Smart Money Is Betting Big In ORCL Options

Smart Money Is Betting Big In ORCL Options

Whales with a lot of money to spend have taken a noticeably bullish stance on Oracle.

擁有雄厚資金的鯨魚對甲骨文采取了明顯的看好態度。

Looking at options history for Oracle (NYSE:ORCL) we detected 15 trades.

查看甲骨文(紐交所代碼:ORCL)的期權歷史,我們檢測到15筆交易。

If we consider the specifics of each trade, it is accurate to state that 60% of the investors opened trades with bullish expectations and 40% with bearish.

考慮到每筆交易的具體情況,可以準確地說,60%的投資者以看好的預期開盤交易,40%則是看淡。

From the overall spotted trades, 5 are puts, for a total amount of $705,955 and 10, calls, for a total amount of $862,606.

在總體發現的交易中,有5筆爲看跌期權,總金額爲705,955美元,10筆爲看漲期權,總金額爲862,606美元。

What's The Price Target?

價格目標是什麼?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $120.0 to $270.0 for Oracle over the recent three months.

根據交易活動,重大投資者的目標是將甲骨文的價格區間範圍定在120.0美元到270.0美元之間,時段爲最近三個月。

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

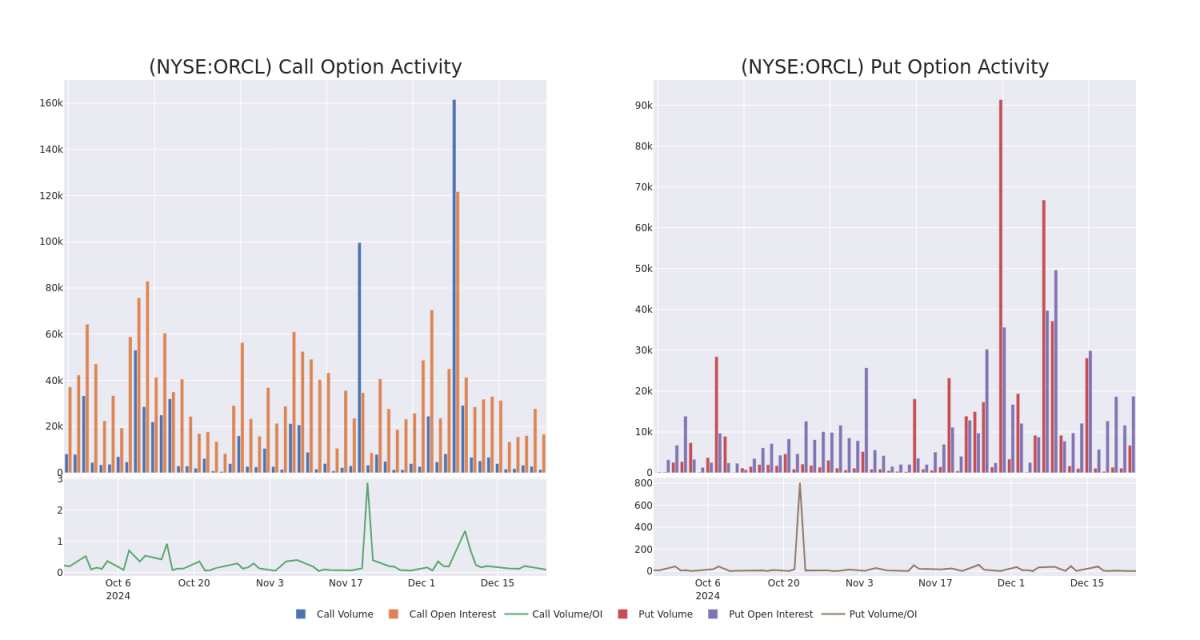

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Oracle's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Oracle's significant trades, within a strike price range of $120.0 to $270.0, over the past month.

審查成交量和未平倉合約提供了對股票研究的關鍵見解。這條信息對於評估甲骨文在某些行權價的流動性和興趣水平至關重要。以下,我們展示了在過去一個月中甲骨文重大交易的看漲和看跌期權的成交量和未平倉合約趨勢快照,行權價範圍爲120.0美元到270.0美元。

