Unpacking the Latest Options Trading Trends in Boeing

Unpacking the Latest Options Trading Trends in Boeing

Financial giants have made a conspicuous bullish move on Boeing. Our analysis of options history for Boeing (NYSE:BA) revealed 12 unusual trades.

金融巨頭對波音採取了明顯的看漲舉動。我們對波音(紐約證券交易所代碼:BA)期權歷史的分析顯示了12筆不尋常的交易。

Delving into the details, we found 75% of traders were bullish, while 16% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $88,250, and 10 were calls, valued at $441,683.

深入研究細節,我們發現75%的交易者看漲,而16%的交易者表現出看跌趨勢。在我們發現的所有交易中,有2筆是看跌期權,價值爲88,250美元,10筆是看漲期權,價值441,683美元。

Projected Price Targets

預計的目標價格

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $155.0 to $210.0 for Boeing over the recent three months.

根據交易活動,看來主要投資者的目標是波音在最近三個月的價格區間從155.0美元到210.0美元不等。

Volume & Open Interest Development

成交量和未平倉合約發展

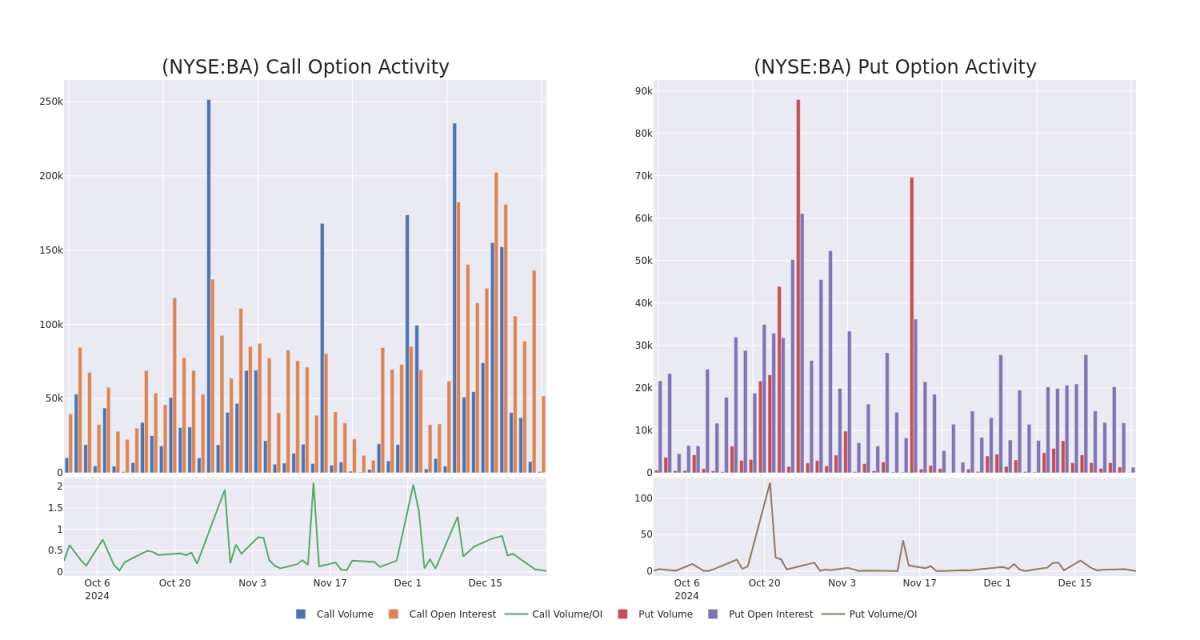

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Boeing's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Boeing's substantial trades, within a strike price spectrum from $155.0 to $210.0 over the preceding 30 days.

