報。此外,美國股票估值擴張的潛力似乎有限,未來的價格增長預計將更多地由盈利增長驅動,而不是由估值提升推動。

In contrast, market attention is increasingly shifting toward small and mid-cap stocks, which are benefiting from valuation discounts, resilient real GDP growth, and the current cycle of interest rate cuts, as well as favorable policies from the Trump administration. This segment of the market may present more attractive investment opportunities compared to larger-cap stocks.

相反,市場關注正越來越多地轉向小型和中型股票,這些股票受益於估值折扣、韌性的實際國內生產總值增長,以及當前的利率下調週期,以及特朗普政府的有利政策。與大型股票相比,該市場部分可能提供更具吸引力的投資機會。

Tariff policies will be a key variable in 2025, influencing not only markets outside the U.S. but also posing risks to the revenues of American companies engaged in global operations. Investors should remain vigilant regarding the potential for revenue declines among U.S. firms stemming from changes in tariffs and evolving trade dynamics.

2025年的關稅政策將是一個關鍵變量,不僅影響美國以外的市場,還對參與全球業務的美國公司的營業收入構成風險。投資者應保持警惕,關注美國公司因關稅變化和貿易動態演變而導致的收入下降潛在風險。

⭐ Mag7 Growth Slows, Yet Outperforms: Spotlight on High-Growth Stocks

⭐ 科技七巨頭增長放緩,但表現優於:聚焦高增長股票

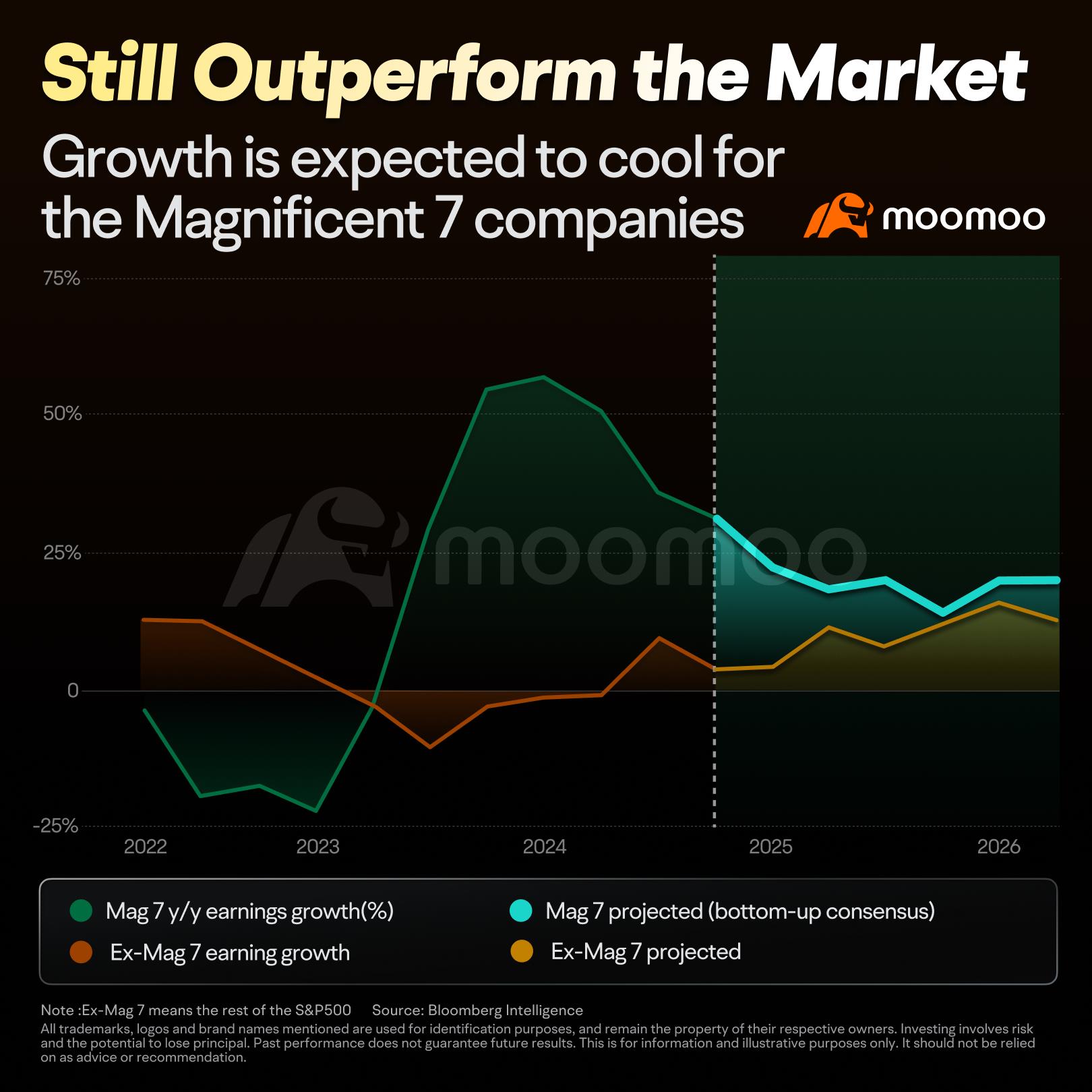

In 2025, the Magnificent Seven (Mag7) is projected to continue outperforming the S&P 500 $S&P 500 Index (.SPX.US)$ , although the magnitude of excess returns is likely to diminish. While these companies still demonstrate robust growth potential driven by advancements in AI, growth rates are expected to decelerate. Moreover, elevated valuations may limit further upside, resulting in greater differentiation in stock performance.

2025年,科技七巨頭(Mag7)預計將繼續優於S&P 500 $標普500指數 (.SPX.US)$ ,儘管超額收益的幅度可能會縮小。雖然這些公司仍顯示出由人工智能推動的強勁增長潛力,但增長率預計將放緩。此外,較高的估值可能限制進一步的上行空間,導致股票表現的差異化加大。

