Top 3 Risk Off Stocks Which Could Rescue Your Portfolio For Q4

Top 3 Risk Off Stocks Which Could Rescue Your Portfolio For Q4

The most oversold stocks in the consumer staples sector presents an opportunity to buy into undervalued companies.

必需消費品板塊中超賣最多的股票爲買入被低估的公司提供了機會。

The RSI is a momentum indicator, which compares a stock's strength on days when prices go up to its strength on days when prices go down. When compared to a stock's price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

RSI是一個動量指標,它比較股票在價格上漲的日子裏的走強與價格下跌的日子的走強。與股票的價格走勢相比,它可以讓交易者更好地了解股票在短期內的表現。根據Benzinga Pro的數據,當相對強弱指數低於30時,資產通常被視爲超賣。

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

以下是該行業主要超賣參與者的最新名單,其相對強弱指數接近或低於30。

PepsiCo Inc (NASDAQ:PEP)

百事可樂公司(納斯達克股票代碼:PEP)

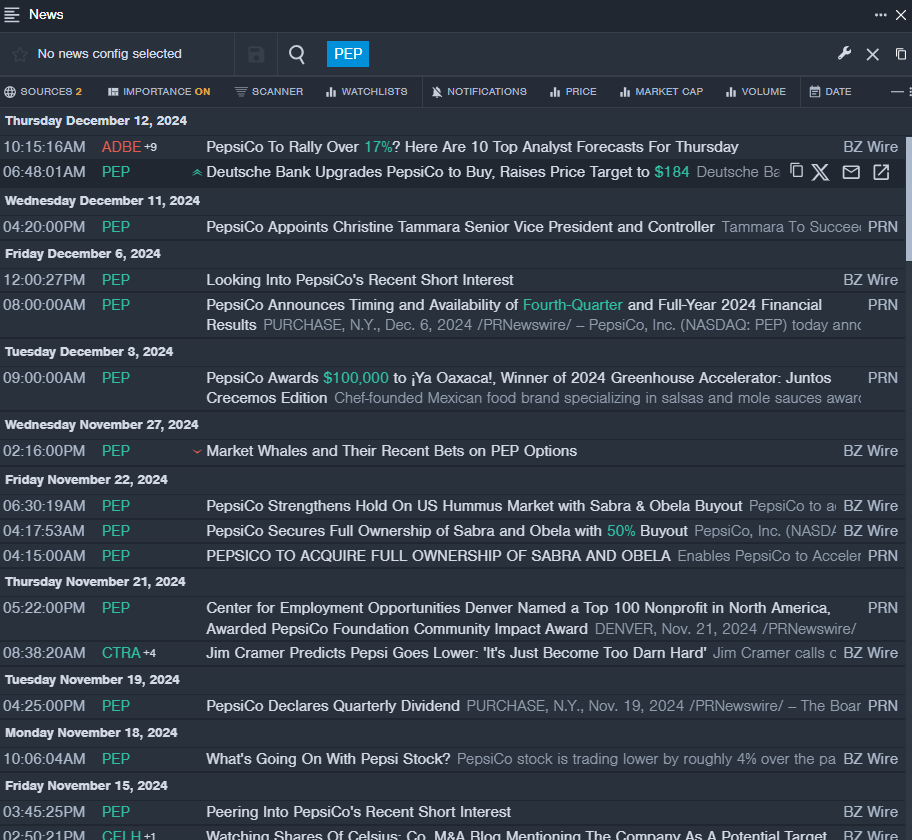

- On Dec. 12, Deutsche Bank analyst Steve Powers upgraded PepsiCo from Hold to Buy and raised the price target from $179 to $184. The company's stock fell around 7% over the past month and has a 52-week low of $149.71.

- RSI Value: 26.8

- PEP Price Action: Shares of PepsiCo fell 0.8% to close at $151.72 on Monday.

- Benzinga Pro's real-time newsfeed alerted to latest PEP news.

- 12月12日,德意志銀行分析師史蒂夫·鮑爾斯將百事可樂從 「持有」 上調至 「買入」,並將目標股價從179美元上調至184美元。該公司的股票在過去一個月中下跌了約7%,跌至52周低點149.71美元。

- RSI 值:26.8

- PEP價格走勢:週一,百事可樂股價下跌0.8%,收於151.72美元。

- Benzinga Pro的實時新聞提醒了最新的PEP新聞。

Mondelez International Inc (NASDAQ:MDLZ)

Mondelez 國際公司(納斯達克股票代碼:MDLZ)

- On Dec. 11, Mondelez International Board of Directors approved a new share repurchase program of up to $9 billion in Class A common stock, effective January 1, 2025, and lasting until December 31, 2027. This new authorization will replace the current $6 billion program, of which approximately $2.8 billion remains and would otherwise expire at the end of 2025. The company's stock fell around 9% over the past month and has a 52-week low of $58.90.

