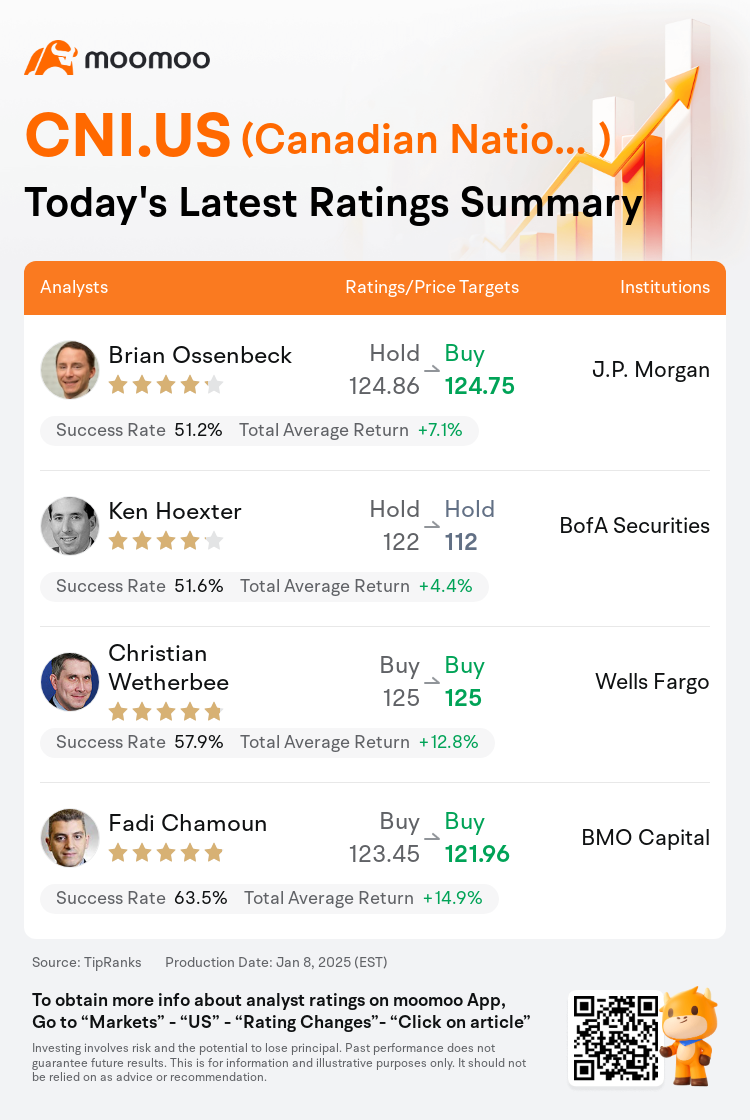

On Jan 08, major Wall Street analysts update their ratings for $Canadian National Railway (CNI.US)$, with price targets ranging from $112 to $125.

J.P. Morgan analyst Brian Ossenbeck upgrades to a buy rating, and adjusts the target price from $124.86 to $124.75.

BofA Securities analyst Ken Hoexter maintains with a hold rating, and adjusts the target price from $122 to $112.

Wells Fargo analyst Christian Wetherbee maintains with a buy rating, and maintains the target price at $125.

Wells Fargo analyst Christian Wetherbee maintains with a buy rating, and maintains the target price at $125.

BMO Capital analyst Fadi Chamoun maintains with a buy rating, and adjusts the target price from $123.45 to $121.96.

Furthermore, according to the comprehensive report, the opinions of $Canadian National Railway (CNI.US)$'s main analysts recently are as follows:

The stock is noted to trade at a significant discount compared to Union Pacific, with favorable volume comparisons and currency tailwinds enhancing its potential for earnings growth by 2025 more than its peers. These factors are prominent as the market's gradual recovery continues, highlighting the potential risks to the substantial earnings growth anticipated in 2025 estimates.

Looking ahead into Q4 results and 2025 outlooks, the recommendation is to embrace early cycle opportunities. There are indications that volume may expand to include improved industrial freight. Despite near-term expectations continuing to adjust, the fundamental direction appears positive.

