投稿

ニュース

最新

人気

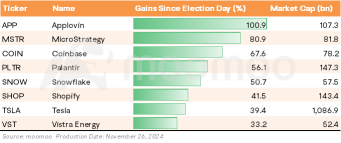

選挙から3週間後、投資家はトランプ関連政権の政策軌道に注目しています。トランプ 2.0内閣はほぼ構築され、財務長官や商務長官などの主要経済ポストの指名者はほとんど決まっています。

この環境下で、米国株式市場は不安定でした。初めは「トランプ取引」が急騰しましたが、リフレーションへの懸念から後退し、その後回復し始めました。選挙日以来、 $S&P 500 Index (.SPX.US)$上昇しました...

この環境下で、米国株式市場は不安定でした。初めは「トランプ取引」が急騰しましたが、リフレーションへの懸念から後退し、その後回復し始めました。選挙日以来、 $S&P 500 Index (.SPX.US)$上昇しました...

翻訳済み

+1

75

10

$ビットコイン (BTC.CC)$ チームを率いる適任者、企業を率いる適任者、国を率いる適任者がいると、素晴らしいことが起こることがあります。

イーロン・マスクやトランプなど、左派の失敗を修正する多くの人々がいれば、アメリカ合衆国は新たな明日に乗り出し、新たな日の始まりを迎えるかもしれません。

問題の1つは、多くの人々がこれについて話をしてきて、批判してきた中で、私自身もそのグループに属しており、社会保障に関連しています。費用は莫大であり、人々は常に、もし私が自分のお金を投資していたらと言ってきました...

イーロン・マスクやトランプなど、左派の失敗を修正する多くの人々がいれば、アメリカ合衆国は新たな明日に乗り出し、新たな日の始まりを迎えるかもしれません。

問題の1つは、多くの人々がこれについて話をしてきて、批判してきた中で、私自身もそのグループに属しており、社会保障に関連しています。費用は莫大であり、人々は常に、もし私が自分のお金を投資していたらと言ってきました...

翻訳済み

8

2

$トランプ・メディア・アンド・テクノロジー・グループ (DJT.US)$ これは来月間違いなく圧迫されるだろう

翻訳済み

3

3

トランプはカナダとメキシコからの輸入品に25%の関税を、中国からの輸入品に10%の関税を発表しました。発表の後、米ドルは上昇し、リスク感情が打撃を受けたため、オーストラリアドルは圧力を受けました。米ドルは安全資産と見なされ、一時的に0.6434まで下落し、その日は0.69%下落しました。 $豪ドル/米ドル (AUDUSD.FX)$ が一時的に0.6434まで下落し、 $ASX 200 (LIST91328.AU)$ がその日0.69%下落しました。

アメリカは直接的に輸入品に関税を課すかもしれません...

アメリカは直接的に輸入品に関税を課すかもしれません...

翻訳済み

6

$ビットコイン (BTC.CC)$トランプはまだ💩スワンプアスと囲まれていると言った。スコットバセットハウンドは、トランプの最初の任期中に全ての暴動を始めた反保守グループAntifaの主要な支援者であるジョージ・ソロスファンドを管理していた...まさか、なんて冗談だ。

$テスラ (TSLA.US)$ $エヌビディア (NVDA.US)$

$テスラ (TSLA.US)$ $エヌビディア (NVDA.US)$

翻訳済み

1

3

$トランプ・メディア・アンド・テクノロジー・グループ (DJT.US)$

パンダがローデッドを置いて、27で会いましょう

パンダがローデッドを置いて、27で会いましょう

翻訳済み

3

$SPDR S&P 500 ETF (SPY.US)$

トランプ大統領のカナダ関税により、アメリカは「重大な結果」を直面するとゴールドマンが述べる

トランプ大統領のカナダ関税により、アメリカは「重大な結果」を直面するとゴールドマンが述べる Investinは報道

トランプ大統領のカナダ関税により、アメリカは「重大な結果」を直面するとゴールドマンが述べる

トランプ大統領のカナダ関税により、アメリカは「重大な結果」を直面するとゴールドマンが述べる Investinは報道

翻訳済み

1

1

$エヌビディア (NVDA.US)$ 過剰な価格設定で、大手企業はトランプの関税詳細を待っています

翻訳済み

1

Goldmanは、中央銀行の需要、連邦準備制度の利下げ、リスク回避により、2025年までに金が1オンス3,000ドルに達すると予測しています。

2025年には、OPEC+およびトランプの関税により原油価格が1バレル70~85ドルで推移する可能性がありますが、2026年末には1バレル61ドルまで下落する可能性があります。

$WTI 原油(2501) (CLmain.US)$ $ブレント(2502) (BZmain.US)$ $オクシデンタル・ペトロリアム (OXY.US)$ $エクソン・モービル (XOM.US)$

2025年には、OPEC+およびトランプの関税により原油価格が1バレル70~85ドルで推移する可能性がありますが、2026年末には1バレル61ドルまで下落する可能性があります。

$WTI 原油(2501) (CLmain.US)$ $ブレント(2502) (BZmain.US)$ $オクシデンタル・ペトロリアム (OXY.US)$ $エクソン・モービル (XOM.US)$

翻訳済み

1

103492837 : 共有してくれてありがとう

MsMay : P

104088143 : どうですか

103811630 : 「Q

103681739 : 年末は資本を投入する良い時期であることを知っているのは良いことです

もっとコメントを見る...