Goldenmax International Group (SZSE:002636) Shareholders Have Lost 47% Over 3 Years, Earnings Decline Likely the Culprit

Goldenmax International Group (SZSE:002636) Shareholders Have Lost 47% Over 3 Years, Earnings Decline Likely the Culprit

For many investors, the main point of stock picking is to generate higher returns than the overall market. But the risk of stock picking is that you will likely buy under-performing companies. Unfortunately, that's been the case for longer term Goldenmax International Group Ltd. (SZSE:002636) shareholders, since the share price is down 48% in the last three years, falling well short of the market decline of around 15%. And the share price decline continued over the last week, dropping some 7.1%.

對於許多投資者來說,挑選股票的主要目的是產生比整體市場更高的回報。但挑選股票的風險在於,你可能會購買表現不佳的公司。不幸的是,對於長揸金安國紀國際集團(SZSE:002636)的股東來說,情況就是如此,因爲過去三年股價下跌了48%,遠低於市場約15%的跌幅。並且,股價在過去一週繼續下跌,下降了大約7.1%。

If the past week is anything to go by, investor sentiment for Goldenmax International Group isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

如果說過去一週有什麼值得注意的,投資者對金安國紀國際集團的情緒並不樂觀,因此讓我們看看基本面與股價之間是否存在不匹配。

Given that Goldenmax International Group only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

考慮到金安國紀國際集團在過去十二個月中的盈利幾乎微不足道,我們將關注營業收入以評估其業務發展。一般而言,我們認爲這類公司更可與虧損股票進行比較,因爲實際利潤非常低。爲了讓股東對公司會顯著增長利潤有信心,公司必須增加營業收入。

In the last three years Goldenmax International Group saw its revenue shrink by 18% per year. That means its revenue trend is very weak compared to other loss making companies. With revenue in decline, the share price decline of 14% per year is hardly undeserved. The key question now is whether the company has the capacity to fund itself to profitability, without more cash. Of course, it is possible for businesses to bounce back from a revenue drop - but we'd want to see that before getting interested.

在過去三年中,金安國紀國際集團的營業收入每年縮減18%。這意味着其營業收入趨勢相較於其他虧損公司非常疲弱。在營業收入下降的情況下,股價每年下降14%幾乎是當之無愧的。現在的關鍵問題是,公司是否有能力在沒有更多現金的情況下自我融資以實現盈利。當然,企業有可能在營業收入下滑後反彈——但我們希望在對此感興趣之前能看到這樣的跡象。

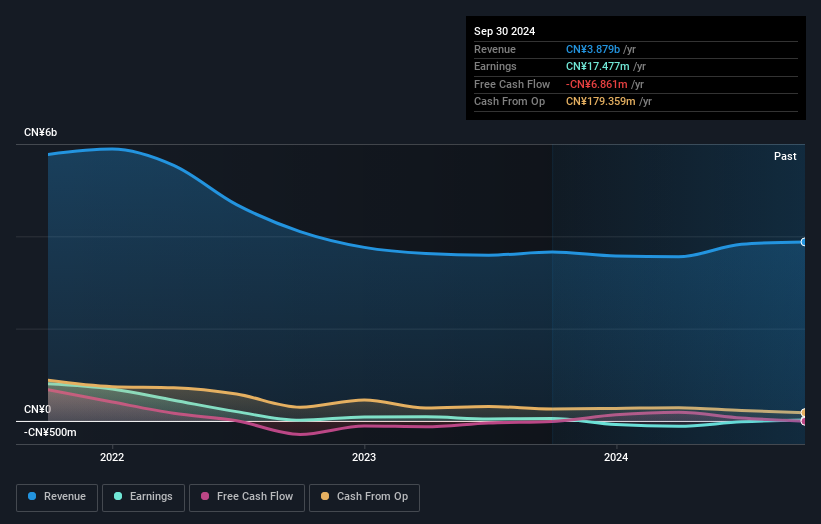

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

您可以在下面看到盈利和營業收入隨時間的變化(通過點擊圖片發現確切值)。

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

您可以通過這個免費的互動圖形查看其資產負債表隨時間的增強(或減弱)。

A Different Perspective

不同的視角

Investors in Goldenmax International Group had a tough year, with a total loss of 13% (including dividends), against a market gain of about 10%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 2% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with Goldenmax International Group (at least 2 which don't sit too well with us) , and understanding them should be part of your investment process.

金安國紀集團的投資者經歷了艱難的一年,整體損失爲13%(包括分紅派息),而市場增幅約爲10%。即使是優質股票的股價有時也會下跌,但我們希望在對業務產生過多興趣之前,看到其基本指標的改善。 不幸的是,去年的表現可能表明存在尚未解決的挑戰,畢竟它比過去五年半的年化損失2%還要糟糕。我們意識到,巴倫·羅斯柴爾德曾說投資者應在「街上有血的時候買入」,但我們提醒投資者首先要確保他們所購買的業務質量高。 我認爲從長遠來看觀察股價作爲業務表現的代理指標非常有趣。但要真正獲得洞見,我們還需要考慮其他信息。 例如,要考慮投資風險這個時刻存在的幽靈。我們已識別出金安國紀集團的4個警告信號(至少有2個令我們不太滿意),理解它們應成爲您投資過程的一部分。

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

對於喜歡尋找贏家投資的人來說,這份關於最近有內部人士購買的被低估公司的免費名單,可能正是你所需要的。

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

請注意,本文中引用的市場回報反映了目前在中國交易所交易的股票的市場加權平均回報。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對本文有反饋?對內容有疑慮?請直接與我們聯繫。或者,發送電子郵件至 editorial-team (at) simplywallst.com。

這篇來自Simply Wall ST的文章是一般性的。我們根據歷史數據和分析師預測提供評論,採用無偏見的方法,我們的文章並不旨在提供財務建議。它不構成對任何股票的買入或賣出建議,也未考慮到您的目標或財務狀況。我們旨在爲您提供以基本數據驅動的長期分析。請注意,我們的分析可能未考慮最新的價格敏感公司公告或定性材料。Simply Wall ST在提到的任何股票中均沒有持倉。

In the last three years Goldenmax International Group saw its revenue shrink by 18% per year. That means its revenue trend is very weak compared to other loss making companies. With revenue in decline, the share price decline of 14% per year is hardly undeserved. The key question now is whether the company has the capacity to fund itself to profitability, without more cash. Of course, it is possible for businesses to bounce back from a revenue drop - but we'd want to see that before getting interested.

In the last three years Goldenmax International Group saw its revenue shrink by 18% per year. That means its revenue trend is very weak compared to other loss making companies. With revenue in decline, the share price decline of 14% per year is hardly undeserved. The key question now is whether the company has the capacity to fund itself to profitability, without more cash. Of course, it is possible for businesses to bounce back from a revenue drop - but we'd want to see that before getting interested.