A Closer Look at Qualcomm's Options Market Dynamics

A Closer Look at Qualcomm's Options Market Dynamics

Financial giants have made a conspicuous bullish move on Qualcomm. Our analysis of options history for Qualcomm (NASDAQ:QCOM) revealed 17 unusual trades.

金融巨頭們對高通做出了明顯的看好舉動。我們對高通(納斯達克:QCOM)期權歷史的分析顯示出17筆異常交易。

Delving into the details, we found 52% of traders were bullish, while 35% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $350,320, and 11 were calls, valued at $628,525.

深入細節後,我們發現52%的交易者看好,而35%則表現出看淡的傾向。在我們觀察到的所有交易中,6筆是看跌的,價值爲$350,320,11筆是看漲的,價值爲$628,525。

What's The Price Target?

價格目標是什麼?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $100.0 to $200.0 for Qualcomm over the recent three months.

根據交易活動,顯然大型投資者的目標價區間爲高通在最近三個月內的$100.0到$200.0。

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

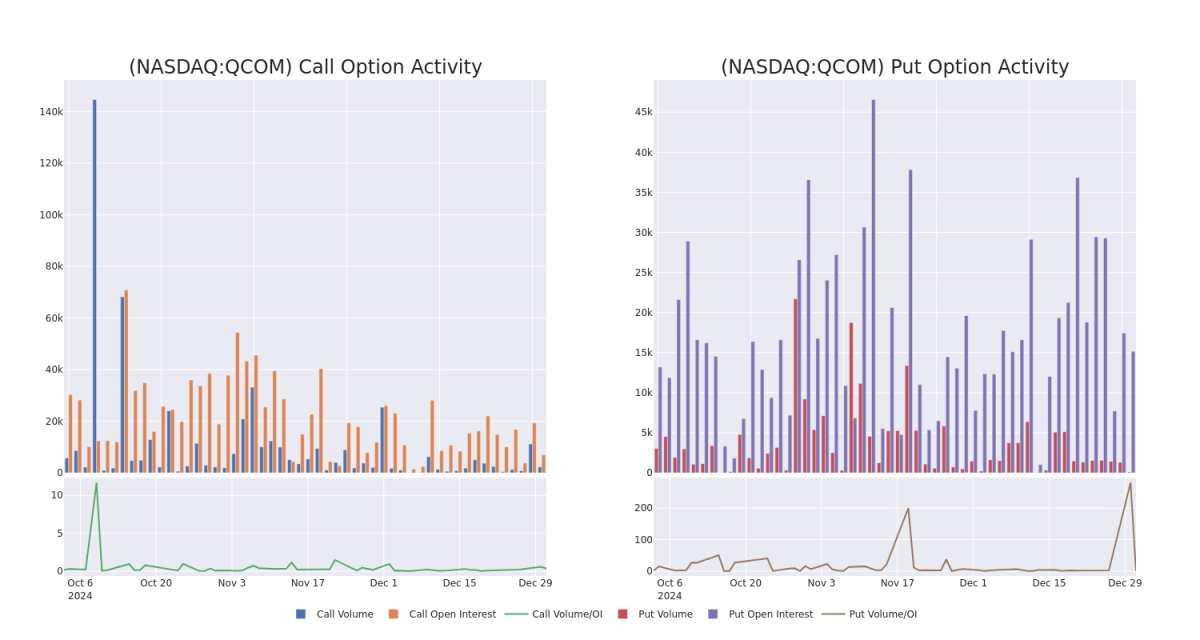

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

觀察成交量和未平倉合約是進行股票盡職調查的一個有見地的方法。

This data can help you track the liquidity and interest for Qualcomm's options for a given strike price.

這些數據可以幫助您跟蹤高通在特定行權價下的流動性和興趣。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Qualcomm's whale activity within a strike price range from $100.0 to $200.0 in the last 30 days.

