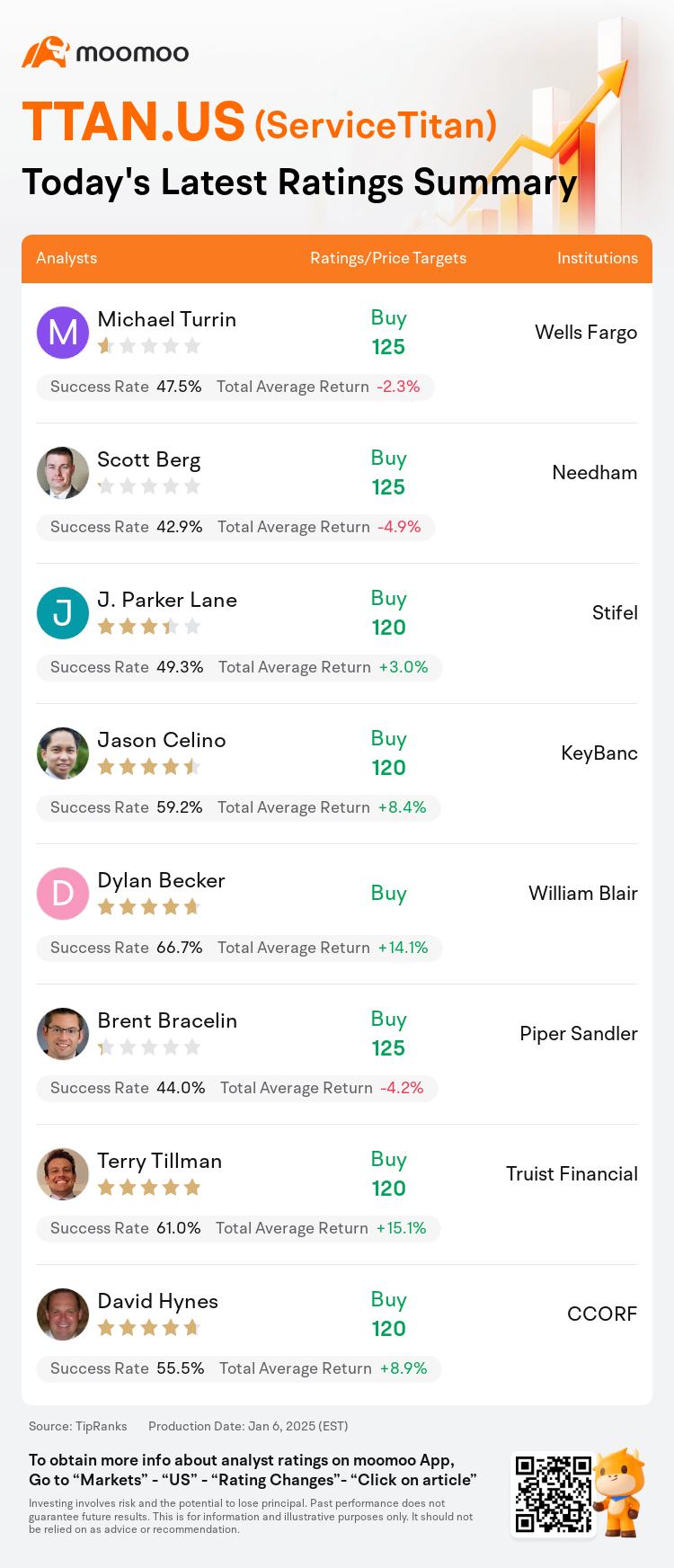

On Jan 06, major Wall Street analysts update their ratings for $ServiceTitan (TTAN.US)$, with price targets ranging from $120 to $125.

Wells Fargo analyst Michael Turrin initiates coverage with a buy rating, and sets the target price at $125.

Needham analyst Scott Berg initiates coverage with a buy rating, and sets the target price at $125.

