Goodyear Tire & Rubber (NASDAQ:GT) Seems To Be Using A Lot Of Debt

Goodyear Tire & Rubber (NASDAQ:GT) Seems To Be Using A Lot Of Debt

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies The Goodyear Tire & Rubber Company (NASDAQ:GT) makes use of debt. But should shareholders be worried about its use of debt?

霍華德·馬克斯很好地說過,與其擔心股票價格的波動,倒不如說,'我擔心的風險是永久性損失的可能性……而我認識的每位實際投資者也都擔心這個。' 所以,當你考慮任何給定股票的風險時,考慮債務是顯而易見的,因爲過多的債務可以致使一家公司破產。與許多其他公司一樣,固特異輪胎橡膠公司(納斯達克:GT)也在利用債務。但股東需要擔心它的債務使用嗎?

When Is Debt A Problem?

何時債務成爲問題?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

債務在企業中起到輔助作用,直到企業在用新資本或自由現金流償還債務時遇到困難。最終,如果公司無法履行其法律還債義務,股東可能會一無所獲。然而,更常見(但仍然代價高昂)的情況是,公司不得不以低價稀釋股東,只是爲了控制債務。當然,債務可以是企業中的一個重要工具,特別是資本密集型企業。當我們研究債務水平時,我們首先考慮現金和債務水平的結合。

What Is Goodyear Tire & Rubber's Debt?

固特異輪胎橡膠的債務狀況是什麼?

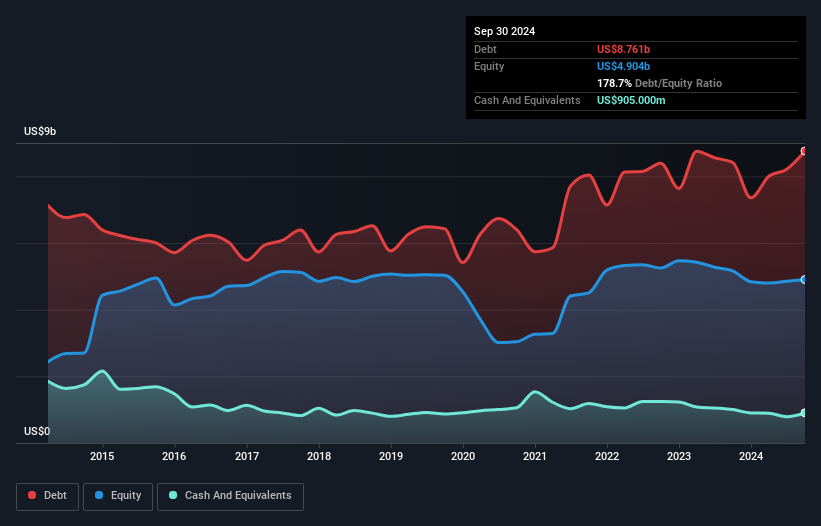

You can click the graphic below for the historical numbers, but it shows that as of September 2024 Goodyear Tire & Rubber had US$8.76b of debt, an increase on US$8.41b, over one year. However, because it has a cash reserve of US$905.0m, its net debt is less, at about US$7.86b.

您可以點擊下面的圖形查看歷史數據,但它顯示截至2024年9月,固特異輪胎橡膠的債務爲87.6億美元,與84.1億美元相比有所增加,增加幅度爲一年。然而,由於它擁有90500萬美元的現金儲備,因此其淨債務較少,約爲78.6億美元。

A Look At Goodyear Tire & Rubber's Liabilities

審視固特異輪胎橡膠的負債

According to the last reported balance sheet, Goodyear Tire & Rubber had liabilities of US$7.80b due within 12 months, and liabilities of US$9.85b due beyond 12 months. Offsetting these obligations, it had cash of US$905.0m as well as receivables valued at US$3.38b due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$13.4b.

根據最後報告的資產負債表,固特異輪胎橡膠的負債爲78億美元,12個月內到期,12個月之後到期的負債爲98.5億美元。抵消這些義務的是它的現金爲90500萬美元以及價值33.8億美元的應收款,12個月內到期。因此,它的負債超過了現金和(近期)應收款的總和134億美元。

This deficit casts a shadow over the US$2.52b company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. After all, Goodyear Tire & Rubber would likely require a major re-capitalisation if it had to pay its creditors today.

