Markets Weekly Update (January 3) Tesla's Q4 Delivery Data Missed Expectations, Stock Price Drops by Over 6%

Markets Weekly Update (January 3) Tesla's Q4 Delivery Data Missed Expectations, Stock Price Drops by Over 6%

Welcome to the Markets Weekly Update, the column committed to delivering essential investing insights for the week and key events that could move markets in the week ahead.

歡迎收看《市場週報》,該專欄致力於提供本週的基本投資見解以及可能在未來一週推動市場的關鍵事件。

Macro Matters

宏觀問題

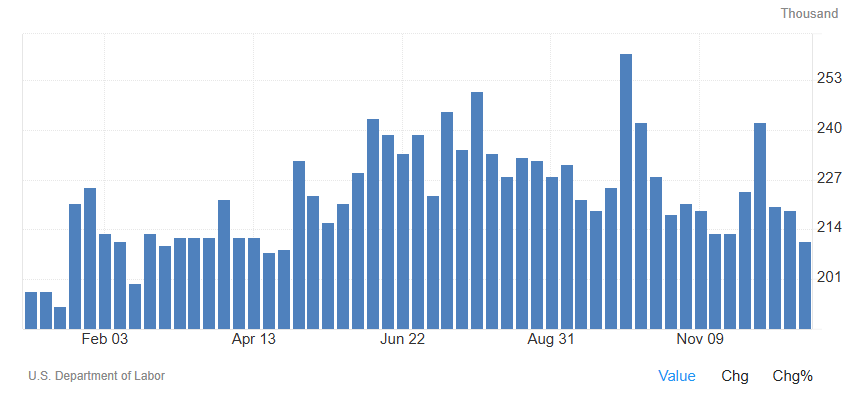

US Initial Jobless Claims Fall to 8-Month Low

美國首次申請失業救濟人數降至8個月低點

In the final week of 2024, the number of first-time unemployment claims in the US dropped unexpectedly by 9,000 to 211,000, which is a significant decrease from the anticipated rise to 222,000, and represents the fewest initial claims seen in eight months. This is according to data from the U.S. Department of Labor. The week before, continuing claims for unemployment benefits decreased by 52,000 to 1,844,000, which was lower than the expected 1,890,000. These figures suggest that the US job market is still very competitive compared to historical norms. This situation could give the Federal Reserve the flexibility to maintain higher interest rates if inflation doesn't slow down at the rate they want.

在2024年的最後一週,美國首次申請失業救濟的人數出人意料地下降了9,000人,至21.1萬人,較預期的22.2萬人大幅下降,是八個月來首次申請失業救濟人數最少的一次。這是根據美國勞工部的數據得出的。前一週,持續申請失業救濟金的人數減少了52,000人,至184.4萬人,低於預期的189萬人。這些數字表明,與歷史標準相比,美國就業市場仍然競爭激烈。如果通貨膨脹不以他們想要的利率放緩,這種情況可能會使聯儲局能夠靈活地維持更高的利率。

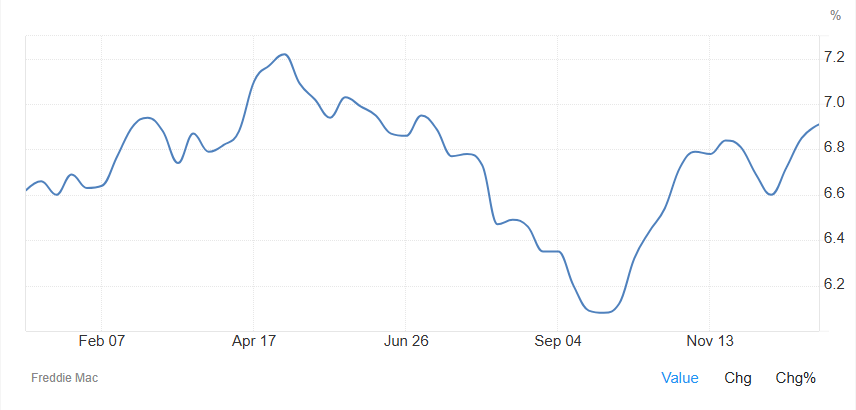

US Mortgage Rate Approaches 7%

美國抵押貸款利率接近7%

As of January 2, the average interest rate for 30-year fixed mortgages backed by Freddie Mac rose to 6.91%, the highest level since July. This increase aligns with the surge in long-term Treasury yields, driven by the Federal Reserve's hawkish signals and strong economic data. Freddie Mac's Chief Economist, Sam Khater, stated, "Mortgage rates have slightly increased to just below 7%, reaching their highest point in nearly six months. Compared to the same period last year, rates have risen, and the headwind of affordability persists. However, with the rise in pending home sales, it appears that buyers are more inclined to wait and see".

