Unpacking the Latest Options Trading Trends in Mobileye Global

Unpacking the Latest Options Trading Trends in Mobileye Global

Deep-pocketed investors have adopted a bullish approach towards Mobileye Global (NASDAQ:MBLY), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in MBLY usually suggests something big is about to happen.

資金雄厚的投資者對Mobileye Global(納斯達克:MBLY)採取了看好的策略,這一點市場參與者不應忽視。我們在Benzinga跟蹤的公共期權記錄揭示了這一重大動向。雖然這些投資者的身份仍然不明,但MBLY如此大規模的變動通常預示着重大事件即將發生。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 12 extraordinary options activities for Mobileye Global. This level of activity is out of the ordinary.

我們從今天的觀察中獲得了這些信息,當時Benzinga的期權掃描器突出了Mobileye Global的12個非凡期權活動。這一活動水平超出了常規。

The general mood among these heavyweight investors is divided, with 58% leaning bullish and 41% bearish. Among these notable options, 2 are puts, totaling $70,339, and 10 are calls, amounting to $538,719.

這些重量級投資者的整體情緒存在分歧,58%傾向於看好,41%則看淡。在這些顯著的期權中,有2個看跌期權,總計$70,339,和10個看漲期權,總額爲$538,719。

Predicted Price Range

預測價格區間

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $17.0 to $22.0 for Mobileye Global over the last 3 months.

考慮到這些合約的成交量和未平倉合約,看來鯨魚們在過去三個月中一直瞄準Mobileye Global的價格區間爲$17.0到$22.0。

Insights into Volume & Open Interest

成交量和持倉量分析

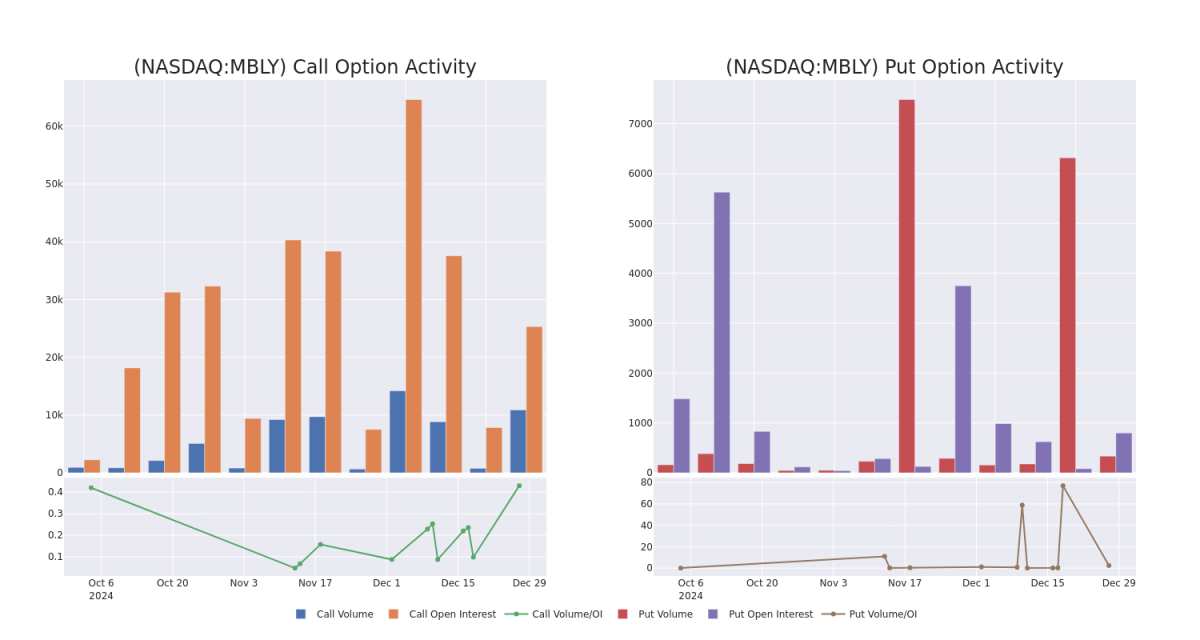

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Mobileye Global's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Mobileye Global's significant trades, within a strike price range of $17.0 to $22.0, over the past month.

