最新

人気

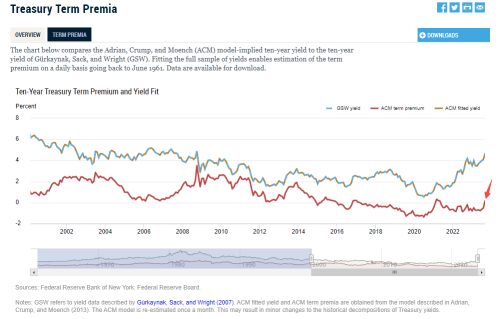

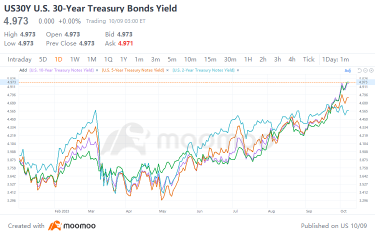

世界で最も流動性の高い市場として広く認識されている米国財務省市場は、最近、ジャンク株のような激しい混乱に見舞われています。 10年国債利回りと30年国債利回りの両方が10月3日に16年ぶりの最高水準に達したため、長期国債利回りの急上昇は特に顕著です。10月6日に発表された予想を上回る雇用報告を受けて、...

翻訳済み

+2

50

5

10月に入り、急騰する米国債券利回りが再び世界の金融市場で動揺を引き起こし、投資家の懸念を高めています。先週、米国10年債券利回りは16年ぶりに%を超え、同利回りは2007年以来初めて%に達すると市場の専門家が予想しています。 $米国債30年 (US30Y.BD)$5% $米国債10年 (US10Y.BD)$4.85%5%

...

...

翻訳済み

+3

33

3

要約

年末の強い上昇相場が、水曜日に勢いを失い、米国株は大幅に下落し、nyダウは歴代最高を更新していた終値の5連続記録をストップ、S&P 500も歴代最高値に向けたプッシュを一時停止した。

$NYダウ (.DJI.US)$予備的な数字によると、nyダウは470ポイント以上下落し、約37,082で1.3%下落した。 $S&P 500 Index (.SPX.US)$約4,6...で1.5%下落し、低下した。

年末の強い上昇相場が、水曜日に勢いを失い、米国株は大幅に下落し、nyダウは歴代最高を更新していた終値の5連続記録をストップ、S&P 500も歴代最高値に向けたプッシュを一時停止した。

$NYダウ (.DJI.US)$予備的な数字によると、nyダウは470ポイント以上下落し、約37,082で1.3%下落した。 $S&P 500 Index (.SPX.US)$約4,6...で1.5%下落し、低下した。

