Vistra Unusual Options Activity

Vistra Unusual Options Activity

Whales with a lot of money to spend have taken a noticeably bullish stance on Vistra.

擁有大量資金的鯨魚們對Vistra Energy採取了明顯的看好態度。

Looking at options history for Vistra (NYSE:VST) we detected 53 trades.

查看Vistra Energy(紐交所:VST)的期權歷史,我們檢測到53筆交易。

If we consider the specifics of each trade, it is accurate to state that 41% of the investors opened trades with bullish expectations and 41% with bearish.

如果我們考慮每筆交易的具體情況,可以準確地說41%的投資者以看好的期望開盤,41%則是看淡。

From the overall spotted trades, 5 are puts, for a total amount of $294,607 and 48, calls, for a total amount of $6,628,383.

在整體發現的交易中,5筆是看跌期權,總金額爲294,607美元,48筆是看漲期權,總金額爲6,628,383美元。

What's The Price Target?

價格目標是什麼?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $47.0 to $200.0 for Vistra during the past quarter.

分析這些合約的成交量和未平倉合約,似乎大玩家在過去一個季度裏一直關注着Vistra Energy價格在47.0美元到200.0美元之間的窗口。

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

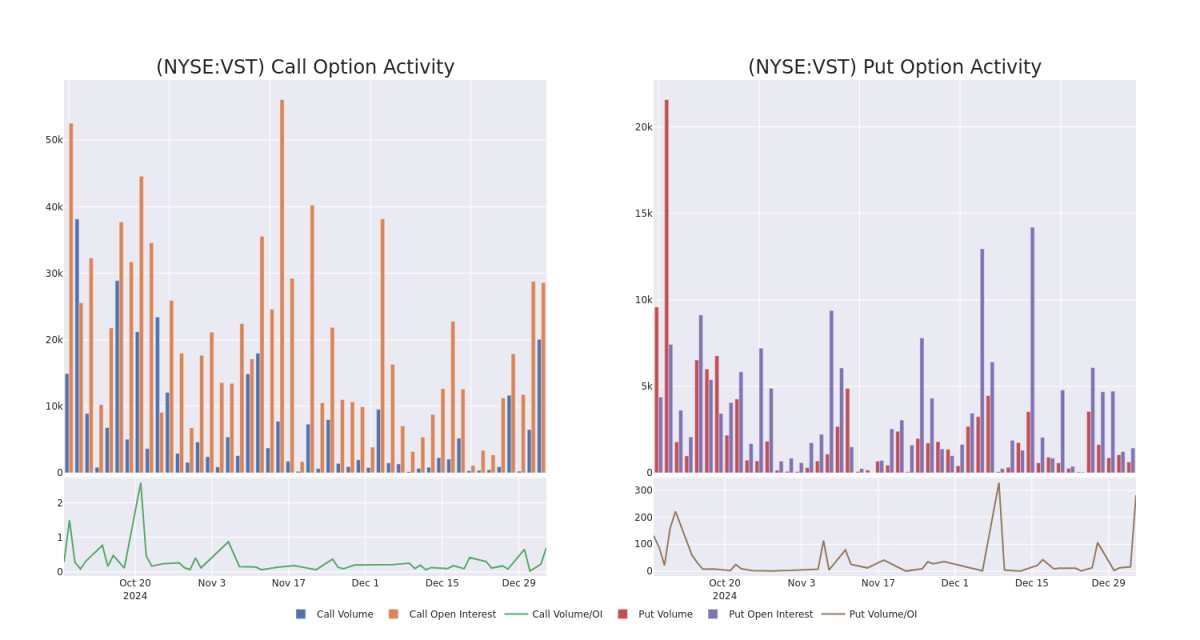

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Vistra's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Vistra's substantial trades, within a strike price spectrum from $47.0 to $200.0 over the preceding 30 days.