評估交易量和未平倉合約是期權交易的戰略步驟。這些指標揭示了波音期權在指定行使價下的流動性和投資者對波音期權的興趣。即將發佈的數據可視化了與波音的大量交易相關的看漲期權和看跌期權的交易量和未平倉合約的波動,在過去30天內,行使價範圍從155.0美元到210.0美元不等。

Boeing Option Volume And Open Interest Over Last 30 Days

過去30天的波音期權交易量和未平倉合約

Biggest Options Spotted:

發現的最大選擇:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BA | CALL | SWEEP | BULLISH | 01/17/25 | $6.0 | $5.85 | $6.0 | $180.00 | $167.4K | 22.1K | 307 |

| BA | PUT | TRADE | BULLISH | 03/21/25 | $11.55 | $11.45 | $11.45 | $180.00 | $57.2K | 574 | 50 |

| BA | CALL | TRADE | BULLISH | 05/16/25 | $29.7 | $29.4 | $29.7 | $160.00 | $41.5K | 1.1K | 14 |

| BA | CALL | TRADE | BULLISH | 03/21/25 | $29.75 | $29.65 | $29.75 | $155.00 | $35.7K | 3.3K | 12 |

| BA | CALL | TRADE | BULLISH | 06/20/25 | $31.6 | $30.5 | $31.6 | $160.00 | $31.6K | 1.3K | 0 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BA | 打電話 | 掃 | 看漲 | 01/17/25 | 6.0 美元 | 5.85 美元 | 6.0 美元 | 180.00 美元 | 167.4 萬美元 | 22.1K | 307 |

| BA | 放 | 貿易 | 看漲 | 03/21/25 | 11.55 美元 | 11.45 美元 | 11.45 美元 | 180.00 美元 | 57.2 萬美元 | 574 | 50 |

| BA | 打電話 | 貿易 | 看漲 | 05/16/25 | 29.7 美元 | 29.4 美元 | 29.7 美元 | 160.00 美元 | 41.5 萬美元 | 1.1K | 14 |

| BA | 打電話 | 貿易 | 看漲 | 03/21/25 | 29.75 美元 | 29.65 美元 | 29.75 美元 | 155.00 美元 | 35.7 萬美元 | 3.3K | 12 |

| BA | 打電話 | 貿易 | 看漲 | 06/20/25 | 31.6 美元 | 30.5 美元 | 31.6 美元 | 160.00 美元 | 31.6 萬美元 | 1.3K | 0 |

About Boeing

關於波音

Boeing is a major aerospace and defense firm. It operates in three segments: commercial airplanes; defense, space, and security; and Global services. Boeing's commercial airplanes segment competes with Airbus in the production of aircraft that can carry more than 130 passengers. Boeing's defense, space, and security segment competes with Lockheed, Northrop, and several other firms to create military aircraft, satellites, and weaponry. Global services provides aftermarket support to airlines.

波音是一家大型航空航太和國防公司。它分爲三個部門:商用飛機;國防、太空和安全;以及全球服務。波音的商用飛機部門在生產可運載超過130名乘客的飛機方面與空中客車公司競爭。波音的國防、太空和安全部門與洛克希德、諾斯羅普和其他幾家公司競爭,以製造軍用飛機、衛星和武器。全球服務爲航空公司提供售後支持。

Following our analysis of the options activities associated with Boeing, we pivot to a closer look at the company's own performance.

在分析了與波音相關的期權活動之後,我們將轉向仔細研究公司自身的表現。

Current Position of Boeing

波音公司目前的立場

- Trading volume stands at 156,743, with BA's price up by 0.14%, positioned at $179.59.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 34 days.

- 交易量爲156,743美元,英國航空的價格上漲了0.14%,爲179.59美元。

- RSI指標顯示該股可能被超買。

- 預計將在34天內公佈業績。

Turn $1000 into $1270 in just 20 days?

在短短 20 天內將 1000 美元變成 1270 美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

20年專業期權交易員透露了他的單線圖技術,該技術顯示何時買入和賣出。複製他的交易,平均每20天獲利27%。點擊此處訪問。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Boeing with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供了更高利潤的潛力。精明的交易者通過持續的教育、戰略貿易調整、利用各種指標以及隨時關注市場動態來降低這些風險。使用Benzinga Pro了解波音的最新期權交易,以獲取實時警報。

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Boeing's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Boeing's substantial trades, within a strike price spectrum from $155.0 to $210.0 over the preceding 30 days.

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Boeing's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Boeing's substantial trades, within a strike price spectrum from $155.0 to $210.0 over the preceding 30 days.