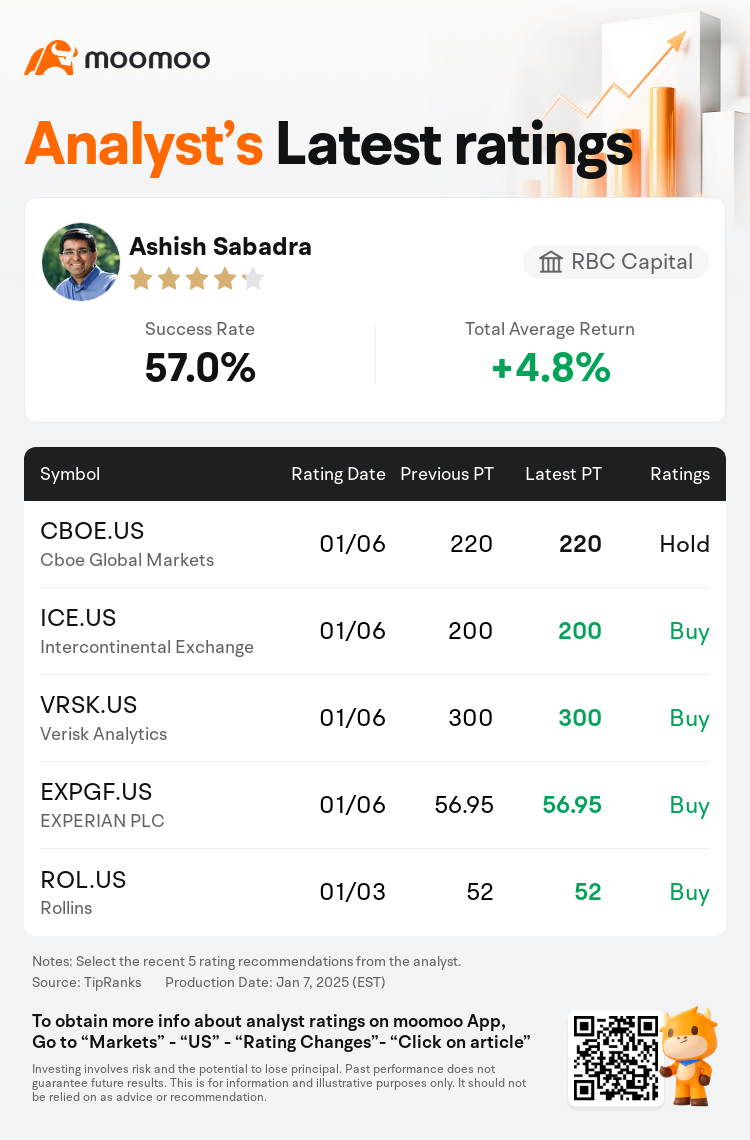

RBC Capital analyst Ashish Sabadra maintains $Cboe Global Markets (CBOE.US)$ with a hold rating, and maintains the target price at $220.

According to TipRanks data, the analyst has a success rate of 57.0% and a total average return of 4.8% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Cboe Global Markets (CBOE.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Cboe Global Markets (CBOE.US)$'s main analysts recently are as follows:

In a recent overview of the financial sector, particularly focusing on brokers, asset managers, and exchanges, it was noted that alternative asset managers are facing beneficial secular tailwinds, while sectors involving retail and wealth management are deemed highly promising. However, the exchange segment might not appear as attractive in more buoyant markets, implying a potentially slower growth compared to other financial sectors like asset managers and selected brokers that are more sensitive to asset fluctuations. Furthermore, while policies might favor energy exchange ventures, growth prospects in other asset classes seem less convincing. The resilience in short-term rates is expected to bolster margin lending and other lucrative business areas, with a profitable retail customer base possibly sustaining an extended active period for retail traders.