翻訳済み

30

2

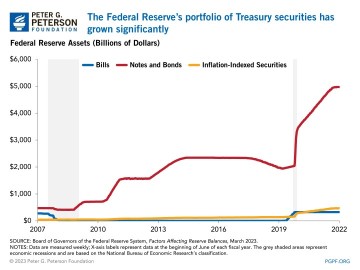

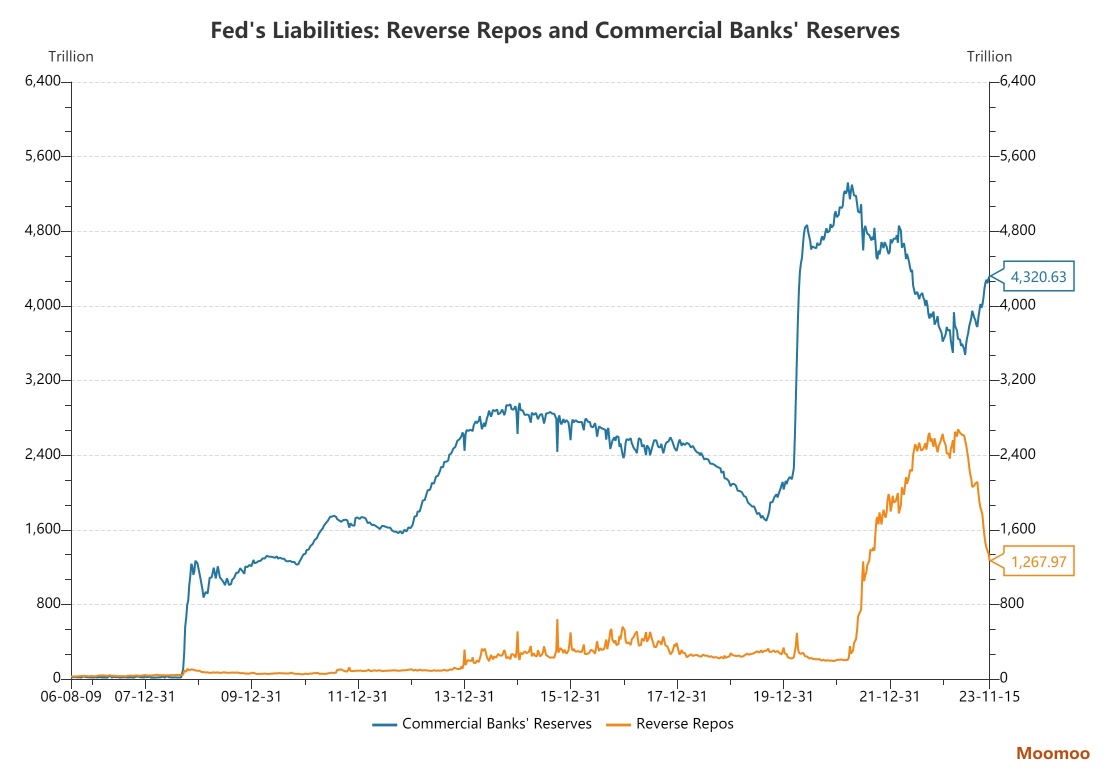

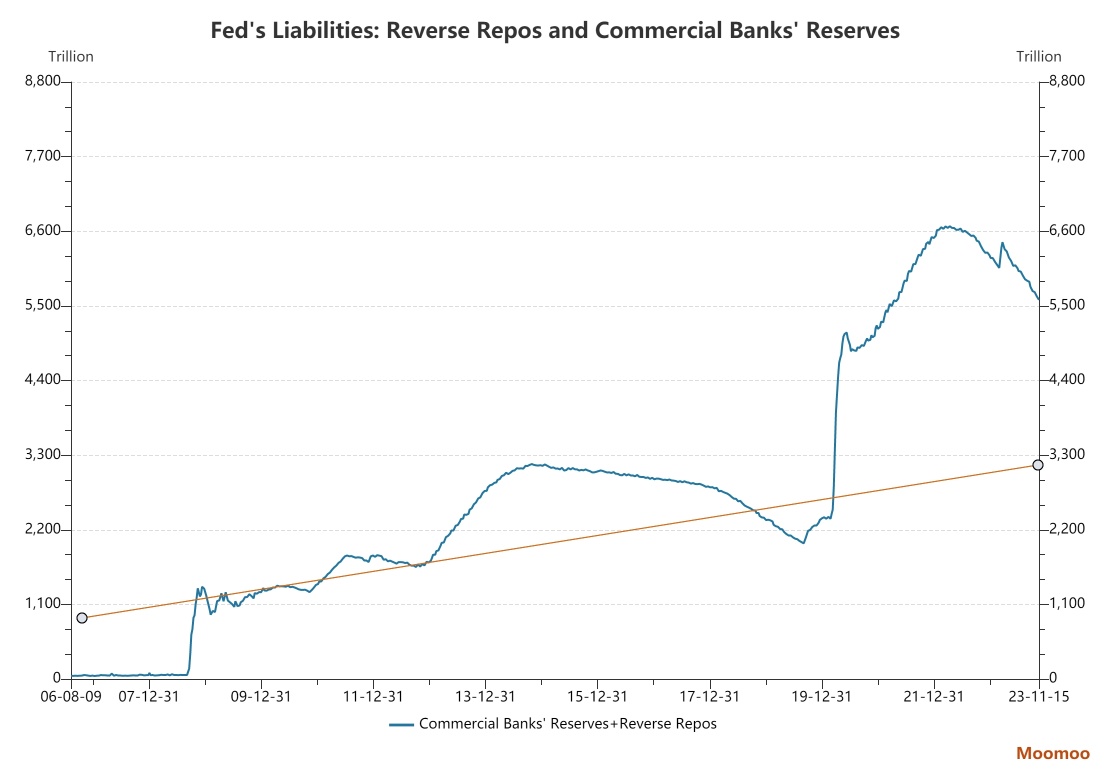

利上げが終わりに近づくにつれ、量的緊張は市場の関心のもう一つの話題になりました。

中央銀行は、Qtに関する経験は2つしかありません。日本は2006年と2007年に、アメリカは2017年から2019年にかけてそれを行いました。両期間中、株式市場は平均以上の変動を示しました。

量的緊張は、思われるほど怖いものではないのでしょうか?

■まず、流動性は十分にあります

指標からは、商業銀行の準備高と中央銀行準備のバランスを見ることができます。

中央銀行は、Qtに関する経験は2つしかありません。日本は2006年と2007年に、アメリカは2017年から2019年にかけてそれを行いました。両期間中、株式市場は平均以上の変動を示しました。

量的緊張は、思われるほど怖いものではないのでしょうか?

■まず、流動性は十分にあります

指標からは、商業銀行の準備高と中央銀行準備のバランスを見ることができます。

翻訳済み

28

1

要約

米国株式市場は、投資家が連邦準備制度理事会(FOMC)の利上げ発表を待ち、最新のインフレーションデータが利下げに対する楽観的な見方を損なわないことを望む中、火曜日の午後に年初来高値で終了しました。

The $NYダウ (.DJI.US)$S&P500は21ポイント、または0.46%増の4,643。 $S&P 500 Index (.SPX.US)$ナスダックは100ポイント、または0.7%増の14,533。 $Nasdaq Composite Index (.IXIC.US)$ナスダックは100ポイント、または0.7%増の14,533。

