Markets Weekly Update (December 27): U.S. Stock Futures Dip, Retail Spending Rises, and Corporate Updates

Markets Weekly Update (December 27): U.S. Stock Futures Dip, Retail Spending Rises, and Corporate Updates

Welcome to the Markets Weekly Update, the column committed to delivering essential investing insights for the week and key events that could move markets in the week ahead.

歡迎來到市場每週更新,本欄目致力於提供本週的重要投資見解以及可能在未來一週影響市場的關鍵事件。

Macro Matters

宏觀問題

U.S. Stock Futures Dip, Retail Spending Rises, and Corporate Updates

美國股指期貨小幅下跌,零售消費上升,以及公司動態

US stock futures modestly declined on Friday after a quiet post-holiday session on Wall Street Thursday, with jobless claims data having minimal impact on altering expectations for the Fed's outlook. New figures showed a slight drop in unemployment claims, down by 1,000 to 219,000, contrary to the expected rise of 4,000. Meantime, holiday consumer data indicated a 3.8% rise in US retail spending from November 1 to December 24, according to a Mastercard SpendingPulse. Most megacaps retreated overnight, though Apple Inc. outperformed after a bullish note from Wedbush. United States Steel slipped 3.0% as its potential buyer, Nippon Steel of Japan, postponed the targeted acquisition from Q4 of 2024 to Q1 of 2025. Conversely, GameStop Corp. rallied after an X post from Keith Gill, the online persona known as Roaring Kitty.

週五美國股指期貨小幅下跌,此前週四華爾街經歷了一次平靜的假期後交易,失業申報數據對聯儲局前景的預期影響有限。新的數據顯示,失業申報輕微下降,減少1,000至219,000,反而預期增加4,000。同時,根據萬事達消費脈搏數據,假期消費數據顯示從11月1日至12月24日,美國零售消費上升了3.8%。大多數大型股票在夜間回落,儘管蘋果公司在Wedbush的看好報告後表現優異。美國鋼鐵下跌3.0%,其潛在買家日本的日產鋼鐵將目標收購時間從2024年第四季度推遲到2025年第一季度。相反,遊戲驛站在網絡紅人Keith Gill,即Roaring Kitty發帖後大幅上漲。

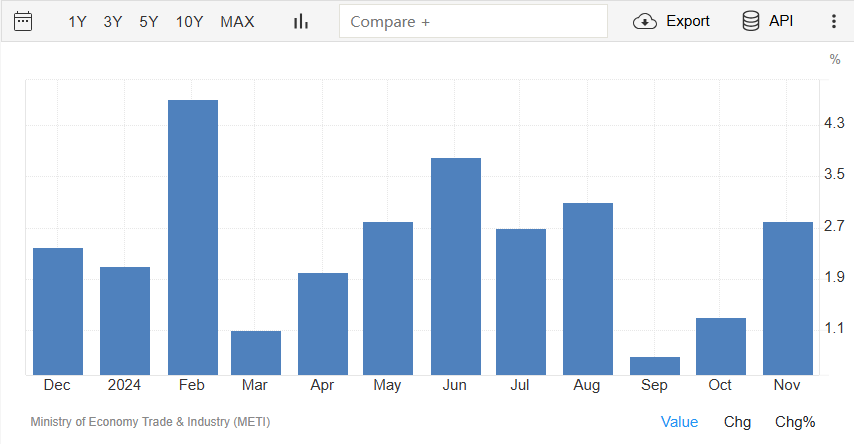

Japan's Retail Sales Surge in November, Exceeding Expectations

日本11月零售銷售激增,超出預期

Retail sales in Japan grew by 2.8% year-on-year in November 2024, up from a downwardly revised 1.3% rise in October, easily beating market expectations of a 1.7% gain. This marked the 32nd straight month of expansion in retail sales and the fastest growth since August, with rising wages continuing to support consumption. Sales growth was robust textiles, clothing & personal goods (10.7%), other retailers (5.7%), non-store retailers (5.5%), fuel (3.6%), machinery & equipment (2.6%), pharmaceuticals & cosmetics (1.8%), food & beverage (1.4%), and department stores (0.9%). By contrast, sales declined in automobiles (-1.9%). On a monthly basis, retail sales rose by 1.8% in November, marking the first increase in three months and the most since September 2021, rebounding from a revised 0.2% fall in October.

