Wall Street's Most Accurate Analysts Give Their Take On 3 Consumer Stocks With Over 7% Dividend Yields

Wall Street's Most Accurate Analysts Give Their Take On 3 Consumer Stocks With Over 7% Dividend Yields

華爾街最準的分析師對3只消費股票的看法,股息收益率超過7%。

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

在市場動盪和不確定時期,許多投資者會選擇高股息股票。這些公司通常具有高自由現金流,並以高股息回報股東。

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Benzinga讀者可以通過訪問分析師股票評級頁面,查看他們最喜歡的股票的最新分析師觀點。交易者可以瀏覽Benzinga廣泛的分析師評級數據庫,包括根據分析師準確性進行排序。

Below are the ratings of the most accurate analysts for three high-yielding stocks in the consumer discretionary sector.

以下是消費品可選板塊中三隻高股息股票的最準分析師評級。

Guess?, Inc. (NYSE:GES)

猜猜品牌公司(紐交所:GES)

- Dividend Yield: 8.63%

- Small Cap Consumer Research analyst Eric Beder reiterated a Buy rating with a price target of $23 on Dec. 18. This analyst has an accuracy rate of 63%.

- Telsey Advisory Group analyst Dana Telsey maintained a Market Perform rating and cut the price target from $21 to $18 on Oct. 27. This analyst has an accuracy rate of 61%.

- Recent News: On Nov. 26, Guess? reported a year-over-year decrease in third-quarter adjusted EPS results.

- Benzinga Pro's real-time newsfeed alerted to latest GES news.

- 股息收益率:8.63%

- 小盤消費研究分析師埃裏克·貝德爾在12月18日重申了買入評級,並將目標價格定爲23美元。該分析師的準確率爲63%。

- 特爾西諮詢集團分析師達納·特爾西維持市場表現評級,並將目標價格從21萬億削減至18美元,日期爲10月27日。該分析師的準確率爲61%。

- 近期資訊:在11月26日,Guess?報告了第三季度調整後每股收益的同比下降。

- Benzinga Pro的實時資訊提醒了最新的GES資訊。

Kohl's Corporation (NYSE:KSS)

Kohl's Corporation(紐約證交所:KSS)

- Dividend Yield: 13.47%

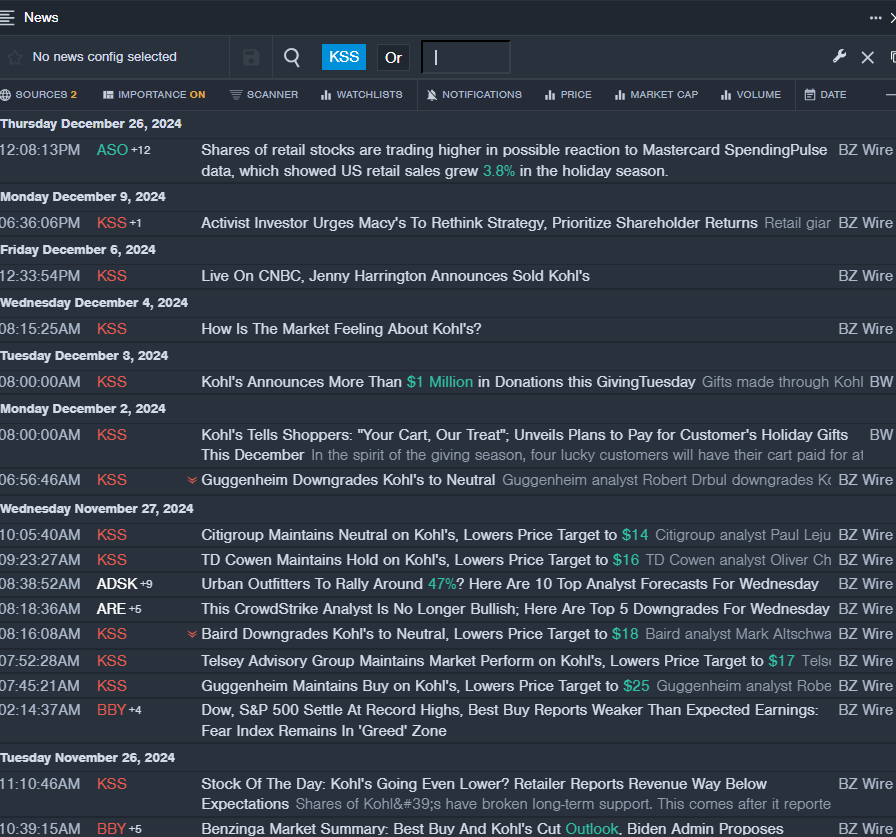

- Guggenheim analyst Robert Drbul downgraded the stock from Buy to Neutral on Dec. 2. This analyst has an accuracy rate of 66%.

- Citigroup analyst Paul Lejuez maintained a Neutral rating and cut the price target from $18 to $14 on Nov. 27. This analyst has an accuracy rate of 66%.

- Recent News: On Nov. 27, Kohl's reported worse-than-expected third-quarter EPS and sales, cut its FY24 EPS guidance, and projected a net sales decrease of 7%-8%.

- Benzinga Pro's real-time newsfeed alerted to latest KSS news

- 股息收益率:13.47%

- 古根海姆分析師羅伯特·德布爾於12月2日將該股票的評級從買入下調至中立。該分析師的準確率爲66%。

- 花旗集團分析師保羅·萊耶茲維持中立評級,並將目標價從18美元下調至14美元,時間爲11月27日。該分析師的準確率爲66%。

- 最新資訊:在11月27日,Kohl's報告了低於預期的第三季度每股收益和銷售額,削減了2024財年的每股收益指導,並預計淨銷售額下降7%-8%。

- Benzinga Pro的實時資訊提醒了最新的KSS資訊。

Bloomin' Brands, Inc. (NASDAQ:BLMN)

Bloomin' Brands, Inc. (納斯達克:BLMN)

- Dividend Yield: 7.73%

- JP Morgan analyst John Ivankoe maintained a Neutral rating and slashed the price target from $19 to $14 on Nov. 12. This analyst has an accuracy rate of 75%.

- Raymond James analyst Brian Vaccaro downgraded the stock from Outperform to Market Perform on Nov. 11. This analyst has an accuracy rate of 81%.

- Recent News: On Nov. 8, the company reported third-quarter adjusted earnings per share of 21 cents, beating the street view of 20 cents. Quarterly revenues of $1.038 billion (down 3.8%) missed the analyst consensus of $1.042 billion.

- Benzinga Pro's charting tool helped identify the trend in BLMN stock.

- 股息收益率:7.73%

- JP摩根分析師約翰·伊萬科在11月12日維持中立評級,並將目標價從19美元下調至14美元。該分析師的準確率爲75%。

- 雷蒙德·詹姆斯分析師布萊恩·瓦卡羅在11月11日將股票評級從跑贏大盤下調至市場表現。該分析師的準確率爲81%。

- 最新資訊:在11月8日,公司報告了第三季度調整後的每股收益爲21美分,超過了市場預期的20美分。季度收入爲10.38億(下降3.8%),未達到分析師一致預期的10.42億。

- Benzinga Pro的圖表工具幫助識別了BLMN股票的趨勢。

Read More:

閱讀更多:

- Dow Edges Higher In Thin Holiday Trading As Tesla, Apple Surge: Investor Sentiment Improves, But Greed Index Remains In 'Fear' Zone

- 道瓊斯在假期交易中小幅上漲,特斯拉和蘋果大幅攀升:投資者情緒改善,但貪婪指數仍在『恐懼』區域內