Wall Street's Most Accurate Analysts Give Their Take On 3 Tech Stocks Delivering High-Dividend Yields

Wall Street's Most Accurate Analysts Give Their Take On 3 Tech Stocks Delivering High-Dividend Yields

華爾街最準確的分析師對三支科技股票的高股息收益率表達了自己的看法。

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

在市場動盪和不確定時期,許多投資者會選擇高股息股票。這些公司通常具有高自由現金流,並以高股息回報股東。

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Benzinga讀者可以通過訪問分析師股票評級頁面,查看他們最喜歡的股票的最新分析師觀點。交易者可以瀏覽Benzinga廣泛的分析師評級數據庫,包括根據分析師準確性進行排序。

Below are the ratings of the most accurate analysts for three high-yielding stocks in the information technology sector.

以下是信息科技板塊三隻高股息股票的最精準分析師評級。

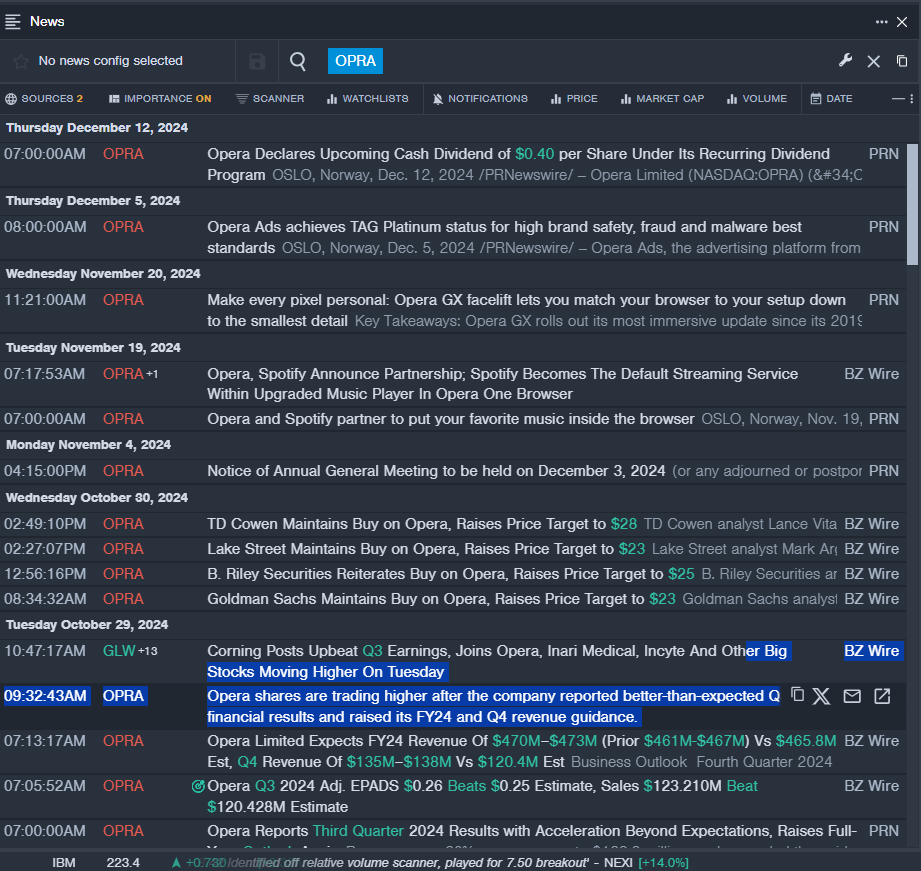

Opera Limited (NASDAQ:OPRA)

歌劇有限公司 (納斯達克:OPRA)

- Dividend Yield: 4.14%

- TD Cowen analyst Lance Vitanza maintained a Buy rating and raised the price target from $25 to $28 on Oct. 30. This analyst has an accuracy rate of 78%.

- B. Riley Securities analyst Lee Krowl reiterated a Buy rating and increased the price target from $24 to $25 on Oct. 30. This analyst has an accuracy rate of 84%.

- Recent News: On Dec. 12, Opera declared upcoming cash dividend of 40 cent per share under its recurring dividend program.

- Benzinga Pro's real-time newsfeed alerted to latest OPRA news.

