プラグパワーのショートスクイーズは29300万株の空売りが期待されています。プラグは人工知能エネルギーアドバンテージを持っています。

プラグパワー株は間もなく$4までのショートスクイーズが倍増するかもしれません。人工知能に基づく投資です

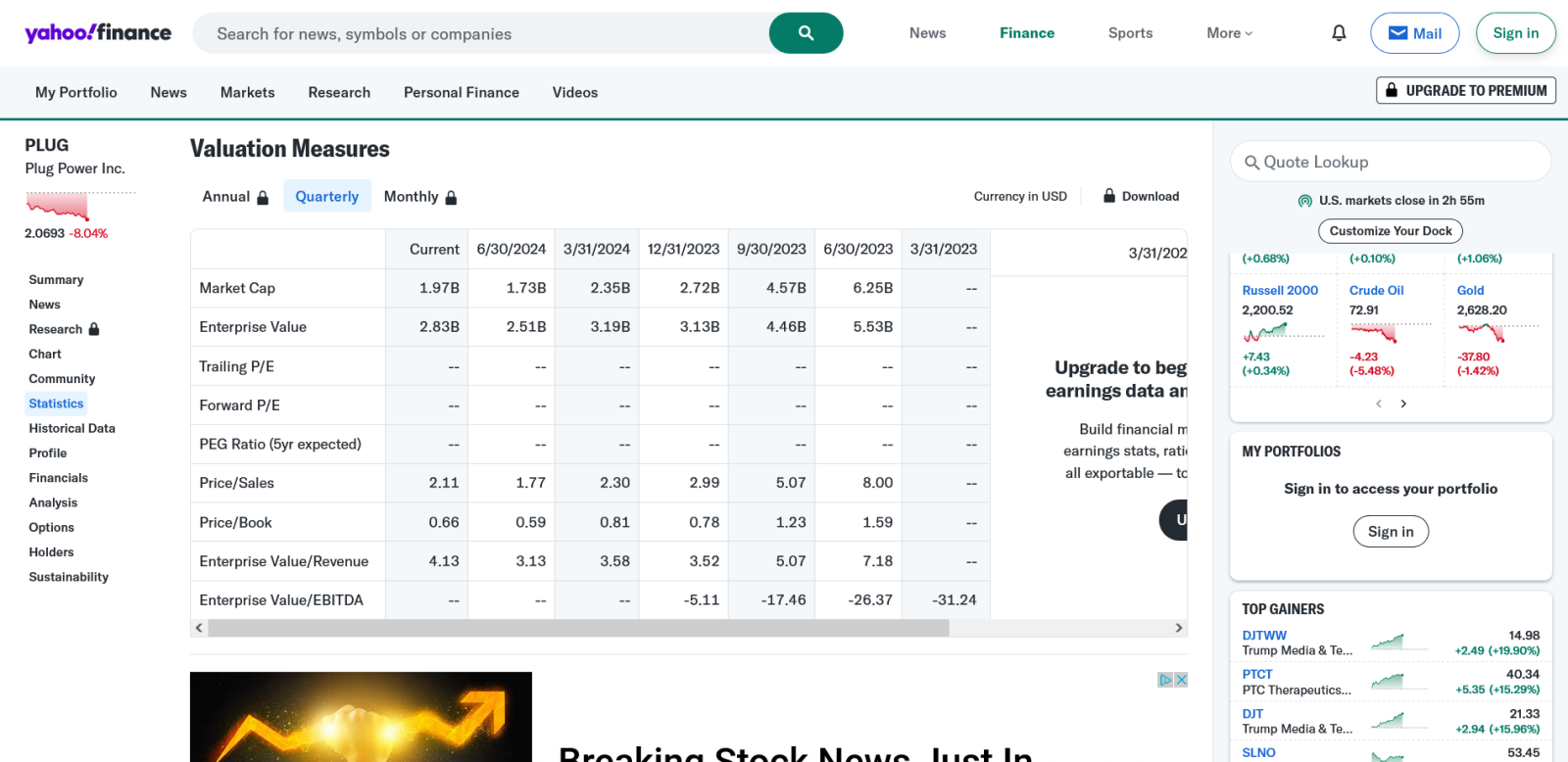

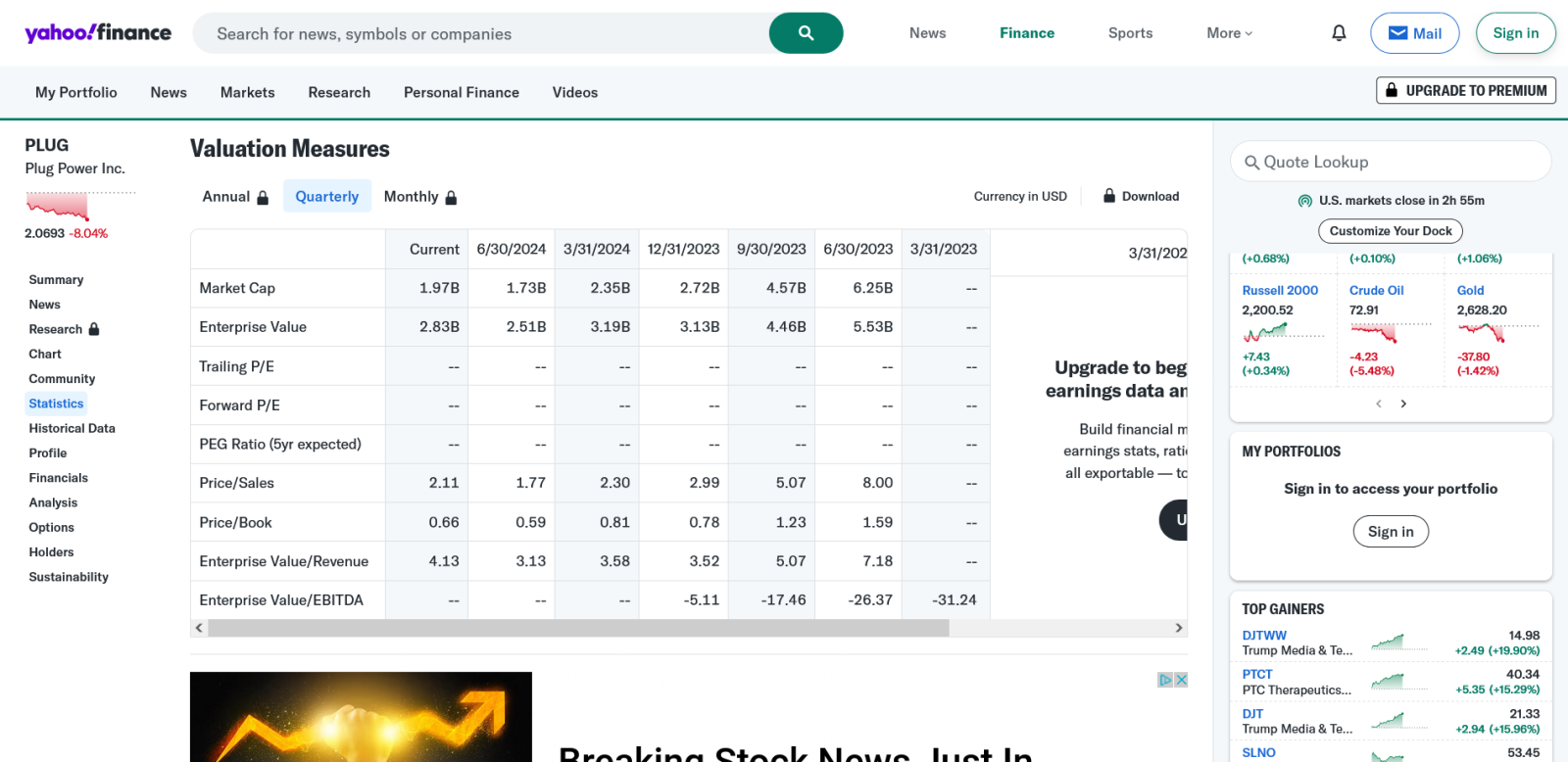

$プラグ・パワー (PLUG.US)$ プラグはショートセラーに打ち負かされましたが、会社は2025年に著しいリターンを生み出す準備を整えました。現在の株価は2.07ドルで、時価簿価値の3.79ドルを下回って取引されています。ショートセラーは公開フロートの31%を保有し、記録の29300万株を保有しています。究極のショートスクイーズは近い将来実現可能です。一部の #WALLSTREETBETSグループのトレーダーはプラグに多くの買いポジションを取り始めました。プラグは非常に自信を持っており、非常に堅実な未来を予測しています。今購入すると、低いダウンサイドリスクと素晴らしいアップサイドリターンが得られます。エネルギー&EV株をいくつか保有している場合、すでに $EVゴー (EVGO.US)$ $ニオ (NIO.US)$ $リビアン・オートモーティブ・インク (RIVN.US)$ $テスラ (TSLA.US)$ $ルーシッド・グループ (LCID.US)$ $フュエルセル・エナジー (FCEL.US)$ $ブリンク・チャージング (BLNK.US)$ $チャージポイント・ホールディングス (CHPT.US)$ $ニコラ (NKLA.US)$ $AMCエンターテインメント クラスA (AMC.US)$ $ゲームストップ クラスA (GME.US)$ $チューイー クラスA (CHWY.US)$ エネルギーおよび電気自動車関連株を保有している場合、PLUGを追加することをお勧めします。

人工知能革命におけるプラグの役割

プラグの燃料セル革新

プラグは水素革命の最前線に立ち、その開発と展開を先導しています 水素と燃料セルテクノロジー さまざまなセクターを横断して。幅広い用途に設計された頑丈な燃料セルソリューションポートフォリオを備え、マテリアルハンドリングユニットから大規模なエネルギーシステムまで、プラグは緑のエネルギー未来への移行を推進しています。

プラグのミッションの核には、革新と持続可能性への取り組みがあり、それは燃料電池での数十年に及ぶ活動を通じて明らかになっています。2023年には、プラグは太陽光と風力源を使用して、1日あたり15トンの水素を生産する国内初の緑の水素製造プラントを開設しました。プラグは、エネルギー解決策が緑色でありながら実用的である未来への道を切り拓いていく中で、より多くの生産プラントを建設中です。 $エヌビディア (NVDA.US)$ $スーパー・マイクロ・コンピューター (SMCI.US)$ $アドバンスト・マイクロ・デバイシズ (AMD.US)$ $アルファベット クラスC (GOOG.US)$ $マイクロソフト (MSFT.US)$ $オラクル (ORCL.US)$

緑のエネルギーでGenerative AIを強化する

Generative AIのエネルギー需要は膨大で拡大していますが、強大なパワーには地球と将来世代への責任が伴います。これを認識し、プラグの燃料電池はGenerative AIテクノロジーの基盤となるデータセンターと計算インフラを動かすための必須ソリューションとして浮上しています。 データセンターを動かすためのプラグの燃料電池 およびGenerative AIテクノロジーの基盤となる計算インフラを支える

プラグの燃料電池はAIセクターに対していくつかの利点を提供しています:

– 中断のない電源供給: AI計算の連続的な運用を保証し、データの損失や計算エラーのリスクを排除するために、大規模なモデルの訓練や実行が行われます。

– 炭素排出量の削減: エネルギーの中断によるデータの損失や計算エラーのリスクを排除することにより、AIテクノロジーの持続可能な環境での成長を実現し、地球規模での気候変動への取り組みと一致しています。

