Behind the Scenes of MARA Holdings's Latest Options Trends

Behind the Scenes of MARA Holdings's Latest Options Trends

Deep-pocketed investors have adopted a bullish approach towards MARA Holdings (NASDAQ:MARA), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in MARA usually suggests something big is about to happen.

資金充裕的投資者對MARA控股(納斯達克:MARA)採取了看好的態度,這一點市場參與者不應忽視。我們在Benzinga跟蹤的公開期權記錄揭示了今天這一重要舉動。這些投資者的身份尚不明確,但MARA的如此重大舉動通常預示着一些大事即將發生。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 22 extraordinary options activities for MARA Holdings. This level of activity is out of the ordinary.

我們今天從觀察中了解到這一信息,當Benzinga的期權掃描儀突出了MARA控股的22個異常期權活動時。這樣的活動水平是不尋常的。

The general mood among these heavyweight investors is divided, with 50% leaning bullish and 18% bearish. Among these notable options, 10 are puts, totaling $639,202, and 12 are calls, amounting to $540,795.

這些重量級投資者之間的整體情緒是分裂的,50%看好,18%看淡。在這些顯著期權中,有10個看跌期權,總計639,202美元,12個看漲期權,總額爲540,795美元。

Projected Price Targets

預計價格目標

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $7.5 to $50.0 for MARA Holdings over the recent three months.

根據交易活動,似乎重大投資者的目標價格區間爲MARA控股的7.5美元至50.0美元,在最近的三個月內。

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

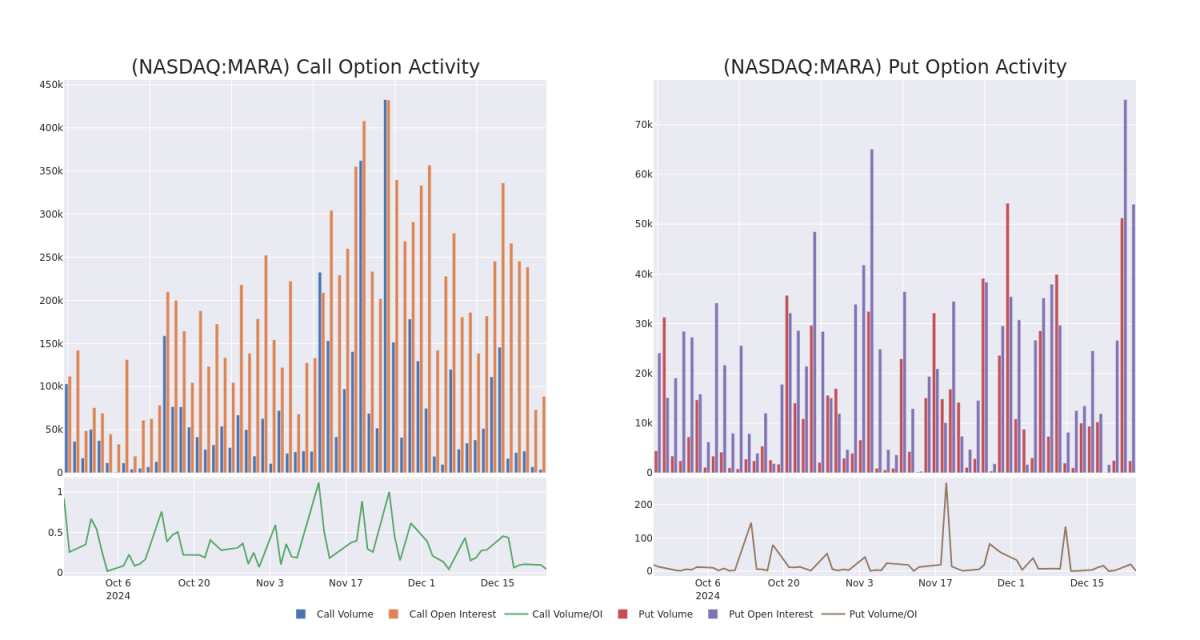

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in MARA Holdings's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to MARA Holdings's substantial trades, within a strike price spectrum from $7.5 to $50.0 over the preceding 30 days.

