Devon Energy Unusual Options Activity

Devon Energy Unusual Options Activity

Financial giants have made a conspicuous bullish move on Devon Energy. Our analysis of options history for Devon Energy (NYSE:DVN) revealed 10 unusual trades.

大型金融巨頭在戴文能源上做出了明顯的看好動作。我們對戴文能源(紐交所:DVN)期權歷史的分析顯示了10筆期權異動交易。

Delving into the details, we found 40% of traders were bullish, while 40% showed bearish tendencies. Out of all the trades we spotted, 7 were puts, with a value of $751,435, and 3 were calls, valued at $125,375.

深入分析後,我們發現40%的交易者持看好態度,而40%則表現出看淡傾向。在我們發現的所有交易中,有7筆是看跌期權,價值爲751,435美元,3筆是看漲期權,價值爲125,375美元。

Predicted Price Range

預測價格區間

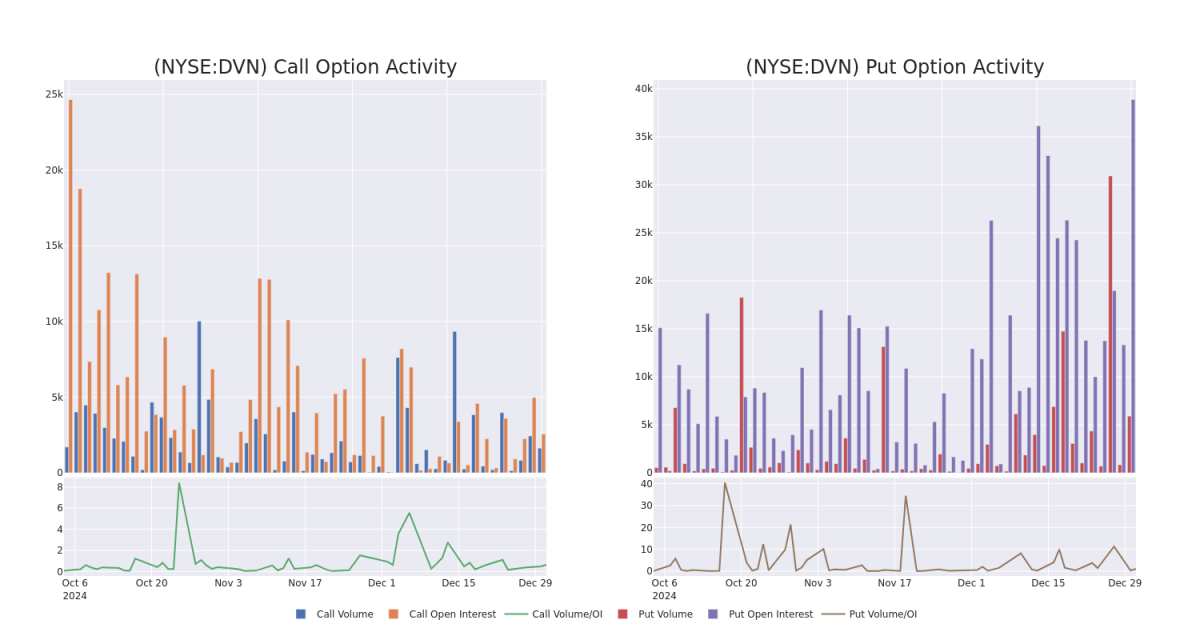

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $25.0 and $45.0 for Devon Energy, spanning the last three months.

在評估了交易量和未平倉合約後,很明顯,主要市場參與者正在關注戴文能源的價格區間在25.0美元到45.0美元之間,跨越了過去三個月。

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

觀察成交量和未平倉合約是進行股票盡職調查的一個有見地的方法。

This data can help you track the liquidity and interest for Devon Energy's options for a given strike price.

這些數據可以幫助您追蹤戴文能源期權在特定行權價的流動性和興趣。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Devon Energy's whale activity within a strike price range from $25.0 to $45.0 in the last 30 days.

