Top 3 Tech And Telecom Stocks That May Rocket Higher In Q4

Top 3 Tech And Telecom Stocks That May Rocket Higher In Q4

The most oversold stocks in the communication services sector presents an opportunity to buy into undervalued companies.

通信服務板塊中最被低估的股票提供了買入被低估公司的機會。

The RSI is a momentum indicator, which compares a stock's strength on days when prices go up to its strength on days when prices go down. When compared to a stock's price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

相對強弱指數(RSI)是一個動量指標,它比較股票在價格上漲天數的強度與價格下跌天數的強度。與股票的價格走勢相比,它可以讓交易者更好地了解股票在開空期的表現。當RSI低於30時,通常認爲資產被超賣,依據Benzinga Pro的說法。

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

以下是該板塊中最新的主要被低估的股票名單,它們的RSI接近或低於30。

Tim SA (NYSE:TIMB)

TIM SA (紐交所:TIMB)

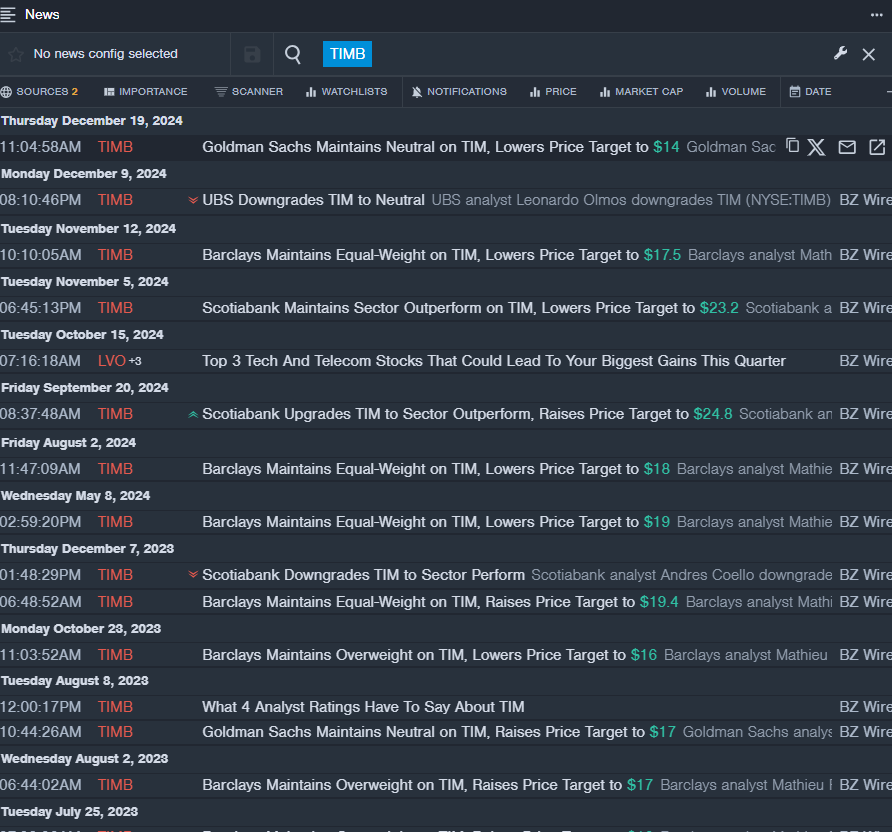

- On Dec. 19, Goldman Sachs analyst Vitor Tomita maintained TIM with a Neutral and lowered the price target from $16.2 to $14. The company's stock fell around 14% over the past month and has a 52-week low of $11.76.

- RSI Value: 28

- TIMB Price Action: Shares of Tim fell 2.2% to close at $11.81 on Thursday.

- Benzinga Pro's real-time newsfeed alerted to latest TIMB news.

- 在12月19日,高盛分析師維託·托米塔對TIM維持中立評級,並將目標價從16.2美元下調至14美元。該公司的股票在過去一個月中下跌了約14%,並在52周內的最低價爲11.76美元。

- 相對強弱指數值:28

- TIMb價格走勢:週四,TIM的股票下跌了2.2%,收於11.81美元。

- Benzinga Pro的實時資訊提醒了最新的TIMb消息。

Gray Television Inc (NYSE:GTN)

格雷電視公司(紐交所:GTN)

- On Dec. 18, Atlanta Braves partnered with Gray Media to simulcast 15 regular season games. The company's stock fell around 28% over the past month and has a 52-week low of $2.91.