截至1月2日,房地美支持的30年期固定抵押貸款的平均利率升至6.91%,爲7月以來的最高水平。這一增長與聯儲局鷹派信號和強勁經濟數據的推動下,長期國債收益率的飆升相吻合。房地美首席經濟學家山姆·哈特表示:「抵押貸款利率略有上升至略低於7%,達到近六個月來的最高點。與去年同期相比,利率有所上升,負擔能力的不利因素仍然存在。但是,隨着待售房屋銷售的增加,買家似乎更傾向於觀望」。

Dollar Holds Near 2-Year Highs Amid Strong US Outlook

在美國前景強勁的情況下,美元維持在兩年高點附近

The US dollar index remained above 109 on Friday, hovering near its highest level in two years as investors are placing bets on a strengthening US economy and anticipating fewer interest rate cuts by the Federal Reserve this year. The American economy continues to demonstrate resilience, which is setting it up to outperform other economies worldwide in the short term. The Federal Reserve has signaled that it will adopt a more cautious approach to easing monetary policy in 2025, in light of persistent inflation. The latest forecasts suggest that there will be just two interest rate cuts of 0.25 percentage points each this year, marking a significant decrease from the 1 percentage point (four 0.25 percentage point cuts) that was expected back in September.

由於投資者押注美國經濟走強,並預計聯儲局今年將減少減息,美元指數週五維持在109以上,徘徊在兩年來的最高水平附近。美國經濟繼續表現出彈性,這爲其在短期內跑贏全球其他經濟體做好了準備。聯儲局表示,鑑於持續的通貨膨脹,它將在2025年採取更加謹慎的態度來放鬆貨幣政策。最新的預測表明,今年僅有兩次減息0.25個百分點,與9月份預期的1個百分點(四次減息0.25個百分點)相比大幅下降。

Furthermore, uncertainties surrounding the policies of the incoming Trump administration have driven investors to seek the safety of the US dollar. As a result, the dollar is currently trading at multi-year highs against the euro, the Australian dollar, and the New Zealand dollar, and at multi-month highs against the Japanese yen and the British pound.

