Wall Street Meets The Grinch Instead Of Santa But This Analyst Believes 'S&P 500 Can Get Close To 7,000' In First Half Of 2025

Wall Street Meets The Grinch Instead Of Santa But This Analyst Believes 'S&P 500 Can Get Close To 7,000' In First Half Of 2025

The Santa Claus Rally, a typical year-end market surge, has seemingly failed to materialize this year, with stocks experiencing a recent downturn. However, this analyst expects the S&P 500 index to hit 7,000 points in the first half of 2025.

聖誕老人反彈,這一典型的年終市場激增,今年似乎未能出現,股票近期經歷了下滑。然而,這位分析師預計,標普500指數將在2025年上半年達到7000點。

What Happened: According to Fundstrat Insights, Tom Lee, the head of research at Fundstrat attributed this decline to profit-taking and investor uncertainty surrounding the Federal Reserve's future interest rate policies. However, he emphasizes that the positive market outlook for 2025 remains largely unchanged.

發生了什麼:根據Fundstrat Insights,Fundstrat的研究負責人湯姆·李將此次下滑歸因於獲利了結和投資者對聯邦儲備未來利率政策的不確定性。然而,他強調,2025年積極的市場前景在很大程度上保持不變。

According to Lee, even if the S&P 500 closes the year at 5,900, it doesn't diminish the significant potential for growth in 2025.

根據李的說法,即使標普500年末收於5900點,也不影響2025年潛在增長的重大前景。

Looking ahead to next year, Lee said that he will closely monitor the CEO confidence index and the ISM manufacturing data for signs of economic expansion. He predicts that the S&P 500 could potentially reach 7,000 in the first half of 2025, representing substantial upside from current levels.

展望明年,李表示,他將密切關注首席執行官信心指數和ISM製造業數據,以尋找經濟擴張的跡象。他預測,標普500在2025年上半年可能會達到7000,意味着從當前水平的顯著上漲。

Louis Navellier from Navellier & Associates also said in his note that "It certainly appears to be a bit of profit-taking."

Navellier & Associates的路易斯·納維爾在他的報告中也表示:「這顯然是有些獲利了結。」

According to Ed Yardeni of Yardeni Research there are multiple reasons for missing the Santa Rally. "From a sentiment perspective, there have been too many bulls. From a technical perspective, breadth has been narrowing again as a few LargeCap momentum stocks continue to outperform."

根據葉爾丹研究的埃德·葉爾丹,有多個原因導致聖誕反彈未能實現。「從情緒角度來看,多頭太多。從技術角度來看,市場的廣度再次在縮小,因爲少數大型動量股票繼續表現突出。」

"From a fundamental perspective, while earnings growth should remain bullish, the Fed may be done easing monetary policy for a while at the same time as the outlook for fiscal policy under Trump 2.0 is uncertain. From a valuation perspective, forward P/Es are stretched," he added.

「從基本面角度來看,儘管盈利增長應保持看好,聯邦儲備可能會在一段時間內停止放鬆貨幣政策,同時特朗普2.0下的財政政策前景不確定。從估值角度來看,未來的市盈率已經過高,」他補充道。

Why It Matters: Ryan Detrick, the chief market strategist at Carson Research, in an earlier X post had highlighted that no other seven-day period except the last seven days of the year is more likely to be higher. This period of 'Santa Rally' has given positive returns at least 78.4% of the time.

爲什麼重要:卡森研究的首席市場策略師瑞安·德特里克在之前的發帖中強調,除了年末最後七天外,沒有其他七天期間的表現更有可能上升。這段「聖誕老人反彈」時期至少有78.4%的時間提供了正回報。

These next 7 trading days are known as the Santa Claus Rally period.

— Ryan Detrick, CMT (@RyanDetrick) December 23, 2024

There is no 7 day period more likely to be higher (78.4% of the time) and only two 7 day periods have a better avg return (1.29%).

pic.twitter.com/40qVwHa1rS

這接下來的7個交易日被稱爲聖誕老人反彈期。

— Ryan Detrick, CMt (@RyanDetrick) 2024年12月23日

沒有哪個7天的週期更有可能出現上漲(78.4%的時間),只有兩個7天的週期有更好的平均回報(1.29%)。

pic.twitter.com/40qVwHa1rS

Reinstalling confidence among investors Navellier added "Normally, we rally going into New Year's, and we normally rally in the new year. So, if we don't, it means we have to wait until the A team comes back, which will of course be after the New Year's holiday."