2024年11月,日本的零售銷售同比增長2.8%,比10月修正後的1.3%有所上升,遠超市場預期的1.7%增幅。這標誌着零售銷售連續第32個月擴張,也是自8月以來最快的增長,工資上升持續支持消費。銷售增長在紡織、品牌服飾及個人商品(10.7%)、其他零售商(5.7%)、非店內零售商(5.5%)、燃料(3.6%)、機械(2.6%)、藥品及化妝品(1.8%)、食品及飲料(1.4%)和百貨商店(0.9%)中表現強勁。相反,汽車銷售下降(-1.9%)。按月計算,11月零售銷售增長1.8%,標誌着三個月來的首次增長,也是自2021年9月以來的最大增長,較10月修正後下降的0.2%回升。

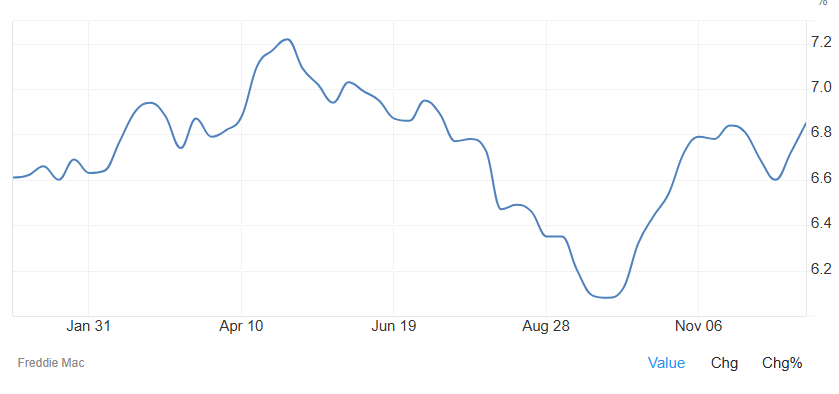

U.S. Mortgage Rates Climb to Six-Month High Amid Economic Uncertainty

美國抵押貸款利率攀升至六個月高點,經濟不確定性增加

The average rate on a 30-year fixed mortgage surged to 6.85% as of December 26th, 2024, rebounding for the second consecutive week to the highest level since early June. The rise aligned with soaring US Treasury yields, as markets adjusted expectations for fewer Federal Reserve rate cuts, influenced by hawkish projections, weaker economic data, and inflation concerns. “Mortgage rates increased for the second straight week, rebounding after a decline from earlier this month. While a slight improvement in new and existing home sales is encouraging, the market remains plagued by an overwhelming undersupply of homes. A strong economy can help build momentum heading into the new year and potentially boost purchase activity,” said Sam Khater, Freddie Mac’s Chief Economist.

截至2024年12月26日,30年期固定抵押貸款的平均利率猛增至6.85%,連續第二週反彈至自6月初以來的最高水平。這一漲幅與美國國債收益率飆升相吻合,市場對聯邦儲備局減少加息的預期進行調整,受鷹派預測、經濟數據疲軟以及通脹擔憂的影響。Freddie Mac首席經濟學家Sam Khater表示:「抵押貸款利率連續第二週上升,在本月早些時候下降後反彈。儘管新房和現房銷售略有改善令人鼓舞,但市場仍然受到房屋供應嚴重不足的困擾。強勁的經濟能幫助在新的一年裏增強動力,並可能提升購房活動。」

