最新

人気

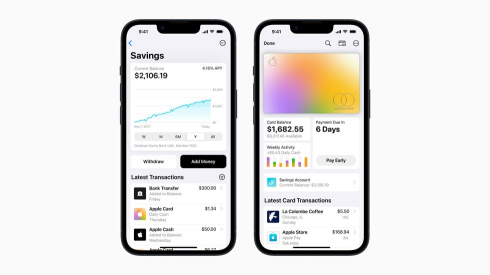

$アップル (AAPL.US)$は、Apple Cardハイイールド貯蓄口座をから導入しました。会社は月曜日のリリースで述べています。 $ゴールドマン・サックス (GS.US)$この口座には手数料、最低入金額、最低残高要件がなく、年間利回りは4.15%です。

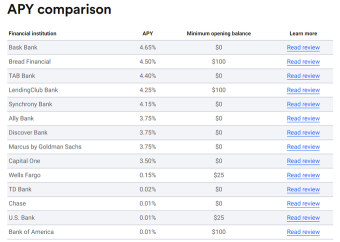

この口座は手数料、最低預入額、最低残高要件がなく、年間利回りは4.15%を提供しています。 2021年4月12日現在、貯蓄口座の全国平均利回りは0.24%APYです。AAPLの提供するものは全国平均の10倍以上になります。AAPLは10倍以上になるでしょう。

この口座は手数料、最低預入額、最低残高要件がなく、年間利回りは4.15%を提供しています。 2021年4月12日現在、貯蓄口座の全国平均利回りは0.24%APYです。AAPLの提供するものは全国平均の10倍以上になります。AAPLは10倍以上になるでしょう。

翻訳済み

+1

12

1

うわー、Appleは4.15%の金利を与える普通預金口座を提供しています。もっと多くの大手テクノロジー企業が追随するでしょうか?そうなると、従来の銀行が脅威にさらされます。

$アップル (AAPL.US)$ $ゴールドマン・サックス (GS.US)$

$アップル (AAPL.US)$ $ゴールドマン・サックス (GS.US)$

翻訳済み

2

2

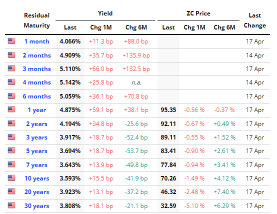

1.資産Pass負担

銀行の業務は本来リスクがある金融Pass負担に基づいています。

このPass負担は、(1)銀行がすべての預金者に支払うための現金を十分に保有していない場合、(2)彼らの主要資産が短期間内に返済されない場合、および(3)融資が顔面価格に近い価値で売却される場合、特に売却にかなりの時間がかかります。銀行はinterest ratesの費用、その他の部分に関してリスクに直面しています。

銀行の業務は本来リスクがある金融Pass負担に基づいています。

このPass負担は、(1)銀行がすべての預金者に支払うための現金を十分に保有していない場合、(2)彼らの主要資産が短期間内に返済されない場合、および(3)融資が顔面価格に近い価値で売却される場合、特に売却にかなりの時間がかかります。銀行はinterest ratesの費用、その他の部分に関してリスクに直面しています。

翻訳済み

3

アップルすごい! $アップル (AAPL.US)$🔥🔥🚀🚀

これは一般の銀行にとって本格的な競争だ!一般の銀行にランが生じる可能性があるだろうか?はい、そうかもしれない。

アップルは世界で最も大きな企業であり、銀行を倒す力を持っていると思う。

スウェーデンの銀行はこれに匹敵する利回りを提供していません!

$Nasdaq Composite Index (.IXIC.US)$ $クレディ・スイス・グループ (CS.US)$ $ジェイピー・モルガン・チェース (JPM.US)$ $ゴールドマン・サックス (GS.US)$

これは一般の銀行にとって本格的な競争だ!一般の銀行にランが生じる可能性があるだろうか?はい、そうかもしれない。

アップルは世界で最も大きな企業であり、銀行を倒す力を持っていると思う。

スウェーデンの銀行はこれに匹敵する利回りを提供していません!

$Nasdaq Composite Index (.IXIC.US)$ $クレディ・スイス・グループ (CS.US)$ $ジェイピー・モルガン・チェース (JPM.US)$ $ゴールドマン・サックス (GS.US)$

翻訳済み

1

UFBダイレクトは、5.02%の利回りの無料の貯蓄口座を提供していますが、私は90%を長期的に株式市場に投資しています。

翻訳済み

1

little baron :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)