Barclays analyst Terry Ma maintains $SLM Corp (SLM.US)$ with a buy rating, and adjusts the target price from $26 to $34.

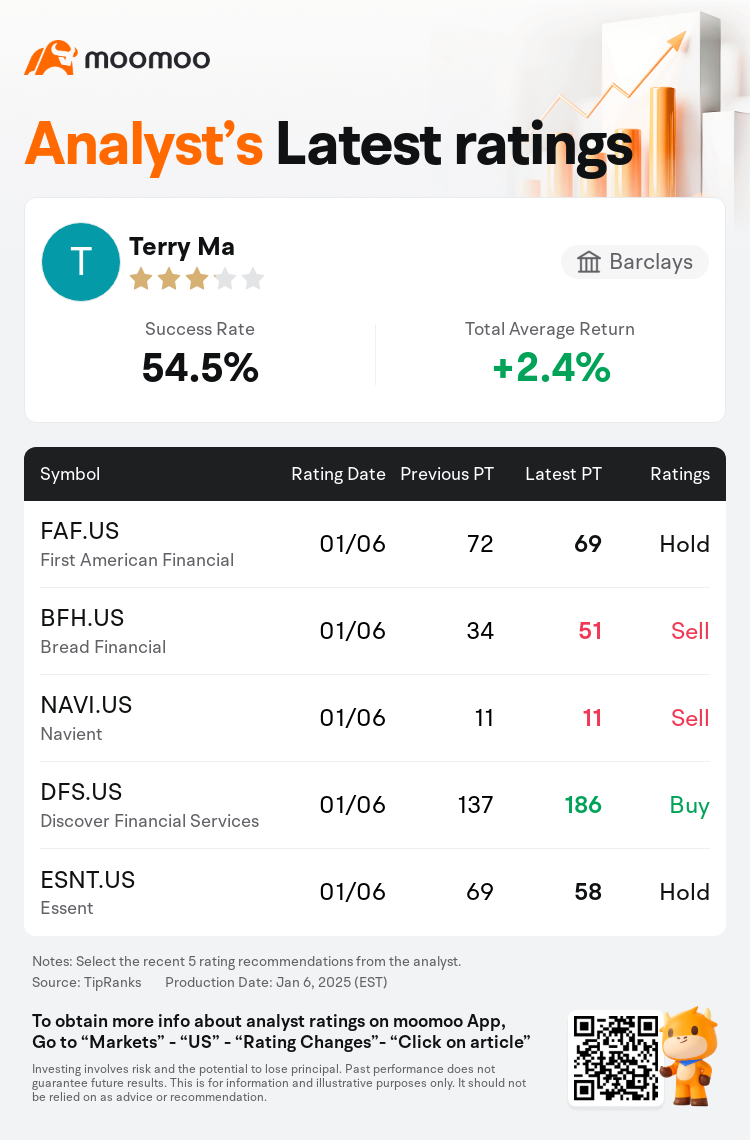

According to TipRanks data, the analyst has a success rate of 54.5% and a total average return of 2.4% over the past year.

Furthermore, according to the comprehensive report, the opinions of $SLM Corp (SLM.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $SLM Corp (SLM.US)$'s main analysts recently are as follows:

Heading into 2025, the focal points for the specialty finance sector include a stable consumer base, improved consumer credit trends particularly among prime borrowers, persistently high mortgage rates, and a more relaxed regulatory environment. Since the election, shares in the consumer lending sector have performed robustly, somewhat accelerating expected returns and complicating stock selection processes. The strategy that was effective in mortgage finance in 2024 is being carried forward to 2025, with a preference for companies having balanced business models. Analyst preference leans towards stocks that possess unacknowledged positive catalysts capable of generating further gains. Moreover, air lessors are still perceived as undervalued, while there's a suggestion of caution towards mortgage credit.