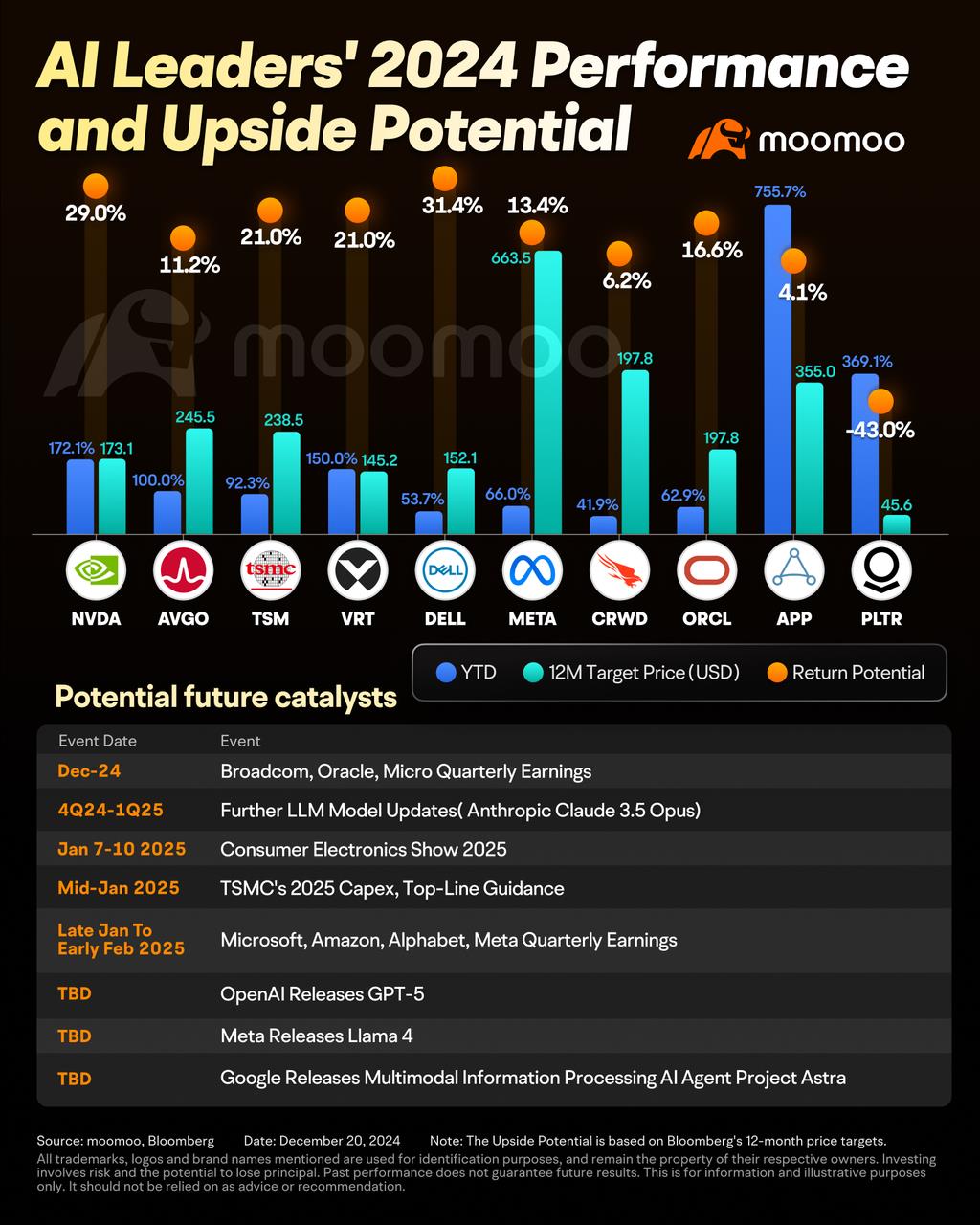

Investors should focus on each company's return on AI investments and overall market competitiveness, particularly for high-growth firms such as Nvidia $NVIDIA (NVDA.US)$ , Meta $Meta Platforms (META.US)$ , and Amazon $Amazon (AMZN.US)$ . It will be essential to closely monitor the challenges and opportunities faced by Apple $Apple (AAPL.US)$ , Google $Alphabet-C (GOOG.US)$ , and Microsoft $Microsoft (MSFT.US)$ to identify stocks with the greatest growth potential. By concentrating on these dynamics, investors can better position themselves to capitalize on the evolving landscape of high-growth stocks within the Mag7.

投資者應關注每家公司在人工智能投資上的回報及其整體市場競爭力,特別是對於如英偉達這樣的高增長公司。 $英偉達 (NVDA.US)$ ,Meta $Meta Platforms (META.US)$ ,以及亞馬遜 $亞馬遜 (AMZN.US)$ 。密切關注蘋果面臨的挑戰和機遇將是至關重要的 $蘋果 (AAPL.US)$ ,谷歌 $谷歌-C (GOOG.US)$ ,和微軟 $微軟 (MSFT.US)$ 來識別具有最大增長潛力的股票。通過關注這些動態,投資者可以更好地定位自己,以便在科技七巨頭的高增長股票不斷演變的格局中抓住機會。

⭐ AI Agents Poised to Lead the AI Theme in 2025

⭐ 人工智能代理在2025年有望引領人工智能主題

As we approach 2025, the AI wave is expected to usher in a new phase characterized by increased software investment, robust revenue growth, and margin expansion. Market attention is likely to shift toward "application and monetization," with key focus areas including AI software, AI agents, large models, public cloud infrastructure, core hardware, and cybersecurity. The application scale of AI agents