Smart Money Flow

智能資金流動

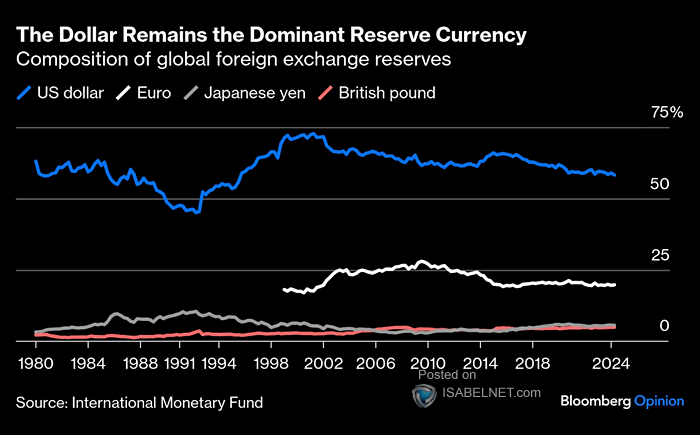

Despite some countries seeking to reduce their dependence on the US dollar, it remains the dominant global reserve currency, accounting for 58% of total reserves, significantly surpassing the euro at 19.8% and the yen at 5.6%.

儘管一些國家尋求減少對美元的依賴,但美元依然是主導的全球儲備貨幣,佔總儲備的58%,遠遠超過歐元的19.8%和日元的5.6%。

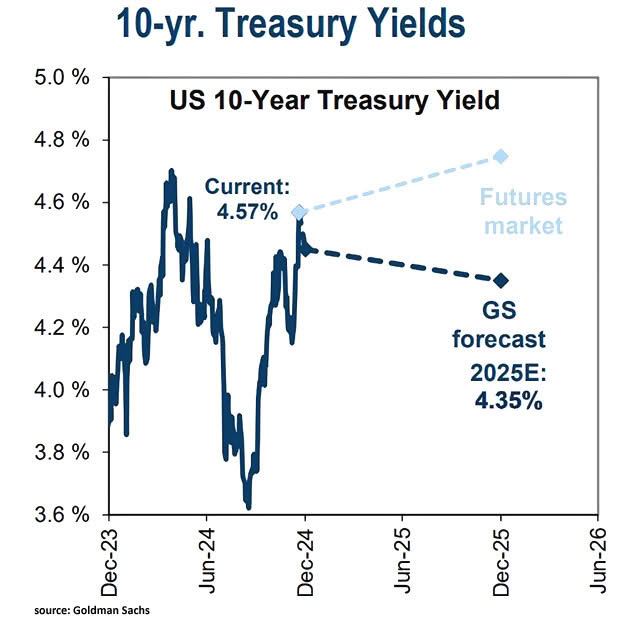

Goldman Sachs forecasts the 10-year US Treasury yield to hit 4.35% by the end of 2025, diverging from current futures market expectations.

高盛預測到2025年底,10年期美國國債收益率將達到4.35%,與當前期貨市場預期有所偏離。

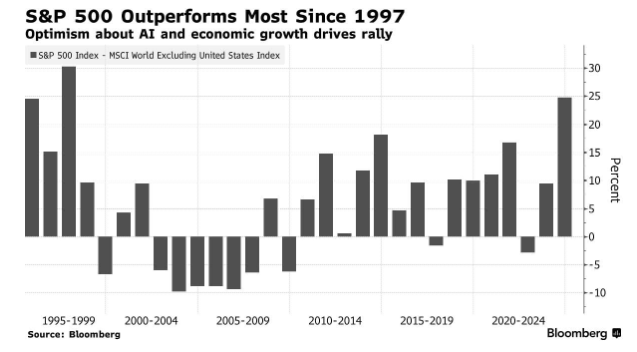

S&P 500 is outperforming the rest of the world by the largest margin since 1997.

