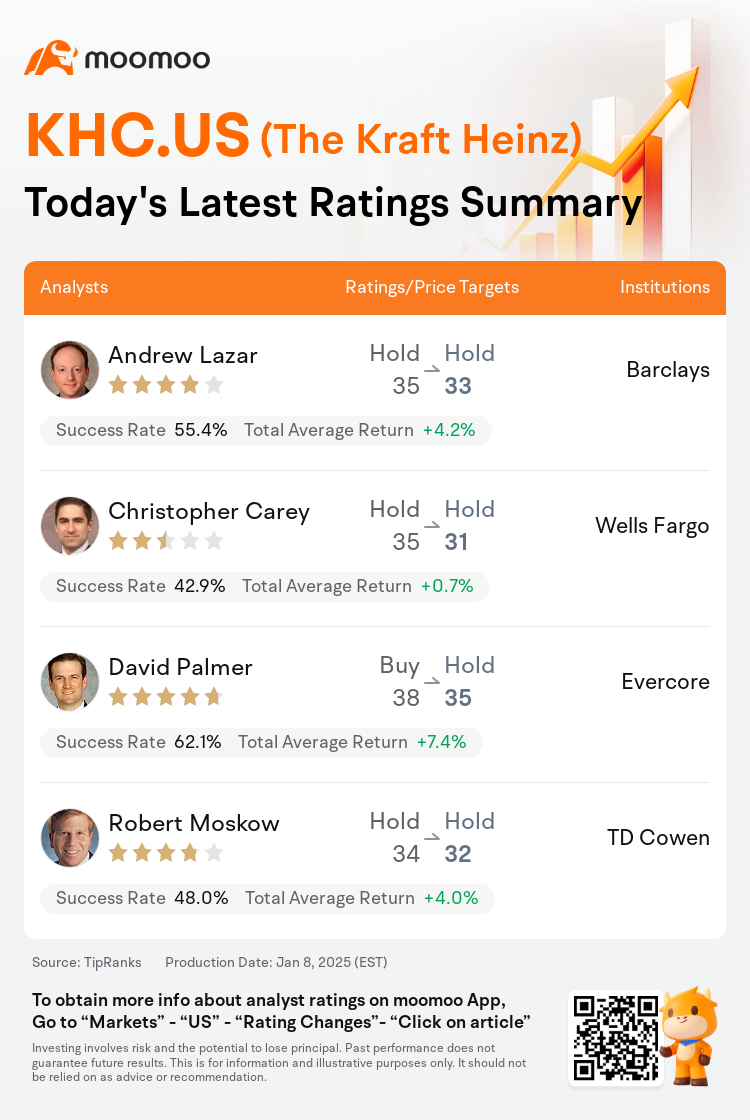

On Jan 08, major Wall Street analysts update their ratings for $The Kraft Heinz (KHC.US)$, with price targets ranging from $31 to $35.

Barclays analyst Andrew Lazar maintains with a hold rating, and adjusts the target price from $35 to $33.

Wells Fargo analyst Christopher Carey maintains with a hold rating, and adjusts the target price from $35 to $31.

Evercore analyst David Palmer downgrades to a hold rating, and adjusts the target price from $38 to $35.

Evercore analyst David Palmer downgrades to a hold rating, and adjusts the target price from $38 to $35.

TD Cowen analyst Robert Moskow maintains with a hold rating, and adjusts the target price from $34 to $32.

Furthermore, according to the comprehensive report, the opinions of $The Kraft Heinz (KHC.US)$'s main analysts recently are as follows:

2025 is anticipated to be a challenging year for the food and beverage industry, largely owing to a low likelihood of significant regulatory changes. Additionally, slow adoption and a high dropout rate in GLP-1 usage, combined with the normalization of value-seeking shopping behaviors as consumers adjust to increased prices and experience benefits from wage inflation, are contributing factors. It's suggested that many food and beverage brands should consider lowering their price points and restructuring their margins to enhance their value perception among consumers.

The downgrade reflects a continuation of 12-week measured channel sales weakness, showing a 4% decline year-over-year, along with limited visibility on when sales will stabilize. It is likely that increased investment spending may be necessary, which could pose a risk to gross margins. Current estimates stand below the consensus for 2025.

