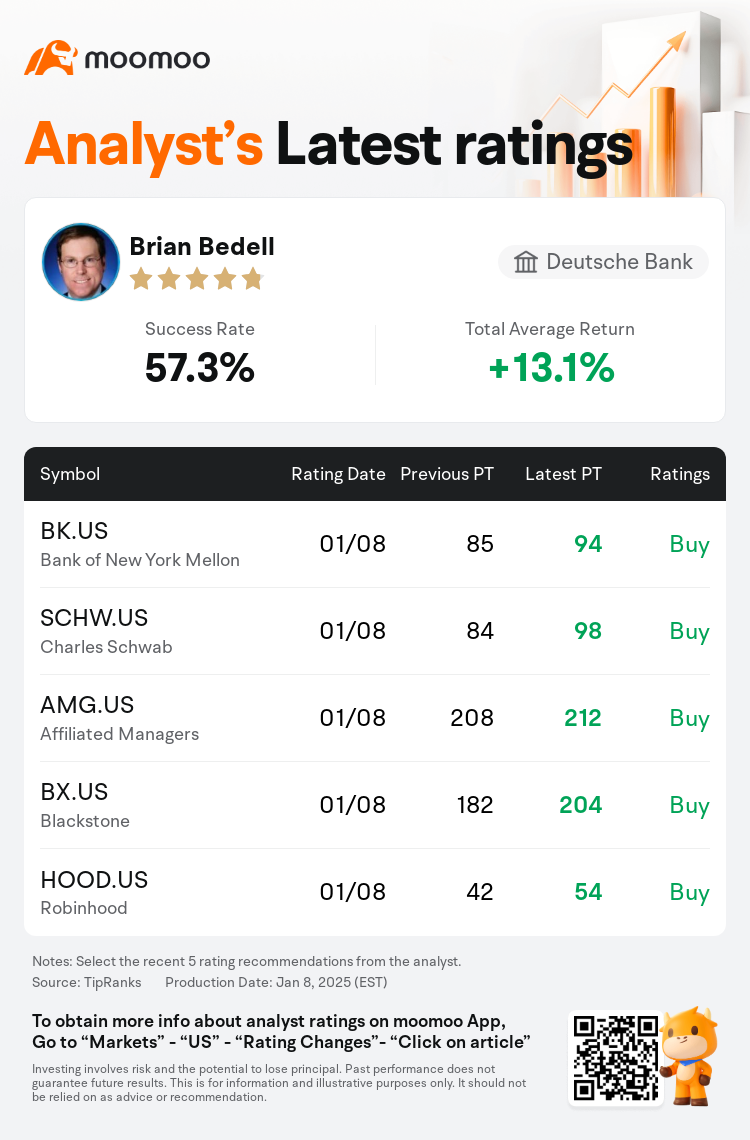

Deutsche Bank analyst Brian Bedell maintains $Charles Schwab (SCHW.US)$ with a buy rating, and adjusts the target price from $84 to $98.

According to TipRanks data, the analyst has a success rate of 57.3% and a total average return of 13.1% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Charles Schwab (SCHW.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Charles Schwab (SCHW.US)$'s main analysts recently are as follows:

The perspective for the majority of the brokers, asset managers, and exchanges sector in 2025 seems relatively favorable, with possible continual returns of 20%-plus in the U.S. equity markets for a third consecutive year. Key drivers likely influencing these markets include increased capital markets activities, a potential for relaxed regulations which might encourage product innovation and more extensive capital deployment, along with the possibility of reduced taxation on individual and corporate levels.

Analysts have expressed positive sentiments regarding developments within the brokers, asset managers, and exchanges sector. They highlighted that alternative asset managers are anticipated to benefit from enduring secular growth drivers. In contrast, the appeal of exchanges is seen as limited in favorable markets, resulting in slower growth compared to more asset-sensitive financial entities such as asset managers and certain brokers. The potential influence of political policies on the energy exchange segment was also discussed, though other asset classes are perceived as having less compelling growth prospects. The brokerage sector is favored for its resilience, supported by stable short-term rates that enhance margin lending and other high-margin activities, coupled with a retail customer base experiencing profitability, which could extend the active trading phase for retail investors.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