is projected to be up to ten times that of traditional SaaS applications, with tech giants leading advancements in large models and public cloud services. Additionally, demand for hardware infrastructure is anticipated to rise, along with an expected increase in cybersecurity spending.

隨着我們逐步接近2025年,預計人工智能浪潮將引入一個新階段,特點是軟體投資增加,營業收入強勁增長,利潤空間擴大。市場注意力很可能會轉向「應用和貨幣化」,主要關注領域包括人工智能軟體、人工智能代理、大型模型、公共雲基礎建設、核心硬件和網絡安全概念。預計人工智能代理的應用規模將是傳統Saas-雲計算應用的十倍,科技巨頭引領大型模型和公共雲服務的進步。此外,硬件基礎設施的需求預計將上升,網絡安全支出的增加也是可以預見的。

However, several risk factors warrant caution. Software companies may be overvalued, and the ultimate winners in this competitive landscape remain uncertain, which could lead to disappointment if valuations are excessively high. Furthermore, the capital expenditures of tech giants may disrupt the valuations of hardware companies, influenced by macroeconomic conditions and challenges related to revenue conversion.

然而,幾個風險因素值得謹慎。軟體公司可能被高估,而在這個競爭格局中最終的贏家仍然不確定,這可能導致如果估值過高而產生失望。此外,科技巨頭的資本支出可能會影響硬件公司的估值,受宏觀經濟條件和營業收入轉換相關的挑戰的影響。

Given these dynamics, investors must carefully assess the potential impacts on their portfolios. Amid the AI surge, it is crucial for investors to selectively identify investment targets, capitalizing on growth opportunities while remaining vigilant about potential risks. By adopting a strategic and informed approach, investors can effectively navigate the evolving AI landscape.

