Looking At Constellation Energy's Recent Unusual Options Activity

Looking At Constellation Energy's Recent Unusual Options Activity

Whales with a lot of money to spend have taken a noticeably bearish stance on Constellation Energy.

擁有大量資金的鯨魚對康斯特拉申能源採取了明顯的看淡態度。

Looking at options history for Constellation Energy (NASDAQ:CEG) we detected 74 trades.

查看康斯特拉申能源(納斯達克:CEG)的期權歷史,我們檢測到74筆交易。

If we consider the specifics of each trade, it is accurate to state that 40% of the investors opened trades with bullish expectations and 41% with bearish.

如果我們考慮每筆交易的具體情況,可以準確地說40%的投資者以看好的預期開盤,而41%則是看淡的。

From the overall spotted trades, 7 are puts, for a total amount of $839,472 and 67, calls, for a total amount of $13,062,035.

在總體監測到的交易中,有7筆是看跌,金額總計爲839,472美元,67筆是看漲,金額總計爲13,062,035美元。

Predicted Price Range

預測價格區間

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $140.0 and $310.0 for Constellation Energy, spanning the last three months.

在評估交易量和未平倉合約後,很明顯主要市場動向集中在康斯特拉申能源的價格區間在140.0美元到310.0美元之間,涵蓋過去三個月。

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

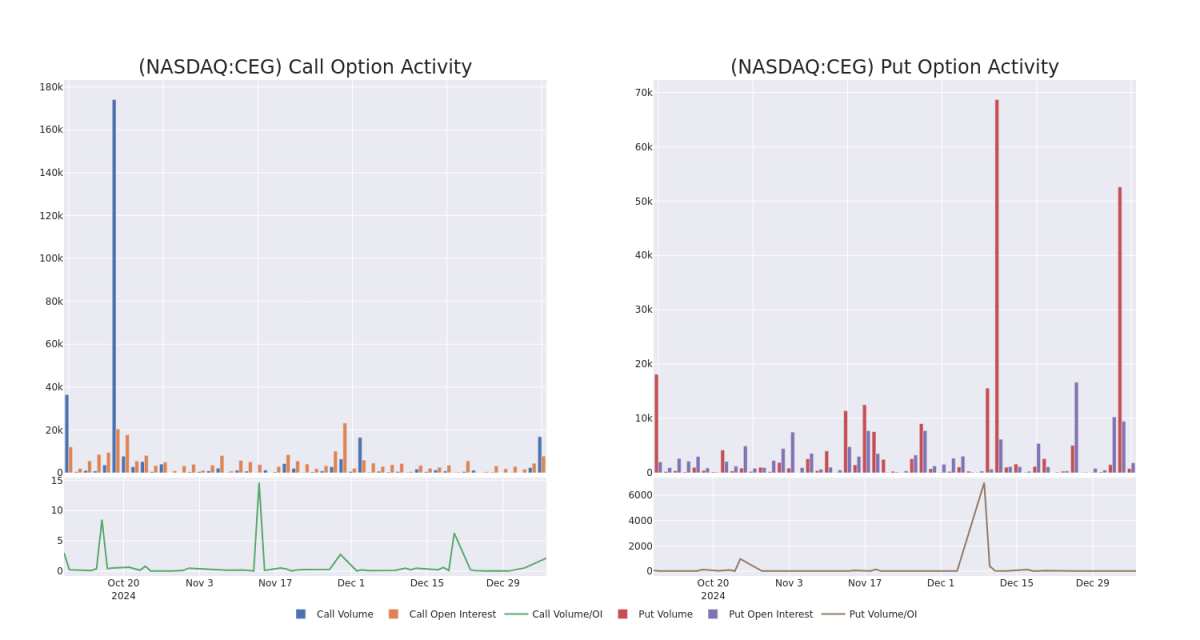

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Constellation Energy's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Constellation Energy's substantial trades, within a strike price spectrum from $140.0 to $310.0 over the preceding 30 days.

評估成交量和未平倉合約是期權交易中的一個戰略步驟。這些指標揭示了在指定行權價下,投資者對康斯特拉申能源期權的流動性和興趣。接下來的數據可視化了與康斯特拉申能源的重大交易相關的看漲和看跌的成交量和未平倉合約的波動,行權價範圍從140.0美元到310.0美元,在過去30天內。