The results of the recent November election seem to have revitalized economic enthusiasm, enhancing business and consumer confidence in anticipation of a more pro-business climate. This shift has heightened expectations for the U.S. economy while diminishing prospects for further Federal Reserve easing. This scenario is viewed as favorable for companies linked to consumer credit and spending, but less so for those connected to the mortgage market, which continues to suffer from high rates and a shortage of housing supply.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

巴克萊銀行分析師Terry Ma維持$學貸美 (SLM.US)$買入評級,並將目標價從26美元上調至34美元。

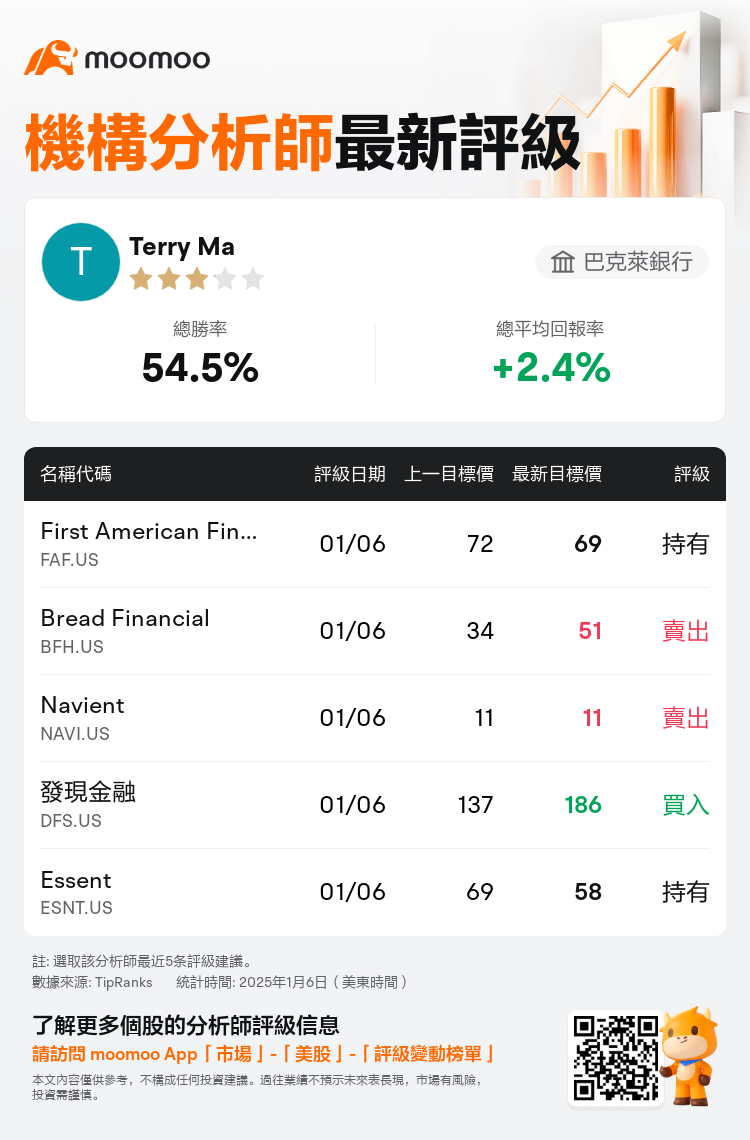

根據TipRanks數據顯示,該分析師近一年總勝率為54.5%,總平均回報率為2.4%。

此外,綜合報道,$學貸美 (SLM.US)$近期主要分析師觀點如下:

此外,綜合報道,$學貸美 (SLM.US)$近期主要分析師觀點如下:

進入2025年,專業金融行業的重點包括穩定的消費者基礎、消費信貸趨勢的改善(尤其是主要借款人的消費信貸趨勢)、持續居高不下的抵押貸款利率以及更加寬鬆的監管環境。自大選以來,消費貸款行業的股票表現強勁,在一定程度上加快了預期回報,使選股過程複雜化。2024年在抵押貸款融資中有效的戰略將延續到2025年,優先考慮具有平衡商業模式的公司。分析師的偏好傾向於那些具有未被承認的積極催化劑、能夠產生進一步收益的股票。此外,航空出租人仍被視爲被低估,同時有人建議對抵押貸款持謹慎態度。

最近11月大選的結果似乎重振了經濟熱情,增強了企業和消費者的信心,以應對更加親商的環境。這種轉變提高了對美國經濟的預期,同時也削弱了聯儲局進一步寬鬆政策的前景。這種情況被認爲對與消費信貸和支出相關的公司有利,但對那些與抵押貸款市場相關的公司則不那麼有利,抵押貸款市場繼續遭受高利率和住房供應短缺的困擾。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$學貸美 (SLM.US)$近期主要分析師觀點如下:

此外,綜合報道,$學貸美 (SLM.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of