Here are the latest investment ratings and price targets for $The Kraft Heinz (KHC.US)$ from 4 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

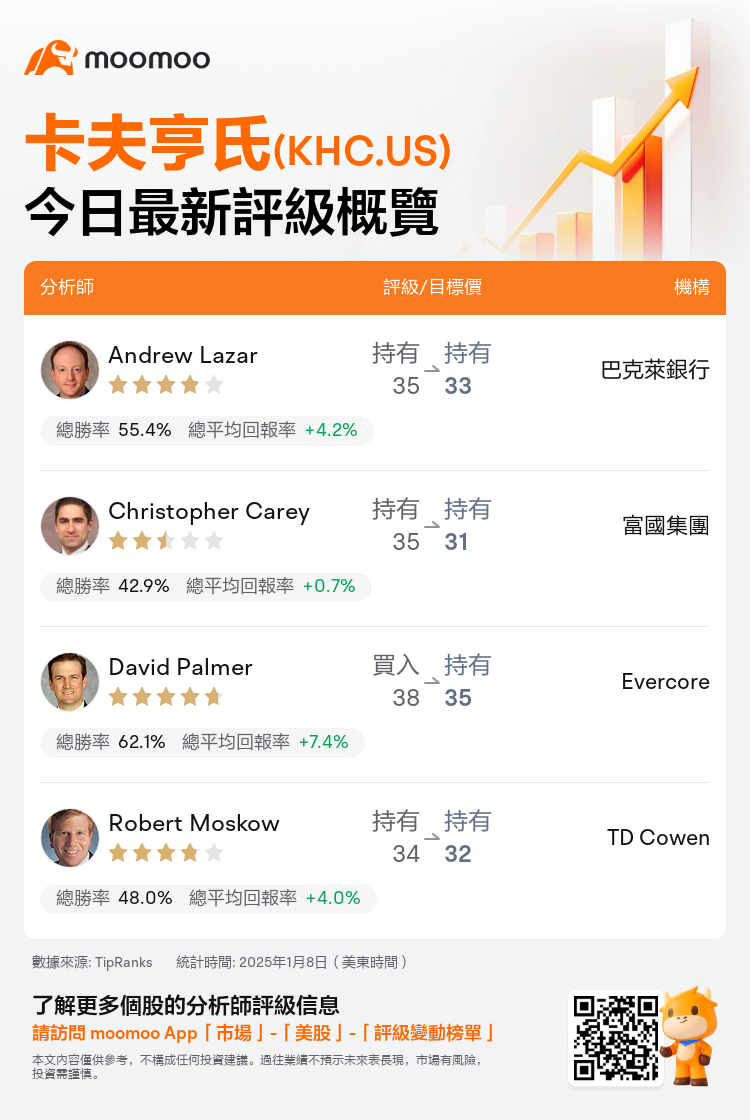

美東時間1月8日,多家華爾街大行更新了$卡夫亨氏 (KHC.US)$的評級,目標價介於31美元至35美元。

巴克萊銀行分析師Andrew Lazar維持持有評級,並將目標價從35美元下調至33美元。

富國集團分析師Christopher Carey維持持有評級,並將目標價從35美元下調至31美元。

Evercore分析師David Palmer下調至持有評級,並將目標價從38美元下調至35美元。

Evercore分析師David Palmer下調至持有評級,並將目標價從38美元下調至35美元。

TD Cowen分析師Robert Moskow維持持有評級,並將目標價從34美元下調至32美元。

此外,綜合報道,$卡夫亨氏 (KHC.US)$近期主要分析師觀點如下:

2025年預計將是食品和飲料行業一個充滿挑戰的年份,主要是由於顯著的監管變化的可能性較低。此外,GLP-1的使用普及緩慢和高退出現象,加上消費者在適應價格上漲和經歷工資通脹帶來的好處後購物行爲的正常化,都是影響因素。建議許多食品和飲料品牌考慮降低價格點,並重組利潤率,以提升在消費者心中的價值感。

這一評級下調反映了12周測量的渠道銷售疲軟的持續,顯示出同比下降4%,同時對何時銷售將穩定缺乏清晰的視野。可能需要增加投資支出,這可能對毛利率構成風險。當前的估計低於2025年的共識。

以下爲今日4位分析師對$卡夫亨氏 (KHC.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

Evercore分析師David Palmer下調至持有評級,並將目標價從38美元下調至35美元。

Evercore分析師David Palmer下調至持有評級,並將目標價從38美元下調至35美元。

Evercore analyst David Palmer downgrades to a hold rating, and adjusts the target price from $38 to $35.

Evercore analyst David Palmer downgrades to a hold rating, and adjusts the target price from $38 to $35.