下面,我們可以觀察到在過去30天內高通所有鯨魚活動在$100.0到$200.0的行權價格區間內的看漲和看跌的成交量和未平倉合約的演變。

Qualcomm Option Activity Analysis: Last 30 Days

高通期權活動分析:過去30天

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| QCOM | CALL | SWEEP | BULLISH | 01/15/27 | $32.3 | $31.85 | $32.3 | $160.00 | $129.2K | 146 | 40 |

| QCOM | PUT | TRADE | BEARISH | 01/16/26 | $18.0 | $17.85 | $18.0 | $150.00 | $117.0K | 2.1K | 2 |

| QCOM | CALL | SWEEP | BULLISH | 01/17/25 | $49.9 | $49.75 | $49.9 | $105.00 | $74.8K | 1.2K | 15 |

| QCOM | PUT | TRADE | BULLISH | 06/20/25 | $47.05 | $46.6 | $46.6 | $200.00 | $69.9K | 641 | 15 |

| QCOM | CALL | SWEEP | BULLISH | 02/21/25 | $9.4 | $9.15 | $9.25 | $155.00 | $64.7K | 943 | 154 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 行權價 | 總交易價格 | 未平倉合約 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| QCOM | 看漲 | 掃單 | 看好 | 01/15/27 | $32.3 | $31.85 | $32.3 | $160.00 | $129.2K | 146 | 40 |

| QCOM | 看跌 | 交易 | 看淡 | 01/16/26 | $18.0 | $17.85 | $18.0 | $150.00 | $117.0K | 2.1K | 2 |

| QCOM | 看漲 | 掃單 | 看好 | 01/17/25 | $49.9 | $49.75 | $49.9 | $105.00 | $74.8K | 1.2K | 15 |

| QCOM | 看跌 | 交易 | 看好 | 06/20/25 | $47.05 | $46.6 | $46.6 | $200.00 | 69.9K美元 | 641 | 15 |

| QCOM | 看漲 | 掃單 | 看好 | 02/21/25 | $9.4 | $9.15 | $9.25 | $155.00 | $64.7K | 943 | 154 |

About Qualcomm

關於高通

Qualcomm develops and licenses wireless technology and designs chips for smartphones. The company's key patents revolve around CDMA and OFDMA technologies, which are standards in wireless communications that are the backbone of all 3G, 4G, and 5G networks. Qualcomm's IP is licensed by virtually all wireless device makers. The firm is also the world's largest wireless chip vendor, supplying nearly every premier handset maker with leading-edge processors. Qualcomm also sells RF-front end modules into smartphones, as well as chips into automotive and Internet of Things markets.

高通開發和授權無線技術,併爲智能手機設計芯片。公司的關鍵專利圍繞CDMA和OFDMA技術,這些都是無線通信的標準,是所有3G、4G和5G網絡的支柱。幾乎所有無線設備製造商都獲得了高通的知識產權許可。該公司還是全球最大的無線芯片供應商,爲幾乎所有頂級手機制造商提供尖端處理器。高通還向智能手機銷售射頻前端模塊,以及向汽車和物聯網市場銷售芯片。

Having examined the options trading patterns of Qualcomm, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在分析了高通的期權交易模式後,我們現在直接關注該公司。這一轉變使我們能夠深入了解其當前的市場地位和表現

Current Position of Qualcomm

高通當前走勢

- With a volume of 757,903, the price of QCOM is down -0.04% at $154.52.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 29 days.

- QCOM的成交量爲757,903,價格下跌了-0.04%,現報154.52美元。

- RSI因數暗示基礎股票可能接近超賣。

- 下一個業績預計將在29天內發佈。

Expert Opinions on Qualcomm

關於高通的專家意見

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $180.0.

在過去一個月裏,1位行業分析師分享了他們對該股票的見解,提出平均目標價爲180.0美元。

Turn $1000 into $1270 in just 20 days?

在短短20天內將1000美元變成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* An analyst from Melius Research downgraded its action to Hold with a price target of $180.

一位擁有20年經驗的專業期權交易員透露了他的單行圖表技巧,顯示何時買入和賣出。複製他的交易,這些交易每20天平均獲利27%。點擊這裏獲取訪問權限。* Melius Research的一位分析師將其評估下調至持有,目標價爲180美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Qualcomm options trades with real-time alerts from Benzinga Pro.

期權交易具有更高的風險和潛在的回報。精明的交易者通過持續學習、調整策略、監控多個因數並密切關注市場動態來管理這些風險。通過Benzinga Pro的實時警報,保持對最新高通期權交易的了解。

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.