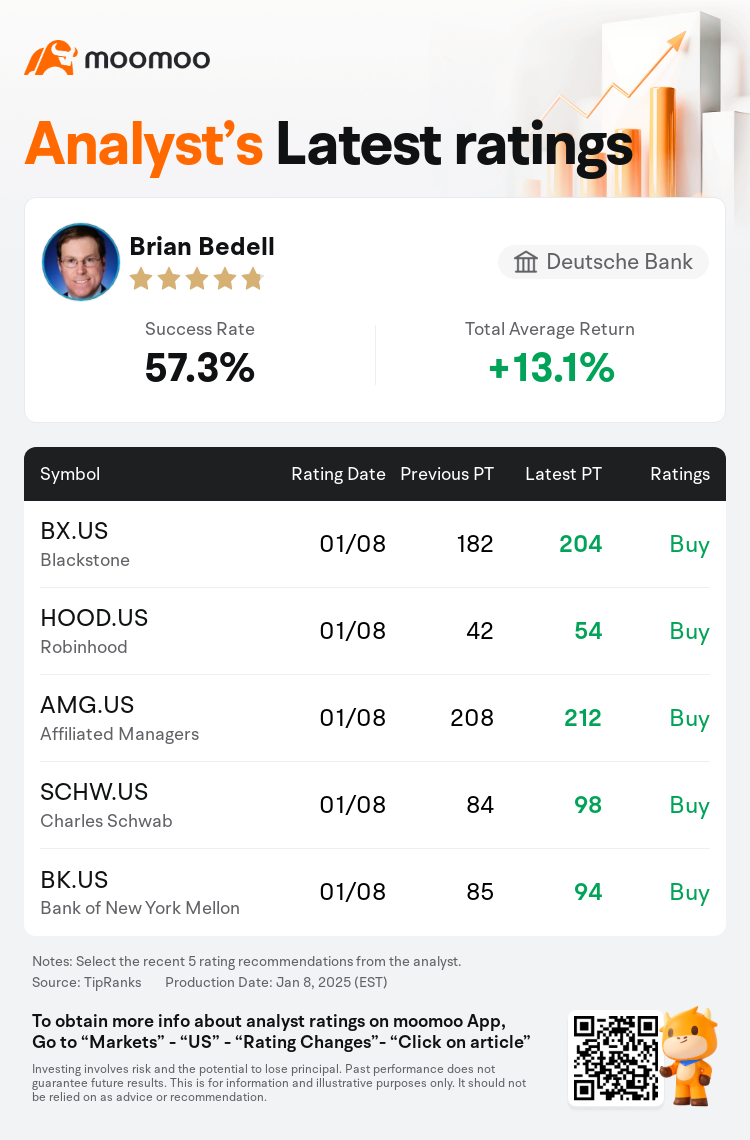

Deutsche Bank analyst Brian Bedell maintains $Robinhood (HOOD.US)$ with a buy rating, and adjusts the target price from $42 to $54.

According to TipRanks data, the analyst has a success rate of 57.3% and a total average return of 13.1% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Robinhood (HOOD.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Robinhood (HOOD.US)$'s main analysts recently are as follows:

The outlook for 2025 across brokers, asset managers, and exchanges is viewed positively, with expectations for a robust performance akin to a third consecutive year of over 20% total returns in U.S. equity markets. The key drivers likely to influence this sector include increased capital markets activities, a potential reduction in regulatory constraints which may encourage product innovation and capital deployment, alongside the possibility of reduced individual and corporate taxes.

In a recent assessment of the financial sector, analysts noted that alternative asset managers are experiencing significant secular tailwinds, with the retail and wealth sectors highlighted as particularly compelling. In contrast, exchanges are viewed as less appealing during positive market conditions, expecting slower growth compared to asset managers and certain brokers. Furthermore, some analysts anticipate that certain Trump policies may benefit energy exchange businesses. As for brokers, they are favored as the top sector moving into 2025 due to factors such as resilient short-term rates enhancing margin lending and other high-margin activities. A financially successful retail customer base may also prolong a more active trading environment. It is also noted that Robinhood has significantly advanced in legitimizing its business operations, moving away from its earlier dependence on meme-stock trading.

Robinhood has evolved from a rapidly expanding, occasionally profitable online broker predominantly serving younger investors to a premier entity in terms of revenue and asset growth and custody compounding, with an expanding total addressable market. Near to medium-term growth is anticipated to be fueled by ongoing wallet share gains among highly-profitable active traders, alongside a long-term potential to broaden Robinhood's market into sectors like wealth management and international markets.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

德意志銀行分析師Brian Bedell維持$Robinhood (HOOD.US)$買入評級,並將目標價從42美元上調至54美元。

根據TipRanks數據顯示,該分析師近一年總勝率為57.3%,總平均回報率為13.1%。

此外,綜合報道,$Robinhood (HOOD.US)$近期主要分析師觀點如下:

此外,綜合報道,$Robinhood (HOOD.US)$近期主要分析師觀點如下:

對於2025年,券商、資產管理公司和交易所的前景被普遍看好,預計美國股票市場將連續第三年實現超過20%的總回報。可能影響該板塊的主要驅動因素包括資本市場活動的增加,潛在的監管限制減少,這可能鼓勵產品創新和資本部署,以及個體和企業稅收減少的可能性。

在近期對金融板塊的評估中,分析師指出,另類資產管理公司正體驗到顯著的長期順風,零售和財富板塊尤爲吸引人。相比之下,在積極的市場條件下,交易所被視爲吸引力較小,預計增長速度將慢於資產管理公司和一些券商。此外,一些分析師預計,特朗普的某些政策可能有利於能源交易所的業務。就券商而言,他們在2025年被認爲是頂級板塊,原因包括有韌性的短期利率提升了按金貸款和其他高利潤活動。一個財務成功的零售客戶基礎也可能延長更活躍的交易環境。此外,還提到Robinhood在合法化其業務運作方面取得了顯著進展,正在擺脫對迷因股交易的早期依賴。

Robinhood已經從一個快速擴張、偶爾盈利的在線券商,主要服務於年輕投資者,演變爲在營業收入、資產增長和保管複利方面的一個領先實體,擁有不斷擴大的可尋址市場。預計短期到中期的增長將受到高度盈利的活躍交易者持續增加錢包份額的推動,同時有潛力長期拓展Robinhood的市場到财富管理和國際市場等領域。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$Robinhood (HOOD.US)$近期主要分析師觀點如下:

此外,綜合報道,$Robinhood (HOOD.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of