米国株式市場は、投資家が連邦準備制度理事会(FOMC)の利上げ発表を待ち、最新のインフレーションデータが利下げに対する楽観的な見方を損なわないことを望む中、火曜日の午後に年初来高値で終了しました。

The $NYダウ (.DJI.US)$S&P500は21ポイント、または0.46%増の4,643。 $S&P 500 Index (.SPX.US)$ナスダックは100ポイント、または0.7%増の14,533。 $Nasdaq Composite Index (.IXIC.US)$ナスダックは100ポイント、または0.7%増の14,533。

翻訳済み

25

2

最近、米国の株式市場は、連邦準備制度理事会が利上げサイクルをやがて終わらせるという楽観的な見通しとアメリカの「ゴールディロックス」経済に対する再びの期待によって強力な回復を経験しています。しかし、急激な上昇は売り手にとって悪い影響を及ぼし、激しい「新規売りリスク」を引き起こし、大きな損失を被りました。S3パートナーズのデータによると、ヘッジファンドは432億ドルの損失を被りました。

翻訳済み

21

7

moomoo ニュース キキの報告による

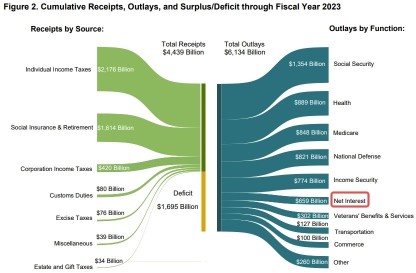

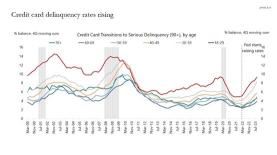

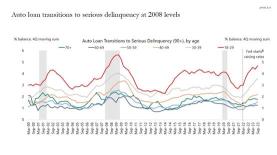

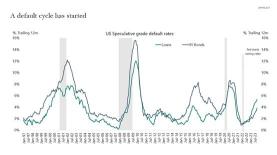

10月のCPIレポートの発表に伴い、米国のインフレが急速に減速しており、多くのアナリストが景気がソフトランディングを実現することを予想しています。しかし、いくつかの主要な経済指標は楽観的ではありません。市場は完全な除却反転に注目しており、一部の主要な指標の悪化を無視しています。これらの指標は景気後退を示唆している場合があります。

クレジットカード...

