NVIDIA Unusual Options Activity For December 24

NVIDIA Unusual Options Activity For December 24

Deep-pocketed investors have adopted a bearish approach towards NVIDIA (NASDAQ:NVDA), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in NVDA usually suggests something big is about to happen.

財力雄厚的投資者對NVIDIA(納斯達克股票代碼:NVDA)採取了看跌的態度,這是市場參與者不容忽視的。我們對本辛加公開期權記錄的追蹤今天揭示了這一重大舉措。這些投資者的身份仍然未知,但是NVDA的如此重大變動通常表明即將發生重大事件。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 279 extraordinary options activities for NVIDIA. This level of activity is out of the ordinary.

我們今天從觀察中收集了這些信息,當時Benzinga的期權掃描儀重點介紹了NVIDIA的279項非凡期權活動。這種活動水平與衆不同。

The general mood among these heavyweight investors is divided, with 43% leaning bullish and 46% bearish. Among these notable options, 26 are puts, totaling $1,945,197, and 253 are calls, amounting to $19,205,178.

這些重量級投資者的總體情緒存在分歧,43%的人傾向於看漲,46%的人傾向於看跌。在這些值得注意的期權中,有26個是看跌期權,總額爲1,945,197美元,還有253個是看漲期權,總額爲19,205,178美元。

Projected Price Targets

預計的目標價格

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $104.0 to $191.0 for NVIDIA during the past quarter.

分析這些合約的交易量和未平倉合約,大型企業似乎一直在關注NVIDIA在過去一個季度的價格範圍從104.0美元到191.0美元不等。

Analyzing Volume & Open Interest

分析交易量和未平倉合約

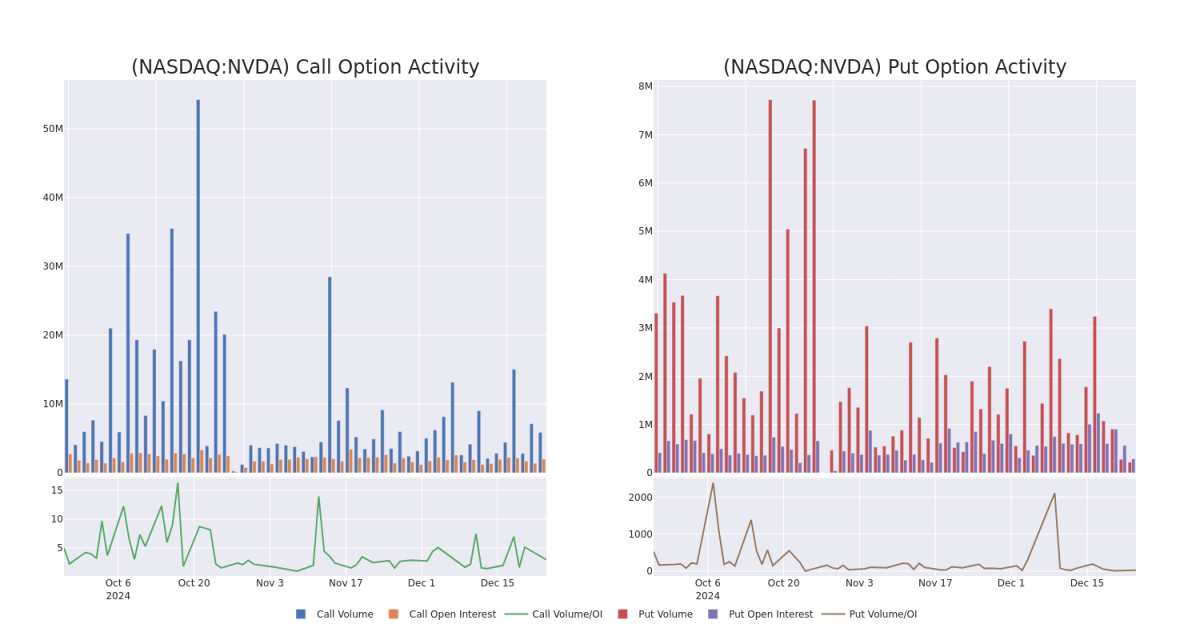

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in NVIDIA's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to NVIDIA's substantial trades, within a strike price spectrum from $104.0 to $191.0 over the preceding 30 days.