S&P 500自1997年以來以最大的幅度超越世界其他市場。

Top Corporate News

頭條公司新聞

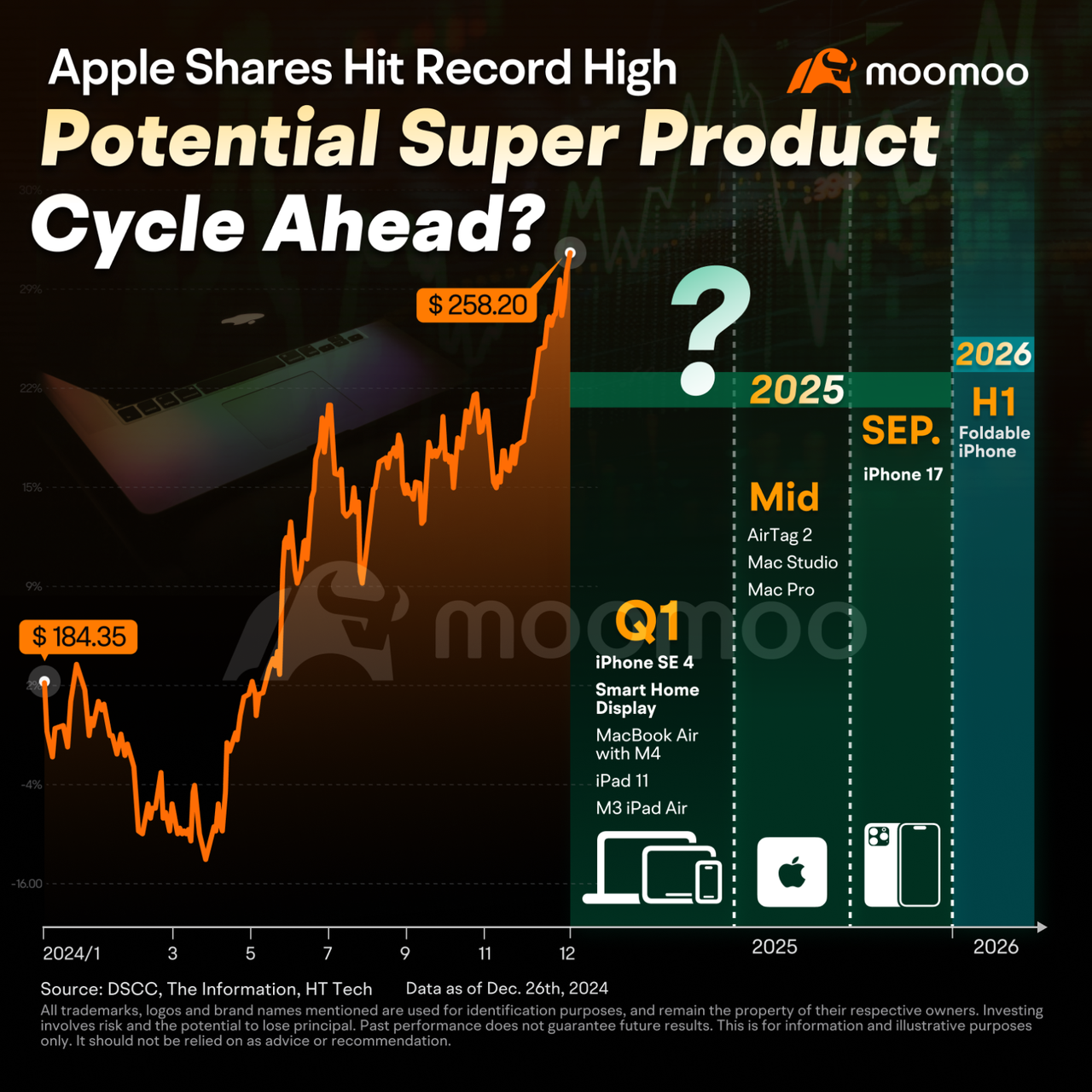

Apple Poised to Become First $4 Trillion Company

蘋果有望成爲首個市值達到4萬億美元的公司

With a market cap of $3.9 trillion, Apple maintains its position as the most valuable publicly traded U.S. company, surpassing the combined market caps of stock exchanges in countries such as the UK, Canada, and Germany. A modest 2.5% increase would elevate Apple's valuation to $4 trillion, positioning it as the likely first company to reach that milestone.