- RSI Value: 24

- GTN Price Action: Shares of Gray Television gained 3% to close at $3.12 on Thursday.

- Benzinga Pro's charting tool helped identify the trend in GTN stock.

- 12月18日,亞特蘭大勇士隊與格雷媒體合作直播15場常規賽。該公司的股票在過去一個月內下跌了約28%,並且在過去52周的最低價爲2.91美元。

- 相對強弱指數(RSI)值:24

- GTN價格動態:格雷電視的股價上漲了3%,週四收於3.12美元。

- Benzinga Pro的圖表工具幫助識別了GTN股票的趨勢。

Electronic Arts Inc (NASDAQ:EA)

藝電(納斯達克:EA)

- On Dec. 18, Stifel analyst Drew Crum downgraded Electronic Arts from Buy to Hold and maintained the price target of $167. The company's stock fell around 9% over the past month and has a 52-week low of $124.96.

- RSI Value: 26

- EA Price Action: Shares of Electronic Arts slipped 0.1% to close at $149.07 on Thursday.

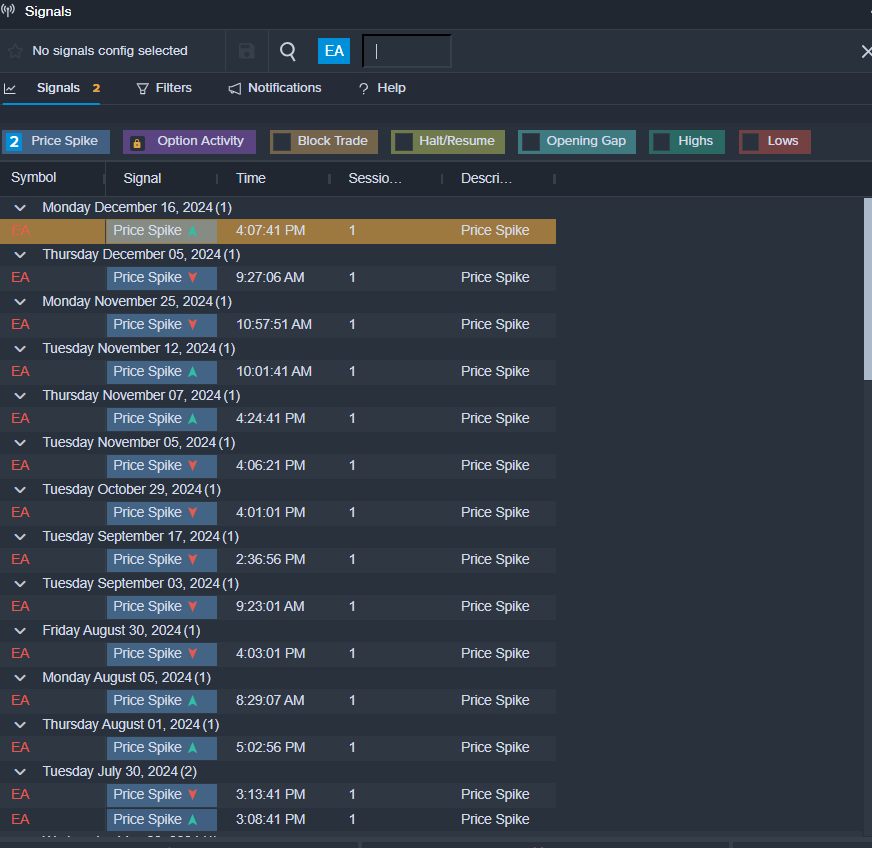

- Benzinga Pro's signals feature notified of a potential breakout in EA shares.

- 12月18日,高盛分析師德魯·克魯姆將藝電的評級從買入下調至持有,並維持167美元的目標價格。該公司的股票在過去一個月下跌了約9%,其52周最低價爲124.96美元。

- 相對強弱指數值:26

- 藝電價格動態:藝電的股票在週四下跌0.1%,收於149.07美元。

- Benzinga Pro的信號功能提醒藝電股票可能出現突破。

Read This More:

閱讀更多:

- Dow Edges Higher In Thin Holiday Trading As Tesla, Apple Surge: Investor Sentiment Improves, But Greed Index Remains In 'Fear' Zone

- 道瓊斯在假期交易中小幅上漲,特斯拉和蘋果大幅攀升:投資者情緒改善,但貪婪指數仍在『恐懼』區域內