Constellation Energy Option Activity Analysis: Last 30 Days

康斯泰雷能源期權活動分析:過去30天

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CEG | CALL | TRADE | BEARISH | 03/21/25 | $37.8 | $36.4 | $36.6 | $240.00 | $6.4M | 1.9K | 1.7K |

| CEG | CALL | TRADE | BULLISH | 03/21/25 | $16.9 | $16.4 | $16.9 | $280.00 | $3.3M | 38 | 2.1K |

| CEG | PUT | TRADE | BEARISH | 04/17/25 | $18.4 | $17.4 | $18.05 | $250.00 | $180.5K | 153 | 7 |

| CEG | CALL | TRADE | BEARISH | 01/15/27 | $56.1 | $53.9 | $54.7 | $300.00 | $164.1K | 54 | 33 |

| CEG | PUT | TRADE | BULLISH | 04/17/25 | $15.6 | $15.1 | $15.3 | $240.00 | $153.0K | 234 | 100 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 行權價 | 總交易價格 | 未平倉合約 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CEG | 看漲 | 交易 | 看淡 | 03/21/25 | $37.8 | $36.4 | $36.6 | $240.00 | $640萬美元 | 1.9K | 1.7K |

| CEG | 看漲 | 交易 | 看好 | 03/21/25 | $16.9 | $16.4 | $16.9 | $280.00 | 3M | 38 | 2.1K |

| CEG | 看跌 | 交易 | 看淡 | 04/17/25 | $18.4 | $17.4 | $18.05 | $250.00 | 美金180.5K | 153 | 7 |

| CEG | 看漲 | 交易 | 看淡 | 01/15/27 | $56.1 | $53.9 | $54.7 | $300.00 | 164.1K美元 | 54 | 33 |

| CEG | 看跌 | 交易 | 看好 | 04/17/25 | $15.6 | $15.1 | $15.3 | $240.00 | 15.3萬美元 | 234 | 100 |

About Constellation Energy

Constellation Energy

Constellation Energy Corp offers energy solutions. It provides clean energy and sustainable solutions to homes, businesses, the public sector, community aggregations, and a range of wholesale customers (such as municipalities, cooperatives, and other strategics). The company offers comprehensive energy solutions and a variety of pricing options for electric, natural gas, and renewable energy products for companies of any size.

星座能源CORP提供能源解決方案。它爲住宅、企業、公共部門、社區聚合體以及一系列批發客戶(如市政府、合作社和其他戰略客戶)提供清潔能源和可持續解決方案。該公司爲任何規模的公司提供全面的能源解決方案和多種電力、天然氣和可再生能源產品的定價選項。

Following our analysis of the options activities associated with Constellation Energy, we pivot to a closer look at the company's own performance.

根據我們對與康斯特ellation能源相關的期權活動的分析,我們轉向更仔細地觀察公司的自身表現。

Present Market Standing of Constellation Energy

康斯特萊能源目前的市場地位

- With a volume of 2,439,865, the price of CEG is up 2.61% at $259.0.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 50 days.

- 成交量爲2,439,865,CEG的價格上漲2.61%,達259.0美元。

- RSI因數提示基準股可能被高估。

- 下一個業績預計將在50天后發佈。

What Analysts Are Saying About Constellation Energy

分析師對康斯特雷能源的看法

4 market experts have recently issued ratings for this stock, with a consensus target price of $278.5.

4位市場專家最近對該股票發佈了評級,普遍目標價爲278.5美元。

Unusual Options Activity Detected: Smart Money on the Move

檢測到期權異動:聰明資金正在行動

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* Maintaining their stance, an analyst from Evercore ISI Group continues to hold a Outperform rating for Constellation Energy, targeting a price of $258. * An analyst from UBS persists with their Buy rating on Constellation Energy, maintaining a target price of $289. * Showing optimism, an analyst from B of A Securities upgrades its rating to Buy with a revised price target of $269. * Reflecting concerns, an analyst from Keybanc lowers its rating to Overweight with a new price target of $298.

Benzinga Edge的期權異動板塊在市場動向發生之前發現潛在的市場動向。查看大資金在您喜愛的股票上採取了什麼倉位。點擊這裏進行訪問。* 堅持他們的觀點,Evercore ISI Group的一位分析師繼續對Constellation Energy維持超越大盤的評級,目標價爲258美元。* UBS的一位分析師繼續對Constellation Energy保持買入評級,目標價維持在289美元。* 顯示出樂觀情緒,B of A Securities的一位分析師將其評級提升至買入,修訂後的目標價爲269美元。* 反映出擔憂,Keybanc的一位分析師將其評級下調至增持,新的目標價爲298美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Constellation Energy options trades with real-time alerts from Benzinga Pro.

期權交易帶來了更高的風險和潛在的回報。敏銳的交易員通過不斷學習、調整策略、監控多個因數以及密切關注市場動態來管理這些風險。通過Benzinga Pro的實時警報,隨時了解最新的星座能源期權交易。

From the overall spotted trades, 7 are puts, for a total amount of $839,472 and 67, calls, for a total amount of $13,062,035.

From the overall spotted trades, 7 are puts, for a total amount of $839,472 and 67, calls, for a total amount of $13,062,035.