最新

人気

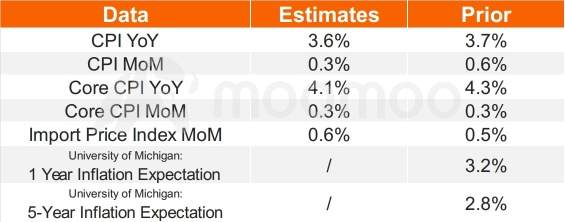

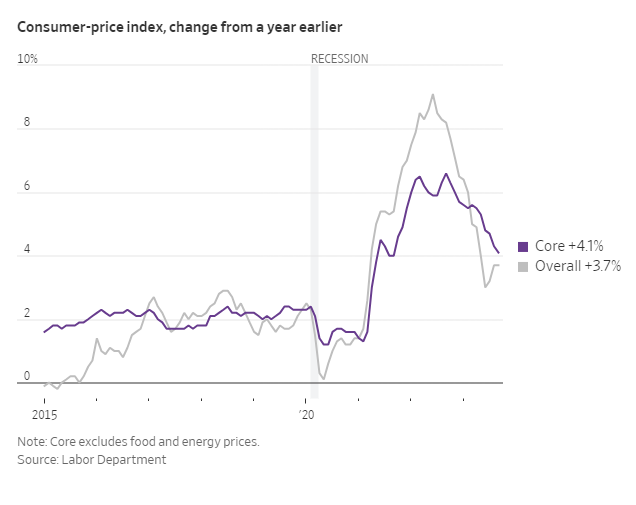

労働統計局は木曜日の東部標準時8時30分に9月の消費者物価指数を発表します。エコノミストは、2か月連続で上昇傾向が続いた後、9月のインフレ率は上昇傾向を逆転させると予想しています。

ブルームバーグのデータによると、前年比CPIインフレ率は3.6%(以前の3.7%に対して)に低下し、年間のコアインフレ率は以前の4.3%から4.1%に減速します。前月比では、ヘッドラインとコアCPIのインフレ率の両方が...

ブルームバーグのデータによると、前年比CPIインフレ率は3.6%(以前の3.7%に対して)に低下し、年間のコアインフレ率は以前の4.3%から4.1%に減速します。前月比では、ヘッドラインとコアCPIのインフレ率の両方が...

翻訳済み

+5

24

5

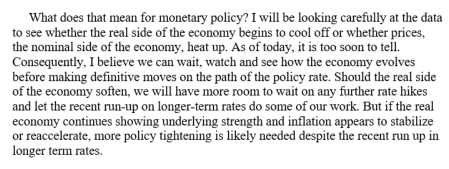

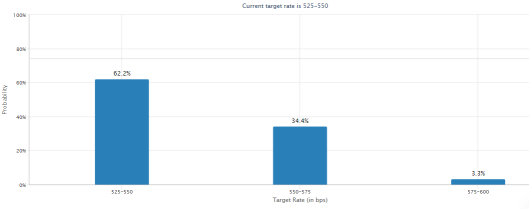

フェッドのガバナーであるクリス・ウォーラーは11月の一時停止を支持します。

その後、9月のように成長が低下した場合は、中立の状態を維持してください。

しかし、強力な需要がインフレに対する最近の進展を止めた場合、「タイムリーな方法で反応しないことは、私たちがこれまでに行ってきた作業を無効にするリスクを引き起こす」。

$Nasdaq Composite Index (.IXIC.US)$ $NYダウ (.DJI.US)$ $S&P 500 Index (.SPX.US)$ $インベスコQQQ 信託シリーズ1 (QQQ.US)$ $SPDR S&P 500 ETF (SPY.US)$

その後、9月のように成長が低下した場合は、中立の状態を維持してください。

しかし、強力な需要がインフレに対する最近の進展を止めた場合、「タイムリーな方法で反応しないことは、私たちがこれまでに行ってきた作業を無効にするリスクを引き起こす」。

$Nasdaq Composite Index (.IXIC.US)$ $NYダウ (.DJI.US)$ $S&P 500 Index (.SPX.US)$ $インベスコQQQ 信託シリーズ1 (QQQ.US)$ $SPDR S&P 500 ETF (SPY.US)$

