美股期權個股詳情

NNE241129P16000

- 0.48

- 0.000.00%

延時15分鐘行情收盤價 11/26 16:00 (美東)

0.00最高價0.00最低價

0.48今開0.48昨收0張成交量14張未平倉合約數16.00行權價0.00成交額480.10%引伸波幅40.35%溢價2024/11/29到期日0.00内在价值100合約乘數3天距到期日0.48時間價值100合約規模美式期權類型-0.0824Delta0.0142Gamma54.21槓桿倍數-0.2850Theta-0.0002Rho-4.47有效槓桿0.0034Vega

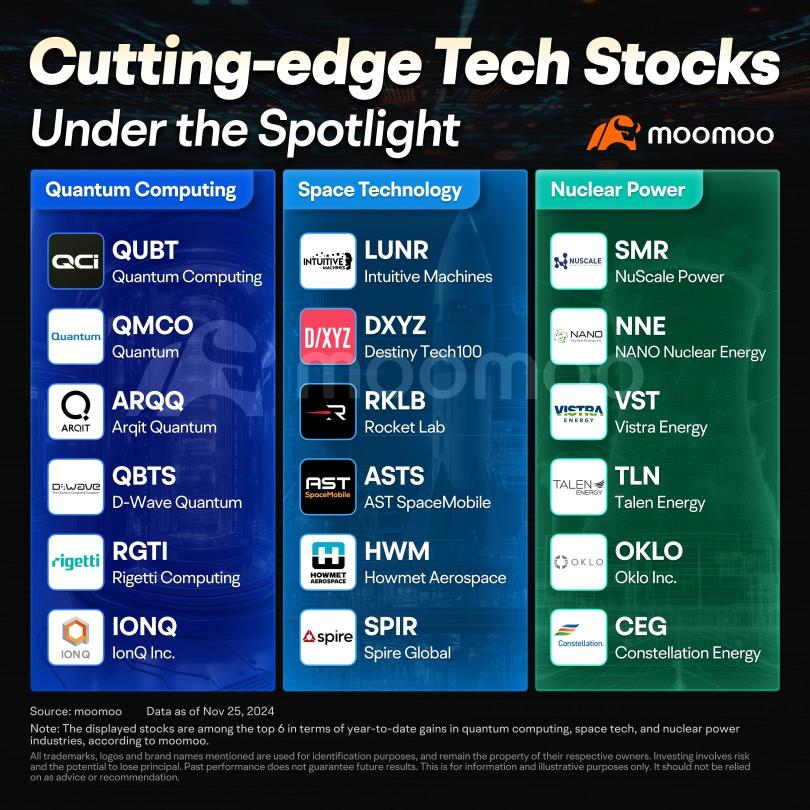

NANO Nuclear Energy股票討論

$NANO Nuclear Energy (NNE.US)$ 22又1/2是股票的移動平均價,它一直在這個價位通過,不是指數金額,我所指的是移動平均價,所以你需要明白其他人也看到了這一點。所以你可以等到它跌落,或者你可以在這個價位附近出售選擇權,收取這些保費,一開始就收取費用,每週都能賺點錢,同時等待股票達到那個水平。

已翻譯

8

3

隨著美國經濟繼續展現出令人驚訝的韌性,加上唐納德·特朗普在2024年選舉中獲勝後樂觀情緒激增,華爾街分析師一直在修訂他們對其預測的展望, $標普500指數 (.SPX.US)$ ,表明看好的前景可能導致指數在2025年底前升至前所未有的高度。

德意志銀行首席全球策略師Binky Chadha已提出...

德意志銀行首席全球策略師Binky Chadha已提出...

已翻譯

45

3

$NANO Nuclear Energy (NNE.US)$ 在今天的資訊中,股票已跌到最低,下週末將重新測試30美元...

這支股票是一項投資,我預期未來幾年都會看到利好...然而,這次的下跌確實成為了一筆很棒的快速交易

這支股票是一項投資,我預期未來幾年都會看到利好...然而,這次的下跌確實成為了一筆很棒的快速交易

已翻譯

3

$NANO Nuclear Energy (NNE.US)$ 週一,這家下一代核能公司宣布在私募中出售約6000萬美元的股票和warrants後,股價下跌超過20%,引發了其他核能股票的回調。

NNE透露將以每股24美元的價格向三家未公開的機構投資者出售250萬股新股,股價下跌22.9%至25.91美元收盤。公司還向投資者發行了五年期認股權證,以每股26美元的價格購買另外250萬股。

NNE透露將以每股24美元的價格向三家未公開的機構投資者出售250萬股新股,股價下跌22.9%至25.91美元收盤。公司還向投資者發行了五年期認股權證,以每股26美元的價格購買另外250萬股。

已翻譯

5

1

目前正在測試25的壓力位。如果無法支撐,請關注下一個23.00。如果成功反彈,可考慮在26.82區域進行再測試。

更大的圖片: tradingview.com...

$NANO Nuclear Energy (NNE.US)$

更大的圖片: tradingview.com...

$NANO Nuclear Energy (NNE.US)$

已翻譯

3

1

$NANO Nuclear Energy (NNE.US)$將有更多向下的賣壓,如果這一度跌至24點附近,我不會感到驚訝。

已翻譯

3

12

$NANO Nuclear Energy (NNE.US)$ 如果您在這次購買中虧了幾美元,不要驚慌,因為股票會有另一個循環,同時,他們有每週期權您可以賣出看漲期權以對沖您的倉位,由於股票存在的波動性,保費非常不錯,因此,例如如果您有數百、100、200、500、1000股股票任何圓形交易手數,您可以賣出看漲期權以降低成本基準或在等待之際獲得現金...

已翻譯

6

6

$NANO Nuclear Energy (NNE.US)$ 現在是一個適合買入的好時機

已翻譯

1

$NANO核能(NNE.US)應該接觸定向增發的定價,然後再次上升。

已翻譯

1

暫無評論

JennyLeitch : 要是我能理解所有那些.. 聽起來很聰明。

Sean Parker JennyLeitch : 他只是建議現在買入看跌期權,因為他認為價格很快會下跌。如果你有能力,或許這不是一個壞主意。

10baggerbamm 樓主 Sean Parker : I'm not saying bye put options. it's important to understand that when you buy a put or buy a call you're making a bet and that bet it must be right on two fronts. if it's a call the stock must rise to that strike price or close to it or exceed it within the time frame before that option expires and even if it goes up you can still lose because of the decay Factor which is the time that erodes every second of every day up to expiration so even if the stock goes up but it goes up very slowly you're losing the time value.. and same thing with the put it needs to fall within that time frame and a faster that stock falls the more money you'll make because you still have time value left. so statistically 90% of the people that buy puts and buy calls lose their money. because even if the stock does go up or down if it takes too long to get there your option goes to zero.

by selling a put you pick the strike price that you think you would want to own that stock at you pick the time frame and somebody else places the bet. so you're playing the casino you're playing the house you're letting the person on the other side make the bet with their money that the stock will fall to your strike price or less than it within that time frame and in exchange they pay you a premium like an insurance premium they pay it to you right up front and it's yours to keep no matter what happens.

if on the expiration day which is a Friday at 4:00 p.m. that stock is at the money at that price of the strike or in the money below then you own that stock and your cost basis would be the strike price minus the premium that you received..

if the stock never reaches that price on expiration day you kept the premium for free and you get to do it again the next Monday if you choose to.

so by selling puts on companies that you want to own you get paid up front and most of the time the other person they lost their money because the stock doesn't close at or below that strike price on expiration day.