以下,我們可以觀察到戴文能源在過去30天內看漲和看跌期權的成交量和未平倉合約的演變,標的行使價格範圍從25.0美元到45.0美元。

Devon Energy Call and Put Volume: 30-Day Overview

戴文能源看漲期權和看跌期權的成交量:30天總覽

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DVN | PUT | TRADE | BEARISH | 06/20/25 | $0.76 | $0.56 | $0.72 | $25.00 | $378.0K | 9.4K | 5.2K |

| DVN | PUT | TRADE | BULLISH | 01/16/26 | $6.2 | $5.0 | $5.35 | $35.00 | $142.8K | 4.5K | 270 |

| DVN | PUT | SWEEP | BULLISH | 04/17/25 | $13.8 | $12.95 | $12.95 | $45.00 | $69.9K | 2.4K | 54 |

| DVN | PUT | SWEEP | BEARISH | 07/18/25 | $3.3 | $3.2 | $3.3 | $32.50 | $64.0K | 658 | 195 |

| DVN | CALL | TRADE | BULLISH | 07/18/25 | $1.06 | $0.91 | $1.0 | $40.00 | $50.0K | 225 | 503 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 行權價 | 總交易價格 | 未平倉合約 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DVN | 看跌 | 交易 | 看淡 | 06/20/25 | $0.76 | $0.56 | $0.72 | $25.00 | 378.0K美元 | 9.4K | 5200 |

| DVN | 看跌 | 交易 | 看好 | 01/16/26 | $6.2 | $5.0 | $5.35 | $35.00 | 142.8K美元 | 4.5K | 270 |

| DVN | 看跌 | 掃單 | 看好 | 04/17/25 | $13.8 | $12.95 | $12.95 | $45.00 | 69.9K美元 | 2.4K | 54 |

| DVN | 看跌 | 掃單 | 看淡 | 07/18/25 | $3.3 | $3.2 | $3.3 | $32.50 | 64,000美元 | 658 | 195 |

| DVN | 看漲 | 交易 | 看好 | 07/18/25 | $1.06 | $0.91 | $1.0 | $40.00 | 50,000美元 | 225 | 503 |

About Devon Energy

關於戴文能源

Devon Energy is an oil and gas producer with acreage in several top US shale plays. While roughly two thirds of its production comes from the Permian Basin, it also holds a meaningful presence in the Anadarko, Eagle Ford, and Bakken basins. At the end of 2023, Devon reported net proved reserves of 1.8 billion barrels of oil equivalent. Net production averaged roughly 658,000 barrels of oil equivalent per day in 2023 at a ratio of 73% oil and natural gas liquids and 27% natural gas.

戴文能源是一家在美國多個頂尖頁巖氣區擁有地塊的石油和天然氣生產商。雖然大約三分之二的生產來自佩米安盆地,但它在阿納達科、鷹福特和巴肯盆地也佔有重要地位。到2023年底,戴文能源報告的淨探明儲量爲18億桶油當量。2023年的淨生產量平均約爲658,000桶油當量/天,分別爲73%的原油和天然氣液體以及27%的天然氣。

Following our analysis of the options activities associated with Devon Energy, we pivot to a closer look at the company's own performance.

根據我們對戴文能源相關期權活動的分析,我們將重點放在公司自身的表現上。

Current Position of Devon Energy

戴文能源的當前狀態

- Trading volume stands at 2,528,529, with DVN's price up by 1.83%, positioned at $32.55.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 56 days.

- 成交量爲2,528,529,DVN的價格上漲1.83%,當前價格爲32.55美元。

- 相對強弱指數因數顯示股票可能接近超賣。

- 盈餘公告預計將在56天內發佈。

Unusual Options Activity Detected: Smart Money on the Move

檢測到期權異動:聰明資金正在行動

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Benzinga Edge的期權異動板塊在市場發生變化之前發現潛在的市場動向。看看大資金在你喜歡的股票上採取了什麼倉位。點擊這裏獲取訪問權限。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

與僅僅交易股票相比,期權是一種風險較高的資產,但它們具有更高的盈利潛力。嚴肅的期權交易者通過日常學習、逐步進出交易、關注多個因數以及密切關注市場來管理這種風險。

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.