Here are the latest investment ratings and price targets for $Canadian National Railway (CNI.US)$ from 4 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

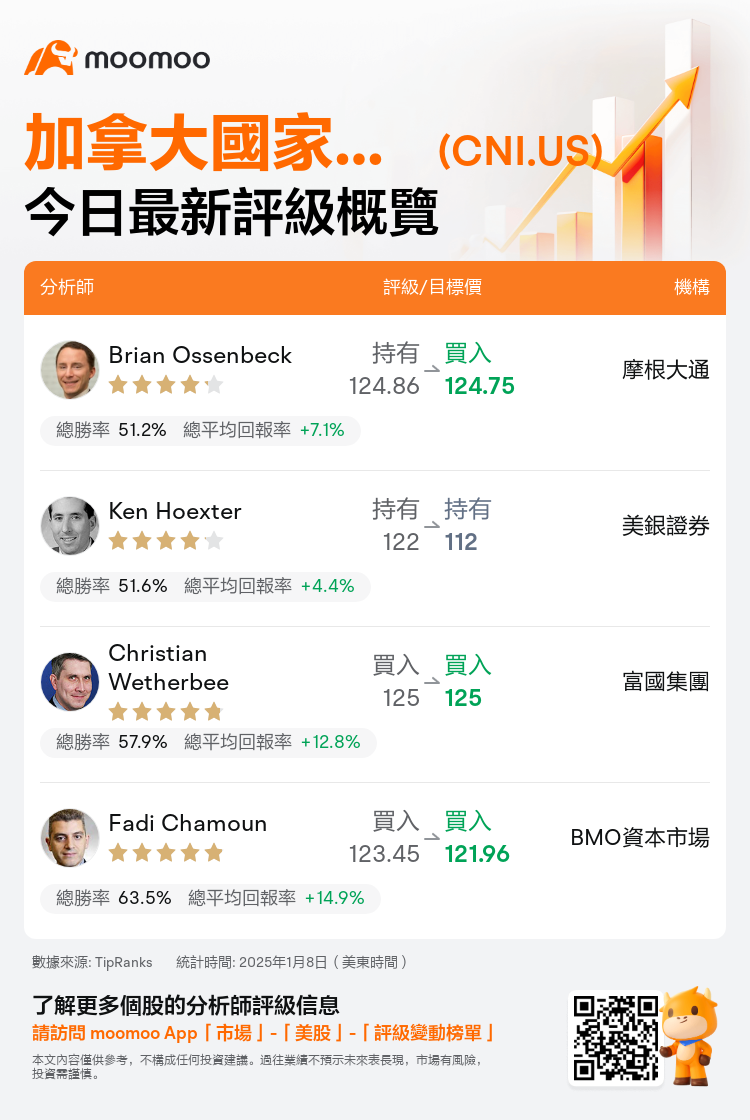

美東時間1月8日,多家華爾街大行更新了$加拿大國家鐵路 (CNI.US)$的評級,目標價介於112美元至125美元。

摩根大通分析師Brian Ossenbeck上調至買入評級,並將目標價從124.86美元下調至124.75美元。

美銀證券分析師Ken Hoexter維持持有評級,並將目標價從122美元下調至112美元。

富國集團分析師Christian Wetherbee維持買入評級,維持目標價125美元。

富國集團分析師Christian Wetherbee維持買入評級,維持目標價125美元。

BMO資本市場分析師Fadi Chamoun維持買入評級,並將目標價從123.45美元下調至121.96美元。

此外,綜合報道,$加拿大國家鐵路 (CNI.US)$近期主要分析師觀點如下:

以下爲今日4位分析師對$加拿大國家鐵路 (CNI.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

富國集團分析師Christian Wetherbee維持買入評級,維持目標價125美元。

富國集團分析師Christian Wetherbee維持買入評級,維持目標價125美元。

Wells Fargo analyst Christian Wetherbee maintains with a buy rating, and maintains the target price at $125.

Wells Fargo analyst Christian Wetherbee maintains with a buy rating, and maintains the target price at $125.