評估交易量和未平倉合約是期權交易的戰略步驟。這些指標揭示了指定行使價下NVIDIA期權的流動性和投資者對NVIDIA期權的興趣。即將發佈的數據可視化了與NVIDIA大量交易相關的看漲期權和看跌期權的交易量和未平倉合約的波動,在過去30天內,行使價範圍從104.0美元到191.0美元不等。

NVIDIA Option Volume And Open Interest Over Last 30 Days

過去 30 天的 NVIDIA 期權交易量和未平倉合約

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NVDA | CALL | SWEEP | BULLISH | 12/27/24 | $1.37 | $1.36 | $1.37 | $142.00 | $239.0K | 33.8K | 88.7K |

| NVDA | CALL | SWEEP | BULLISH | 12/27/24 | $1.38 | $1.36 | $1.37 | $142.00 | $164.2K | 33.8K | 85.6K |

| NVDA | CALL | TRADE | BEARISH | 12/27/24 | $1.04 | $1.03 | $1.03 | $142.00 | $144.5K | 33.8K | 68.8K |

| NVDA | CALL | SWEEP | BULLISH | 12/27/24 | $1.07 | $1.06 | $1.07 | $142.00 | $128.6K | 33.8K | 79.4K |

| NVDA | CALL | SWEEP | BEARISH | 12/27/24 | $1.41 | $1.4 | $1.4 | $142.00 | $128.3K | 33.8K | 94.4K |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NVDA | 打電話 | 掃 | 看漲 | 12/27/24 | 1.37 美元 | 1.36 美元 | 1.37 美元 | 142.00 美元 | 239.0 萬美元 | 33.8 K | 88.7K |

| NVDA | 打電話 | 掃 | 看漲 | 12/27/24 | 1.38 美元 | 1.36 美元 | 1.37 美元 | 142.00 美元 | 164.2 萬美元 | 33.8 K | 85.6K |

| NVDA | 打電話 | 貿易 | 粗魯的 | 12/27/24 | 1.04 美元 | 1.03 美元 | 1.03 美元 | 142.00 美元 | 144.5 萬美元 | 33.8 K | 68.8K |

| NVDA | 打電話 | 掃 | 看漲 | 12/27/24 | 1.07 美元 | 1.06 美元 | 1.07 美元 | 142.00 美元 | 128.6 萬美元 | 33.8 K | 79.4K |

| NVDA | 打電話 | 掃 | 粗魯的 | 12/27/24 | 1.41 美元 | 1.4 美元 | 1.4 美元 | 142.00 美元 | 128.3 萬美元 | 33.8 K | 94.4K |

About NVIDIA

關於英偉達

Nvidia is a leading developer of graphics processing units. Traditionally, GPUs were used to enhance the experience on computing platforms, most notably in gaming applications on PCs. GPU use cases have since emerged as important semiconductors used in artificial intelligence. Nvidia not only offers AI GPUs, but also a software platform, Cuda, used for AI model development and training. Nvidia is also expanding its data center networking solutions, helping to tie GPUs together to handle complex workloads.

Nvidia 是圖形處理單元的領先開發商。傳統上,GPU 用於增強計算平台上的體驗,尤其是在電腦上的遊戲應用程序中。此後,GPU 用例已成爲人工智能中使用的重要半導體。英偉達不僅提供人工智能顯卡,還提供一個名爲Cuda的軟體平台,用於人工智能模型開發和訓練。Nvidia 還在擴展其數據中心網絡解決方案,幫助將 GPU 結合在一起以處理複雜的工作負載。

Following our analysis of the options activities associated with NVIDIA, we pivot to a closer look at the company's own performance.

在分析了與NVIDIA相關的期權活動之後,我們轉而仔細研究公司自身的表現。

Current Position of NVIDIA

NVIDIA 的現狀

- Currently trading with a volume of 56,542,252, the NVDA's price is up by 1.1%, now at $141.21.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 64 days.

- NVDA目前的交易量爲56,542,252美元,價格上漲了1.1%,目前爲141.21美元。

- RSI讀數表明該股目前可能接近超買。

- 預計收益將在64天后發佈。

Turn $1000 into $1270 in just 20 days?

在短短 20 天內將 1000 美元變成 1270 美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

20年專業期權交易員透露了他的單線圖技術,該技術顯示何時買入和賣出。複製他的交易,平均每20天獲利27%。點擊此處訪問。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest NVIDIA options trades with real-time alerts from Benzinga Pro.

期權交易具有更高的風險和潛在的回報。精明的交易者通過不斷自我教育、調整策略、監控多個指標以及密切關注市場走勢來管理這些風險。藉助Benzinga Pro的實時警報,隨時了解最新的NVIDIA期權交易。

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $104.0 to $191.0 for NVIDIA during the past quarter.

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $104.0 to $191.0 for NVIDIA during the past quarter.