此外,圍繞即將上任的特朗普政府政策的不確定性促使投資者尋求美元的安全。因此,美元兌歐元、澳元和新西蘭元目前處於多年高位,兌日元和英鎊處於數月高點。

Smart Money Flow

智能資金流

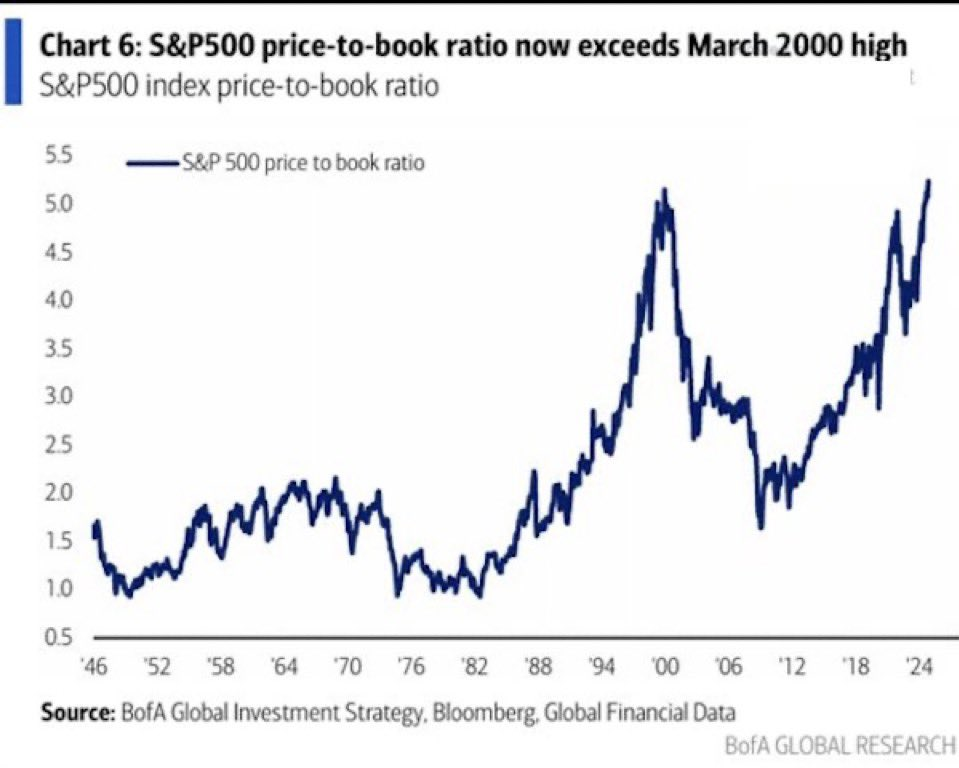

The price-to-book ratio of the S&P 500 Index has now surpassed its peak during the dot-com bubble era.

