Palo Alto Networks Inc. (NASDAQ:PANW) was downgraded to 'hold' by Deutsche Bank because the cybersecurity stock owned by Nancy Pelosi could be affected by a sector-wide "consolidation down-cycle". This follows Pelosi's February 2024 purchase of nearly $1.25 million in call options of PAWN, which expire on Jan. 17.

What Happened: In its 2025 Software Outlook, Deutsche Bank predicts that the cybersecurity sector will underperform broader software this year after a strong 2024. The bank believes that the market overestimated the impact of consolidation in 2024. "We expect 2025 will remain in a consolidation down-cycle," stated Deutsche's research note dated Jan. 7.

Ahead of its expiry on Jan. 17, Nancy Pelosi's call options have a strike price of $200 apiece and the current share price of $172.83, as of Wednesday's close, is still below the strike price.

Cybersecurity consolidation is the process of centralizing and streamlining cybersecurity tools, technologies, and processes to improve an organization's security posture. The goal is to create a unified, more efficient, and cost-effective security infrastructure.

Cybersecurity consolidation is the process of centralizing and streamlining cybersecurity tools, technologies, and processes to improve an organization's security posture. The goal is to create a unified, more efficient, and cost-effective security infrastructure.

"Consolidation is no doubt a powerful force, but it's subject to cyclical peaks and troughs," the report said. The bank also said that it struggles to see fundamentals living up to last year's expansion. "We expect market preference in 2025 will tilt in favor of best-of-breed vs. best-of-suite platforms," it added.

"After a year where Security stocks outperformed Apps and Infrastructure, the overall category is more likely to underperform broader Software in 2025, in our view," the note added.

Why It Matters: Deutsche Bank cited four factors contributing to this consolidation slowdown, which include easing IT spending, a surge in AI innovation, a temporary pause in mergers and acquisitions following a July 19 outage, and increased competition in pricing.

The disruption on July 19 resulted in flight cancellations globally and impacted sectors such as banking, healthcare, and hospitality.

Despite the downgrade, Deutsche Bank acknowledged the strength of Palo Alto Networks and CrowdStrike as leading cybersecurity companies. However, the bank believes that the current market conditions favor smaller, more innovative players.

Price Action: Shares of Palo Alto advanced 2.82% over the last six months, underperforming the Nasdaq 100 index which gained 3.56% in the same period.

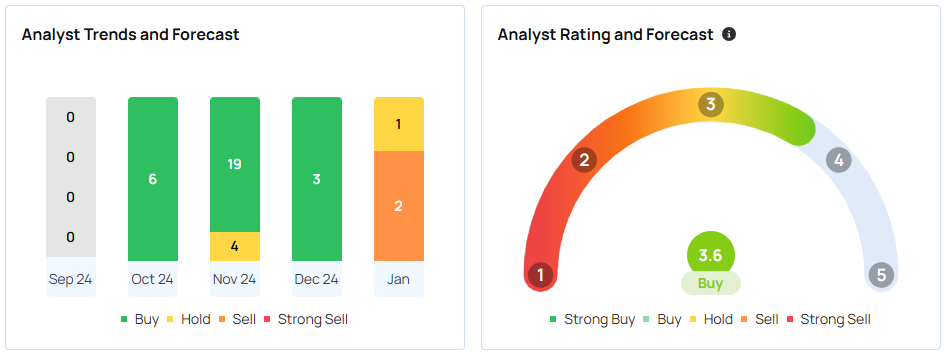

According to Benzinga, Palo Alto has a consensus price target of $373.63 apiece based on the ratings of 42 analysts.

The high is $450 per share issued by RBC Capital on Nov. 21, 2024, and the low is $130 apiece issued by Guggenheim on Jan. 7, 2025.

The average price target of $150 between Deutsche Bank and Guggenheim implies a 13.14% downside for PANW.

Photo courtesy: Shutterstock

德意志銀行將Palo Alto Networks Inc.(納斯達克股票代碼:PANW)的評級下調至 「持有」,因爲南希·佩洛西擁有的網絡安全股票可能會受到全行業 「整合下行週期」 的影響。在此之前,佩洛西於2024年2月收購了PAWN近125萬美元的看漲期權,該期權將於1月17日到期。

發生了什麼:德意志銀行在其《2025年軟體展望》中預測,在經歷了強勁的2024年之後,網絡安全行業今年的表現將低於更廣泛的軟體。該銀行認爲,市場高估了2024年整合的影響。德意志1月7日的研究報告稱:「我們預計2025年將處於盤整下行週期。」

在1月17日到期之前,南希·佩洛西的看漲期權的行使價爲每股200美元,截至週三收盤,目前的股價爲172.83美元,仍低於行使價。

網絡安全整合是集中和簡化網絡安全工具、技術和流程以改善組織安全狀況的過程。目標是創建統一、更高效、更具成本效益的安全基礎架構。

網絡安全整合是集中和簡化網絡安全工具、技術和流程以改善組織安全狀況的過程。目標是創建統一、更高效、更具成本效益的安全基礎架構。

報告稱:「整合無疑是一種強大的力量,但它會受到週期性高峰和低谷的影響。」該銀行還表示,很難看到基本面能夠適應去年的擴張。它補充說:「我們預計,到2025年,市場偏好將傾向於同類最佳平台而不是最佳平台。」

報告補充說:「在安全類股票表現優於應用程序和基礎設施的一年之後,我們認爲,到2025年,整個類別的表現更有可能低於整個軟體類。」

爲何重要:德意志銀行列舉了導致整合放緩的四個因素,其中包括放鬆IT支出、人工智能創新激增、7月19日停電後暫時暫停併購以及定價競爭加劇。

7月19日的中斷導致全球航班取消,並影響了銀行、醫療保健和酒店業等行業。

儘管評級下調,但德意志銀行承認了帕洛阿爾託網絡和CrowdStrike作爲領先的網絡安全公司的實力。但是,該銀行認爲,當前的市場狀況有利於規模較小、更具創新性的參與者。

價格走勢:帕洛阿爾託的股價在過去六個月中上漲了2.82%,低於同期上漲3.56%的納斯達克100指數。

根據本辛加的說法,根據42位分析師的評級,帕洛阿爾託的共識目標股價爲每股373.63美元。

最高價爲加拿大皇家銀行資本於2024年11月21日發行的每股450美元,最低價爲古根海姆於2025年1月7日發行的每股130美元。

德意志銀行和古根海姆之間的平均目標股價爲150美元,這意味着PANW的下跌幅度爲13.14%。

照片來源:Shutterstock

網絡安全整合是集中和簡化網絡安全工具、技術和流程以改善組織安全狀況的過程。目標是創建統一、更高效、更具成本效益的安全基礎架構。

網絡安全整合是集中和簡化網絡安全工具、技術和流程以改善組織安全狀況的過程。目標是創建統一、更高效、更具成本效益的安全基礎架構。

Cybersecurity consolidation is the process of centralizing and streamlining cybersecurity tools, technologies, and processes to improve an organization's security posture. The goal is to create a unified, more efficient, and cost-effective security infrastructure.

Cybersecurity consolidation is the process of centralizing and streamlining cybersecurity tools, technologies, and processes to improve an organization's security posture. The goal is to create a unified, more efficient, and cost-effective security infrastructure.