Smart Money Is Betting Big In LLY Options

Smart Money Is Betting Big In LLY Options

Deep-pocketed investors have adopted a bearish approach towards Eli Lilly (NYSE:LLY), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in LLY usually suggests something big is about to happen.

資金雄厚的投資者對禮來公司(紐交所: LLY)採取了看淡的策略,這是市場參與者不應忽視的事情。我們在Benzinga對公開期權記錄的跟蹤揭示了今天這一重要舉動。這些投資者的身份尚不清楚,但在LLY中如此大規模的舉動通常暗示着即將發生重大事件。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 28 extraordinary options activities for Eli Lilly. This level of activity is out of the ordinary.

我們今天通過觀察了解到這一信息,當Benzinga的期權掃描儀強調了禮來公司的28項非凡期權活動時。這一活動水平顯得不尋常。

The general mood among these heavyweight investors is divided, with 35% leaning bullish and 46% bearish. Among these notable options, 9 are puts, totaling $918,100, and 19 are calls, amounting to $2,223,588.

這些重量級投資者的整體情緒出現分歧,35%傾向於看好,46%看淡。在這些顯著的期權中,9個是看跌期權,總計918,100美元,19個是看漲期權,金額達到2,223,588美元。

What's The Price Target?

價格目標是什麼?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $330.0 to $940.0 for Eli Lilly over the recent three months.

根據交易活動來看,大型投資者的目標價位區間爲330.0美元到940.0美元,這個區間是針對禮來公司在最近三個月內的走勢。

Analyzing Volume & Open Interest

分析成交量和未平倉合約

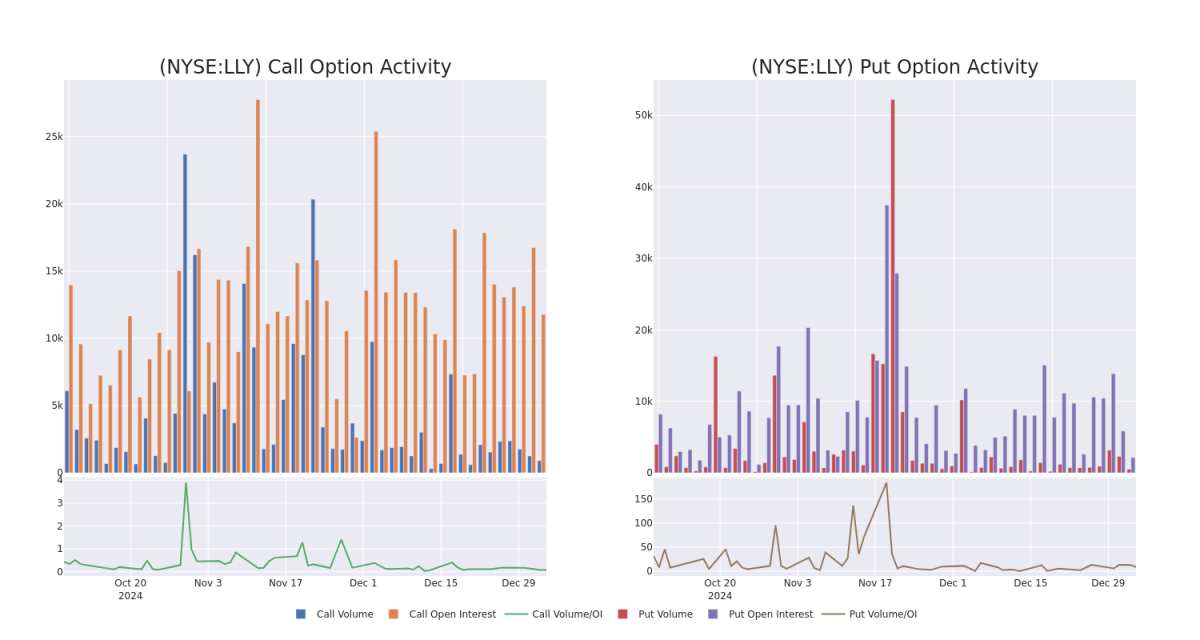

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

觀察成交量和未平倉合約是進行股票盡職調查的一個有見地的方法。

This data can help you track the liquidity and interest for Eli Lilly's options for a given strike price.

這些數據可以幫助你追蹤禮來公司在特定行權價的流動性和興趣。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Eli Lilly's whale activity within a strike price range from $330.0 to $940.0 in the last 30 days.