– 拡張可能なソリューション: Generative AIの採用が拡大するにつれて、スケーラブルなエネルギーソリューションの必要性が重要となります。プラグの燃料電池は、この増加する需要に効率的にスケーリングされ、エネルギーインフラが技術革新に遅れることなく適応することを保証します。

水素燃料電池をAI技術のエネルギーミックスに統合することで、プラグは持続可能性と信頼性の即座の課題だけでなく、イノベーションと環境責任が共存する未来の舞台を築いています。

これらの取り組みは、先端技術とクリーンエネルギーソリューションの間に共生関係がある可能性と必要性を裏付けています。

Generative AIと環境エネルギーの将来展望

Generative AIとクリーンエネルギーの先物は単に絡み合っているだけでなく、相互に依存しています。AI技術の進歩は、成長するAIシステムのエネルギー需要にスケーリングできる持続可能で信頼性の高いエネルギー解決策の開発に依存しています。

プラグは革新的な燃料セルソリューションを提供し、技術と持続可能性が共存し、お互いを推進する方法の設計図を提供する革命の最前線に立っています。

PLUGが未来を見据える中、人工知能のイノベーターとプラグのようなクリーンエネルギーのリーダーとの協力はますます重要となります。生成AIの可能性は莫大であり、しかし、その可能性を実現して惑星を守る方法には、産業全体でのコミットメント、イノベーション、パートナーシップが必要です。

持続可能な技術的未来への旅は、進歩の再定義の機会であり、責任ある革新と、技術の未来がスマートであるだけでなく、環境に配慮したことを実証する機会でもあります。プラグのような企業が先導する中、持続可能で人工知能による未来への道はこれまでにないほど楽観的です。

私のファンドは成長の見込みが非常に高いPLUGに投資しています。ショート売りの方はカバーしてロングポジションを取ることが賢明でしょう。

ローン保証書

2024年5月、DOEのローンプログラムオフィス(LPO)は、プラグパワーに最大16.6億ドルのローン保証を提供するための条件付き承諾を発表しました。この資金援助は、プラグパワーがきれいな水素を生産するための最大6つの施設を建設するのを助けます。

7月にPLUGは1株2.54ドルで7800万株を売り、20000万ドルを調達しました。

2024年12月QTRには、プラグは売上高が51%増加することを予想しています。2025年には、PLUGの売上高の伸び率は45%から55%と推定されています。

水素電解装置テクノロジー

プラグ・パワーのプロトン交換膜(PEM)電解装置は、電気分解によって水を酸素と水素に分解します。そのモジュラータイプのGenFuelシステムは、サブメガワットから10メガワットの種類に柔軟に対応し、現地で1日4,250キログラムの水素を生産します。

一般的に、水素はディーゼルやガソリンのような高排出の燃料源よりもクリーンであり、持続可能性目標を追求する法人顧客にとって有望です。水素の唯一の排出物は、燃焼中に水蒸気のみです。しかし、水素の製造はプロセスで使用される電気のクリーンさによるため、完全に排出物ゼロではありません。世界のほとんどの水素は、天然ガスに基づいた蒸気およびメタンを使って、化石燃料から作られています。

グリーン水素 アマゾンの電解装置などの展開は、太陽光パネルや風力タービンから電力を利用しています。アマゾンの最新の持続可能性レポートによると、同社の電力消費量の約90%は、20 GWの400以上の再生可能エネルギープロジェクトで構成されるグローバル拠点からのものです。同社は、164の風力発電所とソーラーファーム、237のルーフトップソーラープロジェクトを設置しています。

水素燃料電池フォークリフトの動力

電解装置によって生産された水素は、アマゾンのコロラド州オーロラのフルフィルメントセンターにおける既存の給水インフラストラクチャーおよび燃料電池をサポートします。プラグ・パワーは、電解機および水素蓄積システムを設計、設置し、稼働させ、継続的なメンテナンスを提供します。プラグ・パワーの現地モデルにより、顧客は再生可能エネルギーからの余剰電力を利用して水素を生産および蓄えることができ、液化および供給物質の輸送からの排出量を抑制できます。

