最新

人気

11月のスタートからナイスなランアップが続いています。

過去2週間でS&P500は約7%上昇しました。明日の消費者物価指数は現在の上昇が続くかどうかを決定する上で重要になる可能性があります。

水曜日の小売販売データは、消費者支出の健康状態についての手がかりを提供することができます。投資家は、経済が減速しているかどうかを見たいと思うでしょう。

これらはすべて重要なデータポイントであり、連邦準備制度理事会が次の決定をするのに役立ちますが、市場は今年の追加利上げを織り込んでいません。

$ホームデポ (HD.US)$ $ウォルマート (WMT.US)$ $ターゲット (TGT.US)$ $SPDR S&P 500 ETF (SPY.US)$ $S&P 500 Index (.SPX.US)$ ��������...

過去2週間でS&P500は約7%上昇しました。明日の消費者物価指数は現在の上昇が続くかどうかを決定する上で重要になる可能性があります。

水曜日の小売販売データは、消費者支出の健康状態についての手がかりを提供することができます。投資家は、経済が減速しているかどうかを見たいと思うでしょう。

これらはすべて重要なデータポイントであり、連邦準備制度理事会が次の決定をするのに役立ちますが、市場は今年の追加利上げを織り込んでいません。

$ホームデポ (HD.US)$ $ウォルマート (WMT.US)$ $ターゲット (TGT.US)$ $SPDR S&P 500 ETF (SPY.US)$ $S&P 500 Index (.SPX.US)$ ��������...

翻訳済み

From YouTube

1

2

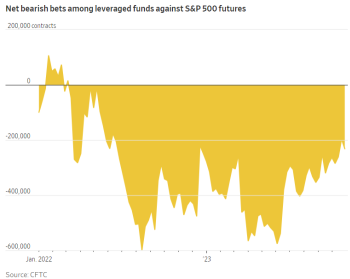

2023年が終わりに近づく中、ウォールストリートが経済に対して予測した暗い見通しは裏切られそうです。 $S&P 500 Index (.SPX.US)$ 過去10回の取引セッションで9回上昇し、過去2週間で7.2%増加したことから、多くの投資家は株式市場の上昇が続くと信じています。 ラリーは続く可能性がある。

なぜ市場が急変したのでしょうか?

米国財務省は、長期債入札規模の増加が予想より小さいことを発表しました。 ...

なぜ市場が急変したのでしょうか?

米国財務省は、長期債入札規模の増加が予想より小さいことを発表しました。 ...

翻訳済み

+1

19

11月8日までの7日間、連邦準備制度理事会が利子を変更しない決定を下したことにより、国債価格が反転することを期待して、米国投資家たちはすべて投信に莫大な資金を流入させました。

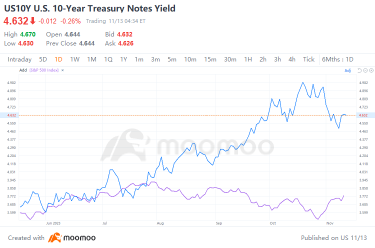

先週、雇用の増加の減速を示す米労働省の報告書が発表され、債券価格が上昇しました。価格に逆相関する基準の米国10年債券の利回りは、先週金曜日に5週間ぶりの低水準である4.484%に下落しました。

先週、雇用の増加の減速を示す米労働省の報告書が発表され、債券価格が上昇しました。価格に逆相関する基準の米国10年債券の利回りは、先週金曜日に5週間ぶりの低水準である4.484%に下落しました。

翻訳済み

8

今週は軍事会議、米国のインフレと小売売上高、そして「Fourfecta」と呼ばれる買い物フレンジーが注目の的です。取引や投資に関する影響を考慮する必要があることをカバーします。

_________

APECサミットでの軍事会議

両国のトップである米国のジョー・バイデン大統領と中国の習近平主席が、木曜日(米国時間)に会う際には、米中軍事交流が優先事項となります。関係が断絶された間隔が一年ぶりの再会であり、習氏にとっては6年ぶりの米国訪問になります。投資のヒントのために軍事と貿易のメディア発表に注目しましょう。

_________

APECサミットでの軍事会議

両国のトップである米国のジョー・バイデン大統領と中国の習近平主席が、木曜日(米国時間)に会う際には、米中軍事交流が優先事項となります。関係が断絶された間隔が一年ぶりの再会であり、習氏にとっては6年ぶりの米国訪問になります。投資のヒントのために軍事と貿易のメディア発表に注目しましょう。

翻訳済み

27

1

米国株式市場は、週のスタートを2週続けての上昇を背景にスタートする予定です。

先週金曜日、ナスダックは2%以上上昇し、5月26日以来の最大の一日の上昇を記録しました - テック業種をリードしたMagnificent 7による急上昇の結果です。

強気の季節性トレンドは現在非常にうまく進行しています。一部の調整が予想されますが、主要水準が維持されれば問題ないはずです。

$S&P500(2412) (ESmain.US)$ $NASDAQ-100(2412) (NQmain.US)$ $WTI 原油(2501) (CLmain.US)$ $SPDR ダウ工業株平均 ETF (DIA.US)$ $NYダウ (.DJI.US)$ $NYダウ(2412) (YMmain.US)$ $iシェアーズ 米国国債 20年超 ETF (TLT.US)$ $米国債10年 (US10Y.BD)$ $米国債30年 (US30Y.BD)$ $HP (HPQ.US)$

先週金曜日、ナスダックは2%以上上昇し、5月26日以来の最大の一日の上昇を記録しました - テック業種をリードしたMagnificent 7による急上昇の結果です。

