FedEx Insiders Sold US$3.1m Of Shares Suggesting Hesitancy

FedEx Insiders Sold US$3.1m Of Shares Suggesting Hesitancy

Over the past year, many FedEx Corporation (NYSE:FDX) insiders sold a significant stake in the company which may have piqued investors' interest. When evaluating insider transactions, knowing whether insiders are buying is usually more beneficial than knowing whether they are selling, as the latter can be open to many interpretations. However, when multiple insiders sell stock over a specific duration, shareholders should take notice as that could possibly be a red flag.

在過去的一年中,許多聯邦快遞公司(紐交所:FDX)的內部人士出售了公司的一部分股份,這可能引起了投資者的關注。當評估內部交易時,知道內部人士在買入通常比知道他們在賣出更有利,因爲後者可能有多種解讀。然而,當多個內部人士在特定時間內出售股票時,股東應該引起注意,因爲這可能是一個警示信號。

While insider transactions are not the most important thing when it comes to long-term investing, logic dictates you should pay some attention to whether insiders are buying or selling shares.

儘管在長期投資中內部交易並不是最重要的事情,但從邏輯上講,您應該關注內部人員是否買入或出售股票。

FedEx Insider Transactions Over The Last Year

過去一年聯邦快遞內部交易

In the last twelve months, the biggest single sale by an insider was when the insider, Mark Allen, sold US$1.5m worth of shares at a price of US$297 per share. That means that an insider was selling shares at around the current price of US$274. While insider selling is a negative, to us, it is more negative if the shares are sold at a lower price. We note that this sale took place at around the current price, so it isn't a major concern, though it's hardly a good sign.

在過去的十二個月中,內部人士最大的單次銷售是內部人士馬克·艾倫以每股297美元的價格出售了價值150萬美元的股票。這意味着有一位內部人士以當前股價約爲274美元的價格出售了股票。雖然內部人士的出售是一個負面因素,但如果股票以較低的價格出售,對我們而言更具負面影響。我們注意到這筆交易發生在當前價格附近,因此這並不是一個重大擔憂,儘管這絕對不是一個好兆頭。

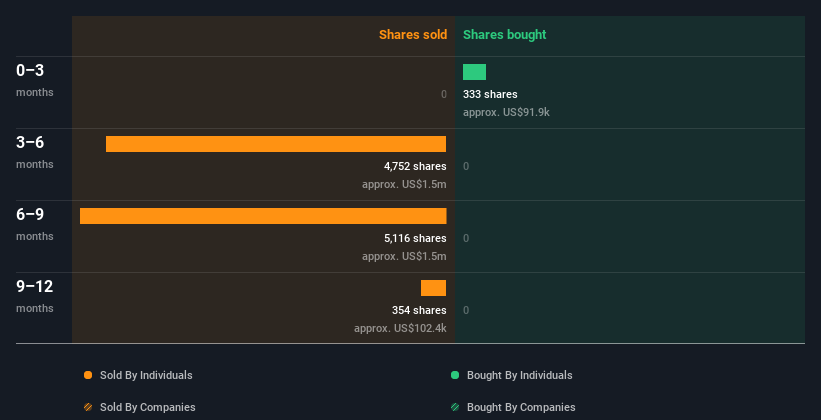

All up, insiders sold more shares in FedEx than they bought, over the last year. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. By clicking on the graph below, you can see the precise details of each insider transaction!

綜上所述,在過去一年中,內部人士出售的聯邦快遞股票數量超過了他們購買的數量。您可以在下面看到過去12個月內部交易(按公司和個人)可視化的表現形式。通過點擊下面的圖表,您可以查看每筆內部交易的詳細信息!

If you like to buy stocks that insiders are buying, rather than selling, then you might just love this free list of companies. (Hint: Most of them are flying under the radar).

如果你喜歡買入內部人士正在買入而不是賣出的股票,那麼你可能會喜歡這份免費的公司名單。(提示:他們中的大多數正處於雷達之外)。

FedEx Insiders Bought Stock Recently

聯邦快遞內部人士最近買入了股票

Over the last quarter, FedEx insiders have spent a meaningful amount on shares. We can see that Independent Director Amy Lane paid US$92k for shares in the company. No-one sold. This could be interpreted as suggesting a positive outlook.

在過去的一個季度,聯邦快遞的內部人士在股票上花費了相當大的金額。我們可以看到,獨立董事艾米·萊恩爲公司股票支付了92,000美元。沒有人賣出。這可以被解讀爲暗示積極的前景。

Does FedEx Boast High Insider Ownership?

聯邦快遞是否擁有高比例的內部人士股權?

Another way to test the alignment between the leaders of a company and other shareholders is to look at how many shares they own. A high insider ownership often makes company leadership more mindful of shareholder interests. It's great to see that FedEx insiders own 8.4% of the company, worth about US$5.5b. Most shareholders would be happy to see this sort of insider ownership, since it suggests that management incentives are well aligned with other shareholders.

另一個測試公司領導與其他股東之間協調的方法是查看他們持有多少股票。 高比例的內部持股通常使公司領導更能關注股東利益。 很高興看到聯邦快遞的內部人士持有8.4%的股份,價值約爲55億美元。 大多數股東會樂於看到這種內部持股,因爲這表明管理層的激勵與其他股東良好對齊。

What Might The Insider Transactions At FedEx Tell Us?

聯邦快遞的內部交易對我們意味着什麼?

It's certainly positive to see the recent insider purchase. On the other hand the transaction history, over the last year, isn't so positive. Overall, we'd prefer see a more sustained buying from directors, but with a significant insider holding and more recent purchases, FedEx insiders are reasonably well aligned, and optimistic for the future. So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. Case in point: We've spotted 1 warning sign for FedEx you should be aware of.

看到最近的內部購買確實是個好兆頭。 另一方面,過去一年的交易歷史並不是那麼積極。 總的來說,我們希望看到董事們更持續的買入,但考慮到內部持股比例較高和更近的購買,聯邦快遞的內部人士處於合理的協調狀態,對未來持樂觀態度。因此,這些內部交易可以幫助我們建立關於股票的論點,但了解公司面臨的風險也是值得的。 此外,我們已經發現了1個關於聯邦快遞的警示信號,您應該了解。

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

如果你更願意查看另一家公司——一家可能財務狀況更優秀的公司——那麼請不要錯過這份有趣公司的免費列表,這些公司具有高投資回報率和低負債。

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

在本文中,內部人士是指向相關監管機構報告其交易的個人。我們目前僅考慮公開市場交易和直接利益的私人處置,但不包括衍生交易或間接利益。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對本文有反饋?對內容有疑慮?請直接與我們聯繫。或者,發送電子郵件至 editorial-team (at) simplywallst.com。

這篇來自Simply Wall ST的文章是一般性的。我們根據歷史數據和分析師預測提供評論,採用無偏見的方法,我們的文章並不旨在提供財務建議。它不構成對任何股票的買入或賣出建議,也未考慮到您的目標或財務狀況。我們旨在爲您提供以基本數據驅動的長期分析。請注意,我們的分析可能未考慮最新的價格敏感公司公告或定性材料。Simply Wall ST在提到的任何股票中均沒有持倉。

All up, insiders sold more shares in FedEx than they bought, over the last year. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. By clicking on the graph below, you can see the precise details of each insider transaction!

All up, insiders sold more shares in FedEx than they bought, over the last year. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. By clicking on the graph below, you can see the precise details of each insider transaction!