評估成交量和未平倉合約是期權交易中的一個戰略步驟。這些指標揭示了投資者在指定行權價下對Vistra Energy期權的流動性和興趣。以下數據可視化了與Vistra Energy的大手交易相關的看漲和看跌期權的成交量和未平倉合約的波動,涵蓋47.0美元到200.0美元的行權價區間,時間範圍爲過去30天。

Vistra Option Activity Analysis: Last 30 Days

Vistra期權活動分析:過去30天

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VST | CALL | TRADE | BEARISH | 03/21/25 | $19.75 | $19.4 | $19.4 | $160.00 | $1.2M | 6.2K | 1.1K |

| VST | CALL | TRADE | BULLISH | 03/21/25 | $19.6 | $19.0 | $19.5 | $160.00 | $780.0K | 6.2K | 1.6K |

| VST | CALL | SWEEP | BEARISH | 03/21/25 | $6.7 | $6.6 | $6.6 | $200.00 | $257.9K | 169 | 419 |

| VST | CALL | SWEEP | BEARISH | 01/17/25 | $8.65 | $8.35 | $8.35 | $157.50 | $241.8K | 409 | 413 |

| VST | CALL | SWEEP | BEARISH | 02/21/25 | $43.95 | $43.25 | $43.5 | $115.00 | $217.5K | 89 | 180 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 行權價 | 總交易價格 | 未平倉合約 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Vistra Energy | 看漲 | 交易 | 看淡 | 03/21/25 | $19.75 | $19.4 | $19.4 | $160.00 | 120萬美元 | 6.2K | 1.1千 |

| Vistra Energy | 看漲 | 交易 | 看好 | 03/21/25 | $19.6 | $19.0 | $19.5 | $160.00 | 780,000美元 | 6.2K | 1.6K |

| Vistra Energy | 看漲 | 掃單 | 看淡 | 03/21/25 | $6.7 | $6.6 | $6.6 | $200.00 | $257.9K | 169 | 419 |

| Vistra Energy | 看漲 | 掃單 | 看淡 | 01/17/25 | $8.65 | $8.35 | $8.35 | $157.50 | $241.8K | 409 | 413 |

| Vistra Energy | 看漲 | 掃單 | 看淡 | 02/21/25 | $43.95 | $43.25 | $43.5 | $115.00 | $217.5K | 89 | 180 |

About Vistra

關於Vistra

Vistra Energy is one of the largest power producers and retail energy providers in the us Following the 2024 Energy Harbor acquisition, Vistra owns 41 gigawatts of nuclear, coal, natural gas, and solar power generation along with one of the largest utility-scale battery projects in the world. Its retail electricity business serves 5 million customers in 20 states, including almost a third of all Texas electricity consumers. Vistra emerged from the Energy Future Holdings bankruptcy as a stand-alone entity in 2016. It acquired Dynegy in 2018.

Vistra Energy is one of the largest power producers and retail energy providers in the us Following the 2024 Energy Harbor acquisition, Vistra owns 41 gigawatts of nuclear, coal, natural gas, and solar power generation along with one of the largest utility-scale battery projects in the world. Its retail electricity business serves 500萬 customers in 20 states, including almost a third of all Texas electricity consumers. Vistra emerged from the Energy Future Holdings bankruptcy as a stand-alone entity in 2016. It acquired Dynegy in 2018.

Following our analysis of the options activities associated with Vistra, we pivot to a closer look at the company's own performance.

Following our analysis of the options activities associated with Vistra, we pivot to a closer look at the company's own performance.

Present Market Standing of Vistra

Vistra當前市場狀態

- Currently trading with a volume of 4,072,053, the VST's price is up by 7.24%, now at $160.49.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 54 days.

- 目前交易量爲4,072,053,VST的價格上漲了7.24%,現在爲$160.49。

- RSI讀數表明該股票目前可能接近超買狀態。

- 預計收益發佈將在54天后。

Expert Opinions on Vistra

關於Vistra的專家意見

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $174.0.

在過去一個月中,1 位行業分析師分享了他們對這隻股票的見解,提出的平均目標價爲 $174.0。

Unusual Options Activity Detected: Smart Money on the Move

檢測到期權異動:聰明資金正在行動

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* Consistent in their evaluation, an analyst from UBS keeps a Buy rating on Vistra with a target price of $174.

Benzinga Edge的期權異動板塊在潛在市場動向發生之前識別出潛在的市場推動者。查看大資金在你最喜歡的股票上的操作。點擊這裏獲取訪問權限。* 一位來自瑞銀的分析師在評估中保持對Vistra的買入評級,目標價爲$174。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

與僅僅交易股票相比,期權是一種風險較高的資產,但它們具有更高的盈利潛力。嚴肅的期權交易者通過日常學習、逐步進出交易、關注多個因數以及密切關注市場來管理這種風險。

From the overall spotted trades, 5 are puts, for a total amount of $294,607 and 48, calls, for a total amount of $6,628,383.

From the overall spotted trades, 5 are puts, for a total amount of $294,607 and 48, calls, for a total amount of $6,628,383.