10月のCPIレポートの発表に伴い、米国のインフレが急速に減速しており、多くのアナリストが景気がソフトランディングを実現することを予想しています。しかし、いくつかの主要な経済指標は楽観的ではありません。市場は完全な除却反転に注目しており、一部の主要な指標の悪化を無視しています。これらの指標は景気後退を示唆している場合があります。

クレジットカード...

翻訳済み

+1

24

1

要約

米国株式市場は木曜日、ダウ・ジョーンズ工業株価指数がわずか60ポイント上昇し、新記録を更新した後、2日連続で上昇しました。連邦準備制度理事会の利下げ予想に対する楽観論が昨日も支配的で、急激な上昇トレンドが続いていました。国債利回りが低下し、住宅や自動車部門の利回り依存型株式が飛躍しました。

The $NYダウ (.DJI.US)$広告...

米国株式市場は木曜日、ダウ・ジョーンズ工業株価指数がわずか60ポイント上昇し、新記録を更新した後、2日連続で上昇しました。連邦準備制度理事会の利下げ予想に対する楽観論が昨日も支配的で、急激な上昇トレンドが続いていました。国債利回りが低下し、住宅や自動車部門の利回り依存型株式が飛躍しました。

The $NYダウ (.DJI.US)$広告...

翻訳済み

26

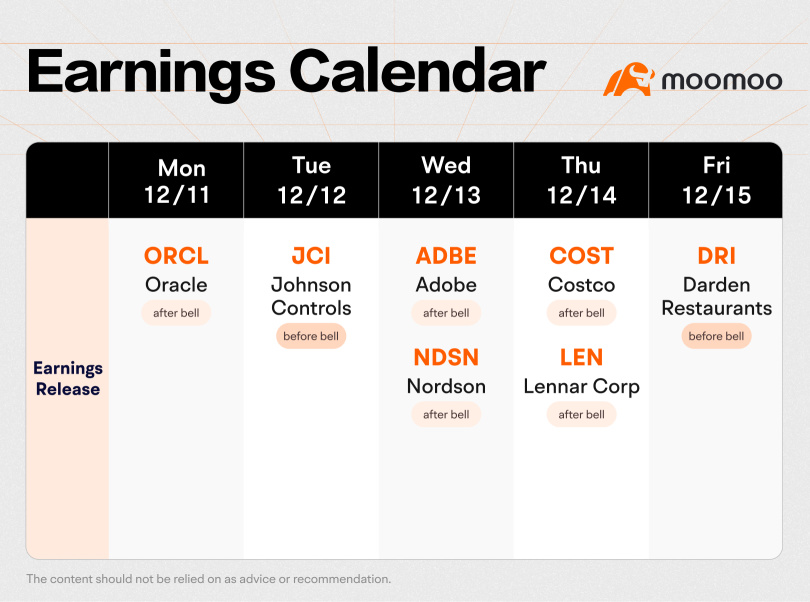

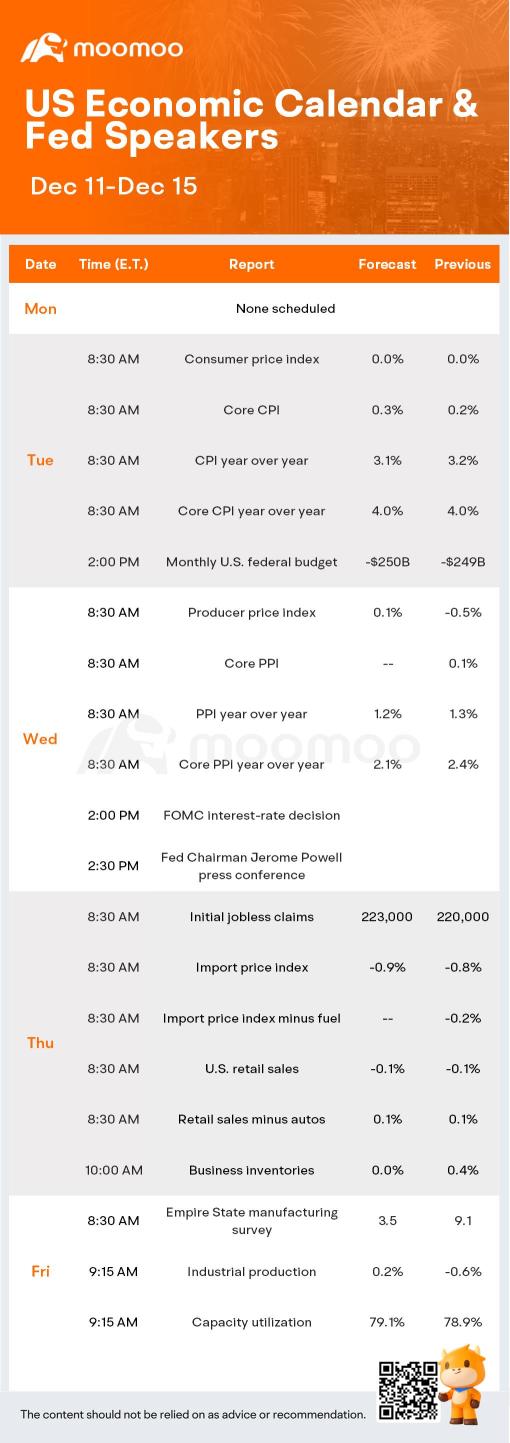

今週の主要イベントは最新のインフレデータと連邦準備委員会の12月ミーティングで、利上げについての決定は水曜日の午後に予定されています。市場は利率の変更なしを圧倒的に予想しています。連邦公開市場委員会の最新の経済および利率の予測は、今後の金融政策の方向性を示す手がかりとなるでしょう。

オラクルとAdobeの決算発表...

決算発表...

オラクルとAdobeの決算発表...

決算発表...

翻訳済み

+3

25

要約

