What the Options Market Tells Us About Quantum Computing

What the Options Market Tells Us About Quantum Computing

Investors with a lot of money to spend have taken a bearish stance on Quantum Computing (NASDAQ:QUBT).

有大量資金的投資者對量子計算概念(納斯達克:QUBT)持看淡態度。

And retail traders should know.

零售交易者應該了解這一點。

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

我們今天注意到這一點,當交易出現在我們在Benzinga跟蹤的公共可用期權歷史記錄中時。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with QUBT, it often means somebody knows something is about to happen.

無論這些是機構還是隻是富有的個人,我們並不知道。但當QUBT發生如此大的事情時,這通常意味着有人知道即將發生的事情。

So how do we know what these investors just did?

那麼我們怎麼知道這些投資者剛剛做了什麼呢?

Today, Benzinga's options scanner spotted 34 uncommon options trades for Quantum Computing.

今天,Benzinga的期權掃描儀發現了34筆不尋常的期權交易,涉及量子計算概念。

This isn't normal.

這並不正常。

The overall sentiment of these big-money traders is split between 44% bullish and 55%, bearish.

這些大資金交易者的整體情緒在44%的看好和55%的看淡之間分歧。

Out of all of the special options we uncovered, 13 are puts, for a total amount of $629,077, and 21 are calls, for a total amount of $1,000,700.

在我們發現的所有特殊期權中,13個是看跌期權,總金額爲629,077美元,21個是看漲期權,總金額爲1,000,700美元。

Projected Price Targets

預計價格目標

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $1.0 and $36.0 for Quantum Computing, spanning the last three months.

經過對交易量和未平倉合約的評估,很明顯主要市場參與者正關注量子計算的價格區間在1.0美元到36.0美元之間,這一範圍持續了過去三個月。

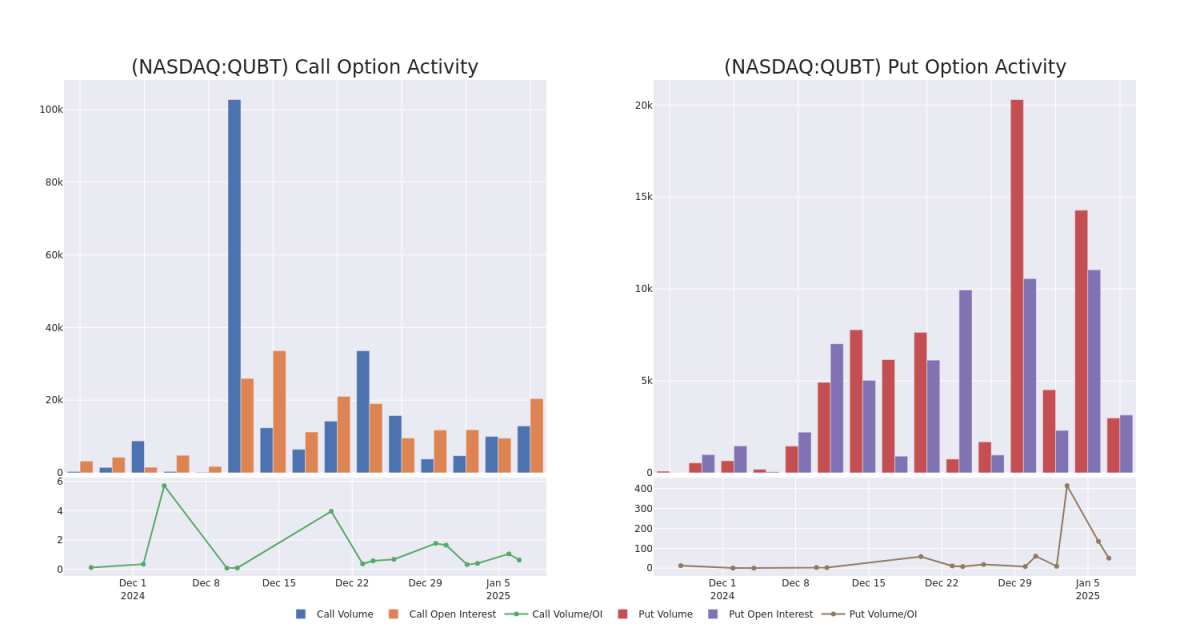

Volume & Open Interest Trends

成交量和未平倉量趨勢

In terms of liquidity and interest, the mean open interest for Quantum Computing options trades today is 981.96 with a total volume of 15,349.00.

