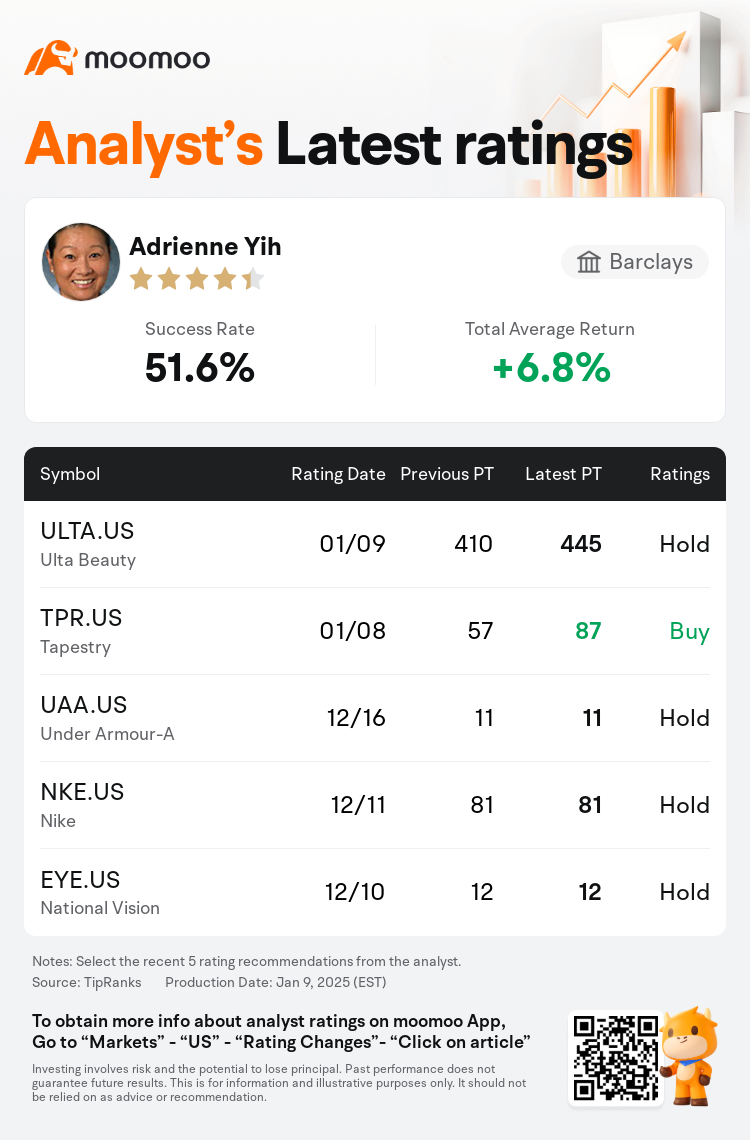

Barclays analyst Adrienne Yih maintains $Ulta Beauty (ULTA.US)$ with a hold rating, and adjusts the target price from $410 to $445.

According to TipRanks data, the analyst has a success rate of 51.6% and a total average return of 6.8% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Ulta Beauty (ULTA.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Ulta Beauty (ULTA.US)$'s main analysts recently are as follows:

Ulta Beauty's preliminary Q3 results surpassed expectations. The appointment of Kecia Steelman as CEO is seen positively, given her extensive experience over a decade in various operational, real estate, growth, and strategic capacities within the company. However, concerns persist about the competitive challenges in the beauty industry in the near-term.

Ulta Beauty anticipates a modest increase in Q4 comps and projects that the operating margin will exceed the upper limit of the previous guidance after a robust holiday season. This follows the announcement of Kecia Steelman succeeding Dave Kimbell as CEO. It's projected that the Q4 EPS will be $7.17, compared to the earlier forecast of $6.66. There is a positive outlook on the recent preannouncement, though margins are expected to decline by 200 basis points year-over-year in Q4, and by 180 points for the full year FY24.

After four years at the helm, Ulta Beauty announced that CEO Dave Kimbell will retire and will be succeeded by current COO Kecia Steelman effective immediately. Analysts believe that though the transition was unexpected, Steelman is well-suited for the role. Furthermore, Ulta's updated Q4 guidance forecasts modestly rising comps, contrary to the expected decrease, and an EBIT margin that exceeds previous forecasts, indicating less reliance on promotions to achieve positive results. Analysts are also becoming more optimistic about the fiscal year 2025, perceiving a reduction in competitive pressures.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

巴克萊銀行分析師Adrienne Yih維持$Ulta美容 (ULTA.US)$持有評級,並將目標價從410美元上調至445美元。

根據TipRanks數據顯示,該分析師近一年總勝率為51.6%,總平均回報率為6.8%。

此外,綜合報道,$Ulta美容 (ULTA.US)$近期主要分析師觀點如下:

此外,綜合報道,$Ulta美容 (ULTA.US)$近期主要分析師觀點如下:

Ulta美容的初步第三季度業績超出預期。考慮到她在公司各個運營、房地產業、增長和戰略職能上超過十年的豐富經驗,Kecia Steelman被任命爲CEO受到積極評價。然而,對於美妝行業在短期內面臨的競爭挑戰仍然存在擔憂。

Ulta美容預計第四季度同店銷售將有適度增長,並預測營業利潤率將超過之前指引的上限,這一切是在強勁的假日季節之後公佈的。這在於Kecia Steelman接替Dave Kimbell成爲CEO的公告後。預計第四季度每股收益將爲7.17美元,較之前預測的6.66美元有所增加。對於最近的預公告持樂觀態度,儘管預計第四季度的利潤率將同比下降200個點子,全年FY24則下降180個點子。

經過四年的領導,Ulta美容宣佈CEO Dave Kimbell將退休,由現任首席運營官Kecia Steelman立即接任。分析師認爲,儘管這一過渡出乎意料,但Steelman非常適合這一角色。此外,Ulta更新的第四季度指引預測同店銷售將適度上升,這與預期的下降相悖,並且EBIT利潤率超過之前的預測,表明在實現積極成果方面對促銷的依賴減少。分析師們對2025財政年度的前景也越來越樂觀,認爲競爭壓力有所減輕。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$Ulta美容 (ULTA.US)$近期主要分析師觀點如下:

此外,綜合報道,$Ulta美容 (ULTA.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of