Stifel analyst J. Parker Lane initiates coverage with a buy rating, and sets the target price at $120.

Stifel analyst J. Parker Lane initiates coverage with a buy rating, and sets the target price at $120.

KeyBanc analyst Jason Celino initiates coverage with a buy rating, and sets the target price at $120.

William Blair analyst Dylan Becker initiates coverage with a buy rating.

Furthermore, according to the comprehensive report, the opinions of $ServiceTitan (TTAN.US)$'s main analysts recently are as follows:

ServiceTitan operates in large, expanding markets, displaying strong competitive differentiation and market leadership, accompanied by a consistent track record of innovation and powerful growth vectors. The current valuation of the shares is seen as fair.

ServiceTitan, a cloud-based, end-to-end platform, is designed to digitize and streamline business workflows for field service trades like plumbing and electrical. Analysts are optimistic about the company's potential to evolve into a strong vertical software-as-a-service business, potentially generating $4B-$5B in revenue. However, it is noted that the market already recognizes the company's positive factors, suggesting a cautionary approach towards the risk/reward ratio at current levels.

ServiceTitan is recognized for offering a unique blend of attributes that not only enhance short-term but also long-term share value. These attributes include a dominant position in the vertical SaaS market, targeting a large and expanding total addressable market, continuous customer growth, and strong unit economics. In the near-term, earning potential is seen to benefit from newfound strengths in the Electrical trade and expansion into the Commercial sector.

ServiceTitan is positioned to potentially become the primary operating system for the trades, with a broad and growing total addressable market contributing to steady compounding growth and promising long-term margin potential.

The trades sector is described as being underserved, with many businesses not yet incorporating essential software functionalities common in other industries. ServiceTitan is highlighted as a leading entity in this particular market segment.

Here are the latest investment ratings and price targets for $ServiceTitan (TTAN.US)$ from 8 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