分析成交量和未平倉合約爲股票研究提供了重要見解。這些信息對於衡量Mobileye Global在特定行使價格的期權流動性和興趣水平至關重要。以下,我們展示了在過去一個月內,Mobileye Global在$17.0到$22.0的行使價格範圍內看漲和看跌期權的成交量和未平倉合約的趨勢快照。

Mobileye Global 30-Day Option Volume & Interest Snapshot

Mobileye Global 30天期權成交量及興趣快照

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MBLY | CALL | SWEEP | BULLISH | 05/16/25 | $5.2 | $5.1 | $5.2 | $17.00 | $91.8K | 2.6K | 178 |

| MBLY | CALL | TRADE | BEARISH | 01/17/25 | $1.55 | $1.3 | $1.4 | $20.00 | $91.2K | 11.2K | 735 |

| MBLY | CALL | TRADE | BULLISH | 02/21/25 | $2.85 | $2.8 | $2.85 | $20.00 | $82.6K | 9.0K | 6.4K |

| MBLY | CALL | SWEEP | BULLISH | 01/03/25 | $2.7 | $2.65 | $2.65 | $17.00 | $69.1K | 230 | 675 |

| MBLY | CALL | SWEEP | BULLISH | 02/21/25 | $2.5 | $2.4 | $2.49 | $20.00 | $44.8K | 9.0K | 882 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 行權價 | 總交易價格 | 未平倉合約 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MBLY | 看漲 | 掃單 | 看好 | 05/16/25 | $5.2 | $5.1 | $5.2 | $17.00 | $91.8K | 2.6千 | 178 |

| MBLY | 看漲 | 交易 | 看淡 | 01/17/25 | $1.55 | $1.3 | $1.4 | $20.00 | $91.2K | 11.2K | 735 |

| MBLY | 看漲 | 交易 | 看好 | 02/21/25 | $2.85 | $2.8 | $2.85 | $20.00 | $82.6K | 9.0K | 6.4K |

| MBLY | 看漲 | 掃單 | 看好 | 01/03/25 | $2.7 | $2.65 | $2.65 | $17.00 | $69.1K | 230 | 675 |

| MBLY | 看漲 | 掃單 | 看好 | 02/21/25 | $2.5 | $2.4 | $2.49 | $20.00 | $44.8K | 9.0K | 882 |

About Mobileye Global

關於Mobileye全球

Mobileye Global Inc engages in the development and deployment of ADAS and autonomous driving technologies and solutions. It is building a portfolio of end-to-end ADAS and autonomous driving solutions to provide the capabilities needed for the future of autonomous driving, leveraging a comprehensive suite of purpose-built software and hardware technologies. Mobileye is the Company's only reportable operating segment. Its solutions comprise Driver Assist, Cloud-Enhanced Driver Assist, Mobileye SuperVision Lite, Mobileye SuperVision, Mobileye Chauffeur, Mobileye Drive, Self-Driving System & Vehicles. It also provides data services to Expedite Maintenance Operations with AI-Powered Road Survey Technology.

Mobileye全球公司專注於ADAS(高級駕駛輔助系統)和自動駕駛技術及解決方案的開發和應用。它正在構建一系列端到端的ADAS和自動駕駛解決方案,以提供未來自動駕駛所需的能力,利用一整套專門設計的軟體和硬件技術。Mobileye是公司唯一的可報告經營分部。其解決方案包括駕駛員輔助、雲增強駕駛員輔助、Mobileye SuperVision Lite、Mobileye SuperVision、Mobileye Chauffeur、Mobileye Drive和自動駕駛系統及車輛。它還提供數據服務,以利用人工智能驅動的道路調查技術來加速維護操作。

Having examined the options trading patterns of Mobileye Global, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在審查了Mobileye全球的期權交易模式後,我們的注意力現在直接轉向公司本身。這一轉變讓我們可以深入了解其目前的市場狀況和表現。

Where Is Mobileye Global Standing Right Now?

Mobileye全球當前的市場地位在哪裏?

- Currently trading with a volume of 3,623,808, the MBLY's price is up by 2.57%, now at $19.97.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 27 days.

- 目前,MBLY的成交量爲3,623,808,價格上漲2.57%,現爲19.97美元。

- RSI讀數表明該股票目前可能接近超買狀態。

- 預期的收益發佈將在27天后進行。

Turn $1000 into $1270 in just 20 days?

在短短20天內將1000美元變成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

一位擁有20年經驗的期權交易員揭示了他的單行圖表技巧,幫助判斷何時買入和賣出。複製他的交易,這些交易每20天平均獲得27%的利潤。點擊這裏獲取訪問權限。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Mobileye Global options trades with real-time alerts from Benzinga Pro.

期權交易存在更高的風險和潛在的回報。精明的交易者通過不斷自我教育、調整策略、監測多個因數以及密切關注市場動態來管理這些風險。通過Benzinga Pro的實時警報,隨時了解最新的Mobileye Global期權交易。

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $17.0 to $22.0 for Mobileye Global over the last 3 months.

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $17.0 to $22.0 for Mobileye Global over the last 3 months.