Xerox Holdings (NASDAQ:XRX) Shareholders Are up 8.0% This Past Week, but Still in the Red Over the Last Five Years

Xerox Holdings (NASDAQ:XRX) Shareholders Are up 8.0% This Past Week, but Still in the Red Over the Last Five Years

Statistically speaking, long term investing is a profitable endeavour. But unfortunately, some companies simply don't succeed. Zooming in on an example, the Xerox Holdings Corporation (NASDAQ:XRX) share price dropped 74% in the last half decade. We certainly feel for shareholders who bought near the top. And we doubt long term believers are the only worried holders, since the stock price has declined 49% over the last twelve months. On the other hand the share price has bounced 8.0% over the last week.

從統計學上講,長期投資是一個有利可圖的事業。但不幸的是,有些公司根本無法成功。以施樂控股公司(納斯達克:XRX)爲例,其股價在過去五年中下跌了74%。我們確實對那些在高位買入的股東感到同情。同時,我們懷疑長期投資者不是唯一感到擔憂的持有者,因爲在過去的十二個月中,股價下跌了49%。另一方面,股價在過去一週上漲了8.0%。

While the stock has risen 8.0% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

雖然該股票在過去一週上漲了8.0%,但長期股東仍然處於虧損狀態,我們來看看基本面能告訴我們什麼.

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

借用本傑明·格雷厄姆的話來說:短期內市場是一個投票機,但長期來說它是一個稱重機。一種存在缺陷但合理的評估公司情緒變化的方法是將每股收益(EPS)與股價進行比較。

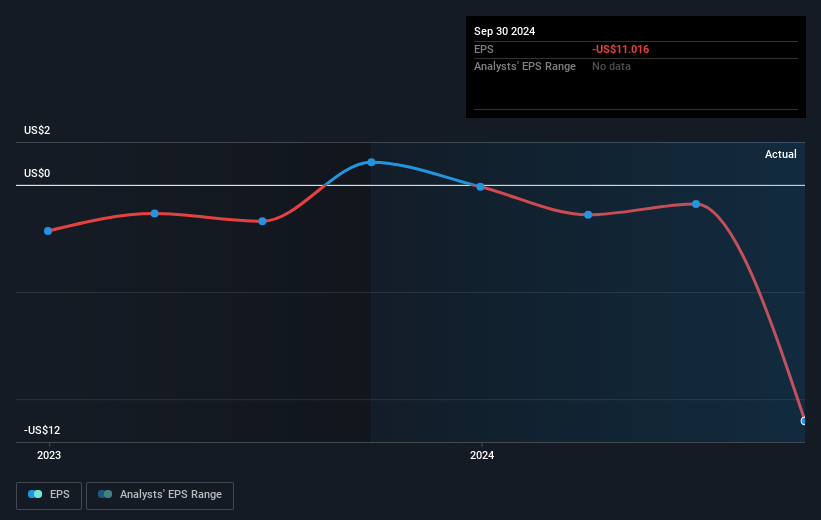

Over five years Xerox Holdings' earnings per share dropped significantly, falling to a loss, with the share price also lower. This was, in part, due to extraordinary items impacting earnings. Since the company has fallen to a loss making position, it's hard to compare the change in EPS with the share price change. However, we can say we'd expect to see a falling share price in this scenario.

在過去五年中,施樂控股的每股收益顯著下降,甚至出現虧損,股價也隨之下跌。這部分是由於影響收益的特殊項目。由於公司已陷入虧損狀態,很難將每股收益的變化與股價變化進行比較。然而,我們可以說在這種情況下,我們會預期看到股價下跌。

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

下面的圖像顯示了EPS隨時間的變化(如果你點擊圖像,可以看到更詳細的信息)。

It might be well worthwhile taking a look at our free report on Xerox Holdings' earnings, revenue and cash flow.

不妨看看我們關於施樂控股公司盈利、營業收入和現金流的免費報告。

What About Dividends?

關於分紅派息的問題

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Xerox Holdings the TSR over the last 5 years was -66%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

在考慮任何特定股票時,考慮股東總回報和股價回報是很重要的。總股東回報(TSR)是一種回報計算,考慮了現金分紅的價值(假設任何收到的分紅都被再投資)以及任何折扣資本籌集和剝離的計算價值。可以公平地說,TSR爲支付分紅的股票提供了更全面的圖景。我們注意到,施樂控股在過去5年中的TSR爲-66%,這比上述的股價回報要好。公司支付的分紅因此提升了總股東回報。

A Different Perspective

不同的視角

Investors in Xerox Holdings had a tough year, with a total loss of 46% (including dividends), against a market gain of about 26%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 11% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for Xerox Holdings (of which 2 shouldn't be ignored!) you should know about.

施樂控股的投資者經歷了艱難的一年,總損失達46%(包括分紅),而市場收益約爲26%。即使好的股票的股價有時也會下跌,但在我們變得過於感興趣之前,我們希望看到業務基本指標的改善。不幸的是,去年的表現可能表明存在未解決的挑戰,因爲其在過去五年中的年化損失爲11%。我們意識到巴倫·羅斯柴爾德曾說過投資者應在"街頭有鮮血流淌時買入",但我們提醒投資者首先要確保他們是在買入一家高質量的業務。我發現從長期來看觀察股價作爲業務表現的代理非常有趣。但要真正獲得洞察力,我們還需要考慮其他信息。例如,風險。每個公司都有風險,我們已經發現施樂控股存在三個警示信號(其中兩個不可忽視!),你應該了解。

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

如果你更傾向於查看其他公司——一個財務狀況可能更優的公司——那麼不要錯過這個免費的公司列表,它們已經證明能夠實現盈利增長。

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

請注意,本文中引用的市場回報反映了當前在美國交易所上市股票的市場加權平均回報。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對本文有反饋?對內容有疑慮?請直接與我們聯繫。或者,發送電子郵件至 editorial-team (at) simplywallst.com。

這篇來自Simply Wall ST的文章是一般性的。我們根據歷史數據和分析師預測提供評論,採用無偏見的方法,我們的文章並不旨在提供財務建議。它不構成對任何股票的買入或賣出建議,也未考慮到您的目標或財務狀況。我們旨在爲您提供以基本數據驅動的長期分析。請注意,我們的分析可能未考慮最新的價格敏感公司公告或定性材料。Simply Wall ST在提到的任何股票中均沒有持倉。

Over five years Xerox Holdings' earnings per share dropped significantly, falling to a loss, with the share price also lower. This was, in part, due to extraordinary items impacting earnings. Since the company has fallen to a loss making position, it's hard to compare the change in EPS with the share price change. However, we can say we'd expect to see a falling share price in this scenario.

Over five years Xerox Holdings' earnings per share dropped significantly, falling to a loss, with the share price also lower. This was, in part, due to extraordinary items impacting earnings. Since the company has fallen to a loss making position, it's hard to compare the change in EPS with the share price change. However, we can say we'd expect to see a falling share price in this scenario.