憑藉3.9萬億美元的市值,蘋果保持其作爲美國上市公司中最有價值公司的地位,超越了英國、加拿大和德國等國股票交易所的總市值。僅2.5%的小幅增長就會將蘋果的估值提升至4萬億美元,使其成爲有可能首個達到該里程碑的公司。

Since November, Apple shares have surged about 15%, adding nearly $500 billion in market value. This growth is fueled by investor enthusiasm for AI and anticipation of a major iPhone upgrade cycle. According to tech journalist Mark Gurman, Apple plans to pivot toward three major growth areas in 2025—artificial intelligence, robotics, and smart homes—after shelving its 2024 car project and receiving a tepid response to its Vision Pro headset.

自11月以來,蘋果股票已上漲約15%,市值增加了近5000億。這一增長得益於投資者對人工智能的熱情以及對iPhone重大升級週期的期待。根據科技記者馬克·古爾曼的說法,蘋果計劃在2025年向三個主要增長領域轉型——人工智能、機器人和智能家居——在擱置2024年的汽車項目並對其Vision Pro頭顯反響平淡之後。

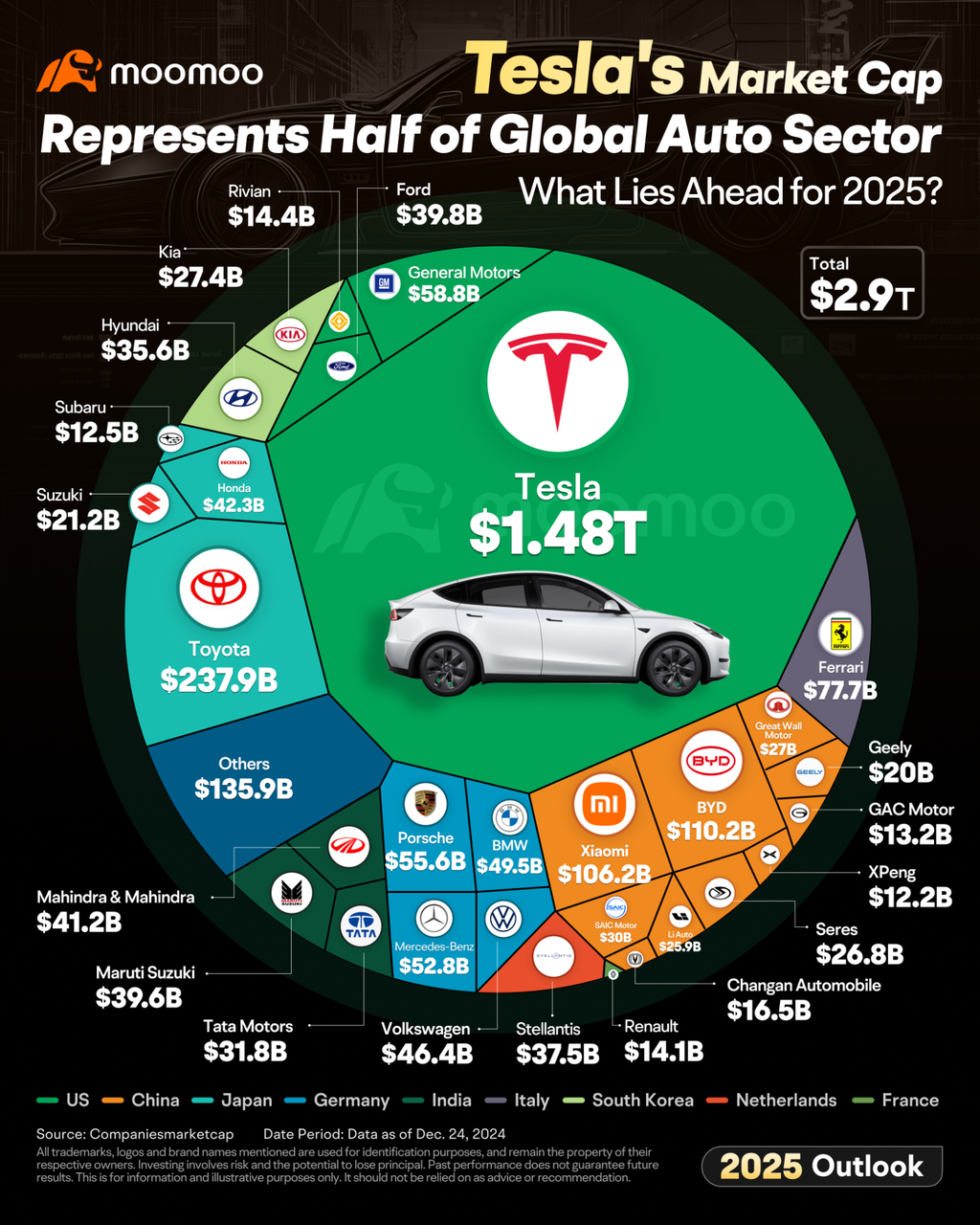

2025 Marks A Pivotal Year for Autonomous Driving. Potential Gains for Tesla Shares?

2025年是自動駕駛的重要一年。特斯拉股票可能獲得收益?

Tesla's shares surged more than 80% after Donald Trump's win in the 2024 presidential election, propelling its market capitalization to $1.5 trillion. This valuation accounts for half of the combined worth of global automakers. A key factor behind Tesla's recent surge is investor optimism that its autonomous driving technology will advance swiftly under Trump's favorable regulatory environment.