- 股息收益率: 4.14%

- TD Cowen 分析師 Lance Vitanza 維持 買入 評級,並在10月30日將目標價從$25萬億提升至$28。該分析師的準確率爲78%。

- b. Riley Securities 分析師 Lee Krowl 重申 買入 評級,並在10月30日將目標價從$24萬億提升至$25。該分析師的準確率爲84%。

- 最近資訊: 在12月12日,Opera 宣佈將在其定期股息計劃下支付每股40美分的即將到來的現金股息。

- Benzinga Pro的實時資訊提醒了最新的OPRA資訊。

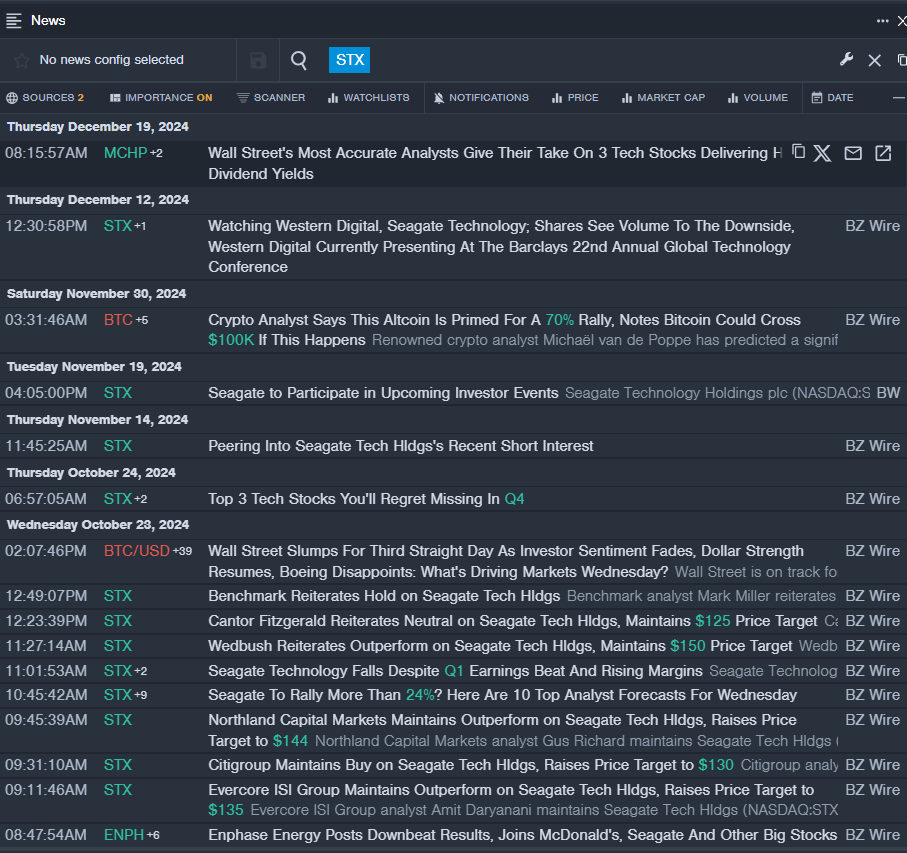

Seagate Technology Holdings plc (NASDAQ:STX)

希捷科技控股有限公司(納斯達克:STX)

- Dividend Yield: 3.23%

- Cantor Fitzgerald analyst C J Muse reiterated a Neutral rating with a price target of $125 on Oct. 23. This analyst has an accuracy rate of 68%.

- Wedbush analyst Matt Bryson reiterated an Outperform rating with a price target of $150 on Oct. 23. This analyst has an accuracy rate of 80%.

- Recent News: On Oct. 22, the company reported first-quarter revenue of $2.17 billion, beating the consensus of $2.119 billion.