評估成交量和未平倉合約是期權交易中的戰略步驟。這些指標爲MARA控股在特定行權價的期權流動性和投資者興趣提供了明確的見解。接下來的數據將可視化在過去30天內與MARA控股的大宗交易相關的看漲和看跌期權的成交量和未平倉合約的波動,行權價範圍爲7.5美元至50.0美元。

MARA Holdings Option Activity Analysis: Last 30 Days

MARA控股期權活動分析:過去30天

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MARA | PUT | TRADE | BEARISH | 01/17/25 | $5.55 | $5.55 | $5.55 | $25.00 | $149.8K | 18.0K | 309 |

| MARA | PUT | SWEEP | BULLISH | 12/27/24 | $2.15 | $2.09 | $2.1 | $22.00 | $105.0K | 3.3K | 1.0K |

| MARA | CALL | SWEEP | BULLISH | 03/21/25 | $5.0 | $4.7 | $5.0 | $18.00 | $100.0K | 2.4K | 200 |

| MARA | PUT | SWEEP | NEUTRAL | 03/21/25 | $7.95 | $7.8 | $7.86 | $25.00 | $78.7K | 9.3K | 102 |

| MARA | PUT | TRADE | BEARISH | 01/16/26 | $9.15 | $9.1 | $9.15 | $22.00 | $73.2K | 991 | 93 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 行權價 | 總交易價格 | 未平倉合約 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MARA | 看跌 | 交易 | 看淡 | 01/17/25 | $5.55 | $5.55 | $5.55 | $25.00 | 149.8K美元 | 18.0K | 309 |

| MARA | 看跌 | 掃單 | 看好 | 12/27/24 | $2.15 | $2.09 | $2.1 | $22.00 | $105.0K | 3.3K | 1.0K |

| MARA | 看漲 | 掃單 | 看好 | 03/21/25 | $5.0 | $4.7 | $5.0 | $18.00 | 100,000美元 | 2.4K | 200 |

| MARA | 看跌 | 掃單 | 中立 | 03/21/25 | $7.95 | $7.8 | $7.86 | $25.00 | $78.7K | 9.3K | 102 |

| MARA | 看跌 | 交易 | 看淡 | 01/16/26 | $9.15 | $9.1 | $9.15 | $22.00 | $73.2K | 991 | 93 |

About MARA Holdings

關於MARA控股

MARA Holdings Inc leverages digital asset compute to support the energy transformation. It secures the blockchain ledger and supports the energy transformation by converting clean, stranded, or underutilized energy into economic value.

MARA控股公司利用數字資產計算來支持能源轉型。它通過將清潔、閒置或利用不足的能源轉化爲經濟價值,確保了區塊鏈賬本並支持能源轉型。

After a thorough review of the options trading surrounding MARA Holdings, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在對MARA控股的期權交易進行全面審查後,我們將更詳細地考察該公司。這包括對其當前市場狀態和表現的評估。

Where Is MARA Holdings Standing Right Now?

MARA控股目前處於何種狀態?

- Trading volume stands at 12,463,116, with MARA's price up by 4.35%, positioned at $20.09.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 64 days.

- 成交量爲12,463,116,MARA的價格上漲了4.35%,目前位於$20.09。

- 相對強弱指數因數顯示股票可能接近超賣。

- 預計在64天后發佈業績。

Unusual Options Activity Detected: Smart Money on the Move

檢測到期權異動:聰明資金正在行動

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Benzinga Edge的期權異動板塊在市場發生變化之前發現潛在的市場動向。看看大資金在你喜歡的股票上採取了什麼倉位。點擊這裏獲取訪問權限。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest MARA Holdings options trades with real-time alerts from Benzinga Pro.

期權交易存在更高的風險和潛在的回報。精明的交易者通過不斷自我教育、調整策略、監控多個因數以及密切關注市場動態來管理這些風險。通過Benzinga Pro的實時提醒,隨時了解最新的MARA Holdings期權交易。

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $7.5 to $50.0 for MARA Holdings over the recent three months.

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $7.5 to $50.0 for MARA Holdings over the recent three months.