翻訳済み

3

1

1

木曜日(10月19日)の取引開始時に、ウォール街とヨーロッパで前日の損失に続き、シンガポール株式は下落しました。

$FTSE Singapore Straits Time Index (.STI.SG)$0.9%下落しました0.8%下落し、9時1分時点で25.12ポイント下落して3,111.50になりました。市場全体では、84.1百万ドル相当の84.8百万の証券が取引され、94銘柄が上昇し、38銘柄が下落しました。最も活発な出来高を誇る銘柄は、「その他」となり、3,670万株取引され、1.7%下落し、S$0.119からS$0.002下落しました。

出来高で最も活発なカウンターは, $セムコープ・マリン (S51.SG)$、これに続いて1.7%下落しました。

$FTSE Singapore Straits Time Index (.STI.SG)$0.9%下落しました0.8%下落し、9時1分時点で25.12ポイント下落して3,111.50になりました。市場全体では、84.1百万ドル相当の84.8百万の証券が取引され、94銘柄が上昇し、38銘柄が下落しました。最も活発な出来高を誇る銘柄は、「その他」となり、3,670万株取引され、1.7%下落し、S$0.119からS$0.002下落しました。

出来高で最も活発なカウンターは, $セムコープ・マリン (S51.SG)$、これに続いて1.7%下落しました。

翻訳済み

2

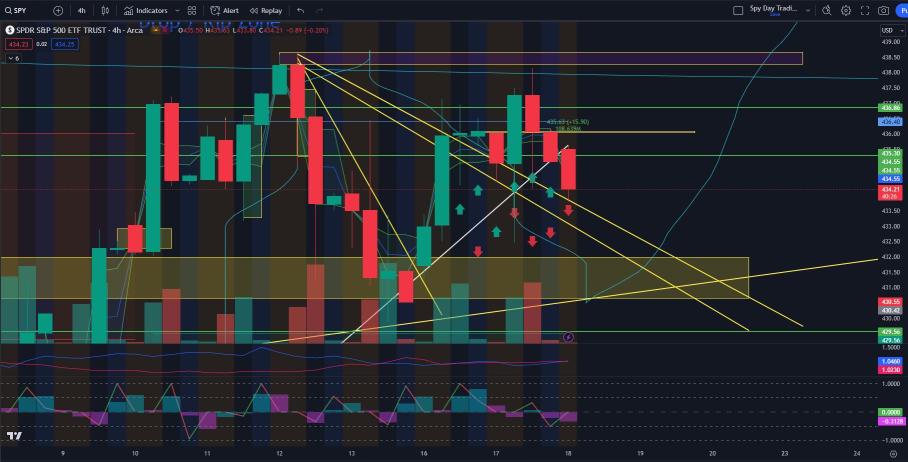

皆さん、おはようございます。MooMooの#1未評価のマーケット分析、ザ・マーケットへようこそ!

もし昨日の版をまだ読んでいない場合は、こちらで読むことができます。市場私たちは市場を分析し、さまざまな取引アイデアを提供しました。

昨日は信じられない一日でした! 小さな損失を数回しましたが、大きな取引がアップサイドにありました 。市場が反転すると予測したでしたが、私は取引を早すぎるタイミングでカットしてしまったので、これはルールに従っているから大丈夫です。

もし昨日の版をまだ読んでいない場合は、こちらで読むことができます。市場私たちは市場を分析し、さまざまな取引アイデアを提供しました。

昨日は信じられない一日でした! 小さな損失を数回しましたが、大きな取引がアップサイドにありました 。市場が反転すると予測したでしたが、私は取引を早すぎるタイミングでカットしてしまったので、これはルールに従っているから大丈夫です。

翻訳済み

+13

4

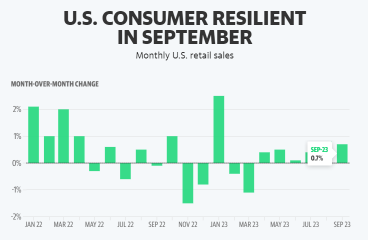

Despite high interest rates and concerns over a weakening economy, retail sales in September increased by 0.7%, which is well above the estimated 0.3%. Gas station sales played a significant role in this growth due to a rise of 0.9% triggered by an increase in gas prices.

Read Here: Here's the Breakdown for Monthly Retail Sales in September

The U.S. consumer cannot stop spending," said David Russell, global head of market strate...

Read Here: Here's the Breakdown for Monthly Retail Sales in September

The U.S. consumer cannot stop spending," said David Russell, global head of market strate...