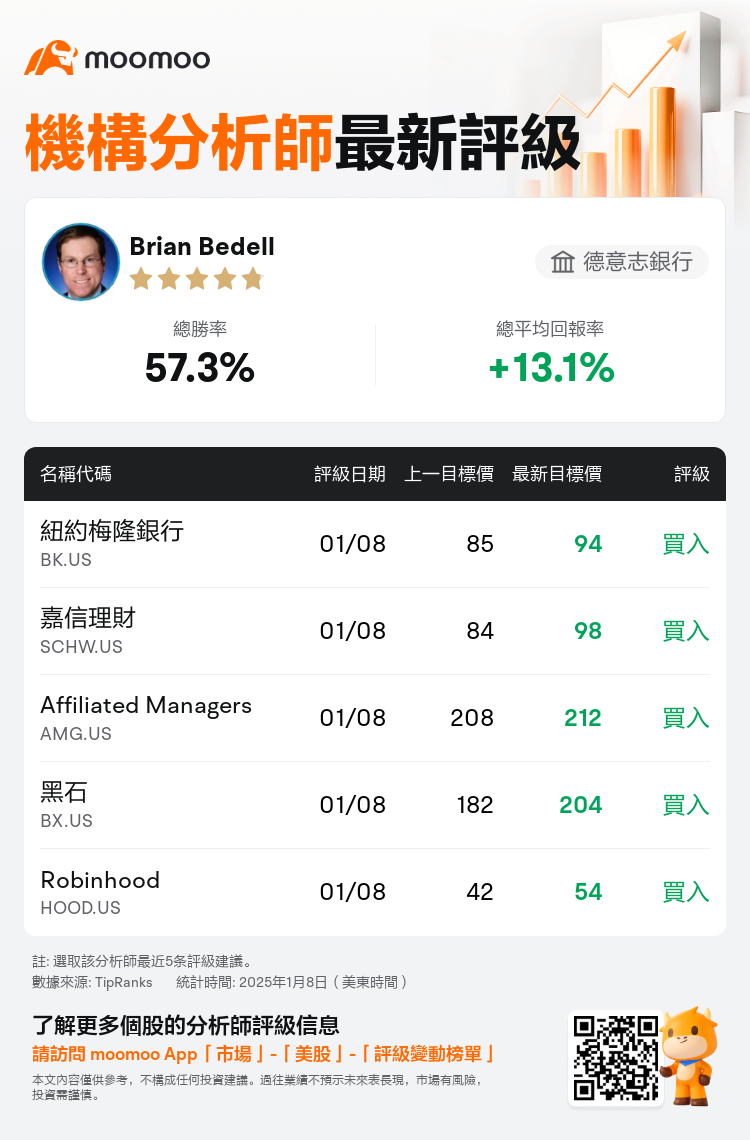

德意志銀行分析師Brian Bedell維持$嘉信理財 (SCHW.US)$買入評級,並將目標價從84美元上調至98美元。

根據TipRanks數據顯示,該分析師近一年總勝率為57.3%,總平均回報率為13.1%。

此外,綜合報道,$嘉信理財 (SCHW.US)$近期主要分析師觀點如下:

此外,綜合報道,$嘉信理財 (SCHW.US)$近期主要分析師觀點如下:

2025年,大多數經紀商、資產管理公司和交易所行業的前景似乎相對樂觀,美國股票市場可能連續第三年持續回報超過20%。可能影響這些市場的主要驅動因素包括資本市場活動的增加、放鬆監管的可能性(可能鼓勵產品創新和更廣泛的資本部署),以及減少個人和公司層面稅收的可能性。

分析師對經紀商、資產管理公司和交易所行業的發展表示了積極的看法。他們強調,另類資產管理公司預計將受益於持續的長期增長動力。相比之下,在有利的市場中,交易所的吸引力被視爲有限,因此與資產管理公司和某些經紀商等對資產更爲敏感的金融實體相比,交易所的增長放緩。還討論了政治政策對能源交易板塊的潛在影響,儘管其他資產類別的增長前景不那麼令人信服。經紀行業因其彈性而受到青睞,這得益於穩定的短期利率,可增強按金貸款和其他高利潤活動,再加上零售客戶群實現盈利,這可能會延長散戶投資者的活躍交易階段。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$嘉信理財 (SCHW.US)$近期主要分析師觀點如下:

此外,綜合報道,$嘉信理財 (SCHW.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of