下面,我們可以觀察到在過去30天內,Eli Lilly 的所有鯨魚活動中,看漲期權和看跌期權的成交量和未平倉合約的演變,執行價格區間爲 $330.0 到 $940.0。

Eli Lilly Option Volume And Open Interest Over Last 30 Days

艾 Eli Lilly在過去30天的期權成交量和未平倉合約

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LLY | CALL | TRADE | BULLISH | 01/17/25 | $17.25 | $16.35 | $17.0 | $780.00 | $850.0K | 3.9K | 519 |

| LLY | PUT | TRADE | NEUTRAL | 12/18/26 | $48.0 | $45.25 | $46.6 | $600.00 | $466.0K | 199 | 100 |

| LLY | CALL | TRADE | BEARISH | 03/21/25 | $13.2 | $12.55 | $12.75 | $900.00 | $277.9K | 940 | 223 |

| LLY | CALL | TRADE | BEARISH | 12/18/26 | $184.0 | $180.5 | $180.5 | $750.00 | $180.5K | 38 | 10 |

| LLY | CALL | TRADE | BEARISH | 12/18/26 | $183.15 | $180.0 | $180.0 | $750.00 | $180.0K | 38 | 20 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 行權價 | 總交易價格 | 未平倉合約 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LLY | 看漲 | 交易 | 看好 | 01/17/25 | $17.25 | $16.35 | $17.0 | $780.00 | $850.0K | 3.9K | 519 |

| LLY | 看跌 | 交易 | 中立 | 12/18/26 | $48.0 | $45.25 | $46.6 | $600.00 | $466.0K | 199 | 100 |

| LLY | 看漲 | 交易 | 看淡 | 03/21/25 | $13.2 | $12.55 | $12.75 | $900.00 | 277.9K美元 | 940 | 223 |

| LLY | 看漲 | 交易 | 看淡 | 12/18/26 | $184.0 | $180.5 | $180.5 | $750.00 | 美金180.5K | 38 | 10 |

| LLY | 看漲 | 交易 | 看淡 | 12/18/26 | $183.15 | $180.0 | $180.0 | $750.00 | $180.0K | 38 | 20 |

About Eli Lilly

關於禮來

Eli Lilly is a drug firm with a focus on neuroscience, cardiometabolic, cancer, and immunology. Lilly's key products include Verzenio for cancer; Mounjaro, Zepbound, Jardiance, Trulicity, Humalog, and Humulin for cardiometabolic; and Taltz and Olumiant for immunology.

禮來是一家專注於神經科學、心臟代謝、癌症和免疫學的製藥公司。禮來的主要產品包括用於癌症的Verzenio;用於心臟代謝的Mounjaro、Zepbound、Jardiance、Trulicity、Humalog和Humulin;以及用於免疫學的Taltz和Olumiant。

In light of the recent options history for Eli Lilly, it's now appropriate to focus on the company itself. We aim to explore its current performance.

考慮到最近關於禮來公司的期權歷史,現在應該關注公司本身。我們旨在探討其當前的表現。

Current Position of Eli Lilly

艾利藥業的當前情況

- With a volume of 506,387, the price of LLY is up 0.23% at $779.88.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 34 days.

- LLY的成交量爲506,387,價格上漲0.23%,達779.88美元。

- RSI因數暗示基礎股票可能接近超賣。

- 下一個業績預計將在34天后發佈。

What The Experts Say On Eli Lilly

專家對艾莉麗的看法

In the last month, 1 experts released ratings on this stock with an average target price of $997.0.

在過去一個月裏,1 位專家對這隻股票發佈了評級,平均目標價爲 997.0 美元。

Turn $1000 into $1270 in just 20 days?

在短短20天內將1000美元變成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* In a cautious move, an analyst from B of A Securities downgraded its rating to Buy, setting a price target of $997.

一位有20年經驗的期權交易員揭示了他的一行圖表技巧,顯示何時買入和賣出。複製他的交易,這些交易每20天平均獲利27%。點擊這裏獲取訪問權限。* 在謹慎的舉動中,來自美國銀行證券的分析師將其評級下調爲買入,目標價設定爲997美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Eli Lilly with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供更高利潤的潛力。精明的交易者通過持續的教育、戰略交易調整、利用各種因數,以及關注市場動態來降低這些風險。通過Benzinga Pro跟蹤艾莉麗的最新期權交易,獲取實時警報。

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $330.0 to $940.0 for Eli Lilly over the recent three months.

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $330.0 to $940.0 for Eli Lilly over the recent three months.