在2024年總統選舉中,特朗普獲勝後,特斯拉的股票上漲了80%以上,使其市值達到1.5萬億。這一估值佔全球汽車製造商總價值的一半。特斯拉近期上漲的一個關鍵因素是投資者對其自動駕駛技術將在特朗普有利的監管環境下迅速發展的樂觀預期。

Investors are also paying close attention to Tesla's upcoming Q4 delivery report, expected on January 2nd. While Tesla's Q4 deliveries are anticipated to reach record levels, Barclays analysts suggest that these figures may not significantly influence the stock's movement, holding the views that a slight beat on 4Q is likely immaterial to the majority of the current Tesla bull case.

投資者還密切關注特斯拉即將在1月2日發佈的第四季度交付報告。儘管特斯拉的第四季度交付預計將創下紀錄,巴克萊銀行的分析師表示,這些數據可能不會顯著影響股票的走勢,他們認爲,對第四季度輕微超出預期在目前特斯拉的看好情況下可能毫無影響。

Disclaimer: This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal.

免責聲明:本演示材料僅供信息和教育用途,並不構成對任何特定投資或投資策略的推薦或認可。本內容提供的投資信息具有一般性,僅供參考,可能不適用於所有投資者。信息提供時未考慮個人投資者的財務能力、財務狀況、投資目標、投資時間框架或風險承受能力。在做出任何投資決定之前,您應考慮根據自己相關的個人情況,該信息的適當性。過去的投資表現並不表明或保證未來的成功。收益會有所不同,所有投資都存在風險,包括本金損失。

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. In the U.S., investment products and services on Moomoo are offered by Moomoo Financial Inc., Member FINRA/SIPC.

moomoo是由moomoo科技公司提供的金融信息和交易應用。在美國,moomoo提供的投資產品和服務由moomoo金融公司提供,成員爲FINRA/SIPC。