This Is What Whales Are Betting On Palantir Technologies

This Is What Whales Are Betting On Palantir Technologies

Financial giants have made a conspicuous bearish move on Palantir Technologies. Our analysis of options history for Palantir Technologies (NASDAQ:PLTR) revealed 8 unusual trades.

金融巨頭對Palantir Technologies採取了明顯的看淡舉動。我們對Palantir Technologies (納斯達克:PLTR)的期權歷史進行了分析,發現了8筆異常交易。

Delving into the details, we found 25% of traders were bullish, while 62% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $448,386, and 4 were calls, valued at $222,912.

深入分析後,我們發現25%的交易者看好,而62%則表現出看淡的趨勢。在我們發現的所有交易中,有4筆是看跌期權,總價值爲448,386美元,4筆是看漲期權,總價值爲222,912美元。

Expected Price Movements

預期價格變動

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $55.0 to $100.0 for Palantir Technologies over the recent three months.

根據交易活動,顯著投資者似乎正在瞄準Palantir Technologies在最近三個月的目標價區間,從55.0美元到100.0美元。

Volume & Open Interest Trends

成交量和未平倉量趨勢

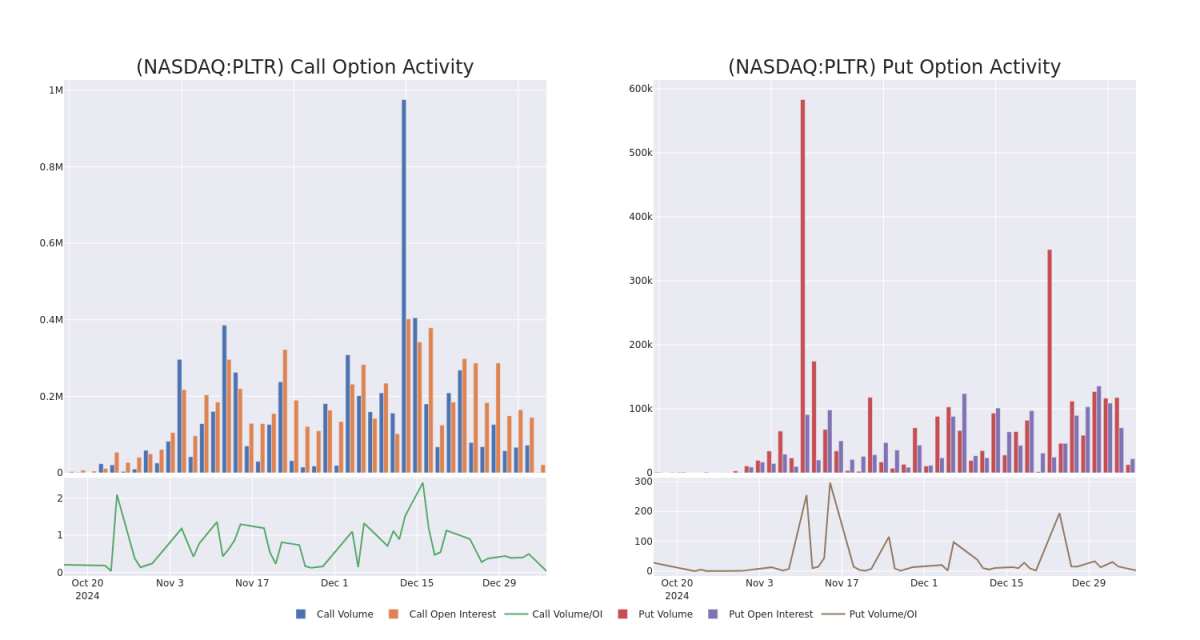

In today's trading context, the average open interest for options of Palantir Technologies stands at 6151.14, with a total volume reaching 13,523.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Palantir Technologies, situated within the strike price corridor from $55.0 to $100.0, throughout the last 30 days.

在今天的交易環境中,Palantir Technologies期權的平均未平倉合約數爲6151.14,成交量達到13,523.00。附帶圖表展示了Palantir Technologies的高價值交易中看漲和看跌期權的成交量與未平倉合約數在過去30天內的變化。