這一赤字在25.2億美元的公司上投下陰影,猶如巨人俯視凡人。因此,我們確實認爲股東需要密切關注這一點。畢竟,如果固特異輪胎橡膠今天需要償還債權人,它可能需要重大再融資。

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

我們使用兩個主要的比率來告訴我們相對於收益的債務水平。第一個是淨債務除以利息、稅、折舊和攤銷前利潤(EBITDA),而第二個是其利潤前利息和稅(EBIT)覆蓋其利息費用的次數(或其利息覆蓋率,簡稱)。因此,我們考慮與折舊和攤銷費用相關的盈利以及沒有相關費用的盈利相對於債務水平。

While Goodyear Tire & Rubber's debt to EBITDA ratio (4.4) suggests that it uses some debt, its interest cover is very weak, at 1.8, suggesting high leverage. In large part that's due to the company's significant depreciation and amortisation charges, which arguably mean its EBITDA is a very generous measure of earnings, and its debt may be more of a burden than it first appears. It seems clear that the cost of borrowing money is negatively impacting returns for shareholders, of late. However, it should be some comfort for shareholders to recall that Goodyear Tire & Rubber actually grew its EBIT by a hefty 129%, over the last 12 months. If that earnings trend continues it will make its debt load much more manageable in the future. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Goodyear Tire & Rubber can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

儘管固特異輪胎橡膠的債務與EBITDA比率(4.4)表明它使用了一定的債務,但其利息覆蓋率非常弱,僅爲1.8,這暗示着高槓杆。很大程度上,這是由於公司的重大折舊和攤銷費用,這可能意味着其EBITDA是一個非常寬鬆的收益度量,而其債務可能比最初看起來的負擔更重。顯然,借貸成本正在對股東的回報產生負面影響。然而,股東應該從中得到一些安慰,因爲固特異輪胎橡膠在過去的12個月裏實際上將EBIT增長了129%。如果這種盈利趨勢持續下去,它的債務負擔在未來將變得更易管理。當你分析債務時,資產負債表顯然是最需要關注的領域。但最終,業務的未來盈利能力將決定固特異輪胎橡膠是否能夠隨着時間的推移增強其資產負債表。因此,如果你專注於未來,可以查看這份免費的報告,了解分析師的盈利預測。

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, Goodyear Tire & Rubber burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

但是我們的最後考慮也是重要的,因爲公司不能用紙面利潤來償還債務;它需要冷硬的現金。因此,邏輯上的步驟是查看EBIT與實際自由現金流的比例。在過去三年中,固特異輪胎橡膠消耗了大量現金。這可能是出於增長支出的結果,但這確實使得債務更加風險隱患。

Our View

我們的觀點

On the face of it, Goodyear Tire & Rubber's conversion of EBIT to free cash flow left us tentative about the stock, and its level of total liabilities was no more enticing than the one empty restaurant on the busiest night of the year. But on the bright side, its EBIT growth rate is a good sign, and makes us more optimistic. We're quite clear that we consider Goodyear Tire & Rubber to be really rather risky, as a result of its balance sheet health. For this reason we're pretty cautious about the stock, and we think shareholders should keep a close eye on its liquidity. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Goodyear Tire & Rubber is showing 1 warning sign in our investment analysis , you should know about...

乍一看,固特異輪胎橡膠的EBIT轉化爲自由現金流使我們對該股票持謹慎態度,其總負債水平並沒有比一年中最繁忙的晚上那家空曠的餐廳更具吸引力。但另一方面,它的EBIT增長率是個好兆頭,令我們更樂觀。我們明確認爲固特異輪胎橡膠因其資產負債表健康狀況而相當危險。因此,我們對該股票持謹慎態度,並認爲股東應密切關注其流動性。資產負債表顯然是分析債務時需要關注的領域。但最終,每家公司都可能存在資產負債表外的風險。請注意,固特異輪胎橡膠在我們的投資分析中顯示出一個警告信號,您需要了解...

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

當然,如果你是那種喜歡購買沒有債務負擔的股票的投資者,那麼不要猶豫,今天就來發現我們獨家的淨現金成長股票列表。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對本文有反饋?對內容有疑慮?請直接與我們聯繫。或者,發送電子郵件至 editorial-team (at) simplywallst.com。

這篇來自Simply Wall ST的文章是一般性的。我們根據歷史數據和分析師預測提供評論,採用無偏見的方法,我們的文章並不旨在提供財務建議。它不構成對任何股票的買入或賣出建議,也未考慮到您的目標或財務狀況。我們旨在爲您提供以基本數據驅動的長期分析。請注意,我們的分析可能未考慮最新的價格敏感公司公告或定性材料。Simply Wall ST在提到的任何股票中均沒有持倉。

According to the last reported balance sheet, Goodyear Tire & Rubber had liabilities of US$7.80b due within 12 months, and liabilities of US$9.85b due beyond 12 months. Offsetting these obligations, it had cash of US$905.0m as well as receivables valued at US$3.38b due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$13.4b.

According to the last reported balance sheet, Goodyear Tire & Rubber had liabilities of US$7.80b due within 12 months, and liabilities of US$9.85b due beyond 12 months. Offsetting these obligations, it had cash of US$905.0m as well as receivables valued at US$3.38b due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$13.4b.