就流動性和興趣而言,今日量子計算期權交易的平均未平倉合約爲981.96,總成交量爲15,349.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for Quantum Computing's big money trades within a strike price range of $1.0 to $36.0 over the last 30 days.

在下面的圖表中,我們能夠跟蹤量子計算大手交易的看漲和看跌期權在1.0美元到36.0美元的執行價格區間內的成交量和未平倉合約的發展,時間範圍爲過去30天。

Quantum Computing 30-Day Option Volume & Interest Snapshot

量子計算30天期權成交量與興趣快照

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| QUBT | CALL | SWEEP | BULLISH | 01/10/25 | $6.2 | $6.1 | $6.2 | $11.00 | $310.0K | 8 | 500 |

| QUBT | PUT | SWEEP | BULLISH | 02/21/25 | $4.8 | $4.7 | $4.7 | $17.00 | $126.9K | 794 | 299 |

| QUBT | PUT | SWEEP | BEARISH | 07/18/25 | $7.0 | $6.9 | $7.0 | $15.00 | $70.0K | 879 | 300 |

| QUBT | PUT | TRADE | BEARISH | 07/18/25 | $7.1 | $6.5 | $7.0 | $15.00 | $70.0K | 879 | 0 |

| QUBT | CALL | SWEEP | BULLISH | 01/17/25 | $1.25 | $1.2 | $1.25 | $18.00 | $58.2K | 6.5K | 1.5K |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 行權價 | 總交易價格 | 未平倉合約 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| QUBT | 看漲 | 掃單 | 看好 | 01/10/25 | $6.2 | $6.1 | $6.2 | $11.00 | $310.0K | 8 | 500 |

| QUBT | 看跌 | 掃單 | 看好 | 02/21/25 | $4.8 | $4.7 | $4.7 | $17.00 | 126.9K美元 | 794 | 299 |

| QUBT | 看跌 | 掃單 | 看淡 | 07/18/25 | $7.0 | $6.9 | $7.0 | $15.00 | $70.0K | 879 | 300 |

| QUBT | 看跌 | 交易 | 看淡 | 07/18/25 | $7.1 | $6.5 | $7.0 | $15.00 | $70.0K | 879 | 0 |

| QUBT | 看漲 | 掃單 | 看好 | 01/17/25 | $1.25 | $1.2 | $1.25 | $18.00 | 58.2K美元 | 6.5K | 1.5K |

About Quantum Computing

關於量子計算概念

Quantum Computing Inc is an American company utilizing non-linear quantum optics (optical devices whose output due to quantum effects is exponentially, not linearly, related to inputs) to deliver quantum products for high-performance computing applications. QCi's products are designed to operate at room temperature and use low power at an affordable cost. The Company's portfolio of core technology and products offer new capabilities in the areas of high-performance computing, artificial intelligence, cyber security as well as remote sensing applications.

量子計算公司是一家美國公司,利用非線性量子光學(由於量子效應其輸出與輸入呈指數關係而非線性關係的光學設備)提供高性能計算應用的量子產品。量子計算公司的產品旨在在常溫下運行,並以一種經濟實惠的方式使用低功耗。公司的核心技術和產品組合在高性能計算、人工智能、網絡安全以及遙感應用領域提供了新的能力。

In light of the recent options history for Quantum Computing, it's now appropriate to focus on the company itself. We aim to explore its current performance.

考慮到最近的量子計算概念期權歷史,現在應該關注公司本身。我們旨在探討其當前表現。

Where Is Quantum Computing Standing Right Now?

量子計算概念現在處於什麼狀態?

- Currently trading with a volume of 29,364,732, the QUBT's price is down by -0.28%, now at $18.04.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 83 days.

- 當前成交量爲29,364,732,QUBT的價格下跌了-0.28%,現在爲$18.04。

- RSI讀數表明該股票目前在超買和超賣之間保持中立。

- 預計在83天后發佈業績。

Unusual Options Activity Detected: Smart Money on the Move

檢測到期權異動:聰明資金正在行動

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Benzinga Edge的期權異動板塊在市場發生變化之前發現潛在的市場動向。看看大資金在你喜歡的股票上採取了什麼倉位。點擊這裏獲取訪問權限。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Quantum Computing with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供了更高利潤的潛力。精明的交易者通過持續教育、戰略性交易調整、利用各種因數以及關注市場動態來降低這些風險。通過Benzinga Pro跟蹤最新的量子計算概念期權交易,獲取實時警報。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with QUBT, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with QUBT, it often means somebody knows something is about to happen.