Palantir Technologies Option Volume And Open Interest Over Last 30 Days

過去30天內Palantir Technologies期權成交量和未平倉合約

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PLTR | PUT | SWEEP | BEARISH | 01/10/25 | $1.9 | $1.87 | $1.9 | $78.00 | $334.5K | 4.6K | 341 |

| PLTR | CALL | SWEEP | BEARISH | 02/21/25 | $24.7 | $24.15 | $24.15 | $55.00 | $121.9K | 4.4K | 51 |

| PLTR | PUT | SWEEP | BEARISH | 01/10/25 | $1.8 | $1.79 | $1.8 | $77.00 | $53.7K | 14.0K | 2.0K |

| PLTR | CALL | TRADE | BULLISH | 06/18/26 | $25.25 | $24.45 | $24.97 | $80.00 | $37.4K | 2.1K | 30 |

| PLTR | PUT | SWEEP | BEARISH | 03/21/25 | $8.0 | $7.5 | $7.85 | $75.00 | $34.5K | 3.3K | 82 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 行權價 | 總交易價格 | 未平倉合約 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PLTR | 看跌 | 掃單 | 看淡 | 01/10/25 | $1.9 | $1.87 | $1.9 | $78.00 | $334.5K | 4.6千 | 341 |

| PLTR | 看漲 | 掃單 | 看淡 | 02/21/25 | $24.7 | $24.15 | $24.15 | $55.00 | $121.9K | 4.4K | 51 |

| PLTR | 看跌 | 掃單 | 看淡 | 01/10/25 | $1.8 | $1.79 | $1.8 | $77.00 | 53.7千美元 | 14.0K | 2.0K |

| PLTR | 看漲 | 交易 | 看好 | 06/18/26 | $25.25 | $24.45 | $24.97 | $80.00 | $37.4K | 2.1K | 30 |

| PLTR | 看跌 | 掃單 | 看淡 | 03/21/25 | $8.0 | $7.5 | $7.85 | $75.00 | 34.5K美元 | 3.3K | 82 |

About Palantir Technologies

關於Palantir Technologies

Palantir is an analytical software company that focuses on leveraging data to create efficiencies in its clients' organizations. The firm serves commercial and government clients via its Foundry and Gotham platforms, respectively. The Denver-based company was founded in 2003 and went public in 2020.

Palantir是一家分析軟體公司,專注於利用數據爲客戶的組織創造效率。該公司通過其Foundry和Gotham平台分別服務於商業和政府客戶。這家總部位於丹佛的公司成立於2003年,並於2020年上市。

Following our analysis of the options activities associated with Palantir Technologies, we pivot to a closer look at the company's own performance.

在對Palantir科技的期權活動進行分析後,我們轉而關注該公司的表現。

Where Is Palantir Technologies Standing Right Now?

Palantir Technologies目前處於什麼位置?

- Currently trading with a volume of 23,543,221, the PLTR's price is down by -1.27%, now at $78.88.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 28 days.

- 目前成交量爲23,543,221,PLTR的價格下跌了-1.27%,現爲$78.88。

- RSI讀數表明該股票目前可能接近超買狀態。

- 預計業績將在28天后發佈。

What The Experts Say On Palantir Technologies

專家對Palantir Technologies的觀點

4 market experts have recently issued ratings for this stock, with a consensus target price of $63.5.

4位市場專家最近對該股票發佈了評級,市場共識目標價爲63.5美元。

Turn $1000 into $1270 in just 20 days?

在短短20天內將1000美元變成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* Reflecting concerns, an analyst from Morgan Stanley lowers its rating to Underweight with a new price target of $60.* An analyst from Baird downgraded its action to Neutral with a price target of $70. * Maintaining their stance, an analyst from Mizuho continues to hold a Underperform rating for Palantir Technologies, targeting a price of $44. * Reflecting concerns, an analyst from UBS lowers its rating to Neutral with a new price target of $80.

一名有20年經驗的期權交易者透露了他的單行圖技術,該技術顯示何時買入和賣出。複製他的交易,平均每20天獲利27%。點擊這裏獲取訪問權限。* 反映出擔憂,摩根士丹利的分析師將其評級下調至減持,並設定新的目標價爲60美元。* 貝爾德的分析師將其評級下調至中立,目標價爲70美元。* 持續保持立場,瑞穗的分析師繼續對Palantir Technologies維持跑輸大盤的評級,目標價爲44美元。* 反映出擔憂,瑞銀的分析師將其評級下調至中立,新的目標價爲80美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Palantir Technologies options trades with real-time alerts from Benzinga Pro.

期權交易存在更高的風險和潛在的回報。精明的交易者通過不斷學習、調整策略、監控多個因數以及密切關注市場動態來管理這些風險。通過Benzinga Pro的實時警報,隨時了解最新的Palantir Technologies期權交易。

In today's trading context, the average open interest for options of Palantir Technologies stands at 6151.14, with a total volume reaching 13,523.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Palantir Technologies, situated within the strike price corridor from $55.0 to $100.0, throughout the last 30 days.

In today's trading context, the average open interest for options of Palantir Technologies stands at 6151.14, with a total volume reaching 13,523.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Palantir Technologies, situated within the strike price corridor from $55.0 to $100.0, throughout the last 30 days.