Taiwan Semiconductor Options Trading: A Deep Dive Into Market Sentiment

Taiwan Semiconductor Options Trading: A Deep Dive Into Market Sentiment

Deep-pocketed investors have adopted a bearish approach towards Taiwan Semiconductor (NYSE:TSM), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in TSM usually suggests something big is about to happen.

資金雄厚的投資者對臺積電(紐交所:TSM)採取了看淡的態度,這一點不容市場參與者忽視。我們在Benzinga跟蹤的公共期權記錄揭示了今天這一重要動向。這些投資者的身份尚不清楚,但在臺積電中出現如此大規模的動向通常意味着將發生重大的事情。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 118 extraordinary options activities for Taiwan Semiconductor. This level of activity is out of the ordinary.

我們從今天的觀察中得知,當Benzinga的期權掃描器突出顯示118個非凡的期權異動時。這個活動水平顯得不尋常。

The general mood among these heavyweight investors is divided, with 33% leaning bullish and 51% bearish. Among these notable options, 56 are puts, totaling $6,557,375, and 62 are calls, amounting to $5,032,902.

這些重量級投資者之間的總體情緒是分歧的,33%傾向於看好,51%看淡。在這些顯著的期權中,有56個看跌期權,總額爲6,557,375美元,而62個看漲期權,總額爲5,032,902美元。

What's The Price Target?

價格目標是什麼?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $65.0 and $310.0 for Taiwan Semiconductor, spanning the last three months.

在評估成交量和未平倉合約後,顯然主要市場參與者正關注台積電在過去三個月中的價格區間在65.0美元到310.0美元之間。

Insights into Volume & Open Interest

成交量和持倉量分析

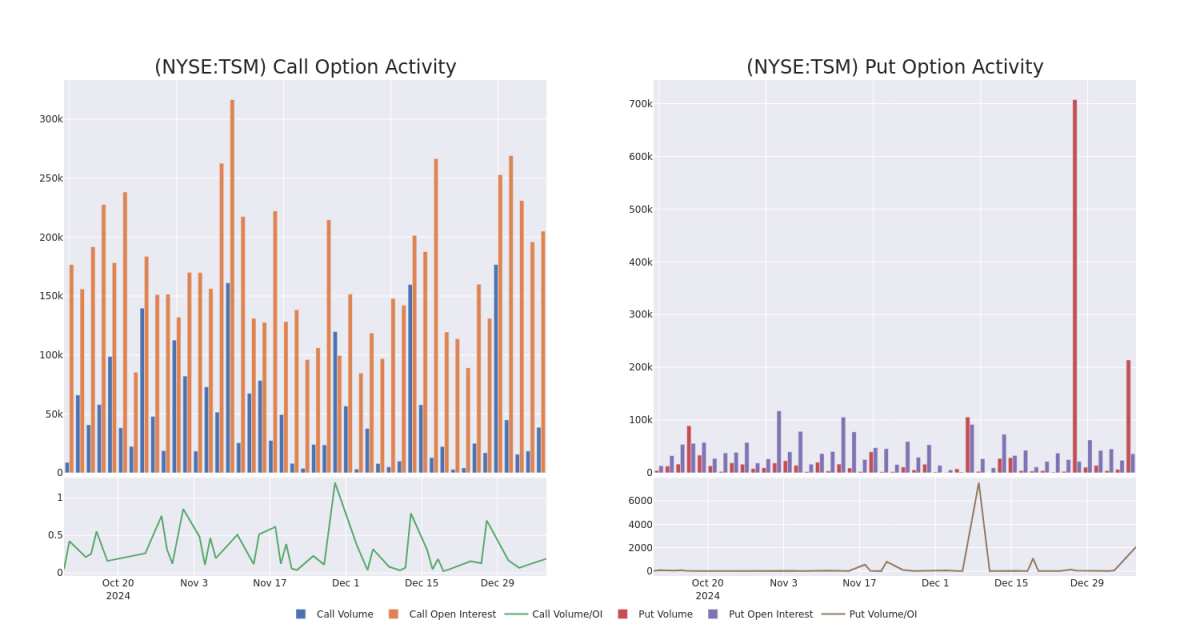

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Taiwan Semiconductor's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Taiwan Semiconductor's whale trades within a strike price range from $65.0 to $310.0 in the last 30 days.

