Verizon Communications Unusual Options Activity For January 02

Verizon Communications Unusual Options Activity For January 02

Whales with a lot of money to spend have taken a noticeably bullish stance on Verizon Communications.

有很多資金的巨頭對Verizon電信服務採取了明顯的看漲態勢。

Looking at options history for Verizon Communications (NYSE:VZ) we detected 12 trades.

查看Verizon通信(紐交所:VZ)的期權歷史數據,我們檢測到了12筆交易。

If we consider the specifics of each trade, it is accurate to state that 66% of the investors opened trades with bullish expectations and 25% with bearish.

如果我們考慮每筆交易的具體情況,可以準確地說,66%的投資者以看好的預期開啓交易,25%則是看淡的。

From the overall spotted trades, 2 are puts, for a total amount of $61,275 and 10, calls, for a total amount of $553,762.

在所有發現的交易中,有2筆爲看跌期權,總金額爲61,275美元,10筆爲看漲期權,總金額爲553,762美元。

Predicted Price Range

預測價格區間

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $35.0 to $42.0 for Verizon Communications during the past quarter.

分析這些合同的成交量和未平倉合約,似乎大玩家在過去一個季度中關注Verizon通信的價格區間從35.0美元到42.0美元。

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

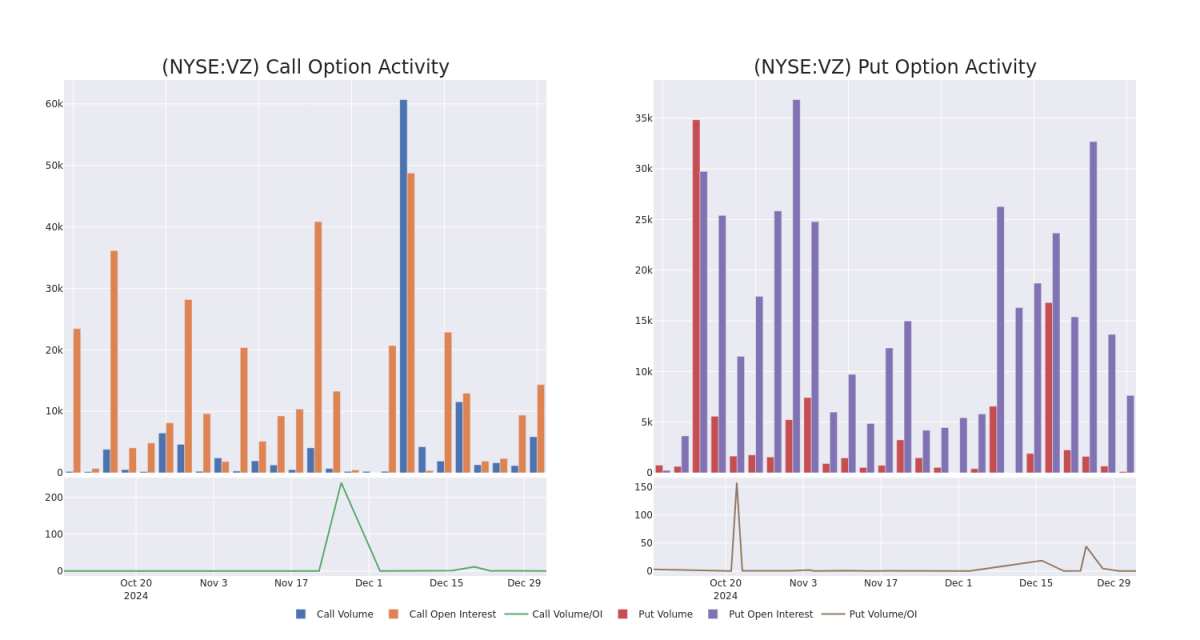

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Verizon Communications's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Verizon Communications's substantial trades, within a strike price spectrum from $35.0 to $42.0 over the preceding 30 days.