- Benzinga Pro's real-time newsfeed alerted to latest STX news

- 股息收益率:3.23%

- Cantor Fitzgerald的分析師C J Muse在10月23日重申了中立評級,目標價爲125美元。該分析師的準確率爲68%。

- Wedbush的分析師Matt Bryson在10月23日重申了跑贏大市評級,目標價爲150美元。該分析師的準確率爲80%。

- 最新資訊:在10月22日,該公司報告了第一季度營業收入爲21.7億,超過市場一致預期的21.19億。

- Benzinga Pro的實時資訊提醒了最新的STX新聞

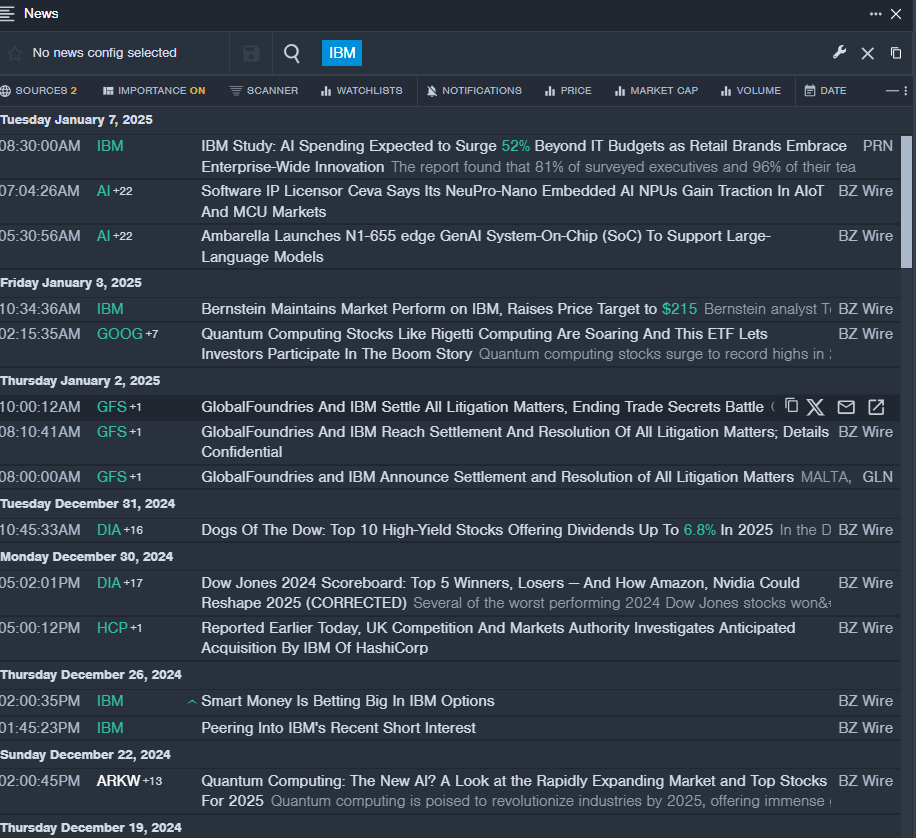

International Business Machines Corporation (NYSE:IBM)

國際商業機器公司(紐交所:IBM)

- Dividend Yield: 3.00%

- Morgan Stanley analyst Erik Woodring maintained an Equal-Weight rating and increased the price target from $208 to $222 on Dec. 16. This analyst has an accuracy rate of 63%.

- BMO Capital analyst Keith Bachman maintained a Market Perform rating and boosted the price target price target from $235 to $260 on Oct. 24. This analyst has an accuracy rate of 82%.

- Recent News: GlobalFoundries Inc. (NASDAQ:GFS) and IBM recently announced a settlement resolving all ongoing lawsuits between the two companies, including claims related to breach of contract, trade secrets, and intellectual property.

- Benzinga Pro's real-time newsfeed alerted to latest IBM news

- 股息收益率:3.00%

- 摩根士丹利的分析師Erik Woodring維持了中立評級,並在12月16日將目標價從208美元上調至222美元。該分析師的準確率爲63%。

- BMO Capital的分析師Keith Bachman維持了市場表現評級,並在10月24日將目標價從235萬億上調至260美元。該分析師的準確率爲82%。

- 最新資訊:GlobalFoundries Inc.(納斯達克:GFS)與IBM最近宣佈達成和解,解決兩家公司之間所有正在進行的訴訟,包括與合同違約、商業祕密及知識產權相關的索賠。

- Benzinga Pro的實時資訊提醒了最新的IBM消息

Read More:

閱讀更多:

- Wells Fargo Gears Up For Q4 Print; Here Are The Recent Forecast Changes From Wall Street's Most Accurate Analysts

- 富國銀行爲第四季度的業績做好準備;以下是華爾街最準確的分析師最近的預測變化