標普500指數的賬面比率現已超過Internet Plus-related泡沫時代的峯值。

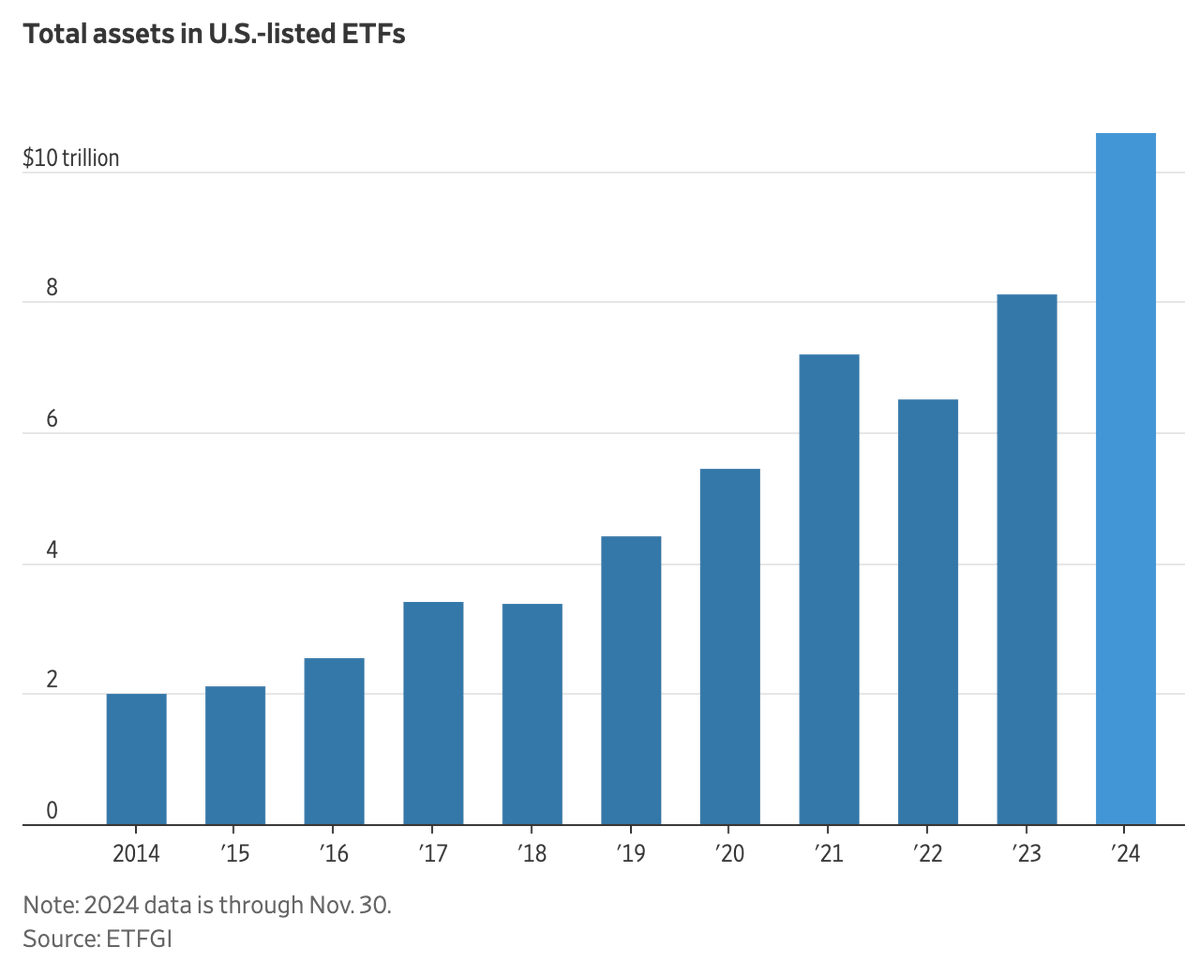

By the end of November, the total assets of Exchange Traded Funds (ETFs) in the United States had reached a record high of $10.6 trillion, marking an increase of over 30% since the beginning of 2024.

截至11月底,美國交易所交易基金(ETF)的總資產已達到10.6萬億美元的歷史新高,自2024年初以來增長了30%以上。

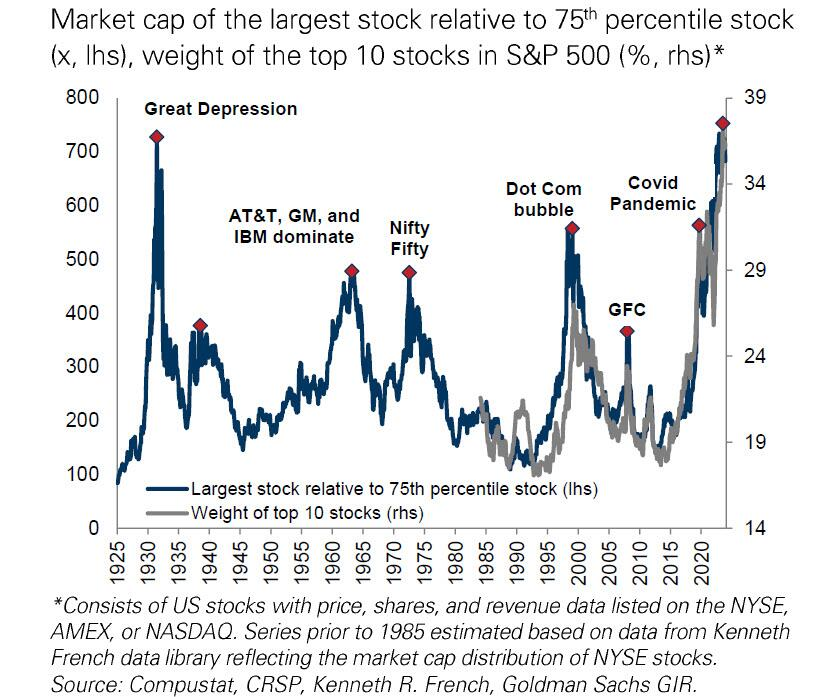

The concentration bubble in the U.S. stock market is rarely bigger

美國股市的集中度泡沫很少會更大

The market concentration at the start of 2025 has reached its highest level since the Great Depression. The top 10 U.S. stocks account for 38% of the total market capitalization.

2025年初的市場集中度已達到大蕭條以來的最高水平。美國排名前十的股票佔總市值的38%。

Top Corporate News

熱門企業新聞

Tesla's Q4 delivery data missed expectations, Stock price drops by over 6%

特斯拉第四季度交付數據未達到預期,股價下跌超過6%

On Thursday, January 2nd, Eastern Time, Tesla released its vehicle delivery data for the full year and fourth quarter of 2024. Subsequently, its stock price fell by more than 6% during the day's trading. Tesla said that 1.79 million vehicles were delivered in 2024, less than the 1.8 million vehicles delivered in 2023 and lower than the analysts' general forecast of 1.8 million. This marks the first annual sales decline since Tesla went public in 2011.