重新建立投資者信心,Navellier補充道:「通常情況下,我們在新年之前會迎來反彈,而在新年的時候也會迎來反彈。所以,如果我們沒有反彈,那就意味着我們得等到A團隊回來,當然這得等到新年假期後。」

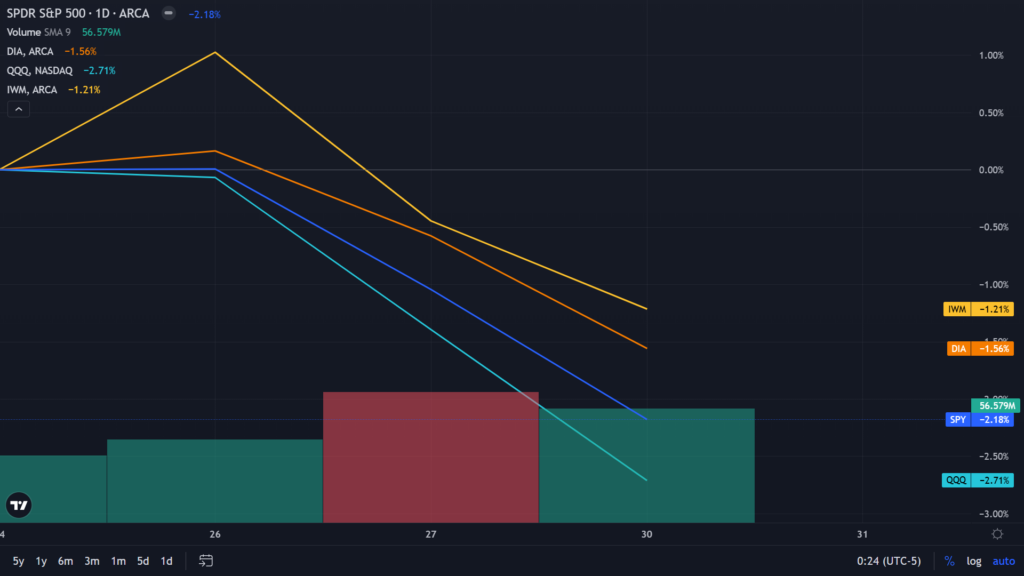

Price Action: According to Benzinga Pro data, the exchange-traded fund tracking the S&P 500, SPDR S&P 500 ETF Trust (NYSE:SPY) was down 2.18% since Dec. 24. Whereas, Invesco QQQ Trust ETF (NASDAQ:QQQ) tracking Nasdaq 100, was down 2.71%. The fund tracking Russell 2000 iShares Russell 2000 ETF (NYSE:IWM) declined 1.21% and Dow Jones tracker SPDR Dow Jones Industrial Average ETF Trust (NYSE:DIA) fell 1.56% in the same period.

價格走勢:根據Benzinga Pro的數據,追蹤S&P 500的可交易基金SPDR 標普500指數ETF (紐交所:SPY)自12月24日以來下跌了2.18%。而追蹤納斯達克100的納指100ETF-Invesco QQQ Trust (納斯達克:QQQ)下跌了2.71%。追蹤羅素2000的iShares羅素2000指數ETF (紐交所:IWM)下降了1.21%,道瓊斯跟蹤基金SPDR 道瓊斯指數ETF (紐交所:DIA)在同一時期下跌了1.56%.

| Index/ETF | YTD |

| S&P 500 Index | 24.54% |

| SPDR S&P 500 ETF Trust (NYSE:SPY) | 24.45% |

| Nasdaq 100 | 28.13% |

| Invesco QQQ Trust ETF (NASDAQ:QQQ) | 28.07% |

| Dow Jones | 12.88% |

| SPDR Dow Jones Industrial Average ETF Trust (NYSE:DIA) | 12.91% |

| Rusell 2000 | 10.68% |

| iShares Russell 2000 ETF (NYSE:IWM) | 10.61% |

| 指數/ETF | 年初至今 |

| 標普500指數 | 24.54% |

| SPDR 標普500指數ETF Trust (紐交所:SPY) | 24.45% |

| 納斯達克100 | 28.13% |

| 納指100ETF-Invesco QQQ Trust (納斯達克:QQQ) | 28.07% |

| 道瓊斯 | 12.88% |

| SPDR 道瓊斯指數ETF Trust (紐交所:DIA) | 12.91% |

| 羅素2000 | 10.68% |

| iShares羅素2000指數ETF (紐交所:IWM) | 10.61% |

- Apple's Chinese Rival Huawei Slashes Prices For New Year Boost: Should Tim Cook-Led Company Be Worried? Here's What Analysts Are Saying About AAPL Stock

- 蘋果的中國競爭對手華爲爲新年提振銷售大幅降價:庫克領導的公司應該擔憂嗎?分析師們對AAPL股票的看法是這樣的

Looking ahead to next year, Lee said that he will closely monitor the CEO confidence index and the ISM manufacturing data for signs of economic expansion. He predicts that the S&P 500 could potentially reach 7,000 in the first half of 2025, representing substantial upside from current levels.

Looking ahead to next year, Lee said that he will closely monitor the CEO confidence index and the ISM manufacturing data for signs of economic expansion. He predicts that the S&P 500 could potentially reach 7,000 in the first half of 2025, representing substantial upside from current levels.