Investors with a lot of money to spend have taken a bearish stance on Taiwan Semiconductor (NYSE:TSM).

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with TSM, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with TSM, it often means somebody knows something is about to happen.

Today, Benzinga's options scanner spotted 10 options trades for Taiwan Semiconductor.

This isn't normal.

The overall sentiment of these big-money traders is split between 30% bullish and 70%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $88,800, and 9, calls, for a total amount of $437,504.

What's The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $170.0 to $220.0 for Taiwan Semiconductor during the past quarter.

Analyzing Volume & Open Interest

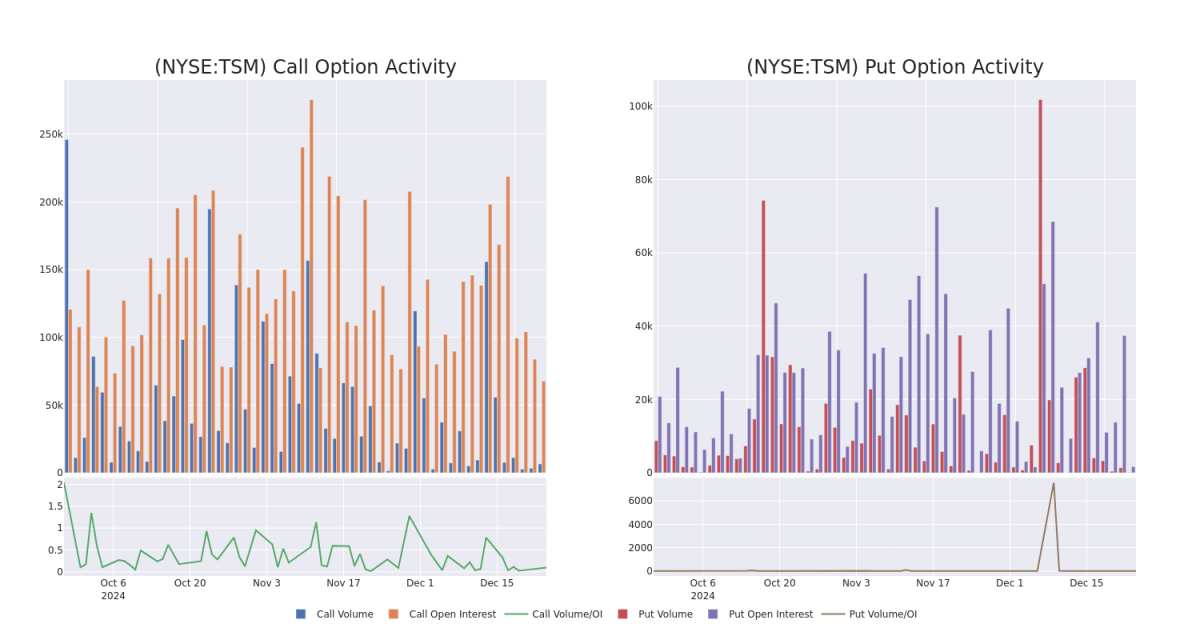

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Taiwan Semiconductor's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Taiwan Semiconductor's substantial trades, within a strike price spectrum from $170.0 to $220.0 over the preceding 30 days.

Taiwan Semiconductor Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|

TSM | PUT | TRADE | BULLISH | 04/17/25 | $7.5 | $7.35 | $7.4 | $180.00 | $88.8K | 1.6K | 120 |

TSM | CALL | SWEEP | BULLISH | 02/21/25 | $40.8 | $38.7 | $40.1 | $170.00 | $80.2K | 1.1K | 1 |

TSM | CALL | TRADE | BEARISH | 01/17/25 | $23.5 | $23.2 | $23.2 | $185.00 | $69.6K | 8.5K | 30 |

TSM | CALL | TRADE | BEARISH | 01/17/25 | $37.35 | $36.1 | $36.1 | $170.00 | $61.3K | 3.0K | 87 |

TSM | CALL | SWEEP | BEARISH | 01/31/25 | $6.15 | $6.0 | $6.08 | $220.00 | $54.7K | 1.2K | 91 |

About Taiwan Semiconductor

Taiwan Semiconductor Manufacturing Co. is the world's largest dedicated chip foundry, with over 60% market share. TSMC was founded in 1987 as a joint venture of Philips and private investors. It went public as an ADR in the us in 1997. TSMC's scale and high-quality technology allow the firm to generate solid operating margins, even in the highly competitive foundry business. Furthermore, the shift to the fabless business model has created tailwinds for TSMC. The foundry leader has an illustrious customer base, including Apple, AMD, and Nvidia, that looks to apply cutting-edge process technologies to its semiconductor designs. TSMC employs more than 73,000 people.

