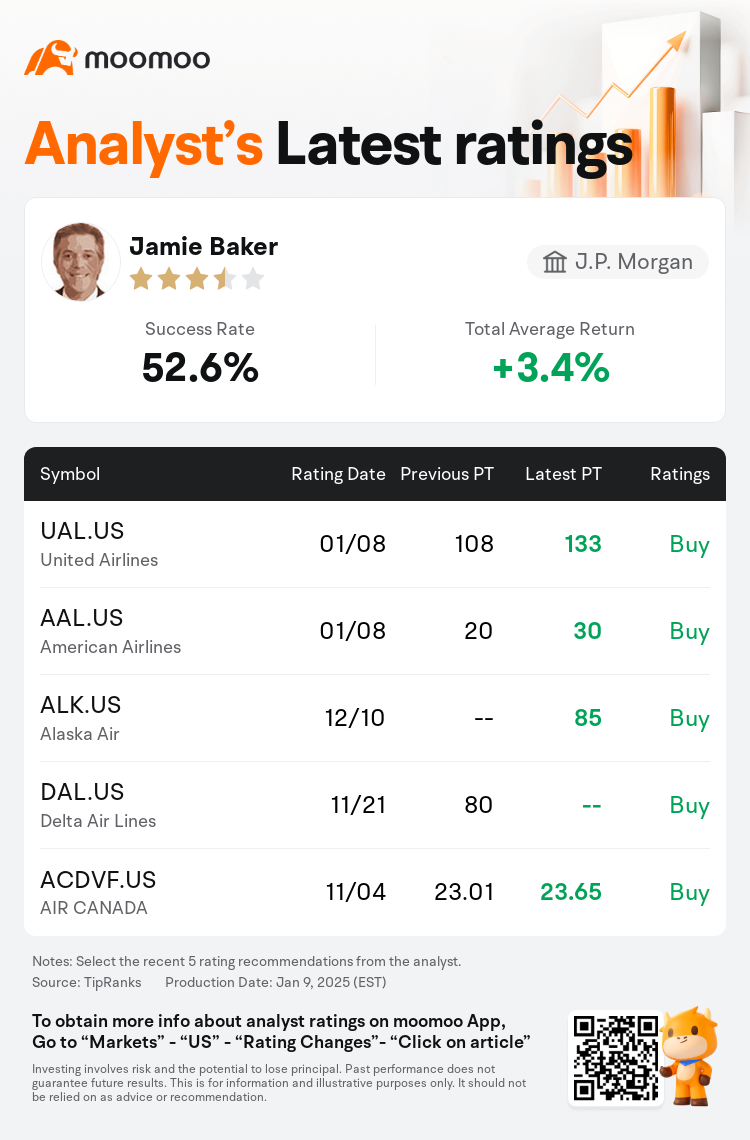

J.P. Morgan analyst Jamie Baker maintains $United Airlines (UAL.US)$ with a buy rating, and adjusts the target price from $108 to $133.

According to TipRanks data, the analyst has a success rate of 52.6% and a total average return of 3.4% over the past year.

Furthermore, according to the comprehensive report, the opinions of $United Airlines (UAL.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $United Airlines (UAL.US)$'s main analysts recently are as follows:

The optimistic stance on United Airlines continues, with revised projections ahead of their January 21 financial disclosures which now incorporate lower anticipated fuel costs for 2025/2026. This adjustment follows a previous conservative estimate on fuel expenses. United Airlines remains a preferred legacy airline in this analysis due to its strategic approach and market positioning.

Expectations are elevated as the reporting season approaches, with a strong likelihood that airlines will disclose robust Q4 results, potentially reaching or surpassing the higher end of their mid-quarter forecasts. Analysts anticipate that airlines which exceed the consensus on Revenue per Available Seat Mile (RASM) will gain favor this season, as this surpasses expectations and bolsters confidence in reaching forecasts for 2025. However, there is minimal tolerance for any underperformance during this period.

The recovery of demand in the aviation industry post-election was surprisingly quick and robust compared to initial projections. This surge, particularly during the tightly packed period between Thanksgiving and the peak holiday season, could be attributed to increased late-year corporate travel activities, contributing to better-than-expected outcomes.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

摩根大通分析師Jamie Baker維持$聯合大陸航空 (UAL.US)$買入評級,並將目標價從108美元上調至133美元。

根據TipRanks數據顯示,該分析師近一年總勝率為52.6%,總平均回報率為3.4%。

此外,綜合報道,$聯合大陸航空 (UAL.US)$近期主要分析師觀點如下:

此外,綜合報道,$聯合大陸航空 (UAL.US)$近期主要分析師觀點如下:

對聯合航空的樂觀立場仍在繼續,在1月21日的財務披露之前,對預測進行了修訂,現在包括較低的2025/2026年預期燃料成本。這一調整遵循了先前對燃料費用的保守估計。由於其戰略方針和市場定位,聯合航空在本次分析中仍然是首選的傳統航空公司。

隨着報告季的臨近,人們的預期有所提高,航空公司很可能會披露強勁的第四季度業績,有可能達到或超過其季度中期預測的較高水平。分析師預計,超過每可用座位里程收入(RASM)共識的航空公司將在本季獲得青睞,因爲這超出了預期,增強了實現2025年預測的信心。但是,在此期間,對任何表現不佳的容忍度微乎其微。

與最初的預測相比,選舉後航空業需求的恢復出人意料地迅速而強勁。這種激增,尤其是在感恩節和假日旺季之間的緊張時期,可以歸因於年底公司差旅活動的增加,結果好於預期。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$聯合大陸航空 (UAL.US)$近期主要分析師觀點如下:

此外,綜合報道,$聯合大陸航空 (UAL.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of