- RSI Value: 21.7

- MDLZ Price Action: Shares of Mondelez fell 1.1% to close at $59.56 on Monday.

- Benzinga Pro's charting tool helped identify the trend in MDLZ stock.

- 12月11日,Mondelez International董事會批准了一項新的A類普通股回購計劃,該計劃自2025年1月1日起生效,有效期至2027年12月31日。這項新授權將取代目前的60億美元計劃,其中約有28億美元仍然存在,否則將在2025年底到期。該公司的股價在過去一個月中下跌了約9%,跌至52周低點58.90美元。

- RSI 值:21.7

- MDLZ價格走勢:週一,Mondelez的股價下跌1.1%,收於59.56美元。

- Benzinga Pro的圖表工具幫助確定了MDLZ股票的走勢。

Archer-Daniels-Midland Co (NYSE:ADM)

Archer-Daniels-Midland Co(紐約證券交易所代碼:ADM)

- On Dec. 11, ADM extended its share repurchase program through 2029, authorizing an additional 100 million shares for a total of 300 million. The company's stock fell around 8% over the past month and has a 52-week low of $48.92.

- RSI Value: 28.6

- ADM Price Action: Shares of Archer-Daniels-Midland slipped 1% to close at $50.07 on Monday.

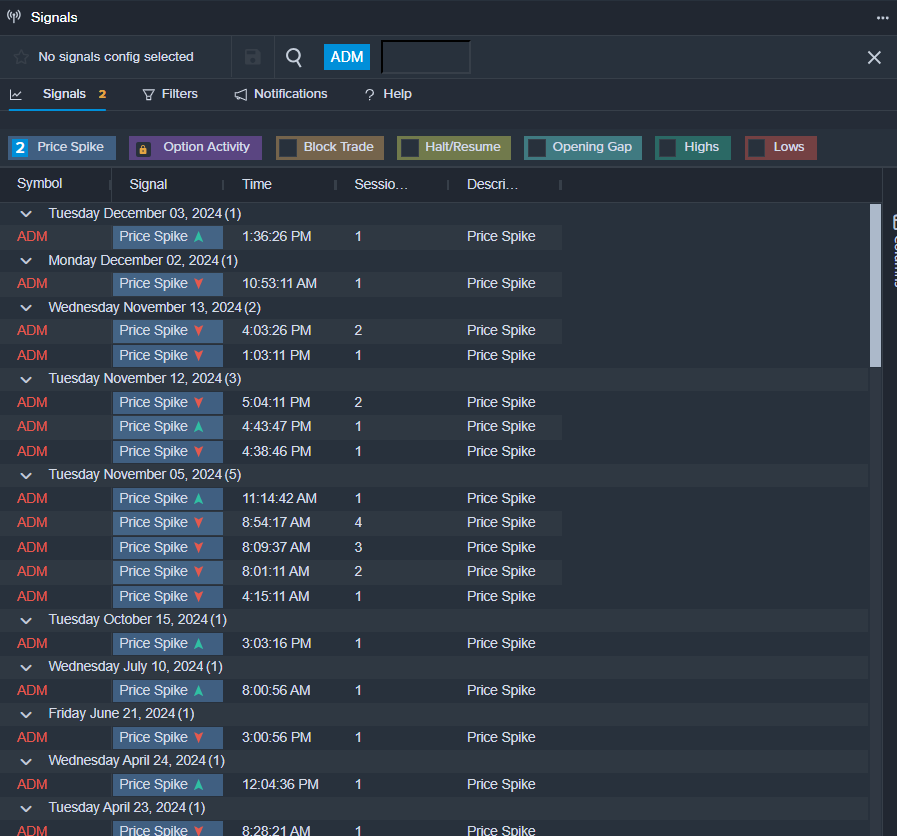

- Benzinga Pro's signals feature notified of a potential breakout in ADM shares.

- 12月11日,adM將其股票回購計劃延長至2029年,授權再發行10000萬股股票,總額爲30000萬股。該公司的股價在過去一個月中下跌了約8%,跌至52周低點48.92美元。

- RSI 值:28.6

- adM價格走勢:週一,Archer-Daniels-Midland的股價下跌了1%,收於50.07美元。

- Benzinga Pro的信號功能被告知AdM股票可能出現突破。

Read This Next:

接下來閱讀這篇文章:

- Top 3 Tech Stocks That May Fall Off A Cliff This Quarter

- 本季度可能跌下懸崖的三大科技股