美國東部時間1月2日星期四,特斯拉發佈了2024年全年和第四季度的車輛交付數據。隨後,其股價在當天的交易中下跌了6%以上。特斯拉表示,2024年交付了179萬輛汽車,低於2023年交付的180萬輛汽車,也低於分析師普遍預測的180萬輛。這標誌着特斯拉自2011年上市以來首次出現年度銷量下降。

Despite the annual sales decline, Tesla still achieved strong growth in the fourth quarter. In the fourth quarter ending December 31st, Tesla delivered 495,570 vehicles, setting a new quarterly delivery record but falling short of the analysts' average expectations. Although the sales of electric vehicles hardly grew, Tesla's stock price rose by more than 60% in 2024. Almost all of the increase occurred after the presidential election on November 5th.

儘管年度銷量下降,但特斯拉在第四季度仍實現強勁增長。在截至12月31日的第四季度中,特斯拉交付了495,570輛汽車,創下了新的季度交付記錄,但未達到分析師的平均預期。儘管電動汽車的銷量幾乎沒有增長,但特斯拉的股價在2024年上漲了60%以上。幾乎所有的增長都發生在11月5日的總統大選之後。

Investors are certainly concerned about quarterly delivery volumes, but currently, they are more focused on the future development in 2025 and how Elon Musk's close relationship with Trump will help the electric vehicle manufacturer.

投資者當然對季度交付量感到擔憂,但目前,他們更關注2025年的未來發展,以及埃隆·馬斯克與特朗普的密切關係將如何幫助這家電動汽車製造商。

Carvana Slips as Hindenburg Alleges 'Related-Party Accounting Games'

興登堡指控 「關聯方會計遊戲」,Carvana下滑

Hindenburg Research has announced that it is shorting Carvana, a used car dealer. It claims that the recent turnaround of this online used car retailer is propped up by shaky loans and accounting manipulations. Carvana's share price dropped approximately 3% on Thursday.

興登堡研究公司宣佈正在做空二手車經銷商Carvana。它聲稱,這家在線二手車零售商最近的轉機是由不穩定的貸款和會計操縱支撐的。週四,Carvana的股價下跌了約3%。

Nathan Anderson, the founder of Hindenburg, said that after conducting extensive document reviews and interviewing 49 industry experts, former Carvana employees, competitors, and relevant parties, the institution firmly believes that Carvana's "transformation is an illusion".

興登堡創始人內森·安德森表示,在進行了廣泛的文件審查並採訪了49位行業專家、前Carvana員工、競爭對手和相關方之後,該機構堅信Carvana的 「轉型是一種幻覺」。

The institution wrote in its report, "Our research has found that the company sold $800 million in loans to suspected undisclosed related parties. Meanwhile, it has utilized accounting manipulations and loose loan approval processes to drive temporary revenue growth, while insiders have taken the opportunity to cash out billions of dollars' worth of stocks."

該機構在其報告中寫道:「我們的研究發現,該公司向可疑的未公開關聯方出售了8億美元的貸款。同時,它利用會計操縱和寬鬆的貸款審批流程來推動臨時收入增長,而內部人士則藉此機會套現了價值數十億美元的股票。」

Disclaimer: This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal.

免責聲明:本演示文稿僅供參考和教育之用,不是對任何特定投資或投資策略的推薦或認可。本內容中提供的投資信息本質上是一般性的,僅用於說明目的,可能不適合所有投資者。其提供時不考慮個人投資者的財務複雜程度、財務狀況、投資目標、投資時間範圍或風險承受能力。在做出任何投資決定之前,您應根據您的相關個人情況考慮這些信息的適當性。過去的投資表現並不表明或保證未來的成功。回報會有所不同,所有投資都有風險,包括本金損失。

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. In the U.S., investment products and services on Moomoo are offered by Moomoo Financial Inc., Member FINRA/SIPC.

moomoo是由moomoo Technologies Inc.提供的財務信息和交易應用程序。在美國,moomoo上的投資產品和服務由成員FINRA/SIPC的moomoo Financial Inc. 提供。