Taiwan Semiconductor's Current Market Status

With a trading volume of 582,898, the price of TSM is down by -0.5%, reaching $206.32.

Current RSI values indicate that the stock is may be approaching overbought.

Next earnings report is scheduled for 23 days from now.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Taiwan Semiconductor with Benzinga Pro for real-time alerts.

有大量資金可以花的投資者對臺灣半導體(紐約證券交易所代碼:TSM)採取了看跌立場。

零售交易者應該知道。

今天,當這些頭寸出現在我們在Benzinga追蹤的公開期權歷史記錄中時,我們注意到了這一點。

無論這些是機構還是僅僅是富人,我們都不知道。但是,當 tSM 發生這麼大的事情時,通常意味着有人知道某件事即將發生。

無論這些是機構還是僅僅是富人,我們都不知道。但是,當 tSM 發生這麼大的事情時,通常意味着有人知道某件事即將發生。

今天,Benzinga的期權掃描儀發現了臺灣半導體的10筆期權交易。

這不正常。

這些大資金交易者的整體情緒介於30%的看漲和70%的看跌之間。

在我們發現的所有期權中,有1個看跌期權,總額爲88,800美元,還有9個看漲期權,總額爲437,504美元。

目標價是多少?

分析這些合約的交易量和未平倉合約,大型企業似乎一直在關注臺灣半導體在過去一個季度的價格範圍從170.0美元到220.0美元不等。

分析交易量和未平倉合約

評估交易量和未平倉合約是期權交易的戰略步驟。這些指標揭示了臺灣半導體在指定行使價下期權的流動性和投資者對他們的興趣。即將發佈的數據可視化了與臺灣半導體大量交易相關的看漲期權和看跌期權的交易量和未平倉合約的波動,行使價範圍爲過去30天在170.0美元至220.0美元之間。

臺灣半導體期權活動分析:過去30天

檢測到的重大期權交易:

Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|

TSM | PUT | TRADE | BULLISH | 04/17/25 | $7.5 | $7.35 | $7.4 | $180.00 | $88.8K | 1.6K | 120 |

TSM | CALL | SWEEP | BULLISH | 02/21/25 | $40.8 | $38.7 | $40.1 | $170.00 | $80.2K | 1.1K | 1 |

TSM | CALL | TRADE | BEARISH | 01/17/25 | $23.5 | $23.2 | $23.2 | $185.00 | $69.6K | 8.5K | 30 |

TSM | CALL | TRADE | BEARISH | 01/17/25 | $37.35 | $36.1 | $36.1 | $170.00 | $61.3K | 3.0K | 87 |

TSM | CALL | SWEEP | BEARISH | 01/31/25 | $6.15 | $6.0 | $6.08 | $220.00 | $54.7K | 1.2K | 91 |

關於臺灣半導體

臺灣半導體製造公司是世界上最大的專用芯片代工廠,擁有超過60%的市場份額。台積電成立於1987年,是飛利浦和私人投資者的合資企業。它於1997年作爲替代性爭議解決在美國上市。即使在競爭激烈的鑄造業務中,台積電的規模和高質量的技術也使該公司能夠創造可觀的營業利潤率。此外,向無晶圓廠商業模式的轉變爲台積電帶來了不利影響。這家晶圓廠的領導者擁有龐大的客戶群,包括蘋果、AMD和Nvidia,他們希望將尖端的工藝技術應用到其半導體設計中。台積電擁有超過73,000名員工。

臺灣半導體的當前市場狀況

檢測到不尋常的期權活動:智能貨幣在移動

Benzinga Edge的不尋常期權委員會在潛在的市場推動者發生之前就發現了它們。看看大筆資金對你最喜歡的股票持有哪些頭寸。點擊此處訪問。

交易期權涉及更大的風險,但也提供了更高利潤的潛力。精明的交易者通過持續的教育、戰略貿易調整、利用各種指標以及隨時關注市場動態來降低這些風險。使用Benzinga Pro了解臺灣半導體的最新期權交易,以獲得實時警報。

無論這些是機構還是僅僅是富人,我們都不知道。但是,當 tSM 發生這麼大的事情時,通常意味着有人知道某件事即將發生。

無論這些是機構還是僅僅是富人,我們都不知道。但是,當 tSM 發生這麼大的事情時,通常意味着有人知道某件事即將發生。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with TSM, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with TSM, it often means somebody knows something is about to happen.