18

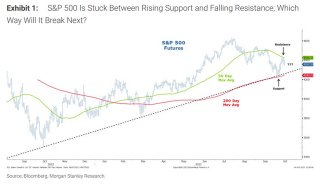

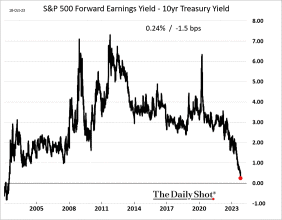

モルガン・スタンレーのマイク・ウィルソンは、今年末に株式がその価値の10%を失うことを示す3900ポイントで終了すると予測しています $S&P 500 Index (.SPX.US)$ 本年度の終わりまでに、モルガン・スタンレーのマイク・ウィルソンは、株式がその価値の10%を失うことを示す3900ポイントで終了すると予測しています

S&P500は今月、波乱の9月を経て、5%急落した後、着実な成長を遂げました。今年はこれまでにほぼ15%の利益を上げています

消費関連の信頼感は、大学の調査データによると弱まっています...

S&P500は今月、波乱の9月を経て、5%急落した後、着実な成長を遂げました。今年はこれまでにほぼ15%の利益を上げています

消費関連の信頼感は、大学の調査データによると弱まっています...

翻訳済み

22

5

ハーカー氏は、インフレ抑制を評価するために連邦準備制度理事会が来年まで待つ可能性を見ています。報告によると、強力なデータにも関わらずビジネスの減速が示唆されています。インフレ率が2%近くになると利上げが考慮されます。資産ポートフォリオの減少ペースが緩やかになる可能性が議論されています。

翻訳済み

基本的には歴史の全ての段階で、連邦準備制度理事会は自己資金調達ができ、利益を上げて財務省(納税者)に送金しています。今連邦準備制度理事会は急速に資産を失い、投資に失敗し、債務が資産を上回ることになるでしょう。

技術的には、連邦準備制度は無限にお金を作り出すことができるため、実際に破産することはできません。しかし、それは世界に対して連邦準備制度がドルの価値のコントロールを失っている程度を示すことになるでしょう。

技術的には、連邦準備制度は無限にお金を作り出すことができるため、実際に破産することはできません。しかし、それは世界に対して連邦準備制度がドルの価値のコントロールを失っている程度を示すことになるでしょう。

翻訳済み

3

2. 8月の小売販売は、以前の0.6%の上昇から0.8%の増加に修正されました。

3. 自動車やガソリンのカテゴリーを取り除いた後のコア小売販売は、+0.2%の期待を軽く超えて、0.6%上昇しました。

3. 自動車とガスのカテゴリを除外した後、コア小売販売は0.6%上昇し、+0.2%の予想を大幅に上回りました。

4. 8月のコア小売販売は、0.6%から0.9%に上方修正されました。

5. ガソリンやエネルギー価格が上昇しているにも関わらず、米国の消費関連は強靭なままです。

3. 自動車やガソリンのカテゴリーを取り除いた後のコア小売販売は、+0.2%の期待を軽く超えて、0.6%上昇しました。

3. 自動車とガスのカテゴリを除外した後、コア小売販売は0.6%上昇し、+0.2%の予想を大幅に上回りました。

4. 8月のコア小売販売は、0.6%から0.9%に上方修正されました。

5. ガソリンやエネルギー価格が上昇しているにも関わらず、米国の消費関連は強靭なままです。

翻訳済み

2

safri_moomoor : 分かりました、いいです

104281896 safri_moomoor : $Bitcoin (BTC.CC)$

KenParks Jr. : クールネス

Revelation 6 : FRBは金利を0.25%引き上げるべきです。このCPIレポートは政治的な冗談で、現実にはほど遠いです。

Smeltzer Gloria : Top Dogsは、従来の清掃を超える優れた家や屋根の洗浄サービスを提供しています。彼らの専門的な専門知識により、家の外壁を若返らせ、汚れ、さらには頑固な汚れさえも取り除きます。彼らの屋根洗浄サービスは家のメンテナンスの重要な一面であり、屋根の見栄えを良くしながら寿命を延ばします。Top Dogsの品質と顧客満足への取り組みは、すべての仕事に表れています。清潔な家だけでなく、安心感ももたらします。経験豊富なチームと一流の設備で、清潔で活気のある家の外観を実現し、近所で目立つ新鮮で清潔で魅力的な物件をお届けします。詳細については、以下をご覧ください。https://www.topdogslandscape.com/house-washing-roof-washing/