Cboe Global Markets' revenue generation appears to be stagnating due to maturing trends within its notable SPX franchise, varied growth levels across VIX products, and market share decrement in U.S. equities and options. The slowdown of its Index franchise – responsible for a third of net revenue and a significant portion of its historical expansion – is said to overshadow other corporate initiatives. A modest growth projection in the mid-single-digit range for Cboe's future earnings is anticipated compared to its historically lower to mid-teen growth rates.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

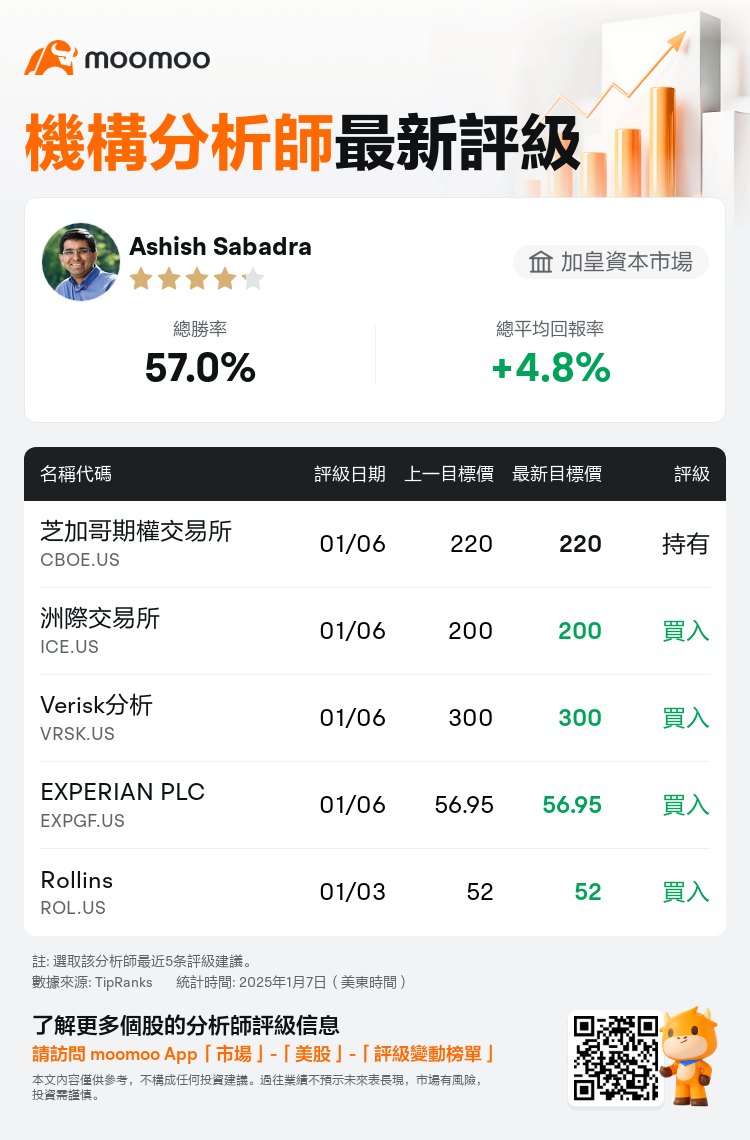

加皇資本市場分析師Ashish Sabadra維持$芝加哥期權交易所 (CBOE.US)$持有評級,維持目標價220美元。

根據TipRanks數據顯示,該分析師近一年總勝率為57.0%,總平均回報率為4.8%。

此外,綜合報道,$芝加哥期權交易所 (CBOE.US)$近期主要分析師觀點如下:

此外,綜合報道,$芝加哥期權交易所 (CBOE.US)$近期主要分析師觀點如下:

在最近對金融行業的概述中,特別關注於經紀人、資產管理人和交易所,指出替代資產管理人員面臨有利的長期趨勢,而涉及零售和财富管理的板塊被認爲前景非常樂觀。然而,交易所部分在更強勁的市場中可能顯得不那麼吸引人,這意味着與其他對資產波動更敏感的金融板塊如資產管理人與部分經紀人相比,增長潛力可能較慢。此外,儘管政策可能會支持能源交易業務,但其他資產類別的增長前景似乎不那麼令人信服。短期利率的韌性預計將促進按金貸款和其他有利可圖的業務領域,盈利的零售客戶基礎可能會維持零售交易者的長期活躍期。

芝加哥期權交易所的營業收入產生似乎正在停滯,原因在於其顯著的SPX業務變化、VIX產品的增長水平不同以及美國股票和期權市場份額的下降。其指數業務的放緩——負責三分之一的淨收入以及其歷史擴展的顯著部分——被認爲掩蓋了其他企業舉措。預計芝加哥期權交易所未來的盈利將出現中個位數的溫和增長預測,低於其歷史上的中低兩位數增長率。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$芝加哥期權交易所 (CBOE.US)$近期主要分析師觀點如下:

此外,綜合報道,$芝加哥期權交易所 (CBOE.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of