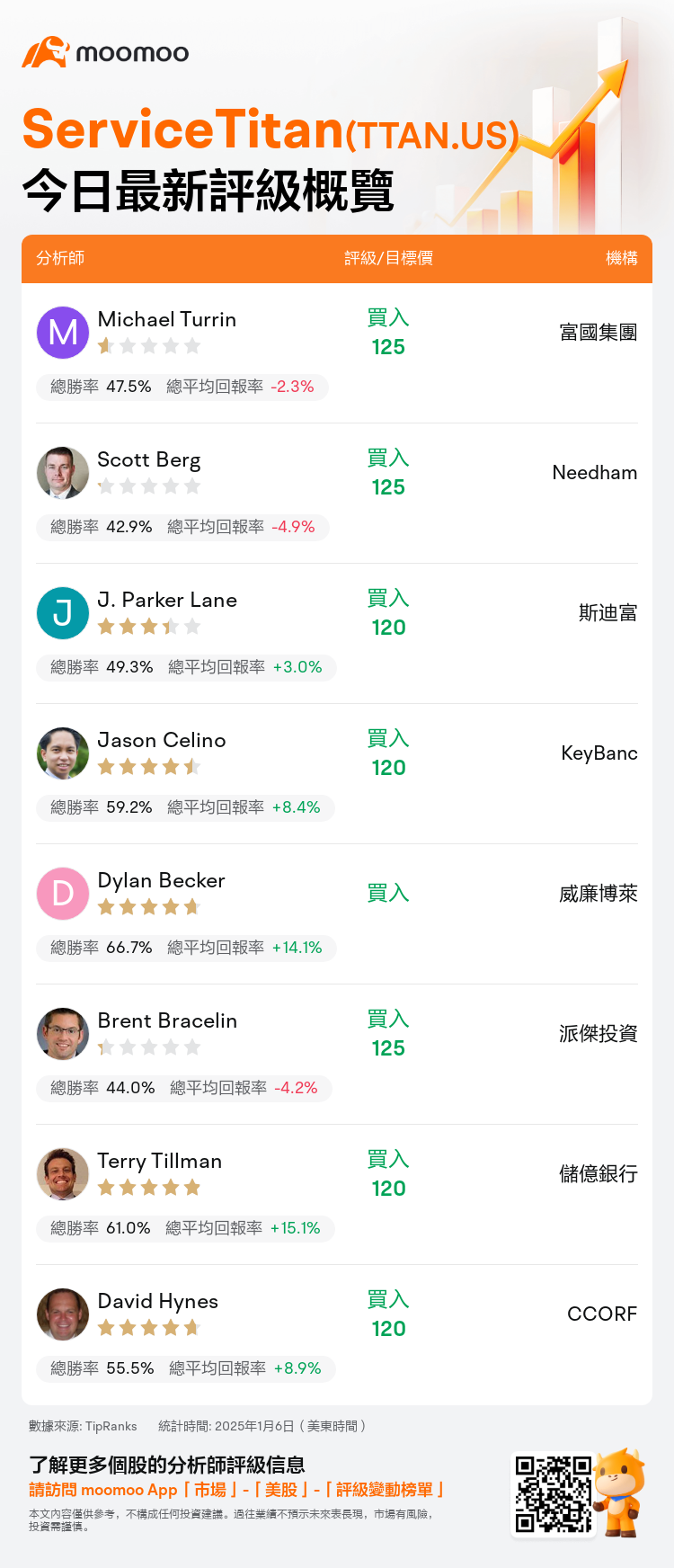

美東時間1月6日,多家華爾街大行更新了$ServiceTitan (TTAN.US)$的評級,目標價介於120美元至125美元。

富國集團分析師Michael Turrin首次給予買入評級,目標價125美元。

Needham分析師Scott Berg首次給予買入評級,目標價125美元。

斯迪富分析師J. Parker Lane首次給予買入評級,目標價120美元。

斯迪富分析師J. Parker Lane首次給予買入評級,目標價120美元。

KeyBanc分析師Jason Celino首次給予買入評級,目標價120美元。

威廉博萊分析師Dylan Becker首次給予買入評級。

此外,綜合報道,$ServiceTitan (TTAN.US)$近期主要分析師觀點如下:

ServiceTitan在大型且不斷擴展的市場中運營,展現出強大的競爭差異化和市場領導地位,並伴隨着持續的創新記錄和強勁的增長動力。當前股票的估值被視爲公平。

ServiceTitan是一個基於雲的端到端平台,旨在數字化和簡化水管和電氣等現場服務行業的業務工作流程。分析師對公司轉型爲強大的垂直Saas-雲計算業務的潛力持樂觀態度,預計將產生40億至50億的營業收入。然而,市場已經認識到公司的積極因素,這提示在當前水平上應謹慎對待風險/收益比。

ServiceTitan因提供一系列獨特屬性而受到認可,這些屬性不僅提升了短期,還提升了長期的股東價值。這些屬性包括在垂直Saas-雲計算市場中的主導地位,目標是一個龐大且不斷擴展的可尋址市場,持續的客戶增長以及強大的單位經濟效益。在短期內,收益潛力預計將受益於電氣行業的新優勢以及向商業板塊的擴展。

ServiceTitan有潛力成爲這一行業主要的操作系統,其廣泛且不斷增長的可尋址市場有助於穩定的複合增長和可喜的長期利潤潛力。

這一行業板塊被描述爲服務不足,許多企業尚未納入其他行業中常見的基本軟體功能。ServiceTitan在這個特定市場細分中被突顯爲領先企業。

以下爲今日8位分析師對$ServiceTitan (TTAN.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

斯迪富分析師J. Parker Lane首次給予買入評級,目標價120美元。

斯迪富分析師J. Parker Lane首次給予買入評級,目標價120美元。

Stifel analyst J. Parker Lane initiates coverage with a buy rating, and sets the target price at $120.

Stifel analyst J. Parker Lane initiates coverage with a buy rating, and sets the target price at $120.