米国株式が下落し、利回りが微増。米連邦準備理事会議長のジェローム・パウエル氏が先週、市場の予想に反し、来年の利下げに関して慎重な姿勢を示した後、投資家は経済データを待って、利上げの方向性を示唆する可能性がある。

米国株は下落し、利回りは上昇しました。投資家たちは、米国連邦準備制度理事会のジェローム・パウエル議長が先週、来年の利下げ期待に対して反発した後、景気指標に関する詳細情報を待ち望んでいます。

The $S&P 500 Index (.SPX.US)$ fell 0.5% to 4,569.78 while the $NYダウ (.DJI.US)$は0.1%下落して36,204.44で取引を終了し、

米国株式が下落し、利回りが微増。米連邦準備理事会議長のジェローム・パウエル氏が先週、市場の予想に反し、来年の利下げに関して慎重な姿勢を示した後、投資家は経済データを待って、利上げの方向性を示唆する可能性がある。

米国株は下落し、利回りは上昇しました。投資家たちは、米国連邦準備制度理事会のジェローム・パウエル議長が先週、来年の利下げ期待に対して反発した後、景気指標に関する詳細情報を待ち望んでいます。

The $S&P 500 Index (.SPX.US)$ fell 0.5% to 4,569.78 while the $NYダウ (.DJI.US)$は0.1%下落して36,204.44で取引を終了し、

翻訳済み

23

1

safri_moomoor : こんにちは、ありがとう

TheOtherGuy2022 : 数字の捏造具合によるが、もし本物で自然な数字だったら...それは株価下落を意味するはずです。

amiable Llama_6295 : 高い金利、強いドルが全てを引き摺ります。![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

104252802 : 私たちは経済成長を罰するのではなく、経済的な回復力を求めています...

Future Dc : ヒー