鑑於這些動態,投資者必須仔細評估潛在影響他們投資組合的因素。在人工智能激增的背景下,投資者務必敏銳地識別投資目標,抓住增長機會,同時保持警惕潛在的風險。通過採取戰略性和信息充分的方式,投資者可以有效地駕馭不斷演變的人工智能格局。

4) Trump's Administration Brings Regulatory Tailwinds; Bitcoin Prices Set to Reach New Heights

4) 特朗普政府帶來監管順風,預計比特幣價格將達到新高

Looking ahead to 2025, the Trump administration has made significant strides in reducing regulatory uncertainty surrounding cryptocurrencies in the U.S., fostering a more optimistic outlook among investors regarding Bitcoin's future. Trump has pledged to establish the U.S. as the "global cryptocurrency capital." This commitment, combined with the ongoing cycle of interest rate cuts and the anticipated Bitcoin halving event, is expected to drive increased demand for Bitcoin. Additionally, the current excitement surrounding Bitcoin ETFs is further integrating Bitcoin into traditional financial investment portfolios, enhancing its legitimacy and accessibility.

展望2025年,特朗普政府在減少美國數字貨幣監管不確定性方面取得了顯著進展,增強了投資者對比特幣未來的樂觀預期。特朗普承諾將美國建立爲"全球數字貨幣中心"。這一承諾,加上持續的利率下調週期和預期中的比特幣減半事件,預計將推動比特幣需求的增長。此外,目前圍繞比特幣ETF的興奮進一步將比特幣融入傳統金融投資組合,提升了其合法性和可獲取性。

However, several risk factors could impact this positive trajectory, including the potential for a global economic recession, inflation risks, and possible adjustments in Federal Reserve policy. Investors should remain vigilant and closely monitor these factors. While the regulatory environment appears favorable and demand for Bitcoin is expected to grow, the broader economic landscape and shifts in investor sentiment will play critical roles in determining Bitcoin's price trajectory in the coming years.

然而,幾個風險因素可能影響這一積極趨勢,包括全球經濟衰退的潛在可能性、通脹風險,以及聯儲局政策的可能調整。投資者應保持警惕,密切關注這些因素。雖然監管環境似乎有利,且比特幣的需求預計將增長,但更廣泛的經濟形勢及投資者情緒的變化將在未來幾年對比特幣價格走勢起到關鍵作用。

5) Gold Likely to Experience Range-Bound Fluctuations; Focus on Three Catalysts

5) 黃金可能經歷區間波動;關注三個催化因素

In 2025, gold is expected to encounter several headwinds that could limit its price appreciation. For instance, an anticipated easing of geopolitical tensions may diminish gold's appeal as a safe-haven asset. Additionally, the new Trump administration aims to promote fiscal efficiency, which could lead to reduced government spending and lower deficit levels, thereby exerting downward pressure on gold prices. Furthermore, the rise of digital assets like Bitcoin is drawing investor interest away from gold, a trend that may be further intensified by supportive policies from the Trump administration.

到2025年,黃金預計將面臨多重阻力,可能限制其價格升值。例如,預計地緣政治緊張局勢的緩解可能會降低黃金作爲避險資產的吸引力。此外,新一屆特朗普政府旨在促進財政效率,這可能導致政府支出減少和赤字水平降低,從而對黃金價格施加下行壓力。此外,比特幣等數字資產的崛起也正在吸引投資者的興趣,可能會進一步加劇特朗普政府的支持政策所帶來的這一趨勢。

What Catalysts Are Needed for Gold Prices to Rise Again?

要使黃金價格再次上漲需要哪些催化劑?

⭐ Potential Safe-Haven Demand: New trade tensions under Trump could reignite safe-haven demand, boosting gold prices even if other conflicts ease. Should the situation in Syria escalate, it may reignite safe-haven demand among investors.

⭐ 潛在的避險需求:特朗普下的新貿易緊張局勢可能重新點燃避險需求,即使其他衝突緩和也會推升黃金價格。如果敘利亞局勢升級,可能會重新點燃投資者的避險需求。

⭐ Fiscal Policy Uncertainties: Trump's fiscal policies, particularly if the fiscal deficit remains high, could degrade the U.S. dollar's creditworthiness and push gold prices up, especially as over 70% of U.S. spending is mandatory.

⭐ 財政策略不確定性:特朗普的財政政策,尤其是如果財政赤字保持在高位,可能會降低美元的信用度並推高黃金價格,特別是因爲超過70%的美國支出是強制性的。

⭐ Central Banks Keeping Gold Purchases: The People's Bank of China has resumed gold purchases, and increased buying by central banks in emerging markets could further stimulate gold prices.

⭐ 中央銀行保持黃金購買:中國人民銀行已經恢復了黃金購買,新興市場中央銀行的增加購買可能會進一步刺激黃金價格。