Decoding MercadoLibre's Options Activity: What's the Big Picture?

Decoding MercadoLibre's Options Activity: What's the Big Picture?

Deep-pocketed investors have adopted a bullish approach towards MercadoLibre (NASDAQ:MELI), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in MELI usually suggests something big is about to happen.

資金雄厚的投資者對MercadoLibre(納斯達克:MELI)採取了看好的態度,這一點市場參與者不應忽視。我們在Benzinga對公開期權記錄的追蹤揭示了這一重要動態。雖然這些投資者的身份仍然未知,但在MELI中出現如此大規模的操作通常預示着一些重大事件即將發生。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 11 extraordinary options activities for MercadoLibre. This level of activity is out of the ordinary.

我們從今天的觀察中得知,當Benzinga的期權掃描儀突顯出MercadoLibre的11項異常期權活動時,獲得了這一信息。這種程度的活動不尋常。

The general mood among these heavyweight investors is divided, with 36% leaning bullish and 36% bearish. Among these notable options, 6 are puts, totaling $370,733, and 5 are calls, amounting to $269,000.

這些重量級投資者之間的總體情緒分化,其中36%看好,36%看淡。在這些顯著的期權中,包括6個看跌期權,總額爲370,733美元,以及5個看漲期權,總額爲269,000美元。

Expected Price Movements

預期價格變動

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $1700.0 to $2300.0 for MercadoLibre over the recent three months.

根據交易活動,看來這些重要投資者的目標價格區間是從1700.0美元到2300.0美元,針對MercadoLibre在最近三個月內。

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

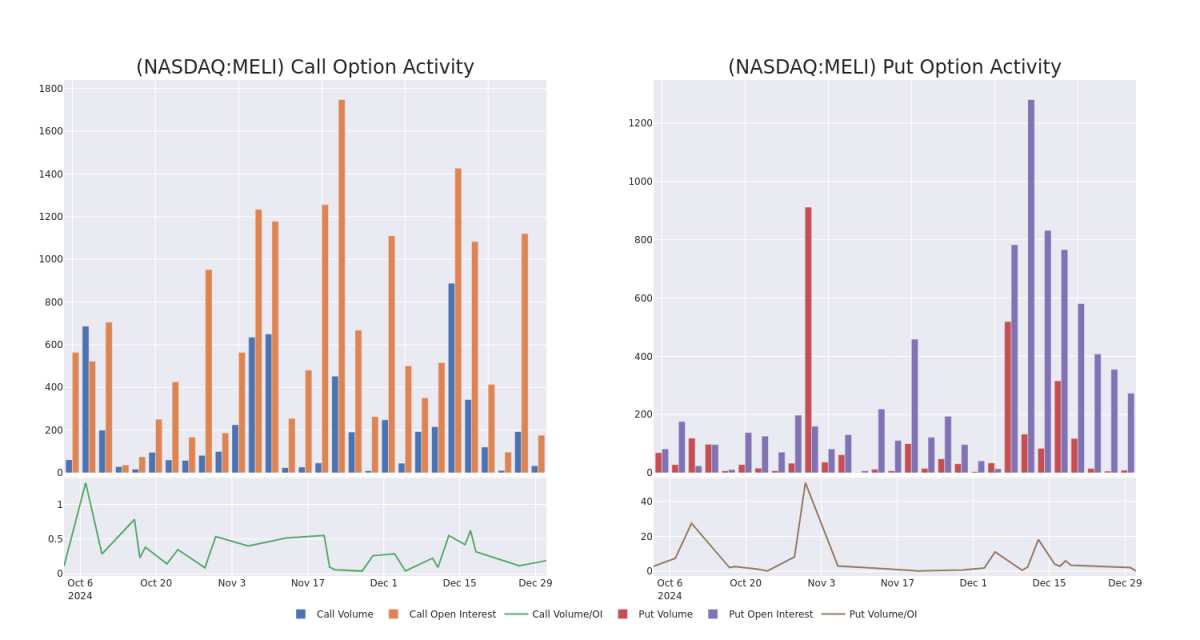

In today's trading context, the average open interest for options of MercadoLibre stands at 40.82, with a total volume reaching 41.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in MercadoLibre, situated within the strike price corridor from $1700.0 to $2300.0, throughout the last 30 days.