觀察成交量和未平倉合約是交易期權時的一項有力操作。此數據可以幫助您跟蹤台積電在特定行權價的期權流動性和興趣。下面,我們可以觀察到在過去30天內,台積電的所有鯨魚交易的看漲和看跌期權的成交量和未平倉合約的演變,行權價範圍從65.0美元到310.0美元。

Taiwan Semiconductor Option Activity Analysis: Last 30 Days

台積電期權異動分析:過去30天

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TSM | PUT | TRADE | BEARISH | 06/20/25 | $8.0 | $7.85 | $7.99 | $180.00 | $1.5M | 1.7K | 2.0K |

| TSM | PUT | TRADE | BULLISH | 07/18/25 | $10.75 | $10.55 | $10.56 | $185.00 | $1.0M | 127 | 1.0K |

| TSM | PUT | SWEEP | NEUTRAL | 02/21/25 | $30.35 | $29.45 | $29.96 | $240.00 | $597.9K | 53 | 300 |

| TSM | CALL | SWEEP | BULLISH | 01/17/25 | $9.7 | $9.6 | $9.7 | $210.00 | $291.0K | 24.8K | 2.5K |

| TSM | PUT | TRADE | BEARISH | 01/16/26 | $13.6 | $13.5 | $13.6 | $175.00 | $238.0K | 1.4K | 281 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 行權價 | 總交易價格 | 未平倉合約 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TSM | 看跌 | 交易 | 看淡 | 06/20/25 | $8.0 | $7.85 | $7.99 | $180.00 | 150萬美元 | 1.7K | 2.0K |

| TSM | 看跌 | 交易 | 看好 | 07/18/25 | $10.75 | $10.55 | $10.56 | $185.00 | 100萬美金 | 127 | 1.0K |

| TSM | 看跌 | 掃單 | 中立 | 02/21/25 | $30.35 | $29.45 | $29.96 | $240.00 | $597.9K | 53 | 300 |

| TSM | 看漲 | 掃單 | 看好 | 01/17/25 | $9.7 | $9.6 | $9.7 | $210.00 | $291.0K | 24.8K | 2.5K |

| TSM | 看跌 | 交易 | 看淡 | 01/16/26 | $13.6 | $13.5 | $13.6 | $175.00 | 238,000美元 | 1.4K | 281 |

About Taiwan Semiconductor

關於台積電

Taiwan Semiconductor Manufacturing Co. is the world's largest dedicated chip foundry, with over 60% market share. TSMC was founded in 1987 as a joint venture of Philips, the government of Taiwan, and private investors. It went public as an ADR in the us in 1997. TSMC's scale and high-quality technology allow the firm to generate solid operating margins, even in the highly competitive foundry business. Furthermore, the shift to the fabless business model has created tailwinds for TSMC. The foundry leader has an illustrious customer base, including Apple, AMD, and Nvidia, that looks to apply cutting-edge process technologies to its semiconductor designs. TSMC employs more than 73,000 people.

台積電是全球最大的專業芯片代工廠,市場份額超過60%。台積電成立於1987年,是飛利浦、臺灣政府和私人投資者的合資企業。它於1997年以ADR形式在美國上市。台積電的規模和高質量技術使其能夠在競爭激烈的代工業務中實現穩定的運營利潤。此外,向無廠房經營的商業模式轉型爲台積電創造了順風。作爲代工行業的領導者,台積電擁有輝煌的客戶基礎,包括蘋果、AMD和英偉達,這些客戶希望將尖端工藝技術應用於其半導體設計。台積電的員工人數超過73,000人。

Following our analysis of the options activities associated with Taiwan Semiconductor, we pivot to a closer look at the company's own performance.

在我們分析與台積電相關的期權活動後,我們轉向更仔細地審視公司的自身表現。

Present Market Standing of Taiwan Semiconductor

台積電的市場現狀

- Currently trading with a volume of 8,980,779, the TSM's price is down by -2.75%, now at $213.96.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 9 days.

- 目前成交量爲8,980,779的台積電,價格下跌2.75%,現爲213.96美元。

- RSI讀數表明該股票目前可能接近超買狀態。

- 預計的盈利發佈將在9天后。

Unusual Options Activity Detected: Smart Money on the Move

檢測到期權異動:聰明資金正在行動

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Benzinga Edge的期權異動板塊在市場發生變化之前發現潛在的市場動向。看看大資金在你喜歡的股票上採取了什麼倉位。點擊這裏獲取訪問權限。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Taiwan Semiconductor options trades with real-time alerts from Benzinga Pro.

期權交易帶來更高的風險和潛在的回報。精明的交易者通過不斷學習、調整策略、監控多個因數並密切關注市場動態來管理這些風險。通過Benzinga Pro的實時提醒,獲取最新的台積電期權交易信息。

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $65.0 and $310.0 for Taiwan Semiconductor, spanning the last three months.

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $65.0 and $310.0 for Taiwan Semiconductor, spanning the last three months.