評估成交量和未平倉合約是進行期權交易的戰略步驟。這些指標揭示了在指定行使價下,投資者對Verizon通信期權的流動性和興趣。以下數據可視化了過去30天內,與Verizon通信相關的顯著交易的看漲與看跌期權的成交量和未平倉合約的波動,涵蓋行使價範圍從35.0美元到42.0美元。

Verizon Communications Option Activity Analysis: Last 30 Days

Verizon通信期權活動分析:過去30天

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VZ | CALL | SWEEP | BULLISH | 01/16/26 | $2.28 | $2.17 | $2.28 | $42.00 | $134.1K | 3.8K | 650 |

| VZ | CALL | SWEEP | BULLISH | 02/21/25 | $1.14 | $1.12 | $1.14 | $40.00 | $73.8K | 1.3K | 721 |

| VZ | CALL | SWEEP | BEARISH | 06/20/25 | $4.05 | $3.95 | $3.95 | $37.00 | $63.5K | 3.2K | 289 |

| VZ | CALL | SWEEP | BULLISH | 02/21/25 | $1.09 | $1.05 | $1.09 | $40.00 | $54.5K | 1.3K | 2.0K |

| VZ | CALL | SWEEP | BEARISH | 06/20/25 | $4.0 | $3.9 | $3.9 | $37.00 | $49.1K | 3.2K | 416 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 行權價 | 總交易價格 | 未平倉合約 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VZ | 看漲 | 掃單 | 看好 | 01/16/26 | $2.28 | $2.17 | $2.28 | $42.00 | 134.1K美元 | 3.8K | 650 |

| VZ | 看漲 | 掃單 | 看好 | 02/21/25 | $1.14 | $1.12 | $1.14 | $40.00 | 73.8K美元 | 1.3K | 721 |

| VZ | 看漲 | 掃單 | 看淡 | 06/20/25 | $4.05 | $3.95 | $3.95 | $37.00 | 63.5K美元 | 3.2K | 289 |

| VZ | 看漲 | 掃單 | 看好 | 02/21/25 | $1.09 | $1.05 | $1.09 | $40.00 | $54.5K | 1.3K | 2.0K |

| VZ | 看漲 | 掃單 | 看淡 | 06/20/25 | $4.0 | $3.9 | $3.9 | $37.00 | $49.1K | 3.2K | 416 |

About Verizon Communications

關於Verizon通信

Wireless services account for about 70% of Verizon Communications' total service revenue and nearly all of its operating income. The firm serves about 93 million postpaid and 20 million prepaid phone customers via its nationwide network, making it the largest US wireless carrier. Fixed-line telecom operations include local networks in the Northeast, which reach about 30 million homes and businesses and serve about 8 million broadband customers. Verizon also provides telecom services nationwide to enterprise customers, often using a mixture of its own and other carriers' networks. Verizon agreed to acquire Frontier Communications in September 2024.

無線服務約佔Verizon通信總服務營業收入的70%,幾乎佔其所有運營收入。該公司通過其全國網絡爲大約9300萬後付費和2000萬預付費電話客戶提供服務,使其成爲美國最大的無線運營商。固定電話運營包括東北部的本地網絡,覆蓋約3000萬家庭和企業,併爲約800萬寬帶客戶提供服務。Verizon還向企業客戶提供全國範圍的電信服務,通常使用自有網絡和其他運營商的網絡的混合。Verizon同意在2024年9月收購Frontier通信。

In light of the recent options history for Verizon Communications, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鑑於近期Verizon通信的期權歷史,現在適合關注公司本身。我們旨在探討其當前表現。

Where Is Verizon Communications Standing Right Now?

Verizon通信目前處於什麼狀態?

- With a volume of 12,643,555, the price of VZ is up 0.33% at $40.12.

- RSI indicators hint that the underlying stock may be oversold.

- Next earnings are expected to be released in 22 days.

- 成交量爲12,643,555,VZ的價格上漲0.33%,現爲$40.12。

- RSI因數暗示標的股票可能被超賣。

- 下一個業績預計將在22天內發佈。

Expert Opinions on Verizon Communications

Verizon通信的專家意見

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $45.0.

在過去30天內,總共有1位專業分析師對這隻股票發表了看法,設定了45.0美元的平均目標價。

Unusual Options Activity Detected: Smart Money on the Move

檢測到期權異動:聰明資金正在行動

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* An analyst from UBS persists with their Neutral rating on Verizon Communications, maintaining a target price of $45.

Benzinga Edge的期權異動平台發現潛在的市場動向,提前預見它們的發生。查看大資金在你最喜歡的股票上持有的頭寸。點擊這裏訪問。* UBS的一位分析師繼續對Verizon通信保持中立評級,維持目標價爲45美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Verizon Communications with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供更高利潤的潛力。精明的交易者通過持續的教育、戰略性交易調整、利用各種因數和關注市場動態來降低這些風險。通過Benzinga Pro跟蹤Verizon通信的最新期權交易,獲取實時提醒。

From the overall spotted trades, 2 are puts, for a total amount of $61,275 and 10, calls, for a total amount of $553,762.

From the overall spotted trades, 2 are puts, for a total amount of $61,275 and 10, calls, for a total amount of $553,762.