強気の季節性トレンドは現在非常にうまく進行しています。一部の調整が予想されますが、主要水準が維持されれば問題ないはずです。

$S&P500(2412) (ESmain.US)$ $NASDAQ-100(2412) (NQmain.US)$ $WTI 原油(2501) (CLmain.US)$ $SPDR ダウ工業株平均 ETF (DIA.US)$ $NYダウ (.DJI.US)$ $NYダウ(2412) (YMmain.US)$ $iシェアーズ 米国国債 20年超 ETF (TLT.US)$ $米国債10年 (US10Y.BD)$ $米国債30年 (US30Y.BD)$ $HP (HPQ.US)$

翻訳済み

From YouTube

CPI、小売販売データ、バイデンと習近平の会見、政府のシャットダウンの可能性、オペックスデーなど、この週は注目する価値があります。

巨大な波乱が予想されます。

$バンガード・S&P 500 ETF (VOO.US)$ $iシェアーズ ラッセル 2000 ETF (IWM.US)$ $Russell 3000 Index Ishares (IWV.US)$ $Russell Midcap Index Ishares (IWR.US)$ $恐怖指数 CBOE Volatility S&P 500 (.VIX.US)$ $米ドル指数 (USDindex.FX)$ $エンフェーズ・エナジー (ENPH.US)$ $コカコーラ (KO.US)$ $スターバックス (SBUX.US)$ $ジョンソン・エンド・ジョンソン (JNJ.US)$

巨大な波乱が予想されます。

$バンガード・S&P 500 ETF (VOO.US)$ $iシェアーズ ラッセル 2000 ETF (IWM.US)$ $Russell 3000 Index Ishares (IWV.US)$ $Russell Midcap Index Ishares (IWR.US)$ $恐怖指数 CBOE Volatility S&P 500 (.VIX.US)$ $米ドル指数 (USDindex.FX)$ $エンフェーズ・エナジー (ENPH.US)$ $コカコーラ (KO.US)$ $スターバックス (SBUX.US)$ $ジョンソン・エンド・ジョンソン (JNJ.US)$

翻訳済み

From YouTube

4

ウォール街の主要指数は金曜日に大幅な上昇で終了し、重量級のテック株や成長株が利回りが落ち着いたことで後押しされました。また、投資家たちは来週のインフレやその他の経済データに向けて注目しています。

テクノロジー株中心のナスダック・コンポジット指数(.IXIC)は、5月26日以来で最大の1日のパーセンテージ上昇を記録しました。

連邦準備制度理事会のジェローム・パウエル議長の鷹派発言に続く前日の株価下落に反発し、株式市場は回復しました。木曜日の下落により、S&P500(.SPX)とナスダックは2年ぶりの最長連続上昇記録が終了しました。

テクノロジー株中心のナスダック・コンポジット指数(.IXIC)は、5月26日以来で最大の1日のパーセンテージ上昇を記録しました。

連邦準備制度理事会のジェローム・パウエル議長の鷹派発言に続く前日の株価下落に反発し、株式市場は回復しました。木曜日の下落により、S&P500(.SPX)とナスダックは2年ぶりの最長連続上昇記録が終了しました。

翻訳済み

5

こんにちは、mooerたち!本日の株式市場の最新ニュースをチェックしてください!

• テック志向のナスダックコンポジットが5月以来の最高値を記録

• ASXが下落、ANZが下落

• 観察すべき株式:ANZ、Ramsay Health Care、TPG Telecom

- MoomooニュースAU

ウォールストリートの概要

アメリカ株は勝利の週を記録し、金曜日に上昇しました、 $Nasdaq Composite Index (.IXIC.US)$5か月以上ぶりの最高値を記録しました。

テクノロジー株が牽引する指数は2%急騰し、5月26日以来の最大の上昇率となりました。

• テック志向のナスダックコンポジットが5月以来の最高値を記録

• ASXが下落、ANZが下落

• 観察すべき株式:ANZ、Ramsay Health Care、TPG Telecom

- MoomooニュースAU

ウォールストリートの概要

アメリカ株は勝利の週を記録し、金曜日に上昇しました、 $Nasdaq Composite Index (.IXIC.US)$5か月以上ぶりの最高値を記録しました。

テクノロジー株が牽引する指数は2%急騰し、5月26日以来の最大の上昇率となりました。

翻訳済み

5

S&P500とNasdaqは2年ぶりの最長勝ち越しを記録しました。 Maginificent 7 に率いられたテクノロジー業界は大きな盛り上がりを見せました。

アルファベットを除く6つのメガキャップ株式は全て2%以上の上昇を記録しました。マイクロソフトは史上最高値を更新し、大幅に上昇しました!

市場は8月から10月までの期間に失った市場価値のかなりを回復しました。

今、みんなの心にある鍵となる問題は、株式市場の上昇が続くかどうかです。...

アルファベットを除く6つのメガキャップ株式は全て2%以上の上昇を記録しました。マイクロソフトは史上最高値を更新し、大幅に上昇しました!

市場は8月から10月までの期間に失った市場価値のかなりを回復しました。

今、みんなの心にある鍵となる問題は、株式市場の上昇が続くかどうかです。...

翻訳済み

From YouTube

7

4

パウエル氏の鷹派的コメントにもかかわらず、トレーダーたちは大半が無視し、市場は回復した。24億ドルの30年債入札に問題があり、長期債への需要の減退についての懸念が高まっている。強いQ3パフォーマンスとテックセクターの堅調な動きは、フェッドの利上げ不透明性のなかで収益を高めている。

翻訳済み

1

Hoguer07 : どうすればいいですか?すでに試したオプションがあり、別のレベルが必要だと言われ続けています。

Cow Moo-ney スレ主 Hoguer07 : こんにちは、moomooに連絡する必要があるかもしれません。アシスタンスを受けるために。