2022年には、同社がアマゾンの輸送および建物の種類に年間10,950トンの緑水素を供給することに合意しており(2025年から開始)、この契約により、30,000台のフォークリフトまたは800台の長距離トラックに十分な電力が供給されます。当時、アマゾンは70のフルフィルメントセンターに水素貯蔵および供給システムを備え、15,000台以上の燃料電池式フォークリフトを動かしています。プラグパワーの現地製造の電解装置モデルは、この拡張を支援します。

アマゾン $アマゾン・ドットコム (AMZN.US)$ アマゾンは、プラグパワーに手を出して、プラグパワーを買収し、プラグパワーが持つ巨額の税金控除を活用するのは賢明かもしれません。AMZNはPLUGに株価の2倍にあたるブック価格を支払い、株価1株当たり7.50ドルと同等です。

プラグ・パワーインクは、北米、ヨーロッパ、アジア、および国際市場で水素および燃料電池製品ソリューションを開発しています。同社は、材料取り扱い用電気自動車に電力を供給する水素燃料のプロトン交換膜(PEM)燃料電池システムであるGenDrive、バックアップおよびグリッドサポート電力要件をサポートするためのPEM燃料電池パワーを提供する静止型燃料電池ソリューションであるGenSure、電動配達バンでエンジンとして使用される移動体および静止型燃料電池システムで使用される燃料電池スタックとエンジン技術であるProGen、液体水素の給燃水配送、発生、貯蔵、供給システムであるGenFuel、GenDrive燃料電池システム向けのIoTベースの定期メンテナンスおよび現地サービスプログラムであるGenCare、GenSure燃料電池システム、GenFuel水素貯蔵および供給製品、ProGen燃料電池エンジン用に使用されるGenCare、GenSure、GenFuelソリューションへの移行のための統合ターンキーソリューションであるGenKeyを提供しています。クリーン水素の生産のための水素発生装置である電解装置、液体水素を顧客に供給する液化システム、輸送用の液化水素、酸素、アルゴン、窒素、および他の極低温ガスの分配のための低温設備、および石油ベースのエネルギーに代わる代替燃料である液体水素を提供しています。同社は、直販、OEM、ディーラーネットワークを通じて製品を販売しています。

免責事項:このコミュニティは、Moomoo Technologies Inc.が教育目的でのみ提供するものです。

さらに詳しい情報

コメント

サインインコメントをする

10xStockPicks スレ主 : 水素燃料補給ステーションの助成金

2024年9月、Plug Powerはワシントン州に水素燃料補給ステーションを開発するための1000万ドルの助成金をDOEから受け取りました。Hyper-Fuelと呼ばれるこのプロジェクトは、中型および大型車向けの次世代の水素燃料補給インフラを実証します。

Growth Investor27 : PLUGを買うのは今賢明です。彼らは多くの大型契約を持っており、安定した収益をもたらします。

Ultratech Growth Investor27 : $FuelCell Energy (FCEL.US)$ 分割される取締役会の決定には注意してください。冗談です。新規買の水力の将来の存在については、人類が次の200年を繁栄することを期待するなら、その後はわかりません。

egan1 10xStockPicks スレ主 : 1000万ドルは、彼らが年間10億ドルを使うときには何もありません

egan1 : 会社が年間100億ドルを消費しているのに、どうして何かが「空売りの売り手に打ちのめされる」のでしょうか?どちらかといえば、それは雄牛によって支えられています。また、ほとんどのショートパンツは1株あたり20ドルから30ドルでショートし始めました。気付くにはショートパン用の10バガー、強制清算を開始するには15バガーが必要です。これはゲームではなく、100%以上のショート金利はなく、フロートは巨額です。スクイーズはほとんどありません。

Growth Investor27 : $Amazon (AMZN.US)$ 簡単に買えます $Plug Power (PLUG.US)$ そして彼らは買うべきです