Oracle Call and Put Volume: 30-Day Overview

甲骨文看漲和看跌成交量:30天概覽

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ORCL | PUT | TRADE | BEARISH | 06/20/25 | $16.75 | $16.0 | $16.65 | $175.00 | $499.5K | 908 | 300 |

| ORCL | CALL | SWEEP | BULLISH | 03/21/25 | $43.2 | $43.0 | $43.18 | $130.00 | $280.7K | 344 | 65 |

| ORCL | CALL | TRADE | BEARISH | 12/19/25 | $25.25 | $25.0 | $25.0 | $170.00 | $170.0K | 252 | 68 |

| ORCL | CALL | TRADE | BULLISH | 01/17/25 | $2.52 | $2.44 | $2.5 | $175.00 | $125.0K | 4.6K | 604 |

| ORCL | PUT | SWEEP | BULLISH | 01/17/25 | $0.89 | $0.81 | $0.81 | $160.00 | $89.2K | 15.1K | 2.1K |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 行權價 | 總交易價格 | 未平倉合約 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ORCL | 看跌 | 交易 | 看淡 | 06/20/25 | $16.75 | $16.0 | $16.65 | $175.00 | 499.5K美元 | 908 | 300 |

| ORCL | 看漲 | 掃單 | 看好 | 03/21/25 | $43.2 | $43.0 | $43.18 | $130.00 | 280.7K美元 | 344 | 65 |

| ORCL | 看漲 | 交易 | 看淡 | 12/19/25 | $25.25 | $25.0 | $25.0 | $170.00 | 170,000美元 | 252 | 68 |

| ORCL | 看漲 | 交易 | 看好 | 01/17/25 | $2.52 | $2.44 | $2.5 | $175.00 | $125.0K | 4.6千 | 604 |

| ORCL | 看跌 | 掃單 | 看好 | 01/17/25 | $0.89 | $0.81 | $0.81 | $160.00 | $89.2K | 15.1K | 2.1K |

About Oracle

關於甲骨文

Oracle provides database technology and enterprise resource planning, or ERP, software to enterprises around the world. Founded in 1977, Oracle pioneered the first commercial SQL-based relational database management system. Today, Oracle has more than 400,000 customers in 175 countries.

甲骨文公司爲全球企業提供數據庫科技和企業資源規劃(ERP)軟體。成立於1977年的甲骨文公司率先推出了第一個商業化的基於SQL的關係數據庫管理系統。如今,甲骨文公司在175個國家擁有超過400,000名客戶。

Where Is Oracle Standing Right Now?

當前Oracle的處境如何?

- Trading volume stands at 2,434,869, with ORCL's price up by 1.34%, positioned at $171.41.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 76 days.

- 成交量爲2,434,869,ORCL的價格上漲了1.34%,目前價格爲$171.41。

- 相對強弱指數因數顯示股票可能接近超賣。

- 預計將在76天內公佈業績。

Expert Opinions on Oracle

關於甲骨文的專家意見

In the last month, 5 experts released ratings on this stock with an average target price of $192.8.

在過去的一個月中,有5位專家對該股票發佈了評級,平均目標價爲192.8美元。

Unusual Options Activity Detected: Smart Money on the Move

檢測到期權異動:聰明資金正在行動

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* Consistent in their evaluation, an analyst from UBS keeps a Buy rating on Oracle with a target price of $210. * An analyst from RBC Capital downgraded its action to Sector Perform with a price target of $165. * An analyst from Jefferies has decided to maintain their Buy rating on Oracle, which currently sits at a price target of $220. * An analyst from Citigroup persists with their Neutral rating on Oracle, maintaining a target price of $194. * Maintaining their stance, an analyst from Morgan Stanley continues to hold a Equal-Weight rating for Oracle, targeting a price of $175.

Benzinga Edge的期權異動板塊在市場動向發生之前就能發現潛在市場推動者。查看大資金對您最喜歡的股票的持倉情況。點擊此處以獲取訪問權限。* 一名來自瑞銀的分析師對甲骨文保持買入評級,目標價爲210美元。* 一名來自RBC資本的分析師將其評級下調爲行業表現,目標價爲165美元。* 一名來自傑弗瑞的分析師決定維持對甲骨文的買入評級,目前目標價爲220美元。* 一名來自花旗集團的分析師堅持對甲骨文的中立評級,維持目標價爲194美元。* 一名來自摩根士丹利的分析師繼續對甲骨文持有相等權重評級,目標價爲175美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Oracle with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供了更高利潤的潛力。精明的交易者通過持續的教育、戰略性的交易調整、利用各種因數,以及密切關注市場動態來降低這些風險。通過Benzinga Pro跟蹤甲骨文最新的期權交易,以獲取實時警報。

From the overall spotted trades, 5 are puts, for a total amount of $705,955 and 10, calls, for a total amount of $862,606.

From the overall spotted trades, 5 are puts, for a total amount of $705,955 and 10, calls, for a total amount of $862,606.