TradePulse Power Inflow Alert: Netflix (NFLX) Moves 14 Points Higher After Alert

TradePulse Power Inflow Alert: Netflix (NFLX) Moves 14 Points Higher After Alert

NFLX REVERSES EARLY DECLINE AT 10:22 AM EST

奈飛逆轉早期下跌 東部時間上午10:22

Netflix, Inc. (NFLX) experienced a Power Inflow, a significant event for those who follow where smart money goes and value order flow analytics in their trading decisions.

奈飛公司 (NFLX) 發生了流入,這對於那些關注聰明資金流向和重視訂單流分析的交易者來說是一個重要事件。

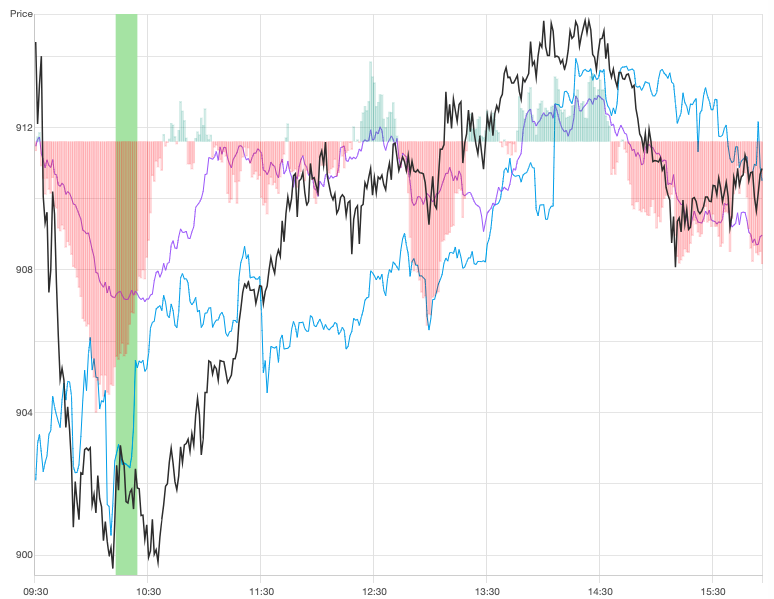

At 10:22 AM on December 23rd, a significant trading signal occurred for Netflix, Inc. (NFLX) as it demonstrated a Power Inflow at a price of $901.29. This indicator is crucial for traders who want to know directionally where institutions and so-called "smart money" moves in the market. They see the value of utilizing order flow analytics to guide their trading decisions. The Power Inflow points to a possible uptrend in Netflix's stock, marking a potential entry point for traders looking to capitalize on the expected upward movement. Traders with this signal closely watch for sustained momentum in Netflix's stock price, interpreting this event as a bullish sign.

在12月23日東部時間上午10:22,奈飛公司 (NFLX) 出現了一個重要交易信號,表現出在$901.29的價格上有流入。這個指標對於想了解機構和所謂的「聰明資金」在市場上流向的交易者來說至關重要。他們看到利用訂單流分析來指導交易決策的價值。流入指向奈飛股票可能的上升趨勢,爲尋求利用預期上漲動向的交易者標記了潛在的入場點。獲得此信號的交易者會密切關注奈飛股價的持續動量,將這一事件解讀爲看好的跡象。

Signal description

信號描述

Order flow analytics, aka transaction or market flow analysis, separate and study both the retail and institutional volume rate of orders (flow). It involves analyzing the flow of buy and sell orders, along with size, timing, and other associated characteristics and patterns, to gain insights and make more informed trading decisions. This particular indicator is interpreted as a bullish signal by active traders.

訂單流分析,也稱爲交易或市場流向分析,分離並研究零售和機構的訂單成交量(流向)。它涉及分析買入和賣出訂單的流向,以及規模、時機和其他相關特徵和模式,以獲得見解並做出更明智的交易決策。這個特定指標被活躍交易者解讀爲看好的信號。

The Power Inflow occurs within the first two hours of the market open and generally signals the trend that helps gauge the stock's overall direction, powered by institutional activity in the stock, for the remainder of the day.

流入力量發生在市場開盤的前兩個小時內,並且通常會預示幫助判斷股票作爲一整天的整體方向的趨勢,由股票中的機構活動推動。

By incorporating order flow analytics into their trading strategies, market participants can better interpret market conditions, identify trading opportunities, and potentially improve their trading performance. But let's not forget that while watching smart money flow can provide valuable insights, it is crucial to incorporate effective risk management strategies to protect capital and mitigate potential losses. Employing a consistent and effective risk management plan helps traders navigate the uncertainties of the market in a more controlled and calculated manner, increasing the likelihood of long-term success

通過將訂單流量分析納入交易策略,市場參與者可以更好地解讀市場狀況、識別交易機會,並可能提高其交易表現。但我們不能忘記,儘管關注聰明錢流動可以提供有價值的見解,但有效的風險管理策略也至關重要,以保護資本並減少潛在損失。實施一致有效的風險管理計劃幫助交易者在市場的不確定性中以更受控和計算的方法進行交易,增加長期成功的可能性。

Market News and Data brought to you by Benzinga APIs and include firms, like which are responsible for parts of the data within this article.

市場資訊和數據由Benzinga APIs提供,包括負責本文中部分數據的公司,如

2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

2024年Benzinga.com保留版權所有,Benzinga.com不提供投資建議。

After Market Close UPDATE:

收盤後更新:

The price at the time of the Power Inflow was $901.29. The returns on the high price ($915) and close price ($911.45) after the power inflow were 1.55% and 1.22% respectively. That is why it is important to have a trading plan that includes Profit Targets and Stop Losses that reflect your risk appetite. In this case, the high of the day and close were very close but that is not always the case

在流入時的價格爲901.29美元。流入後高價(915美元)和收盤價(911.45美元)的收益分別爲1.55%和1.22%。這就是爲什麼擁有一項包含利潤目標和止損的交易計劃非常重要,該計劃應反映您的風險承受能力。在這種情況下,日內最高價和收盤價非常接近,但這並不總是如此。

Past Performance is Not Indicative of Future Results

過去的表現並不代表未來的結果