在今天的交易環境中,MercadoLibre的期權平均持倉量爲40.82,總成交量達到41.00。隨附的圖表描繪了過去30天內MercadoLibre中高價值交易的看漲和看跌期權成交量及持倉量的變化,位於1700.0美元至2300.0美元的行使價區間內。

MercadoLibre 30-Day Option Volume & Interest Snapshot

MercadoLibre 30天期權成交量與持倉快照

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MELI | PUT | SWEEP | BEARISH | 03/21/25 | $302.1 | $287.3 | $296.92 | $2000.00 | $148.4K | 64 | 5 |

| MELI | CALL | TRADE | BEARISH | 01/31/25 | $66.5 | $62.7 | $62.7 | $1730.00 | $125.4K | 38 | 20 |

| MELI | PUT | TRADE | NEUTRAL | 01/16/26 | $624.3 | $612.0 | $618.15 | $2300.00 | $61.8K | 36 | 1 |

| MELI | PUT | TRADE | BEARISH | 06/20/25 | $293.1 | $279.6 | $290.0 | $1940.00 | $58.0K | 15 | 0 |

| MELI | CALL | TRADE | BULLISH | 01/15/27 | $440.0 | $440.0 | $440.0 | $1700.00 | $44.0K | 16 | 1 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 行權價 | 總交易價格 | 未平倉合約 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MercadoLibre | 看跌 | 掃單 | 看淡 | 03/21/25 | $302.1 | $287.3 | $296.92 | $2000.00 | 148.4K美元 | 64 | 5 |

| MercadoLibre | 看漲 | 交易 | 看淡 | 01/31/25 | $66.5 | $62.7 | $62.7 | $1730.00 | 125.4K美元 | 38 | 20 |

| MercadoLibre | 看跌 | 交易 | 中立 | 01/16/26 | $624.3 | $612.0 | $618.15 | $2300.00 | $61.8K | 36 | 1 |

| MercadoLibre | 看跌 | 交易 | 看淡 | 06/20/25 | $293.1 | $279.6 | $290.0 | $1940.00 | 58.0千美元 | 15 | 0 |

| MercadoLibre | 看漲 | 交易 | 看好 | 01/15/27 | $440.0 | $440.0 | $440.0 | $1700.00 | $44.0K | 16 | 1 |

About MercadoLibre

關於MercadoLibre

MercadoLibre runs the largest e-commerce marketplace in Latin America, with more than 218 million active users and 1 million active sellers across 18 countries stitching into its commerce network or fintech solutions as of the end of 2023. The company operates a host of complementary businesses to its core online shop, with shipping solutions (Mercado Envios), a payment and financing operation (Mercado Pago and Mercado Credito), advertisements (Mercado Clics), classifieds, and a turnkey e-commerce solution (Mercado Shops) rounding out its arsenal. MercadoLibre generates revenue from final value fees, advertising royalties, payment processing, insertion fees, subscription fees, and interest income from consumer and small-business lending.

MercadoLibre 在拉丁美洲運營着最大的電子商務市場,截至2023年底,活躍用戶超過21800萬,活躍賣家超過100萬,覆蓋18個國家,融入其商業網絡或金融科技解決方案。該公司經營着一系列與其核心在線商店互補的業務,包括交通解決方案(Mercado Envios)、支付和融資事件(Mercado Pago 和 Mercado Credito)、廣告(Mercado Clics)、分類信息以及一個即用型電子商務解決方案(Mercado Shops),構成其業務陣容。MercadoLibre 從最終價值費用、廣告版稅、支付處理、插入費、訂閱費以及消費者和小企業貸款的利息收入中獲得營業收入。

In light of the recent options history for MercadoLibre, it's now appropriate to focus on the company itself. We aim to explore its current performance.

考慮到最近的 MercadoLibre 期權歷史,現在適合關注該公司本身。我們旨在探討其當前的表現。

MercadoLibre's Current Market Status

MercadoLibre的當前市場狀況

- Currently trading with a volume of 66,265, the MELI's price is down by 0.0%, now at $1721.8.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 51 days.

- 目前的成交量爲66,265,MercadoLibre的價格下跌了0.0%,現在爲$1721.8。

- RSI讀數表明該股票當前可能接近超賣。

- 預計的收益發佈將在51天后。

Turn $1000 into $1270 in just 20 days?

在短短20天內將1000美元變成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

一位擁有20年經驗的期權交易員揭示了他的單行圖表技巧,幫助判斷何時買入和賣出。複製他的交易,這些交易每20天平均獲得27%的利潤。點擊這裏獲取訪問權限。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for MercadoLibre with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供了更高利潤的潛力。精明的交易者通過持續教育、戰略交易調整、利用各種因數以及保持對市場動態的關注來降低這些風險。請通過Benzinga Pro實時跟蹤MercadoLibre最新的期權交易。

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $1700.0 to $2300.0 for MercadoLibre over the recent three months.

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $1700.0 to $2300.0 for MercadoLibre over the recent three months.